How to Find ABN Number of Your Company?

Learn how to easily find ABN number of your company with our straightforward guide to ensure compliance and streamline your business operations today!

- In this article

- What is an ABN Number?

- Understanding ABN Lookup: A Practical Guide for Businesses

- Your ABN Details on the Australian Business Register (ABR)

- Understanding ABN Entitlement: Who Qualifies?

- What if You Can’t Find Your ABN Number?

- Conclusion: Streamlining Your Business Registration with ANNA One

Starting a business in Australia requires understanding several crucial elements to ensure your operation is legitimate.

A key component of this is obtaining an Australian Business Number (ABN).

This article will explain what an ABN is and why it's important for your business.

We'll also guide you on how to find your ABN number, which details include once registered on ABR, and what steps to take if you encounter difficulties in finding it.

Let’s start!

What is an ABN Number?

An ABN is an 11-digit number that distinguishes your business from others in the eyes of the government and other legal entities.

ABN is your company's business unique identification code, similar to your personal ID number.

Why is the ABN Number Important for Your Company?

An Australian Business Number (ABN) is crucial because it enhances your business’s credibility and professionalism, helping to establish it as a legitimate entity and instilling trust in potential customers and partners.

Capabilities of an ABN:

- Allows registration and claiming of GST credits, improving financial efficiency.

- Necessary for participating in government tenders and qualifying for government grants.

- Enables potential customers to verify your business details, enhancing trust and reliability.

- Opens doors to government contracts and funding opportunities, facilitating business growth.

Understanding ABN Lookup: A Practical Guide for Businesses

If you're running a business in Australia, keeping track of your Australian Business Number (ABN) through ABN Lookup is essential.

This public tool, part of the Australian Business Register (ABR), gives everyone free access to the data that businesses provide when they register an ABN.

Over the past ten months, ABN Lookup has processed over 1.1 billion searches, 83% of which used its web services.

How ABN Lookup Can Help Your Business

ABN Lookup is more than a simple search tool. It allows you to integrate ABN validation and data into your own systems.

This can help with filling out forms automatically and keeping your business database accurate and current, all without any cost.

The platform is easy to use, making it accessible for anyone needing to verify business details.

Steps to Use ABN Lookup Effectively

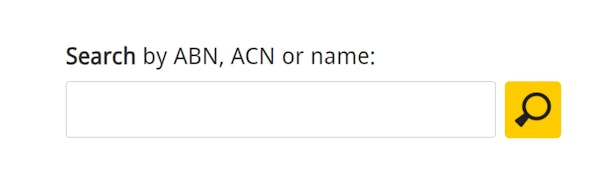

When you visit the ABN Lookup page, simply input your 11-digit Australian Business Number (ABN) and hit the search button.

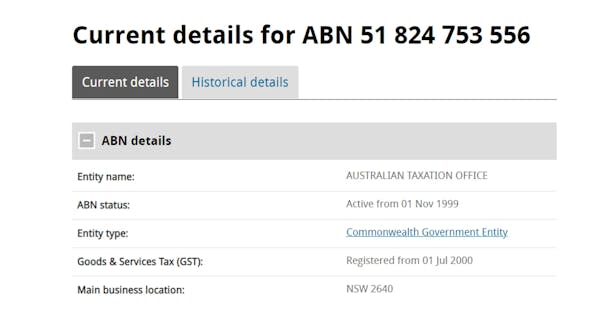

If your ABN is registered correctly, you will be able to view both Current details and Historical details associated with the number.

👉 Search Options: You can search using an ABN, Australian Company Number (ACN), or business name, depending on what information you have.

👉 Multiple Searches: The tool supports multiple searches at once, which is great for checking several records quickly and efficiently.

👉 Trading Names: Until 31 October 2025, trading names will still appear on ABN Lookup. This gives businesses plenty of time to inform their customers and other stakeholders of any name changes before trading names are removed from the site.

Keeping Your ABN Details Up-to-Date

It's important to keep your ABN details up to date. If you need to change your ABN, many government agencies rely on this information to deliver community services. Thus, here are some essential information to keep in mind when obtain ABN number:

📌 When to Update: You should update your details within 28 days if your business stops operating or if there are changes to your business.

📌 Consequences of Not Updating: If you don't update, your ABN may be canceled, which can disrupt your business activities.

📌 How to Update: You can easily update your details online at ABR website.

Your ABN Details on the Australian Business Register (ABR)

Once your application for an Australian Business Number (ABN) is successful, your details are recorded in the Australian Business Register (ABR).

This registration splits your information into two categories: public and non-public.

Public Information

You can check your public ABN details through ABN Lookup. The public information includes:

- ABN: Your unique number.

- ABN Registration: Status, effective dates, and any cancellations.

- Entity Legal Name and Type: Such as sole trader, company, trust, etc.

- GST and Other Registrations: Including status and dates of effect or cancellation.

- Approved Worker Entitlement Fund Status: If applicable.

- Australian Charities and Not-for-profits Commission (ACNC) Registration: Status and effective dates.

- Deductible Gift Recipient and Income Tax Exempt Fund Status: Includes fund name and status.

- Registered Business Name and Trading Name.

- Postcode and State: Of the main business address.

- Tax Concession, Charity Status, and Superannuation Fund Registrations: If applicable.

Non-Public Information

Certain details are not visible to the public and are only accessible to you, your registered tax agent (if you have one), and eligible government agencies:

- Associate Details

- Australian and New Zealand Standard Industrial Classification (ANZSIC) Code and Description

- Business Address and Geocoding: Including latitude and longitude.

- Mailing Address for Service of Notices

- Phone Numbers and Authorized Contacts

- Working Holiday Maker Registration: Dates of effect and cancellation, if applicable.

Special Requests for Privacy

If disclosing certain details could endanger you or your family, you can request these not be made public. This also applies to historical name data following gender reassignment.

Saving Your ABN Application

If you're unable to complete your ABN application in one go, you can save it and return as needed before it expires.

Here’s what you'll receive when you save your application:

- Reference Number: To access your saved application.

- Password: Keep this secure as you'll need it to log back in.

- Expiry Date: Important to note as any saved information will be lost after this date, requiring you to start over.

This structured storage of your ABN details ensures that while essential information is accessible for business transparency, your privacy is also maintained where necessary. Remember to keep a record of your login details and be aware of the expiry date to prevent any disruptions in completing your application.

Understanding ABN Entitlement: Who Qualifies?

Not every individual or entity can obtain an Australian Business Number (ABN).

It's essential to meet specific criteria to be eligible, ensuring compliance with Australian business regulations.

You're entitled to an ABN if you meet any of the following conditions:

- Carrying on or starting an enterprise in Australia. This includes activities that involve regular and systematic commercial operations.

- Making supplies connected with Australia's indirect tax zone—if your business activities are linked to goods and services that engage with Australia’s economic framework.

- Operating as a Corporations Act company. This applies to businesses structured and registered under the Corporations Act.

📌 Important Note: Applying for an ABN, registering for GST, and claiming GST refunds without entitlement can lead to severe legal consequences, including prosecution or criminal charges.

ABN Review Process

During the ABN application process, you will answer questions to ascertain whether you are genuinely carrying on an enterprise.

Additionally, you may undergo an ABN entitlement review at any point, where you must provide evidence proving the initiation or preparation to start your business as claimed in your application.

What Constitutes Carrying on an Enterprise?

Engaging in business-like activities can qualify as an enterprise. Such activities include:

- Operating as the trustee of a superannuation fund.

- Running a charity.

- Renting or leasing property.

However, simply engaging in activities is not enough. The enterprise must:

- Conduct significant commercial activities with the intent to make a profit, evident through a business plan.

- Operate in a repeated, systematic, and business-like manner.

- Keep detailed records and operate similarly to other businesses in the industry.

- Possess the necessary knowledge and skills for the industry.

Commencement Activities for New Enterprises

If you're setting up a new enterprise, you should engage in commencement activities such as:

- Advertising or setting upa digital presence like a website or social media.

- Purchasing business-related items like business cards or stationery.

- Acquiring necessary licenses, insurance, or premises.

- Issuing quotes or bidding for work.

- Consulting with professionals or applying for business finance.

While not all activities are mandatory, undertaking several and providing evidence upon request is necessary.

Specific Cases

👉 Employee vs. Contractor: You cannot obtain an ABN for work done under an employment contract, including roles like apprentices or laborers, even if termed contracting.

👉 Renting Residential Property: Generally, renting out residential property does not require an ABN, as it typically doesn't involve GST or pay-as-you-go obligations.

👉 Foreign Businesses: If your business operates from outside Australia but engages in activities within Australia's indirect tax zone, you may qualify for an ABN.

What if You Can’t Find Your ABN Number?

If you can't find your Australian Business Number (ABN), don't worry—there are several steps you can take to check the status of ABN:

📌 ABN Lookup: Visit the ABN Lookup website and search for your ABN using your business name or other identifiers. This is the quickest and easiest way to find your ABN if it's registered.

📌 Business Documents: Check any previous business documentation, such as invoices, official emails, or registration papers. Your ABN is usually listed on these documents.

📌 Tax Returns: Look through your tax returns. Your ABN is often included in the documentation related to taxation if you have previously registered for an ABN.

📌 Contact Your Accountant: If you use an accountant or tax agent, they should have records of your ABN.

📌 Australian Business Register (ABR): If you're still having trouble, you can contact the ABR directly. They can assist you in finding your ABN provided you can verify your identity and business details.

Conclusion: Streamlining Your Business Registration with ANNA One

Finding your ABN is just the beginning of your business journey in Australia.

With tools like ABN Lookup to retrieve your business number easily, you're set to take the next steps in formalizing your business presence.

But once you've got your ABN, what comes next?

How can ANNA One elevate your business setup to a whole new level of efficiency and ease?

Key Features of ANNA One

🎯 Effortless Company Registration: ANNA handles the ASIC fee and simplifies the registration process.

🎯 Integrated Business Account: Manage all your bookkeeping, invoicing, and tax needs on a single platform.

🎯 Automatic Tax Calculations: Keep your finances in check with automated GST tracking and tax invoice optimization.

🎯 Comprehensive Business Support: Securely store and easily access all your business documents, supported by expert advice whenever needed.

Getting Started with ANNA

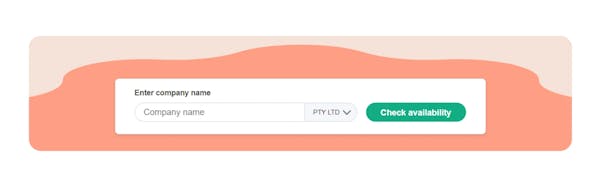

1️⃣ Choose a Unique Company Name: Check the availability of your desired name with ANNA's search tool.

2️⃣ Provide Company Information: Gather and submit details about your directors and shareholders, along with your business’s registered office address.

3️⃣ Complete the Registration: Let ANNA take care of the paperwork. They'll confirm once your business is officially registered.

ANNA's Plans

1. Easy Company - $630 (includes a $576 ASIC fee): A straightforward setup for your new company.

2. ANNA One - $619 for one year: An all-encompassing plan for managing your business efficiently from the start.

Ready to transform your business concept into a functioning enterprise with minimal hassle?

Why not get started with ANNA today and harness a comprehensive set of tools designed to streamline your business operations?

Start your journey with ANNA One now and make business management a breeze. 🚀