Sole Trader vs Company - What's the Difference?

Discover the comparison of Sole Trader vs Company, and learn about their differences, pros and cons to find the perfect structure for your business.

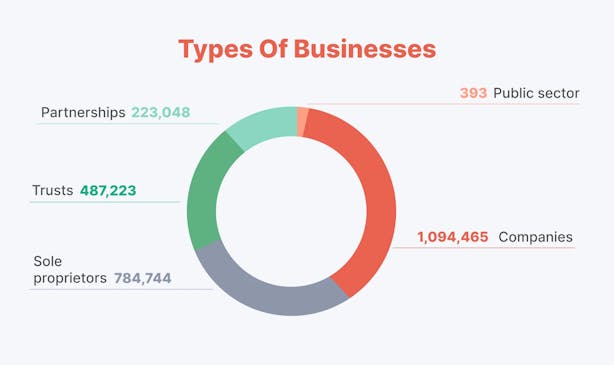

Starting a business is a big deal, and picking the right structure is one of your first and most important choices. Australia's two prominent (and most popular) options are being a sole trader or setting up a company.

Each has pros, cons, and implications for taxes, liability, and legal requirements.

This guide explains these differences in detail and provides examples to help you decide what's best for your new venture.

1. Sole Trader vs Company – Legal Structure

For the sake of this guide, let's introduce Jane, the sole trader, and Evergreen Innovations Pty Ltd, the company.

We'll use these two examples to illustrate the contrasting dynamics between operating as a sole trader and forming a company in Australia.

Sole Trader

Being a sole trader is about as straightforward as it gets in the business world. It's just you -the owner – running the show.

There's no legal separation between you and your business, which means you're personally responsible for everything that goes on.

Example: Jane decides to start a freelance graphic design business.

She registers as a sole trader, meaning she is the business's sole owner and is responsible for all its operations, including profits and losses.

Key Characteristics of a Sole Trader:

- Ownership: Owned by one person.

- Control: The owner has complete control over all business decisions.

- Liability: The owner has unlimited liability, meaning your personal assets can be used to pay off business debts.

- Regulation: Minimal regulatory requirements compared to other business structures.

- Taxation: Business income is reported as part of the owner's personal income tax return. You can use your personal tax file number (TFN) to lodge tax returns.

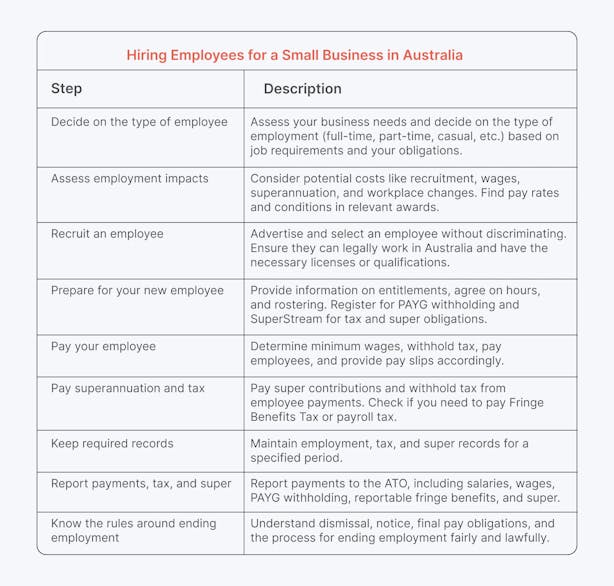

📍Under the sole trader business structure, you can employ staff to help manage your business.

If you choose to do that, you must fulfill certain obligations, including obtaining workers' compensation insurance and making superannuation contributions.

Company

A company is a separate legal entity from its owners (shareholders). It can incur debt, sue, and be sued.

Companies are more complex to set up and operate than sole traders, but they offer several benefits, including limited liability and easier access to capital.

Example: Evergreen Innovations Pty Ltd is a digital marketing agency formed by three shareholders.

The company is registered with the Australian Securities and Investments Commission (ASIC) and operates as a separate legal entity from its owners.

Key Characteristics of a Company:

When starting your business as a company, it's essential to understand these key elements:

- Separate Legal Entity: A company is a separate legal entity from its owners (shareholders). This means it can incur debt, sue, and be sued independently of its shareholders.

- Complexity: Setting up and running a company is more complicated than other business structures. It involves understanding and complying with the obligations under the Corporations Act 2001.

- Costs: Companies have higher setup and ongoing running costs than other structures. These include registration fees, annual review fees, and the costs associated with compliance and reporting.

- Ownership and Control: The company is owned by shareholders who hold shares in the company. Directors appointed by the shareholders manage business operations.

- Limited Liability: Shareholders have limited liability, meaning they are only liable for the company's debts up to the value of their shares. This protects their personal assets from being used to settle company debts.

- Regulation and Reporting: Companies are subject to stringent regulatory and reporting requirements. For example, they must lodge an annual company tax return with the Australian Taxation Office (ATO) and complete an annual review.

- Taxation: Companies pay a flat rate of tax on their profits. Dividends paid to shareholders are also subject to tax. Still, franking credits can reduce shareholders' tax on their dividend income.

- Profit Ownership: The money the business earns belongs to the company. Profits can be distributed to shareholders as dividends, which are taxed accordingly.

- Annual Review and Solvency Declaration: Directors must complete a yearly review, pay an annual review fee, and declare the company's solvency yearly to ensure it meets its financial obligations.

- Access to Capital: Companies have wider access to capital. They can raise funds by issuing shares to investors, which can be a significant advantage for growth and expansion.

- Director ID: Directors are required to have a director ID to ensure their identity is verified and recorded in official registers.

2. Sole Trader vs Company – Taxation

Sole Trader

For sole traders, business income is treated as personal income and taxed at the individual's marginal tax rate.

This means the sole trader's profits are combined with any other personal income (such as wages) and taxed accordingly.

Example: Jane's graphic design business earns $80,000 in a year. This amount is added to her personal income and taxed at her marginal tax rate, which might vary depending on her total yearly income.

Key Taxation Aspects for Sole Traders:

- Personal Income Tax: Business income is included in the owner's personal income tax return.

- Tax Concessions: Sole traders may be eligible for certain tax concessions and deductions for business-related expenses.

- Record Keeping: Records of all income and expenses are required to accurately report income and claim deductions.

Company

Companies are taxed separately from their owners at a flat corporate tax rate.

As of 2024, the tax rate for small businesses (those with an annual turnover of less than $50 million) is 25%, while larger companies are taxed at 30%.

📍 Check out the Treasury Laws Amendment (Cost of Living Tax Cuts) Bill 2024 for more information.

Example: Evergreen Innovations Pty Ltd earns a profit of $200,000. The company pays a 25% tax ($50,000) on this profit.

Suppose the company distributes the remaining $150,000 as dividends to its shareholders. In that case, the shareholders will pay personal income tax on these dividends.

Still, they can also claim franking credits for the tax the company has already paid.

Key Taxation Aspects for Companies:

- Corporate Tax Rate: Companies pay a flat tax rate on their profits.

- Franking Credits: Dividends paid to shareholders come with franking credits, which reduce the amount of tax shareholders need to pay on their dividend income.

- Tax Deductions: Companies can claim deductions for a wide range of business expenses, similar to sole traders.

3. Sole Trader vs Company – Liability

Sole Trader

One of the significant risks of operating as a sole trader is unlimited liability. This means the owner is personally liable for all business debts and obligations.

If the business fails, the owner's personal assets, such as their home or car, may be used to settle these debts.

Example: If Jane's graphic design business incurs a debt of $50,000 that it cannot pay, creditors can claim Jane's assets to settle the debt.

Key Liability Aspects for Sole Traders:

- Unlimited Liability: Personal assets are at risk if the business incurs significant debts.

- Risk: Higher personal financial risk compared to a company structure.

Company

A significant advantage of the company structure is limited liability.

Shareholders are only liable for the company's debts up to the value of their shares, which protects their personal assets from being used to settle company debts.

Example: If Evergreen Innovations Pty Ltd goes bankrupt with debts exceeding its assets, the shareholders only lose the value of their investment in the company. Their assets are not at risk.

Key Liability Aspects for Companies:

- Limited Liability: Shareholders' assets are protected from company debts.

- Protection: Provides greater protection for the personal finances of the business owners.

4. Sole Trader vs Company – Advantages and Disadvantages

Sole Trader

Advantages:

✅ It is easy and inexpensive to set up and operate. Registration as a sole trader involves minimal paperwork and costs.

✅ The owner controls all business decisions, like setting prices, managing clients, and retaining all profits.

✅ The business can be quickly restructured or dissolved without formal, complex legal procedures.

Disadvantages:

❌ Personal assets are at risk if the business incurs significant debts.

❌ Harder to raise capital and attract investors than a company structure because sole traders are often perceived as higher-risk ventures.

❌ The owner is solely responsible for all aspects of the business, from client acquisition to accounting, which can be demanding and stressful.

Company

Advantages:

✅ Personal assets of shareholders are protected from business debts.

✅ Easier to attract investors and raise capital by issuing shares, for example, for expanding its operations.

✅ A company structure can enhance the business's credibility and appeal to clients and investors.

Disadvantages:

❌ More expensive and complex to set up and operate. Companies require registration with ASIC, and ongoing tax and accounting compliance involves additional costs.

❌ Companies must comply with stringent regulatory and reporting requirements.

❌ Profits are taxed at the company level, and dividends are taxed again at the shareholder level, which can result in double taxation.

5. Sole Trader vs Company – Regulatory and Compliance Requirements

Sole Trader

The regulatory requirements for sole traders are relatively minimal. The key obligations include:

- ABN Registration: All businesses must register for an Australian Business Number (ABN).

- GST Registration: A business with an annual turnover of $75,000 or more must register for the Goods and Services Tax (GST).

- Business Name Registration: If the business operates under a name other than the owner's, it must be registered with the Australian Securities and Investments Commission (ASIC).

- Record Keeping: Sole traders must keep accurate and detailed records of all income and expenses for tax purposes.

Company

Companies in Australia are subject to more strict regulatory and compliance requirements, including:

- Company Registration: Companies must be registered with ASIC and comply with the Corporations Act 2001.

- ABN and ACN: Companies must obtain an Australian Business Number (ABN) and an Australian Company Number (ACN).

- GST Registration: Companies with an annual turnover of $75,000 or more must register for GST.

- Company Name Registration: The company name must be registered with ASIC.

- Annual Returns: Companies are required to lodge annual returns with ASIC, including financial statements and reports.

- Director Obligations: Directors have specific legal responsibilities, including ensuring the company meets its obligations under the law.

Conclusion

As a sole trader, you'll enjoy the simplicity and full control of the business but also face higher personal risk and funding challenges.

On the other hand, forming a company offers limited liability, greater credibility, and easier capital raising.

However, it comes with higher setup costs and more regulatory requirements.

It all comes down to your personal preferences, the size and nature of your business, and your vision.

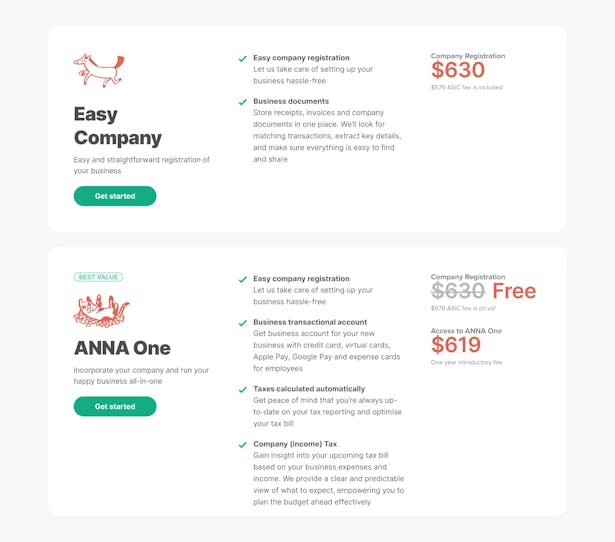

How Can ANNA Help Your Business?

With ANNA, starting and managing your business becomes a breeze.

Whether diving into entrepreneurship or growing your existing venture, ANNA has everything you need to get started hassle-free.

So, what's ANNA One all about?

It's your one-stop shop for business setup and financial management.

Register your company for free and get a nifty business account that handles all your bookkeeping, invoicing, GST, and taxes.

No more stressing over tax deadlines or accounting headaches!

Ready to take the leap? Here's how it works:

- Step 1: Pick a snazzy name for your company and let ANNA check its availability.

- Step 2: Set up your registered office address in Australia.

- Step 3: Provide your details as the director and shareholder.

- Step 4: Ta-da! Your company is officially registered, and you have a new business bank account ready to roll.

But wait, there's more!

- With ANNA One, you'll enjoy extra perks like debit cards, virtual cards, and even expense cards for your team.

- You can also create professional-looking invoices, or we can even chase the unpaid ones for you!

- Plus, ANNA keeps you on track with your taxes, so you'll never miss a deadline again. Say goodbye to tax headaches and hello to smooth sailing with ANNA's personalized tax calendar and friendly support team.

So, why wait?

Register your company with ANNA today and watch your dreams take flight!