4 Types of Business Structures in Australia

Discover the types of business structures in Australia and explore the nuances of them to find the perfect fit for your needs.

Australia is a vibrant hub for different businesses among various industries.

Whether you're looking to register your own business or simply want to better understand the market, remember that there is no one-size-fits-all approach to business structures.

In this blog, we'll explore four popular types: sole trader, company, partnership, and trust.

From launching a fintech startup to establishing a visual arts or fashion business, you'll learn everything you need to know about legal requirements, taxes, and paperwork.

Let’s get started!

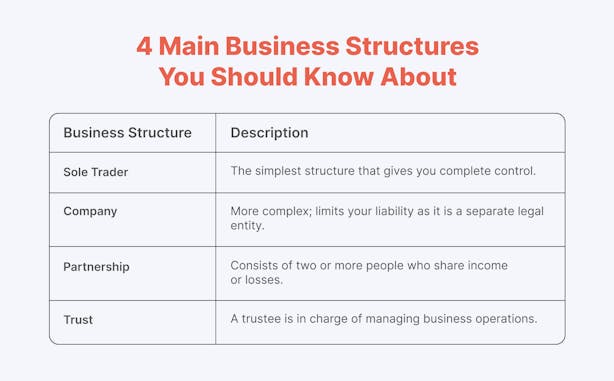

4 Main Business Structures You Should Know About

Let's start with the fundamentals: What exactly is a business structure?

It can impact:

🔸 Licenses: The permissions you need to run your business.

🔸 Taxes: The amount you owe to the tax authorities.

🔸 Role: Whether you're considered the owner or an employee.

🔸 Liability: Your potential personal risk.

🔸 Control: Your authority over business operations.

🔸 Paperwork: The volume of forms and records you must handle.

So, depending on that factor, here are the most important business structures you can choose from:

1. Sole Trader: You run your business solo, making all the decisions. It's straightforward and cost-effective, but be prepared to handle all responsibilities on your own, including debts.

2. Company: For those seeking a formal structure, a company might be the way to go. Companies are separate legal entities, offering limited liability for owners and more opportunities for raising capital. On the flip side, there's a higher level of regulation and complexity to navigate.

3. Partnership: If you believe two heads are better than one, a partnership might be for you. This structure allows you to team up with one or more individuals to share profits, losses, and management duties. Just remember, you're jointly liable for the partnership's debts.

4. Trust: A trust is a unique way to structure a business, with a trustee holding property or income for the benefit of others. Trusts offer tax advantages and asset protection, but they come with a high level of legal and administrative oversight.

📌 Tip

Business structures aren't set in stone – you can always switch things up! As your company grows and evolves, you might decide to change your business structure to fit your shifting needs better.

1. Sole Trader

Operating as a sole trader is one of the simplest ways to start a business.

As of June 30, 2023, the Australian economy hosted 2,589,873 active businesses.

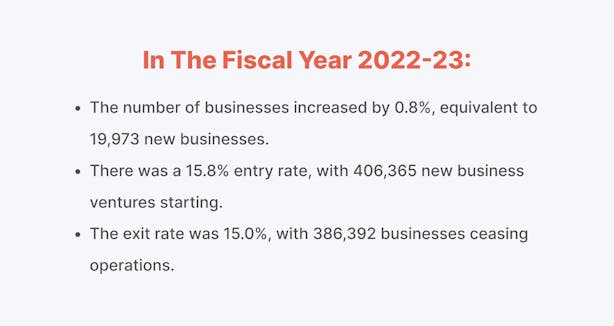

In the fiscal year 2022-23:

- The number of businesses increased by 0.8%, equivalent to 19,973 new businesses.

- There was a 15.8% entry rate, with 406,365 new business ventures starting.

- The exit rate was 15.0%, with 386,392 businesses ceasing operations.

What Type Of Business Are Usually Registered As Sole Traders?

- Tradesperson or Contractor: Individuals providing services such as plumbing, electrical work, or building services.

- Online Business: Entrepreneurs who operate online stores or offer freelance services such as writing or graphic design. These businesses can be run from home, reducing overhead costs.

- Professional Services: Sole traders that provide legal, accounting, and consulting services.

- Personal Services: Sole traders offering services such as hairdressing, beauty services, or personal training. These individuals may rent a space for their business or operate from home.

- Retail or Hospitality: Sole traders who run cafes, restaurants, or boutique stores. These entrepreneurs handle sourcing products, managing staff, and overseeing the financial aspects of the business.

Registering As a Sole Trader: What You Need

To begin operating as a sole trader, all you need is to obtain an Australian Business Number (ABN) for income generation. This involves keeping accurate records and managing the cost of registration, as well as GST collection, reporting, and payments.

Additionally, if your earnings exceed $75,000, you must pay a 10% goods and services tax (GST). This requires you to maintain accurate records and handle GST collection, reporting, and payments. There's also the Medicare levy, which is 2% of your taxable income.

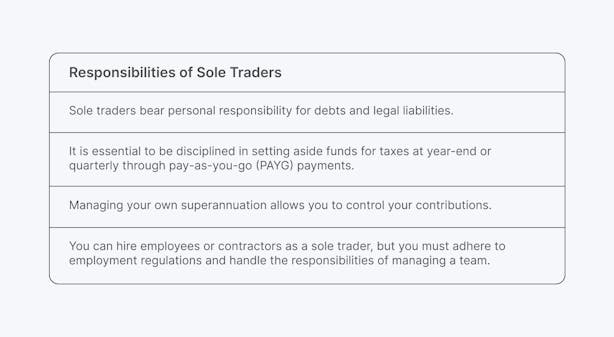

Responsibilities of Sole Traders

Sole traders bear personal responsibility for debts and legal liabilities.

It is essential to be disciplined in setting aside funds for taxes at year-end or quarterly through pay-as-you-go (PAYG) payments.

Managing your own superannuation allows you to control your contributions.

You can hire employees or contractors as a sole trader, but you must adhere to employment regulations and handle the responsibilities of managing a team.

What Taxes Do Sole Traders Have To Pay?

As a sole trader in Australia, the amount of tax you owe in 2024 will depend on your net income, which is calculated as your business profits minus allowable deductions.

Sole traders pay taxes according to individual tax rates, which vary depending on your income level.

For the 2023-24 financial year, the rates are as follows:

- If your income is up to $18,200, you are within the tax-free threshold and owe no tax.

- For income between $18,201 and $45,000, you pay 19 cents per dollar earned over $18,200.

- If you earn between $45,001 and $120,000, you pay $5,092 plus 32.5 cents per dollar over $45,000.

- For incomes between $120,001 and $180,000, you owe $29,467 plus 37 cents per dollar over $120,000.

- If your income exceeds $180,000, you pay $51,667 plus 45 cents per dollar over $180,000.

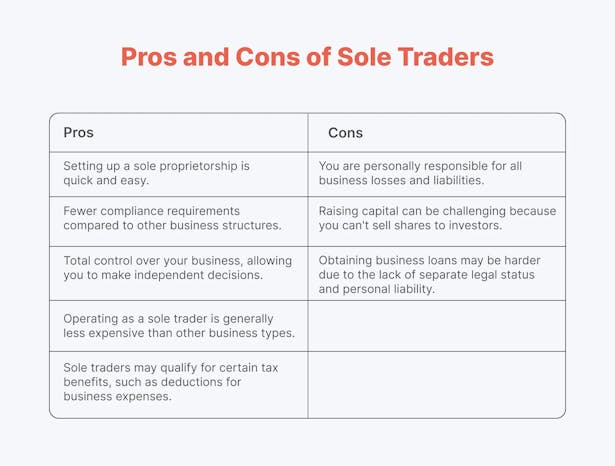

Pros and Cons of Sole Traders

2. Company – Proprietary Limited (Pty Ltd)

A proprietary limited company (Pty Ltd) is a popular business structure in Australia. As of June 30, 2023, there were 2,589,873 actively trading businesses in Australia.

This equates to nearly one business for every 10 people in the country.

What Type Of Business Are Usually Registered As Companies?

According to research, these industries have the most registered companies:

- Construction remains the largest industry in terms of the number of businesses in operation. However, the number of construction businesses declined slightly by 0.1% in 2022-23.

- The healthcare and social assistance sector experienced significant growth, with a 6.1% increase in the number of businesses operating.

- Financial and insurance services businesses in this sector grew by 2.7%.

- Transport, postal, and warehousing businesses in this sector increased by 2.4%.

- Administrative and support services faced a 1.6% decline in the number of businesses.

- The retail trade sector experienced a 1.4% decrease in the number of businesses operating.

Registering As a Company: What You Need

- Register with ASIC: Entrepreneurs establish this type of business by registering with the Australian Securities and Investments Commission (ASIC).

- Separate Legal Entity: Once the company is set up, it becomes a separate legal entity from the owner, allowing the business to own assets and make agreements independently.

- Requirements: To create a Pty Ltd company, you need:

- Bylaws: The rules governing how the company will operate.

- Company Directors: Individuals responsible for managing the company.

- Business Name: The name under which the company will operate.

- Tax File Number (TFN): A unique identifier for tax purposes.

- Australian Business Number (ABN): A unique identifier for business activities.

- Business Bank Accounts: Accounts for managing the company's finances.

- Thorough Record-Keeping: Although it's relatively easy to establish, managing a company requires maintaining meticulous records.

What Taxes Do Companies Have To Pay?

In Australia, companies are required to pay several types of taxes:

1. Company or Income Tax: Companies pay income tax on their profits at a flat rate, which is currently 30% for large companies and 25% for smaller businesses (base rate entities), with an annual turnover of less than $50 million.

2. Capital Gains Tax (CGT): Companies must pay tax on any capital gains made from the sale of assets. This tax is typically calculated as part of the company's income tax return.

3. Goods and Services Tax (GST): Companies with an annual turnover of $75,000 or more must charge a 10% GST on goods and services they provide. This tax is collected from customers and paid to the government.

In addition to these, there are other minor taxes such as:

- Fringe Benefits Tax (FBT): Companies that provide fringe benefits to their employees, such as company cars or low-interest loans, must pay this tax on the taxable value of those benefits.

- Payroll Taxes: Companies may also be liable for payroll taxes, which are state taxes calculated based on the total wages paid to employees.

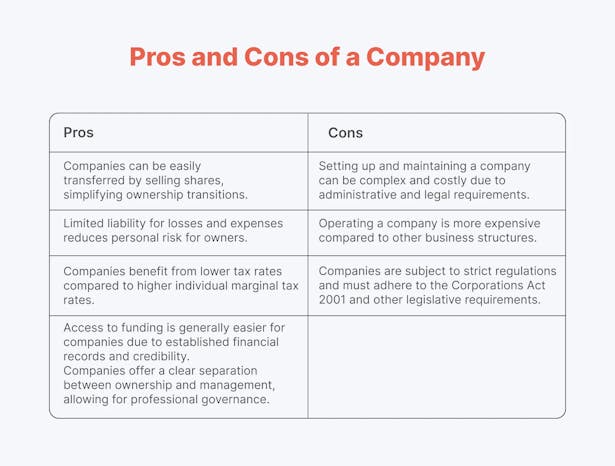

Pros and Cons of a Company

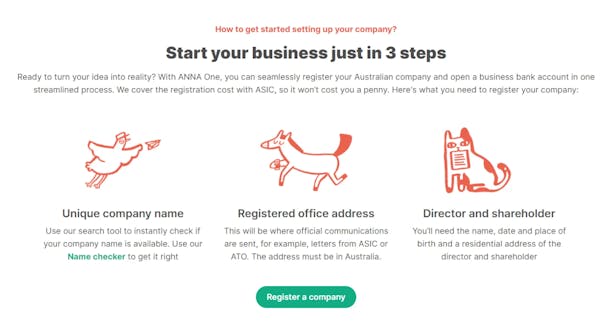

💡 Pro Tip

Registering a business and managing taxes can be complex, so seeking expert assistance is a wise choice if you're unsure how to proceed.

ANNA One simplifies the process by covering your registration fee and helping you open a business account in a few easy steps:

1. Choose your company name.

2. Choose ANNA One subscription

3. Provide your personal and company details. You can also add optional features like a virtual office address to maintain privacy.

4. Receive a notification when your application is complete.

With ANNA One, you can streamline various aspects of your business management:

⭐Taxes: ANNA One helps you calculate and file taxes automatically based on your business transactions. You receive a personalized tax calendar to stay on top of deadlines and know your tax estimate.

⭐ Business Account: Link your bank accounts to ANNA One for a unified view of your finances.

⭐ GST Registration: ANNA One handles the application for you with the Australian Taxation Office (ATO).

⭐ PAYE/Payroll Registration: ANNA One assists with the process and helps you obtain the necessary documents for paying salaries.

⭐ Invoices: Quickly create and send professional invoices with ANNA One. Unpaid invoices are chased for you, leading to prompt payment.

⭐ Expert Accountant Support: Access guidance from ANNA One's team of knowledgeable accountants to address any questions you may have.

3. Partnership

A partnership is a business structure that involves two or more people who work together and share profits and responsibilities. Unlike a sole trader, a partnership requires a separate tax file number and a partnership tax return.

The partnership itself does not pay taxes on its income; instead, each partner reports their share of the income on their personal tax return.

Key features of a partnership:

⚡Shared Income and Control: Partners share business income, decisions, and potential losses.

⚡ Written Partnership Agreement: While not required, having a written agreement is beneficial to outline each partner's roles and responsibilities.

⚡ Money Drawn from the Partnership: Money taken out by partners is not considered 'wages,' so it can't be claimed as a business deduction.

Limited Partnership

A limited partnership combines a traditional partnership structure with one general partner who actively manages the business and one or more limited partners who primarily contribute financially and have limited involvement in day-to-day operations.

Key features of a limited partnership:

⚡ Tax Treatment: The limited partnership is treated as a separate tax-paying entity, paying taxes on its income.

⚡ Liability: All partners share equal responsibility for debts and liabilities, so it's crucial to seek legal advice to understand the risks.

This business structure is often used in venture capital scenarios, where an entrepreneur partners with a financial backer to launch a business.

What Taxes Do Partnerships Have To Pay?

In a partnership, the profits and losses flow through to the individual partners, who report them on their personal tax returns. Here's how partnership tax works:

⚡Partnership Tax Return: Each year, the partnership must file a separate tax return detailing the partnership's income, expenses, and how the profits and losses are distributed among the partners.

⚡ Individual Tax Reporting: Partners must include their share of the partnership's income or losses on their personal tax returns, even if they haven't actually received the money.

⚡ Income Allocation: Each partner reports their portion of the partnership's income or losses on their individual tax return. This includes income from sales, services, and other business activities.

⚡ Responsibility for Gains and Losses: Partners are responsible for reporting their share of any capital gains or losses from the sale of assets or other business transactions for tax purposes.

Pros and Cons of Partnership

4. Trust

A trust is a business structure that involves a trustee managing assets or income for the benefit of beneficiaries. Trusts are a popular but complex choice for business or estate planning in Australia.

Income from a trust is distributed to beneficiaries, and how this income is distributed can affect the tax obligations of the trustee and beneficiaries.

Registering As a Trust: What Do You Need

To set up a trust in Australia, you need the following:

- Trust Deed: A formal legal document outlining how the trust will operate, including the roles of the trustee and beneficiaries, and how income and assets are to be managed and distributed.

- Trustee Appointment: A trustee must be appointed to manage the trust according to the trust deed. The trustee can be an individual or a company.

- Tax File Number (TFN): The trust needs its own TFN to report and pay taxes.

- Tax Returns: The trust must submit tax returns annually. Depending on the trust's structure and the income distribution, the trust or beneficiaries may be responsible for paying taxes.

What Taxes Do Trusts Have To Pay?

In trusts, the way taxes work depends on how the trust distributes income and to whom. Here's how trust taxation works:

- Beneficiaries' Taxation: If the trust's beneficiaries are adults or companies, they pay taxes on the income they receive from the trust according to their regular tax rate. This income is reported on their personal or corporate tax returns.

- Trustee's Taxation: In some cases, such as when income is distributed to non-residents or minors, the trustee may pay the taxes on the income on behalf of the beneficiaries. Beneficiaries may still need to report this income on their tax returns and may be eligible for a tax credit for taxes paid by the trustee.

- Special Rates for Minors: Income distributed to minors (individuals under 18 years old) may be subject to higher tax rates compared to other beneficiaries.

- Undistributed Income: If there is income in the trust that is not distributed to beneficiaries, the trustee pays taxes on that portion of the income. If the trust has net income, the trustee may also be responsible for paying taxes on it.

- Trustee Tax Rate: Generally, the trustee is taxed at the highest individual tax rate, except for certain types of trusts, such as deceased estates, which may have different tax rates.

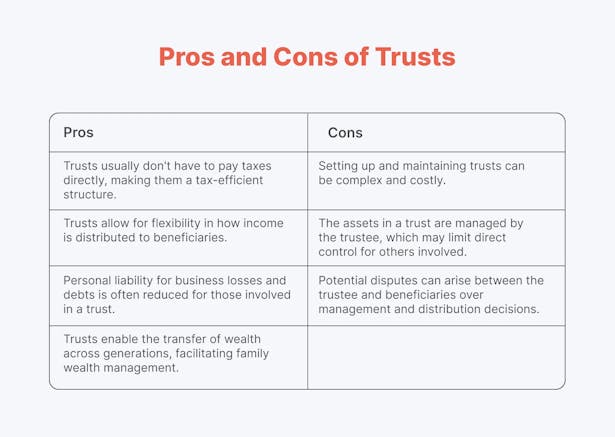

Pros and Cons of Trusts

Wrapping It Up

Australia offers a diverse range of business types, from sole traders and partnerships to companies and trusts, catering to the varied interests and needs of entrepreneurs. No matter which business structure you choose, careful planning and understanding of the legal and financial requirements are key to success.

What Makes ANNA Stand Out?

The experts at ANNA provide comprehensive support for navigating the complexities of starting and running a business in Australia.

ANNA One offers a complete package for business success, from company registration to tax management and banking solutions:

⭐Responsive Customer Support: We're available to address any issues promptly, ensuring a smooth business journey for you.

⭐ Simple Registration Process: We handle the formation fees and offer exceptional value by reducing your government fees.

⭐ Business Categorization for Easy Finances: Our system categorizes your business for precise cost and expense calculation, streamlining your accounting process.

⭐ Advanced ML/AI Technologies for Tax Management: ANNA simplifies tax handling with innovative technology that calculates and files your taxes automatically, tailored to your business.

Ready to elevate your business?

Sign up today and access the tools you need for a smoother, more efficient business journey!