How to Apply for an Australian Business Number (ABN)?

Learn how to apply for an Australian Business Number (ABN) using our step-by-step instructions to streamline your business registration journey.

Starting a business in Australia means you'll need an Australian Business Number, or ABN.

This 11-digit number is essential because it helps you handle taxes and deal with government services.

Getting an ABN is a key step, whether you're starting a new business or updating your current one.

In this article, we'll walk you through how to apply for an ABN.

We'll cover everything you need to know:

- eligibility criteria,

- what documents you need to have ready, and

- how to go through the application process step by step.

Let’s dive in!

How to Apply for an ABN Number?

Whether you are starting a new business or need to reapply due to a previous cancellation, applying for an ABN is a necessary step.

1. Eligibility for an ABN

To qualify for an ABN, you must meet the following criteria:

- You are actively conducting or planning to conduct business activities in Australia on a regular and systematic basis.

- Eligible activities include trading, providing services, or producing goods, whether as a business, sole trader, or independent contractor.

- Special criteria may apply to government agencies and non-profit organizations. For this it's advisable to consult the Australian Taxation Office (ATO) for specific guidance.

2. Required Information for ABN Application

Before applying, ensure you have decided on your business structure (e.g., sole trader or company). During the application, you will need:

👉 Tax File Number (TFN) and the TFNs of any associates (partners, directors, trustees).

👉 Registered agent number if using a tax or BAS agent.

👉 Professional adviser number if using a professional adviser, like an Australian Financial Services licensee.

👉 Any previously held ABN

👉 Australian Company Number (ACN) or Australian Registered Body Number (ARBN), if applicable. Companies and registrable organizations can register for an ACN or ARBN through the Australian Securities and Investments Commission (ASIC).

👉 Date when your ABN is needed, which cannot be more than 6 months ahead.

👉 Entity’s legal name as it appears on official documents.

👉 Contact details of authorized contacts (could be a registered agent).

👉 Details of associates, which vary depending on the entity type.

👉 Business contact details including address, email, and phone number, with specific requirements for the email address.

👉 Main business activity and locations of all business premises, unless disclosing them poses a safety risk.

3. ABN Application Process

Step #1: Eligibility Review — Not everyone qualifies for an ABN, and applying without entitlement can lead to prosecution.

The ABR may review your eligibility at any time, requiring evidence that you have commenced business activities.

Step #2: Processing Time — Providing complete and accurate information, such as your TFN, will expedite the application.

Incomplete applications may face delays.

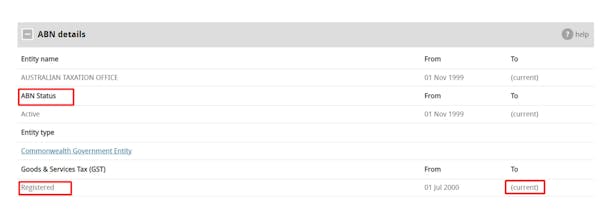

Step #3: Outcome — If successful, you receive your ABN immediately and can register for other business services like GST.

Your business details are also added to the Australian Business Register (ABR), with options to protect certain information for privacy.

If you'd like to track the progress of your application, you can check the application status of ABN on the official ABR website.

How to Cancel or Update Your ABN Number?

According to the ABR, there are 3 top reasons you might need to update your ABN number. They include:

- ABN cancellation

- Updating ABN details

- Changing the business structure

Let’s review each of these situations.

1. How to Cancel Your ABN?

If your business has been sold, shut down, or is no longer operating in Australia, you may need to cancel your Australian Business Number (ABN).

Before proceeding, ensure that you have fulfilled all required lodgments, reporting, and payment obligations with relevant government agencies.

Steps to Cancel Your ABN:

👉 Cancel PAYG: If you're registered for pay-as-you-go (PAYG) withholding, cancel this before your ABN.

👉 Further Guidance: Visit the Australian Business Register (ABR) website and search for "cancel ABN" for step-by-step instructions.

👉 Online Cancellation: Use myGovID and Relationship Authorization Manager (RAM) to cancel your ABN online. Changes take effect immediately.

👉 Alternate Methods: If online cancellation is not possible, you can contact support or submit a cancellation form by mail.

Consequences of ABN Cancellation

Cancellation of your ABN will also terminate:

- registrations for goods and services tax (GST),

- luxury car tax (LCT), wine equalization tax (WET), and

- fuel tax credits (FTC).

It will end any authorized relationships between your myGovID and your ABN.

2. How to Update Your ABN Details?

It’s crucial to keep your ABN details up-to-date. Failure to update details may result in your ABN being canceled.

Why Update Your ABN Details?

Updating your ABN is essential for several reasons:

- It ensures that the correct individuals have the necessary permissions to act on behalf of the business.

- It provides government agencies with updated information, which can be crucial for contacting businesses or providing targeted assistance during emergencies.

- It prepares your business for new government services as they become available.

- It ensures your ABN reflects the full scope of your business activities.

Steps to Update Your ABN

The quickest method to update your ABN details is via the Australian Business Register (ABR) online services.

You can log in using myGovID and Relationship Authorisation Manager (RAM). Updates made online are effective immediately.

For guidance on what details can't be updated online, refer to the ABR's help section.

Accessing the Update Feature

Visit the Update your ABN details page on the ABR website.

Alternative Methods

If online access is unavailable, you can contact the ABR directly, ask your tax professional to make the changes, or complete a paper form.

Limitations on Updating ABN Details

When updating your Australian Business Number (ABN) details through the Australian Business Register (ABR) online services, there are specific restrictions on what cannot be modified directly:

👉 Business Names: Changes to business names are not processed through the ABR. You must handle these updates through the relevant agency.

👉 Legal Names for Individuals and Sole Traders: If you need to update the legal name for an individual or sole trader, you must contact the Australian Taxation Office (ATO) directly.

👉 Legal Names for Companies: Updates to the legal names of companies must be made with the Australian Securities & Investments Commission (ASIC).

Changes to legal names made via the ATO or ASIC will automatically update the details on the ABR.

This integration ensures that your ABN records remain consistent with your legal and business registrations.

Special Instructions for Not-for-Profit Organizations

If you are a not-for-profit organization and need to update your details before accessing ABR online services, follow the specific steps outlined on the ABR website.

3. How to Change Your Business Structure and Its Impact on Your ABN?

When you change your business structure, it often necessitates canceling your current Australian Business Number (ABN) and applying for a new one.

Considerations Before Changing Your Business Structure

👉 Impact on Operations: Understand how the change will affect your business operations, including tax obligations and other registration requirements.

👉 Communication with Clients: Update all business documents, such as invoices, to reflect the new ABN if a new one is granted.

Common Scenarios Requiring a New ABN

- Transitioning from an individual/sole trader to a partnership.

- Changing from a partnership to a company.

- Moving from being an individual/sole trader to establishing a company.

Recommended Action

Seek professional advice before canceling your ABN to ensure that this decision aligns with your overall business strategy and complies with legal requirements.

Challenging Decisions on ABN Applications

If you disagree with a decision made by the Registrar of the Australian Business Register, it's important to first contact them so they can attempt to resolve the issue.

If you remain unsatisfied after initial discussion, you have the right to lodge an objection.

Steps to Lodge an Objection

✔️ Immediate Contact: If you've received correspondence from ABR, please quote the reference number provided. This allows them to quickly access your information and address your concerns.

✔️ Objection Period: You have 60 days from the date of the decision to submit your objection. Ensure that your objection includes all relevant information and supporting documents to avoid delays.

✔️ Providing Evidence: Clearly state which decision you are objecting to and why. Include evidence that you are actively conducting or planning to start a business.

Examples of useful documents include:

- Recent tax invoices you have issued (ideally to different clients).

- Recent quotes you have provided.

- Invoices for materials or equipment purchases.

- A business contract that outlines the terms of goods or services provision.

- A commercial lease agreement.

- An application for business finance.

✔️ Common Objections: The most frequent objections ABR encounters involve the cancellation of an ABN registration or refusal to grant an ABN.

Note on Evidence

Providing comprehensive and relevant evidence will expedite the processing of your objection.

If the evidence is insufficient, ABR will reach out to you for more information, but be aware that this could delay the resolution of your objection.

For detailed information on which decisions can be objected to and the specific time limits, you can refer to ABR website.

How to Register Your Business With ANNA?

As we've explored the steps to applying for an ABN, let's delve into how ANNA One can streamline the process of starting your business in Australia.

ANNA One simplifies the journey from company registration to managing financial tasks, making it an invaluable tool for new entrepreneurs.

But how exactly can ANNA One assist in taking your business idea to the next level?

Key Features of ANNA

✔️ Company Registration Made Easy: Register your company quickly without handling the ASIC fee—ANNA covers this cost for you.

✔️ Integrated Business Account: Seamlessly manage bookkeeping, invoicing, and tax obligations through a single platform.

✔️ Automatic Tax Calculations: Stay updated with automatic GST calculations and optimized tax invoices.

✔️ Comprehensive Business Support: Store and organize essential documents, and receive support from expert accountants.

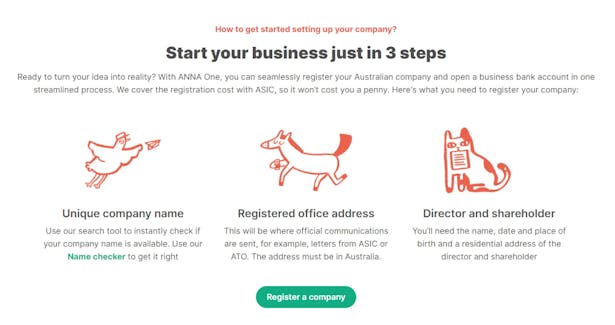

Getting Started with ANNA

1. Choose a Unique Company Name: Use ANNA's search tool to ensure your company name is available.

2. Provide Basic Company Information: You'll need details about your company's directors and shareholders, along with a registered office address in Australia.

3. Complete the Registration: Submit your details, and ANNA will handle the rest, notifying you once your registration is complete.

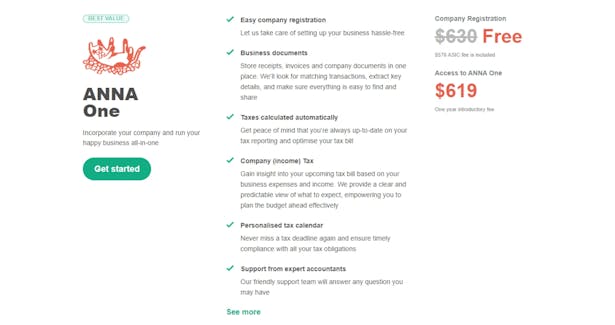

ANNA offers a range of plans to fit different business needs and budgets, such as:

👉 Easy Company: $630 (includes a $576 ASIC fee)

This plan provides a straightforward company registration process and includes handling essential business documents.

ANNA will store receipts, invoices, and company documents, ensuring everything is easy to find and organized.

👉 ANNA One: $619 for one year

This plan offers an all-in-one solution for incorporating and running your business. ANNA One includes easy company registration and hassle-free setup.

It also equips you with automated tax calculations, income tax insights, a personalized tax calendar, expert support, and more.

Ready to turn your business idea into reality with ANNA One and ease your administrative burden?

Get started with ANNA today and empower your business with a suite of tools designed to simplify your business operations. 🚀