How to Check the ABN Application Status of Your Business

Find out how to check the ABN application status of your business to track your Australian Business Number application easily.

- In this article

- The Basics of the ABN Application Process

- How to Locate and Manage Your Australian Business Number (ABN)

- Possible Application Statuses

- Why Is Your ABN Application Canceled and How to Resolve It

- Next Steps After Approval

- What to Do if There's an Issue

- Where to Locate Your ABN in Business Documents and Records

- Why Regular ABN Verification Is A Must

- Conclusion

- Anna One: The All-in-one Solution

- FAQ

You’ve finally taken a leap and started your own business! How exciting!

You’ve been productive and completed all the necessary steps, from registering your company to filing all the required paperwork.

Now, you are eagerly waiting for your ABN application to be approved.

But how can you check the ABN status of your application?

Keep reading to find out!

The Basics of the ABN Application Process

When you file your ABN application through the Australian Business Register (ABR) website, you will receive an ABN number almost immediately.

If you receive a transaction reference number (TRN) instead, it means that some information is missing or there is a need for additional verification.

In that case, you may need to wait up to 20 business days or about 28 days (if you count the weekends).

So, make sure you double-check all the details before you hit the Submit button!

How to Locate and Manage Your Australian Business Number (ABN)

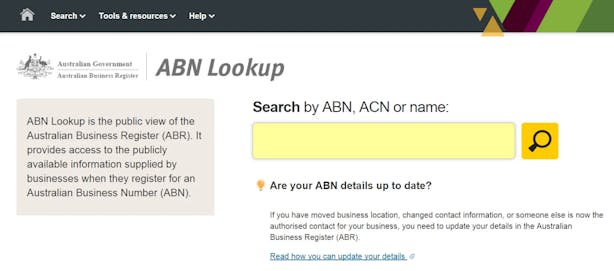

You can check the status of your ABN application using ABN Lookup, a free tool you can find on the Australian Business Register website.

To find your ABN, simply enter your tracking reference number or your business's name in the search bar.

If your ABN doesn't appear in ABN Lookup, the next step is to contact the ABR for assistance.

They can manually update your ABN information and help you retrieve your number.

Once your ABN is activated, it should appear on ABN Lookup the same day.

After that, you should be able to see one of three options:

- "in progress,"

- "approved," or

- "rejected."

Possible Application Statuses

Here are the possible statuses of your ABN application:

- In Progress – Your application is being reviewed and processed. Typically, no further action is required at this stage.

- Approved – Congratulations! Your ABN has been approved, and you will receive it via email or regular mail soon.

- Rejected – Your application was not approved. You will receive an explanation of the reason, and you may need to correct errors or provide additional information to proceed.

Why Is Your ABN Application Canceled and How to Resolve It

If your Australian Business Number (ABN) registration was unexpectedly canceled, you may wonder what went wrong and how to fix it. Here are some possible reasons for the cancellation and steps to get your ABN back on track:

🔶 Business Activity Mismatch: Your business initially focused on consulting, but over time, you switched to selling physical goods. If you didn't update your registration details to reflect this change, your ABN registration could be canceled due to a mismatch in business activities. If this happens, you can change your ABN details to avoid this issue in the future.

🔶 Identity Verification Issues: If you recently moved to a new address or changed your legal name – such alterations might not match the details on your original ABN registration.

Similarly, if someone else is using your ABN without permission, the ATO could take action that affects your registration.

🔶 Tax Filing Discrepancies: For example, you hired a new accountant who uses different accounting practices. If there are any inconsistencies between your tax filings and the records you initially submitted, the ATO may choose to cancel your ABN.

🔶 ABN No Longer Active: The ABR cancels ABNs that are no longer used for different reasons. For instance:

- No business income has been reported

- Lodgments are outdated

- The latest income tax return indicates business termination, or

- A final tax return has been filed.

What Are Your Next Steps?

If ABR contacts you about canceling your ABN, here is what you can do:

- If there was an error and you’re still operating your business, simply respond using the automated phone service number provided to confirm you need your ABN.

- In case you did indeed close your business, you don't need to do anything – ABR will cancel your ABN.

As you may know, to get an ABN number, you must be eligible for it.

So, if you think your ABN number got canceled without the right reason, you need to provide evidence of business activities, such as:

- Business presence online or on social media.

- Business materials like leaflets, cards, or stationery.

- Any licenses or insurance you have.

- Contracts showing leasing or purchasing premises or equipment.

- Issuing quotes or bids for work.

- Consulting with advisors or applying for loans.

Remember that you can always file a complaint if you feel that ABR has made an unfair decision.

Next Steps After Approval

After your application is approved, you will receive your ABN, one of the key requirements for running your business. You can use your ABN to complete any further business registrations, such as GST registration or PAYG Withholding.

Also, note that you need to include ABN on invoices and other business documents you issue to customers, so always have it near you.

What to Do if There's an Issue

If you experience any delays or issues with your ABN application, contact the ABR directly for assistance.

But before you do, review your application for potential errors or missing information that might have caused delays. If you address these issues promptly and fix them, it will help move the process along.

For additional support in navigating business processes, consider our business coaching with Brainiact.

You can also check out our guide on How to apply for ABN to prepare beforehand.

Where to Locate Your ABN in Business Documents and Records

If you've misplaced your Australian Business Number (ABN) or can't recall it offhand, you can find it on several common business documents and other sources.

For example:

- Your ABN should be prominently displayed on your business letterhead as a key identifier.

- Additionally, tax invoices must include your ABN due to GST regulations.

Beyond these primary sources, search for it on contracts and agreements, bank statements, and registration documents from your business's inception.

Check your online business profiles and government correspondence as well, as they may reference your ABN.

If you use accounting software, your ABN might be stored in the business details section.

Why Regular ABN Verification Is A Must

Checking your ABN (Australian Business Number) is one of the key responsibilities of any business owner in Australia.

If you do it periodically, you'll ensure that your business remains compliant with legal requirements, tax reporting, and government regulations.

Conversely, letting your ABN details become outdated can lead to issues such as financial penalties, legal trouble, and disrupted business dealings.

In addition, suppliers and customers often verify your ABN before starting business transactions.

So, to keep your business tides safe and your partners happy, regularly check your ABN details.

Conclusion

Knowing how to check your ABN application status and what steps to take in case of any delays or problems can help you keep your business journey on track.

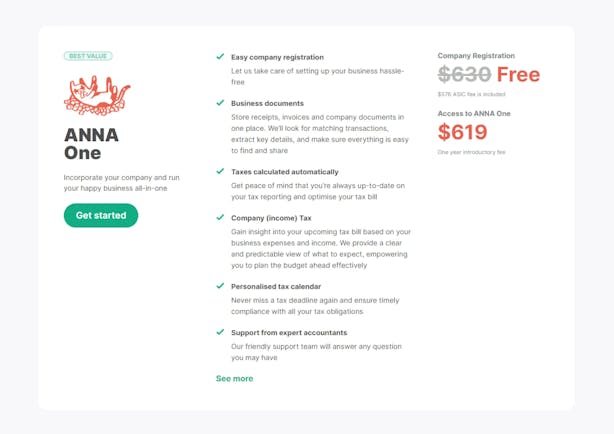

And once you've submitted your ABN application, why not simplify all the other boring paperwork and enhance your business efficiency? Explore Anna One.

Anna One: The All-in-one Solution

Unlock the full potential of your business with Anna One:

- Easy Company Registration: Get your business up and running with easy company registration. Let us handle the paperwork so you can focus on what you love.

- Centralized Business Documents: Store receipts, invoices, and important documents all in one place. We match transactions and extract key details, making everything easy to locate and share.

- Automated Tax Management: Stay ahead of tax season with automatic calculations and a clear, predictable view of your tax obligations.

- Personalized Tax Calendar: Never miss a deadline! Our custom calendar keeps you compliant with all tax requirements.

- Expert Accountant Support: Our knowledgeable support team is ready to assist you with any questions.

- Streamlined Annual Tax Return: Let us handle your tax return for your first year of trading, kickstarting your business journey.

- Smooth GST Management: Automate GST calculations and direct logging with the ATO.

- Professional Invoices That Get Paid Sooner: Create sharp invoices in seconds. We'll even chase down any unpaid invoices for you!

- Boost Your Bookkeeping Score: Stay on top of your books with tips for organizing them for optimal tax relief.

- Automated Receipt Matching: Let us match and categorize your receipts, saving you time and effort.

With Anna, you're in good hands! We take care of the tedious tasks so you can focus on running and growing your business.

Get started today and experience the best value! 💼💸

FAQ

How Long Does it Take to Reactivate an ABN?

An ABN is usually reactivated within 24 hours after submitting the application online. However, processing may take longer if additional information is needed.

What Can and Can't Be Updated in ABN Details?

Updating your ABN details ensures accurate permissions, government agencies' up-to-date information, and readiness for new services and reflects your business activities.

The fastest way to update is through ABR online services, which take effect immediately.

You can't update business names or legal names for individuals and companies registered with ASIC through ABR services; contact ATO or ASIC directly instead.

Changes made by these entities will automatically update your ABN information.