How to Start a Business in Australia from Home?

Learn how to start a business from home in Australia, including key steps, legal requirements, and tips for success in your new company.

Starting your own business from home in Australia is an exciting venture that combines your passion with entrepreneurial spirit.

Whether you're crafting handmade products, offering freelance services, or leveraging your expertise through online consulting, this guide provides detailed steps and practical advice to help you navigate the journey successfully.

1. Assessing Your Business Idea

If you're thinking about starting a home-based business but not sure where to start, here are some great options:

- freelancing ( graphic design, writing),

- e-commerce (selling handmade crafts, digital products),

- professional services (accounting, virtual assistance),

- health and wellness (fitness coaching, natural products),

- creative arts (crafting, art sales),

- home improvement (renovation consulting, gardening), and

- culinary ventures (baking, cooking classes).

These ideas let you use your talents from home, using websites and local markets to build a successful business.

Market Research

But first, you need to understand who is the ideal person for your product or service.

Before diving into your business idea, use thorough market research to understand your target audience and industry landscape:

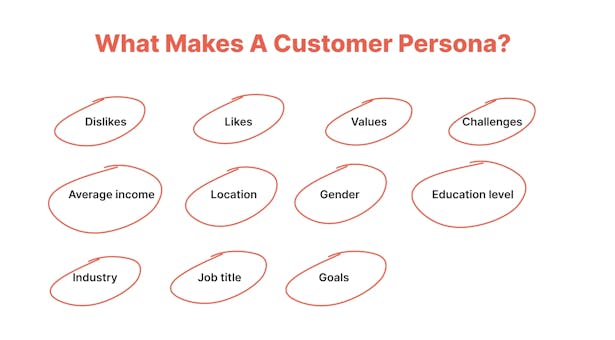

⚡ Identify Your Target Audience:

Develop detailed customer personas based on demographics, behaviors, and needs.

For instance, if you're planning to offer graphic design services, identify potential clients – small businesses seeking affordable branding solutions or individuals in need of creative assistance.

⚡ Competitor Analysis:

Study your competitors to understand their strengths, weaknesses, pricing strategies, and customer feedback.

Let’s say you bake cookies. Find a business you admire, review its portfolio and client testimonials, and identify any gaps or areas for differentiation.

⚡ Validate Your Idea:

Gather feedback from potential customers through surveys, focus groups, or prototype testing to validate market demand.

This part might seem expensive and complicated, but it doesn’t have to be. If you offer baby-related services, try heading to a nearby cafe or park.

You can conduct a survey among parents to find out what services they’re interested in, how much they’re willing to pay, and what extra features they value.

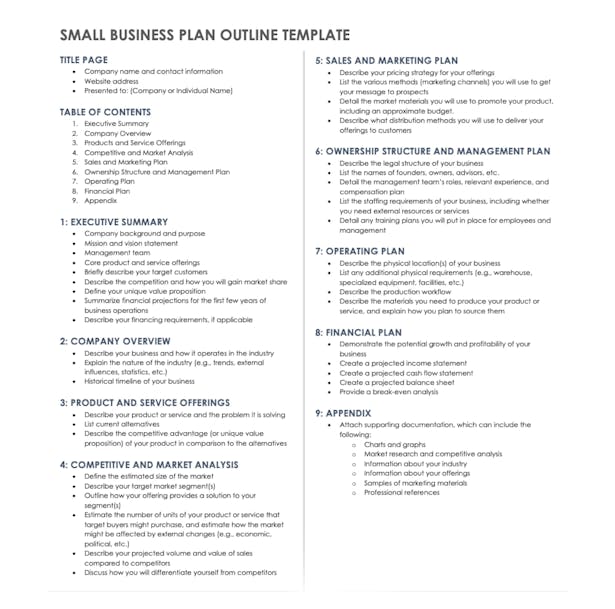

Feasibility Study/Business Plan

Assessing the feasibility of your business idea means looking at whether it can realistically work. You need to evaluate its financial viability, check if you have the necessary resources, and see if you're personally ready to take it on:

⚡ Startup Costs Calculation:

Estimating your initial expenses is crucial to understanding how much capital you'll need to start your business:

- Research Suppliers: Find suppliers who offer quality materials and tools at competitive prices. Compare costs and consider bulk purchasing to save money.

- Equipment Costs: List all necessary equipment for your business operations, such as computers, software, and office supplies.

- Website Development: Factor in the cost of building and maintaining a professional website, including domain registration, budget-friendly Windows hosting, and design services.

- Marketing Expenses: Budget for marketing activities like online advertising, social media promotions, and printed materials.

- Legal Fees: Include costs for registering your business, obtaining necessary licenses, and consulting with a lawyer for legal advice.

⚡ Skills and Resources Assessment:

Identify the skills and resources you need to deliver your product or service effectively:

- Evaluate Your Skills: Assess your proficiency in the key areas required for your business.

- Training and Development: If there are gaps in your skill set, consider enrolling in relevant courses or workshops to improve your abilities.

- Partnerships: Identify potential partners or collaborators who can complement your skills and help you deliver a better product or service.

📍 If you're starting a graphic design business, evaluate your proficiency in graphic design software like Adobe Illustrator and Photoshop. If you need to improve your skills, enroll in online courses or workshops focused on typography or illustration.

⚡ Financial Projections:

Developing realistic financial projections for the first year helps you plan for future revenue and expenses, ensuring your business stays on track financially.

- Revenue Forecasts: Estimate your monthly and annual income based on the number of clients or sales you expect to achieve.

- Operating Expenses: List all ongoing expenses, such as rent, utilities, supplies, and salaries.

- Break-Even Analysis: Calculate the point at which your revenue will cover all your expenses, indicating when your business will start to be profitable.

2. Legal Requirements

The next important step is to determine what type of business you will run.

Business Structure

Choosing the right business structure is essential for legal compliance and personal liability protection. Here are common options in Australia:

- Sole Trader: Operate as an individual without forming a separate legal entity. You are personally liable for business debts and obligations.

- Partnership: Formed with one or more partners sharing ownership, responsibilities, and profits. Partners share liability for business debts.

- Company: A separate legal entity distinct from its owners (shareholders). Provides limited liability protection but requires compliance with more regulatory requirements.

- Trust: Manages assets on behalf of beneficiaries according to specified terms. Offers flexibility in tax planning and distribution of income.

📍 But, in this case, the most suitable business structure for starting a business from home would be registering as a sole trader with the Australian Securities and Investments Commission (ASIC).

Registering Your Business – What Do You Need?

Once you’ve chosen your business structure, you need to register your business name and obtain the necessary identifiers:

- Business Name Registration: If operating under a name other than your own, register it with ASIC to ensure exclusivity and legal protection.

For example, register "Sweet Bakes by Sarah" as your business name to reflect your home-based bakery, which specializes in custom cakes and pastries. This will help establish a unique brand identity and attract local customers looking for personalized baked goods. - Australian Business Number (ABN): Obtain an ABN from the Australian Business Register (ABR), which is essential for invoicing, tax purposes, and business transactions.

- Goods and Services Tax (GST): Register for GST if your annual turnover is expected to exceed $75,000, allowing you to collect GST on taxable sales and claim input tax credits.

Compliance and Regulations

Another thing to pay attention to is to comply with local laws and regulations to avoid penalties and legal issues:

- Licenses and Permits: Research and get any required licenses or permits specific to your industry or location. Check with local council regulations regarding home-based businesses, especially if operating in a residential area.

- Insurance: Consider business insurance options such as public liability insurance to protect against claims and unforeseen incidents.

- Privacy and Data Protection: Implement policies and procedures to comply with Australian Privacy Principles when handling client data and personal information.

3. Setting Up Your Home Office

Your home is where you will be spending a LOT of time, so check out how not to get overwhelmed and divide personal from working space:

Workspace Design

Creating a productive home office environment is crucial for efficiency and focus:

- Designated Space: Choose a quiet, well-lit area of your home with minimal distractions to set up your workspace.

- Ergonomic Setup: Invest in ergonomic furniture to support comfort and posture and to reduce strain on your back and shoulders during long work hours.

- Organizational Systems: Implement organizational systems such as shelving units, filing cabinets, and desktop organizers to keep your workspace tidy and optimize efficiency.

Technology Setup

Equip your home office with essential technology to support your business operations:

- Computer/Laptop: Choose a reliable device with sufficient processing power and memory to handle your business software and multitasking needs.

This is essential for tasks ranging from digital marketing to managing an online store. - High-Speed Internet: Select a stable internet connection with adequate bandwidth to support file uploads, video conferencing, and online collaboration. Make sure you are actually getting the speeds you are paying for by doing an internet speed test before starting operations

- Software Tools: Install industry-standard software and productivity tools relevant to your business operations. Consider using a digital business card app to streamline networking efforts, allowing you to share your contact information instantly at events, meetings, or casual encounters with potential clients.

- Backup and Security: Implement data backup solutions (cloud storage, external hard drives) and cybersecurity measures (antivirus software, firewalls) to protect sensitive client information and intellectual property. If you're comparing options such as ProtonVPN vs NordVPN, look for insights from independent tech review platforms to make an informed choice.

Practical Setup for Non-Internet-Based Businesses

For businesses that aren't primarily internet-based, such as crafting, baking, or consulting, you still need a well-organized and functional home office:

- Crafting Workspace: Ensure you have enough room for all your materials and tools, along with proper lighting and ventilation.

For example, if you're running a home-based pottery business, set up a dedicated area for your pottery wheel, kiln, and storage for clay and tools. Ensure good ventilation for safety when using the kiln. - Baking and Cooking: For a home-based bakery, invest in commercial-grade baking equipment like mixers, ovens, and ingredient storage. Ensure you have a clean and organized workspace to meet health standards.

- Consulting or Coaching: Create a quiet and professional space to meet with clients or conduct virtual sessions. Make sure it’s free from household distractions.

4. Financial Management

The next step is to hopefully earn some money from your home-based business! Let’s see how to track your income and expenses effectively:

- Business Bank Account: Open a dedicated business checking account to separate personal and business finances. If you can, choose a bank offering low-cost transaction fees and online banking features to monitor cash flow and manage client payments.

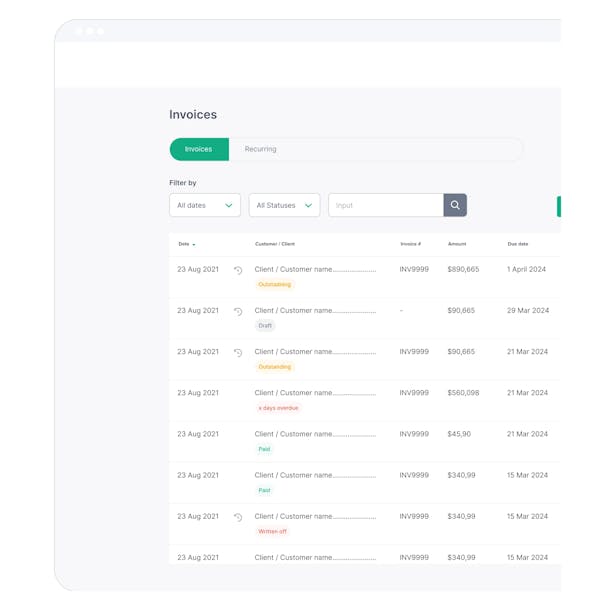

- Accounting Software: Select cloud-based accounting software (ANNA, Xero, QuickBooks) to track invoices, expenses, and financial reports.

With ANNA, you can set up recurring invoices and payment reminders through your account and we can even chase unpaid invoices for you!

- Budgeting and Forecasting: Use budgeting tools within accounting software to categorize expenses, monitor spending trends, and adjust financial projections accordingly.

5. Marketing Your Business

Build a strong online presence to attract and engage potential clients:

Professional Website

Create a visually appealing and responsive website that shows your portfolio, services, client testimonials, and contact information.

Don’t forget to optimize it for mobile devices and feature a gallery of past design projects.

You can either hire a professional, use website builders (WordPress), or use an ecommerce platform (Etsy, Shopify, etc.).

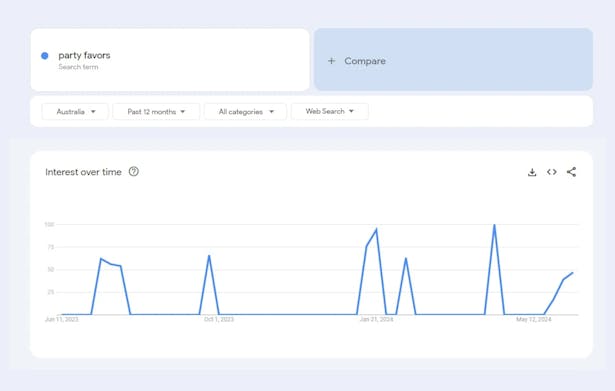

Search Engine Optimization (SEO)

Optimize website content with relevant keywords to improve organic search engine rankings and attract targeted traffic.

Use SEO tools (Google Keyword Planner, Google Trends) to identify high-traffic keywords related to your niche.

Social Media Marketing

Use social media platforms ( LinkedIn, TikTok, Instagram) to share portfolio updates, industry insights, and client success stories.

You can create a content calendar for social media posts that includes business tips, client spotlights, and behind-the-scenes glimpses of your creative process. Also, you can participate in relevant TikTok challenges or create your own to showcase your creativity.

6. Operations and Management

Working from home can blur the line between professional and personal time.

So, establish efficient workflows and management practices to optimize productivity and client satisfaction:

- Project Management: Utilize project management tools (Trello, Asana) to organize tasks, track deadlines, and collaborate with clients remotely.

You can create project boards for each client or project, outlining milestones, deliverables, and timelines to streamline communication and workflow. - Client Communication: Maintain regular communication with clients through professional email correspondence, video calls, or virtual meetings.

- Time Management: Implement time-tracking tools (Harvest, Toggl) to monitor billable hours, allocate resources efficiently, and prioritize tasks.

7. Growth Strategies

The last step is to grow your business. How can you do that?

- Diversification: Explore additional revenue streams or complementary, add-on services to broaden your client base and increase revenue.

- Networking and Partnerships: Build relationships with industry peers, influencers, and potential collaborators to generate referrals and business opportunities.

Attend industry events, workshops, or online forums to network with fellow business owners, potential clients, and business professionals. - Marketing Expansion: Invest in targeted marketing campaigns (Google Ads, email newsletters) to attract new leads and retain existing clients, offer discounts, special offers, etc.

How Can Anna Help Your Small Business?

ANNA makes starting and managing a small business in Australia simple and stress-free. With ANNA One, you can register your company, manage your finances, and stay on top of tax obligations all in one place:

1. Effortless Company Registration:

- Quick and Free Registration: ANNA covers the ASIC registration fee, allowing you to register your company without additional costs.

- Streamlined Process: Provide your company name, registered office address, and director and shareholder details. Use ANNA’s name checker tool to ensure your company name is available and start your business in just three steps.

2. Comprehensive Business Management:

- Bookkeeping and Invoicing: ANNA handles bookkeeping, invoicing, GST, and company taxes. Snap pictures of receipts and ANNA sorts them and attaches them to the correct transactions, keeping your financial records organized.

- Professional Invoicing: Create and send professional invoices quickly. ANNA’s follow-up service ensures your invoices are paid on time, with 80% paid within a week.

3. Financial Peace of Mind:

- Automatic Tax Calculations: ANNA automatically calculates GST and company income tax, providing a clear view of your upcoming tax obligations and helping you optimize your tax bill.

- Personalized Tax Calendar: Stay on top of tax deadlines with reminders, ensuring you meet all compliance requirements.

4. Support from Expert Accountants:

- Expert Advice: ANNA’s support team is available to answer any questions and provide guidance, helping you make informed decisions for your business.

5. Streamlined Financial Management:

- Business Accounts and Cards: Open an ANNA business account to access credit and virtual cards, along with Apple Pay and Google Pay options. Empower your business with modern financial tools for seamless transactions.

Sign up today and see why ANNA’s comprehensive services make it easier for you to start, run, and grow a happy business!