Top 4 No-Fee Bank Accounts in Australia

Explore the top no-fee bank accounts in Australia, offering savings on fees, convenient features, and easy access to your funds.

Choosing the right bank account for your daily operations requires careful consideration, especially with a variety of options offering different features, fees, and benefits.

Thankfully, numerous accounts come with zero monthly fees, helping you maximise the money in your account without unnecessary costs.

This guide explores 4 fee-free bank accounts in Australia, their key features and unique benefits to help you decide where to keep your money.

No-Fee Bank Accounts in Australia: Key Fees and Requirements

No-fee bank accounts are becoming popular in Australia, helping people save on monthly bank fees. But while these accounts seem simple, there are still a few things to know to get the most out of them and avoid unexpected costs:

Common Fees to Watch Out For in Traditional Accounts

In most traditional bank accounts, you’ll often see these fees:

- Monthly account-keeping fees: A regular charge just for having the account.

- Transaction fees: Fees per transaction, though these are rare for local transactions.

- Cash withdrawal fees: Charges for using ATMs outside your bank’s network.

- Overdraft fees: Applied if you spend more than your account balance.

- Dishonour fees: Fees for returned cheques or missed payments due to insufficient funds.

- Foreign transaction fees: Higher fees for purchases or ATM use abroad.

These fees can add up fast, making a no-fee account a great alternative if you’re looking to save.

What to Know About No-Fee Accounts

No-fee accounts don’t have monthly maintenance fees, but they may come with a few conditions:

💡 Requirements to qualify:

- Some banks require a minimum monthly deposit, usually around $2,000.

- Others limit no-fee accounts to people under a certain age, often under 30.

- Certain accounts are only available to those receiving government support payments or pensions.

The Benefits of No-Fee Bank Accounts in Australia

No-fee bank accounts offer multiple advantages that can make banking more affordable, accessible, and user-friendly. Here’s a breakdown of the key benefits:

1. Cost Savings

- No Monthly Fees: By eliminating monthly account-keeping fees, no-fee accounts allow customers to save money over time, a significant benefit for those looking to cut down on regular expenses.

2. Flexibility and Accessibility

- No Minimum Balance Requirement: Some no-fee accounts waive monthly fees without requiring a minimum balance, giving account holders more flexibility and less stress about maintaining a certain amount in the account.

3. Transparent Banking

- Simplified Fee Structure: With fewer fees to track, customers can easily monitor their spending and budget without hidden costs. This transparency makes financial management more straightforward.

4. Increased Financial Control

- No Overdraft or Transaction Fees: Many no-fee accounts don’t charge for overdrafts or transactions, providing greater financial control and eliminating unnecessary charges for everyday banking.

5. Convenient Access and Features

- Online and Mobile Banking: No-fee accounts often include access to online banking, mobile apps, and extensive ATM networks at no extra cost, making it easy for users to manage finances anytime, anywhere.

6. Encouragement of Savings

- Higher Interest Rates or Rewards: Some no-fee accounts offer competitive interest rates or cashback rewards, encouraging customers to save and make the most of their account.

7. Consumer-Focused Options

- Wide Selection of Accounts: With more banks offering no-fee options, consumers can choose from a variety of accounts that suit their needs, including options from both major banks and smaller institutions with fewer restrictions.

4 No-fee Bank Accounts That Fit Your Business Needs

1. Great Southern Bank Business+ Account

The Great Southern Bank Business+ Account is a digital business banking option for small business owners, including sole traders, partnerships, and companies with individual directors or shareholders.

This account provides a cost-effective solution with no monthly fees and features designed for straightforward financial management.

Key Features

- No Monthly Fees: The Business+ Account has no monthly account-keeping fees, helping businesses reduce ongoing costs.

- Unlimited Free Transactions: Provides unlimited transactions without fees, supporting day-to-day business banking needs.

- Interest on Savings: Offers up to 4.10% p.a. with a linked Business+ Saver account, providing an option for earning interest on savings.

- Fully Digital Setup: Accounts can be opened online or through the Business+ app without physical paperwork or in-branch visits.

- In-App Support: Live chat assistance is available through the app for help with account-related questions.

Business+ App Features

- 24/7 Access: Manage accounts, transfer funds, and view balances anytime through the app.

- Debit Mastercard: Provides a debit card with global access and easy transfers between transaction and savings accounts.

- Multiple Accounts: Allows users to open multiple accounts for different purposes, such as setting aside funds for taxes or specific expenses, without additional fees.

- Budgeting Tools: Includes features for expense tracking and cash flow management within the app.

Fees

- Monthly Account-Keeping Fees: None.

- Transaction Fees: Free for unlimited transactions.

- ATM Fees: No fees for withdrawals at in-network ATMs; fees may apply at out-of-network ATMs.

2. Suncorp Business Premium Account

The Suncorp Business Premium Account is a cost-effective and feature-packed solution for business banking. With no monthly account-keeping fees and unlimited fee-free transactions, it’s designed to simplify your finances and maximise your savings.

Key Features

- $0 Monthly Account Keeping Fee: No account-keeping fees for the life of the account.

- Unlimited Fee-Free Transactions: Enjoy unlimited electronic, staff-assisted, and cheque deposit transactions.

- Interest Earnings: Earn 0.01% p.a. interest on all balances.

- Business Visa Debit Card: Pay for business expenses online, in-store, or over the phone. Features include:

- Temporarily locking your card or resetting your PIN via the app.

- Contactless payments with Apple Pay® and Google Pay™.

- Maximise Savings with flexiRates: If you have surplus funds, you can use flexiRates to earn higher interest by locking a portion of your balance for a fixed term:

- 3 months: 4.35% p.a.

- 6 months: 4.70% p.a.

- 12 months: 4.20% p.a.

Additionally, the account integrates with popular accounting software like Xero and MYOB, making bookkeeping and financial management easier.

It also offers an offset account feature, allowing you to reduce interest on eligible Suncorp Bank Small Business Loans using your account balance.

Fees & Rates

- Monthly Account Keeping Fee: $0

- Cheque and Staff-Assisted Deposits: Free

- Electronic Transactions: Free, including external transfers.

- Withdrawals: Unlimited withdrawals at no cost, including at Suncorp Bank ATMs and atmx ATMs.

- Standard Rate: 0.01% p.a. on all balances, calculated daily and paid monthly.

3. Prospa Business Account

The Prospa Business Account is a free everyday transaction account designed to help small businesses manage their finances in one place.

It provides tools for efficient cash flow management, flexible payment options, and secure access through both mobile and online platforms.

The account comes with a Prospa Visa Business Debit Card for making payments wherever Visa is accepted, offering practicality for business owners managing day-to-day expenses.

With features like real-time payments, downloadable statements, and secure card management, the Prospa Business Account is built to support the needs of small businesses efficiently and without unnecessary complexity.

Key Features

- Simplified Payments: Send and receive funds instantly, pay with BPAY, and schedule future transactions.

- Flexible Spending: Use the Prospa Visa Business Debit Card for payments worldwide and withdraw cash from ATMs.

- Mobile and Online Access: Manage your account 24/7 via the Prospa App or Prospa Online.

- Apple Pay & Google Pay: Link your debit card for contactless payments, even before your physical card arrives.

- Seamless Xero Integration: Automatically sync transactions to Xero for effortless accounting and cash flow clarity.

- Quick Setup: Open an account online in minutes with minimal paperwork using just your ABN and a valid driver’s licence.

Fees

- Account Setup: Free

- Monthly Account Fee: $0

- Minimum Balance/Deposits: No minimum requirements.

4. Westpac Business One No Monthly Fee Bank Account

The Business One Transaction Account is a straightforward, cost-effective banking solution for small businesses.

For those who primarily bank online or through the app, this account provides the tools to manage daily business finances efficiently.

With no monthly fees and flexible access options, it’s an ideal choice for business owners seeking a practical and secure way to handle income and expenses.

The account includes unlimited free electronic transactions, integration with accounting software like MYOB and Xero, and a Business Debit Mastercard® for everyday payments.

Additional services like optional overdrafts and EFTPOS solutions make this account versatile for various business needs.

Key Features

- $0 Monthly Fee: No ongoing fees to maintain your account.

- Unlimited Free Electronic Transactions: Make payments, transfers, and other electronic transactions without additional costs.

- Business Debit Mastercard®: Use the card for purchases in person, online, or overseas wherever Mastercard® is accepted.

- Flexible Access Options: Manage your account online, through the mobile app, by phone, or in a branch.

- Integration with Accounting Software: Set up bank feeds for MYOB or Xero to simplify bookkeeping.

- Optional Overdraft Facility: Access additional funds for short-term needs, subject to credit approval.

- Enhanced Security Features: Lock your debit card temporarily, manage direct debits, and authorise new payments securely through the app.

Fees and Interest

- Monthly Fee: $0

- Electronic Transactions: Free

- Staff-Assisted Transactions: $3 per transaction, including branch deposits, withdrawals, and cheque handling.

- Interest on Account Balances: No interest is earned on this account.

- Unarranged Lending Rate (ULR): 15.01% p.a. charged on overdrawn balances without prior arrangement.

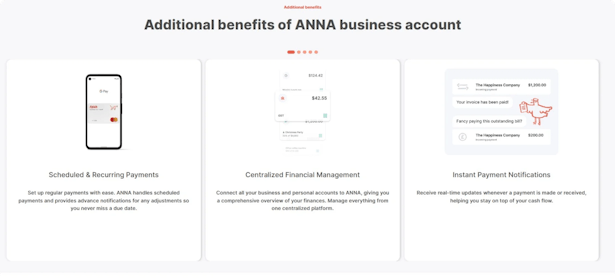

ANNA - A Business Account Plus Much More!

Using a no-fee bank account is a smart way to keep your finances straightforward and costs low. But as your business grows, managing everything separately can get messy.

That’s where ANNA makes things easier. It brings together banking, tax filing, invoicing, and expense management, all in one place.

With ANNA, you’re not just getting a business account. You’re setting up a more organised, hassle-free way to handle the essentials as your business moves forward.

Key Features

⚡ Business Account and Cards

- Credit Card: A physical card designed to handle everyday business expenses.

- Virtual Cards: Perfect for secure and convenient online transactions.

- Apple Pay and Google Pay Compatibility: Enjoy seamless, contactless payments with your ANNA card.

- Expense Cards for Employees: Equip your team with individual cards for expenses, each with customisable spending limits.

⚡ Company Registration Services

- Australian Company Number (ACN): ANNA facilitates the registration of your company with an ACN and provides ASIC documents directly to your inbox.

- Australian Business Number (ABN): Easily obtain your ABN, a unique identifier crucial for businesses in Australia.

- Business Name Registration: Register a business name that best represents your brand, even if it’s different from your official company name.

⚡ Financial Management Tools

- Bookkeeping & Tax: ANNA handles your tax calculations, covering GST and company taxes, keeping you compliant with the ATO.

- Annual Tax Filing: ANNA manages your BAS and tax obligations from the first year of trading.

- Professional Invoicing: Send professional invoices with ease, with automated reminders to ensure timely payment.

⚡ 24/7 Customer Support

ANNA’s support team is available around the clock to assist with any queries, ensuring you’re never left in the dark with your business needs.

⚡ Transparent Pricing

- ANNA One Plan: A cost-effective option that includes registration and ongoing management features, helping you set up and grow your business smoothly.

Streamline your business essentials in one place – banking, tax, invoicing, and more.

Sign up and manage your business more easily with ANNA!