How Can a Foreigner Register a Business in Australia? (6 Easy Steps To Follow)

Explore how foreigners can register a business in Australia, from understanding legal requirements to navigating paperwork, start your business today.

- In this article

- What Are the Benefits of Opening a Company In Australia?

- Step 1: Securing Your Visa

- Step 2: Consider Your Business Structure

- Step 3: Choose a Business Name and Register Your Business

- Step 4: Obtain Necessary Licenses and Permits

- Step 5: Set Up Taxation and Financial Matters

- Step 6: Establish Business Operations

- 8 Additional Tips For Boosting Your Business In Australia

- Conclusion

- FAQ

Australia's robust economy, backed by diverse industries and strategic positioning, attracts significant interest from foreign companies eyeing expansion.

With a stable banking system and high quality of life, it's a prime destination for businesses seeking growth opportunities.

The country's reputation for innovation and entrepreneurship adds further allure to its appeal to international investors.

If you are considering this route, you may be wondering, "How can a foreigner register a business in Australia?"

Let's find out!

What Are the Benefits of Opening a Company In Australia?

"Australia is a land of opportunities" is a well-known saying. This is especially true when it comes to doing business.

If you are thinking about setting up a company, you should be aware of its benefits:

✅ Limited Personal Liability: By forming a company, you can shield your personal assets from business liabilities, reducing financial risk and protecting personal wealth.

✅Tax Minimization: Companies often enjoy lower tax rates than individual taxpayers, leading to potential savings and increased profitability.

✅ Conflict Resolution: Company structures provide precise mechanisms for resolving disagreements among co-founders, ensuring smooth operations, and preserving business relationships.

✅ Legitimacy and Brand Awareness: Registering a company enhances the credibility and visibility of the business, improving its reputation and facilitating future dealings with customers, suppliers, and partners.

✅ Access to Capital: Companies have greater access to funding through equity financing and debt borrowing, enabling them to raise capital for expansion and investment in growth opportunities.

Step 1: Securing Your Visa

When initiating a business venture as a foreigner in Australia, you need to have a clear understanding of the visa requirements:

1. Visa Application Procedure:

The Department of Home Affairs administers Australian business visas for non-Australian citizens or permanent residents:

- Initiate the process by submitting an expression of interest via the Department of Home Affairs' SkillSelect online platform.

- Await an invitation from either a state/territory government or Austrade's CEO to proceed with the visa application.

- Upon receiving an invitation, fulfill the stipulated criteria and provide the necessary documentation.

2. Visa Selection:

There are various visa options you can apply for:

1. Business Innovation and Investment (Provisional) Visa

This visa is for individuals possessing business acumen, enabling them to manage a new or existing business in Australia for a provisional period of 4 years and 3 months.

Provisional visa holders may qualify for a permanent visa upon meeting specific conditions.

2. Business Talent Visas

This visa is available to state/territory government agency nominees or those invited to apply for it, provided they meet the requisite financial criteria.

- Significant Business History Stream: Geared towards seasoned business proprietors seeking to operate a new or existing business in Australia, necessitating a net worth of at least AUD 1.5 million and an annual business turnover exceeding AUD 3 million.

- Venture Capital Entrepreneur Stream: This stream is designed for entrepreneurs intending to launch a new business in Australia. It is backed by at least AUD 1 million in venture capital funding from an Australian Investment Council member.

Step 2: Consider Your Business Structure

Choosing a business structure means deciding whether to be a sole proprietor (sole trader), company, partnership, or trust. Your business structure will determine your control level, taxable income, and personal liability.

- As a sole trader, you alone will be responsible for taking care of all the legal aspects of your business and its daily running.

- If you choose a company business structure, it will have a separate legal existence.

- To diversify risk, you can form a partnership and bring in more people to share the responsibility or become a trust with its own property and income to the advantage of a third party.

📌Whatever the business structure is, make sure you decide before registering your business, as its structure will determine what paperwork you need to file.

Can You Register a Foreign Company in Australia?

If you already own a company and decide to expand its operations into Australia, you have several avenues to establish its presence. Here's a closer look at the three common methods:

1. Proprietary Company (Pty Ltd):

- A proprietary company, often denoted as Pty Ltd, involves setting up a separate legal entity in Australia to manage local operations.

- Pty Ltd companies offer limited liability protection to shareholders, meaning their liability is restricted to the amount unpaid on their shares.

- To establish a Pty Ltd company, at least one shareholder is required, with a maximum of 50 non-employee shareholders allowed. Additionally, at least one resident director and a resident company secretary must be appointed.

- The incorporation process is relatively straightforward, involving steps such as choosing and reserving a company name, deciding on governance structures, and registering the company with the Australian Securities and Investment Commission (ASIC).

2. Registered Foreign Company:

- A foreign company can register directly with ASIC to conduct business without establishing a separate Australian entity. This option suits companies that prefer to maintain their corporate structure.

- Unlike a proprietary company, a registered foreign company does not create a new legal entity in Australia. Instead, it operates as an extension of the overseas parent company.

- Registration typically requires documentation such as a certificate of registration from the home jurisdiction, a copy of the company's constitution, and details of local agents appointed to represent the company in Australia.

3. Representative Office:

- A representative office allows foreign companies to establish a presence in Australia for non-income-generating activities, such as market exploration and client engagement.

- Unlike proprietary and registered foreign companies, representative offices are not legal entities and cannot enter into contracts or engage in revenue-generating activities.

- While representative offices are not required to register with ASIC, they may need to register with the Australian Taxation Office (ATO) if they have employees.

- Setting up a representative office involves establishing a physical office location and complying with any local regulations regarding business operations.

Now that you've understood the different business structures and visa requirements, let's proceed to the next steps of registering your business in Australia:

Step 3: Choose a Business Name and Register Your Business

Once you've decided on the appropriate business structure and secured the necessary visa, it's time to choose a name for your business.

Ensure that the name aligns with ASIC's guidelines and is not already being used by another registered entity.

After finalizing your business name, you'll need to register it.

You can do it through ASIC by submitting the necessary documentation and paying the registration fee.

Upon successful registration, you'll receive an Australian Company Number (ACN), which is essential for conducting business activities in Australia.

💡Pro Tip

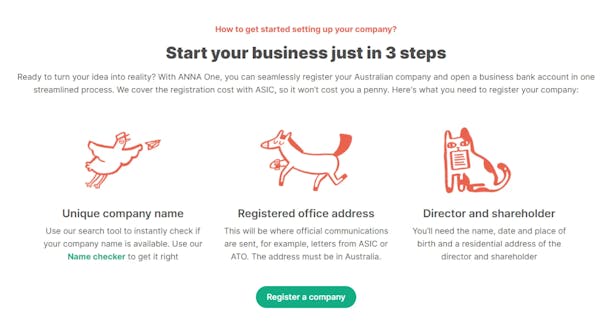

With ANNA One, you can quickly and easily register your proprietary (private) Australian company while opening a business bank account in a single, seamless process.

The platform covers the registration costs with ASIC, eliminating any financial burden.

Here's how:

⚡ 3-Step Registration Process - You can choose a unique company name, verify its availability using the platform's search tool, and provide essential details such as the registered office address and director/shareholder information.

⚡ Comprehensive Tax Management: We automate tax calculations and provide personalized tax calendars to ensure timely compliance with all tax obligations.

⚡ Integrated Banking Solutions: Debit cards, virtual cards, Apple Pay, Google Pay, and expense cards for employees can help you seamlessly manage business finances and expenses.

⚡ Efficient Bookkeeping: Store receipts, invoices, and company documents in one place. The platform automatically matches transactions, extracts key details, and ensures that everything is easy to find and share.

⚡ Business Score: This feature evaluates the tidiness of your business' books and provides simple tasks to optimize your tax efficiency to save you money on taxes and enhance financial management practices.

The best part is that you can access all this information in real time through your Anna account!

Step 4: Obtain Necessary Licenses and Permits

Depending on the nature of your business, you may need specific licenses or permits to operate legally in Australia.

These could include industry-specific licenses, permits for selling certain products, or certifications for professional services.

Research the regulatory requirements relevant to your business and ensure compliance to avoid any legal issues down the line.

Step 5: Set Up Taxation and Financial Matters

Understanding the Australian tax system is crucial for managing your business finances effectively.

Register for a Tax File Number (TFN) and an Australian Business Number (ABN) to fulfill your tax obligations.

You can also seek for an advisor or accountant to ensure compliance with Australian tax laws and optimize your tax strategy for maximum benefits.

💡 Pro Tip

With ANNA One, you get all your taxes covered, including Company income tax, GST, and Annual tax filing. Plus, we provide everything you need to register a new business and receive your Annual company tax return statement (BAS).

This means you can get started with confidence, knowing you've ticked all the ATO's boxes right from the start.

Step 6: Establish Business Operations

With the legal and administrative aspects in place, you can now focus on setting up your business operations in Australia.

Some steps include securing office space, hiring employees, establishing supplier relationships, and developing a marketing strategy to promote your products or services to the Australian market.

8 Additional Tips For Boosting Your Business In Australia

While legal considerations are important, there are also some things you shouldn't overlook:

1. Conduct Market Research

Before registering, conduct thorough market research to understand the Australian market, consumer behavior, competition, and potential opportunities.

This can help you tweak your business strategy and offerings to meet local demands effectively.

2. Be Considerate of Cultural Differences

Australia is a diverse country with various cultural nuances.

Understanding and respecting Australian culture can enhance your business interactions and relationships with customers, suppliers, and employees.

3. Choose Your Location

Carefully consider the geographical location of your business operations.

Australia has major cities like Sydney, Melbourne, Brisbane, and Perth, each with unique business environments and opportunities.

Regional areas might offer specific advantages, such as lower operating costs or government incentives.

4. Take Advantage Of Networking and Collaboration

Engage with local business networks, industry associations, and chambers of commerce to build connections and partnerships.

Networking events, trade shows, and workshops can provide valuable opportunities to meet potential collaborators, suppliers, and clients.

5. Invest In Digital Presence

Australians are tech-savvy consumers, and having a professional website, active social media presence, and e-commerce capabilities can help you reach a wider audience and compete effectively.

6. Be Environmental and Socially Responsible

Australians are increasingly conscious of environmental and social issues.

Incorporating sustainable practices and demonstrating corporate social responsibility can resonate well with consumers and enhance your brand reputation.

7. Embrace the Lifestyle

Australia is known for its laid-back lifestyle, beautiful landscapes, and outdoor recreational activities.

Embrace the local lifestyle and encourage work-life balance among your employees, which can contribute to a positive workplace culture and productivity.

8. Seek Unique Opportunities

Explore niche markets or profitable business ideas that might not be fully tapped in Australia. Being a foreign entrepreneur, you can bring fresh perspectives and unique offerings to the market and set your business apart from competitors.

Conclusion

If you incorporate these elements into your business approach, you can not only navigate the process of registering a business in Australia but also make the journey more enriching and rewarding.

However, if you need an all-in-one streamlined solution, look no further than ANNA!

What Sets ANNA Apart?

The experts at ANNA are here to offer comprehensive support for navigating the complexities of starting and managing a business in Australia.

ANNA One is a package that provides everything you need to run a successful and fruitful business, from company registration to tax management and banking solutions:

🎉 Super Responsive Customer Support: We're here to tackle any issues just in time, ensuring smooth sailing for your business journey.

🚀 Effortless Registration Process: Say goodbye to the hassle! We cover the formation fees, and we offer the best value for your money by discounting your government fees.

📊 Business Categorization for Streamlined Finances: Our system categorizes your business to accurately calculate costs and expenses, simplifying your accounting process.

🤖 ML/AI Technologies for Tax Management: With ANNA, tax handling becomes a breeze. Our cutting-edge technology helps you calculate and file taxes automatically, tailored to your unique business.

Ready to take your business to new heights?

Sign up today and unlock the tools to streamline your business journey!

FAQ

Do Foreigners Need an Australian Resident Director or Shareholder To Register a Business in Australia?

Yes, in most cases, foreigners are required to have at least one Australian resident director when registering a company in Australia. However, specific requirements may vary depending on the chosen business structure and visa type.

Are There Any Restrictions or Limitations For Foreigners Starting a Business In Australia?

While Australia welcomes foreign investment and entrepreneurship, there may be certain restrictions or regulations applicable to specific industries or business activities. It's crucial to research and comply with any relevant laws or regulations.

Can I Start a Business In Australia From the UK?

Yes, starting a business in Australia from the UK is possible. As a foreigner, you'll need to navigate the legal and regulatory requirements for registering a business in Australia, which may include obtaining the necessary visas, choosing a business structure, registering with the appropriate government authorities such as the Australian Securities and Investments Commission (ASIC), and complying with taxation and other regulatory obligations.