What is ABN Number? Everything You Need to Know

Learn what is an ABN number, and explore everything you need to know about it, from its significance to the registration process.

- In this article

- What is an ABN?

- ABN vs. ACN: Understanding the Difference

- Eligibility for an ABN

- Application Process for an ABN

- Cost of Obtaining an ABN

- Can You Have Multiple ABNs?

- Checking the Status of Your ABN Application

- Using One ABN for Multiple Businesses

- Manage Your Business Finances Effortlessly with ANNA

Curious about getting an ABN for your business? Wondering about costs and how long it takes?

You're in the right place!

Our guide covers everything you need to know about applying for and registering your ABN in Australia.

Let's dive in!

What is an ABN?

An ABN, also known as an Australian Business Number, is an 11-digit identifier that officially recognizes your business in Australia.

It is issued by the Australian Business Register (ABR), which is the main national database of business information.

This number is essential for all types of businesses, whether you're operating on your own, in a company, or as part of a partnership.

Getting an ABN makes your business legitimate and simplifies dealings with government bodies.

For companies, the ABN includes the Australian Company Number (ACN), making your business identity clearer and more integrated.

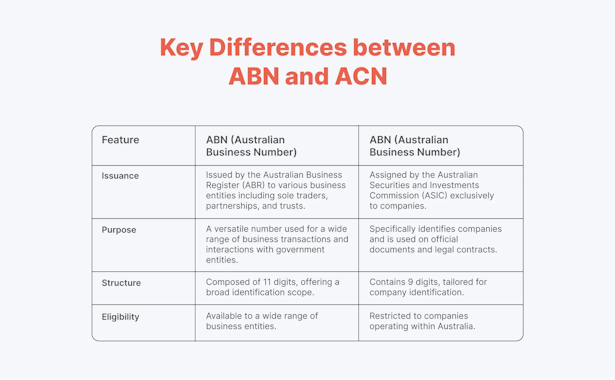

ABN vs. ACN: Understanding the Difference

In Australia, businesses must navigate various regulatory requirements, including the acquisition of an Australian Business Number (ABN) or an Australian Company Number (ACN).

While both are essential identifiers, they have distinct roles and uses.

What is an ACN?

The ACN, short for Australian Company Number, is a 9-digit number assigned by the Australian Securities and Investments Commission (ASIC) to every company registered under the Corporations Act 2001.

It acts as a unique identifier for companies, facilitating legal and administrative processes. Companies use their ACN on official documents and contracts to confirm their registration and legal existence.

Key Differences between ABN and ACN

Let’s review the distinctions between ABN and ACN:

Eligibility for an ABN

To get an Australian Business Number (ABN), you must actively conduct business in Australia.

The criteria for eligibility are broad, allowing various types of business structures to apply. Here's who can apply:

- Companies: If your company is registered and operates in Australia, it's eligible.

- Individuals/Sole Traders: Anyone engaged in business activities in Australia can apply.

- Partnerships: Businesses run by two or more people or entities, sharing profits and responsibilities, qualify.

- Trusts: Entities that hold property or income for others' benefit are eligible.

- Non-profit Organizations: If they operate and provide services or support in Australia, they need an ABN only if their annual turnover is $150,000 or more. This requires them to register for the Goods and Services Tax (GST) and, by extension, to have an ABN.

In short, if you're involved in any form of business activity in Australia, chances are you're eligible for an ABN.

Business Criteria for ABN

Qualifying for an Australian Business Number (ABN) means proving that your business is genuine and aims to make a profit.

Here are the key points that outline the eligibility criteria:

- Genuine Business Activity: It's essential to show that your business is already making sales or providing services or is about to start doing so in Australia. This is to ensure that the ABN is used for real business purposes.

- Australian Presence: It is crucial to have a physical footprint in Australia. This could be a place of business or a representative who resides in Australia, ensuring that your business is grounded in the Australian economy.

- Legal Existence: Your business must be legally recognized under Australian law. This includes any foreign businesses that operate within Australia, highlighting the need for legal compliance and recognition.

In essence, to be eligible for an ABN, your business should be operational or on the verge of operating in Australia, with a clear intention to profit, and it must be legally established and physically present in the country.

Note 📌

👉 Non-residents: If you're a non-resident wanting to start a business in Australia, you can still apply for an ABN, provided you meet the eligibility criteria related to business activities in Australia.

👉 Multiple Businesses: If you're running multiple businesses under the same structure, you can use one ABN for all activities. Different structures require separate ABNs.

Application Process for an ABN

As mentioned previously, applying for an Australian Business Number (ABN) helps in your interactions with the Australian Tax Office (ATO) and other government entities.

Fortunately, the application process is online and straightforward. Here's what you need to do:

- Get Ready: Before applying, make sure you have all your business info ready, like your business structure and tax file number (TFN).

- Start the Application: Go to the ABR website and find the section for ABN applications to begin.

- Fill it Out: The form is straightforward and will ask about your business. You'll need to answer questions about what your business does, why you're applying for an ABN, and your expected earnings.

- Check and Send: Double-check your answers, submit the form, and note your application number.

- Get Your ABN: You might get your ABN immediately, but if there's a need for extra checks, it could take up to 28 days.

💡 ProTip

You can now easily register your ABN via ANNA Money, streamlining the process and getting you one step closer to starting your business.

Remember, this process is designed to be accessible and efficient, ensuring that businesses can easily obtain their ABN and start or continue operating within the Australian legal and tax frameworks.

Cost of Obtaining an ABN

Applying for an ABN is free when done through the Australian Business Register (ABR), allowing businesses to register without incurring upfront costs.

However, hiring tax agents or professional services for application assistance is optional, and such services charge fees that vary based on your business's complexity and the level of help required.

While applying directly can save money for straightforward cases, professional assistance may be valuable for complex situations to ensure accuracy and compliance.

Can You Have Multiple ABNs?

Yes, you can have multiple Australian Business Numbers (ABNs), but this typically depends on your business structure and activities.

Here's what you need to know:

- Different Legal Structures: When operating businesses under different legal structures (such as running one business as a sole trader and another as a registered company), each entity must have its own separate ABN to comply with Australian business law. This clear separation ensures proper financial tracking and regulatory compliance.

- Partnership Requirements: Partnership businesses require unique ABNs for each distinct partnership arrangement. Even if you're involved in multiple business partnerships with different groups of partners, each partnership must maintain its own ABN to properly track ownership and financial obligations.

- Trust Operations: For trust-based business operations, every individual trust must secure its own ABN. This legal requirement helps maintain distinct financial boundaries between different trust structures and ensures clear accountability in financial reporting and tax obligations.

- Single Structure Benefits: Multiple business activities can operate under a single ABN if they share the same legal structure. For example, if you're a sole trader running both a café and a catering service, you can use one ABN for both operations. This approach simplifies administrative tasks while still meeting all legal requirements.

If you need to update or change your ABN due to structural changes, such as switching business types or adding a new partnership, you can do so through the Australian Business Register (ABR) to ensure compliance with Australian business laws.

However, if you're running multiple businesses under the same legal structure, you can use one ABN to cover all of them.

Checking the Status of Your ABN Application

If you're waiting on your Australian Business Number (ABN) and eager to start your business, knowing how to check the status of your ABN application can be very helpful. You can do this with ABN Lookup, a free public view of the Australian Business Register.

Here's what you need to do:

- Keep Your Reference Number: You'll receive a unique reference number when you submit your ABN application. Keep this number safe because you'll need it to track your application's progress.

- Contact the ABR: The most direct way to check the status of your ABN application is by contacting the Australian Business Register (ABR) itself.

It's crucial to note that ABN Lookup, a tool used for verifying ABN details, does not have access to application status or registration details.

So, any questions about the progress of your application or requests for further assistance should be directed exclusively to the ABR.

Using One ABN for Multiple Businesses

It is entirely feasible to operate multiple businesses under a single Australian Business Number (ABN), given certain conditions are met.

This practice can streamline dealings with the Australian Taxation Office (ATO) and simplify tax processes.

However, there are situations where having separate ABNs is necessary, often due to the differing structures or nature of your businesses:

- Different Business Structures: If your businesses operate under different legal structures (e.g., one is a sole trader setup while another is a company), each structure will need its own ABN. This is because different structures have distinct legal and tax implications.

- Partnerships with Different Partners: For businesses operated as partnerships, a new ABN is required if the composition of partners varies between businesses. Each partnership's unique combination of liabilities and rights requires a separate identifier.

- Various Trust Structures: Operating businesses under different trust arrangements also necessitates separate ABNs. The specific obligations and benefits tied to each trust for its beneficiaries demand distinct identification.

Manage Your Business Finances Effortlessly with ANNA

In conclusion, understanding the ABN is essential for navigating Australian business operations.

ANNA provides an innovative and straightforward solution for entrepreneurs looking to streamline this process, making business registration in Australia both straightforward and cost-effective.

Here's how ANNA simplifies starting and managing your business:

👉 Virtual Office in Australia: Offers a professional business address without the need for physical space.

👉 Business Account: Helps organize your business finances with a dedicated account.

👉 Bookkeeping Software: Simplifies bookkeeping with user-friendly software.

👉 Accounting Help: Provides expert advice and services for all accounting needs.

Additionally, ANNA enhances your business management by offering:

👉 Taxes: Simplifies tax calculations and submissions.

👉 Transaction Account: Consolidates all your banking in one place for better financial oversight.

👉 GST and PAYE/Payroll: Assists with GST registration and payroll management, ensuring compliance with the ATO.

👉 Invoices: Facilitates creating, sending, and tracking invoices, including reminders for late payments.

With ANNA One you can save money on business registration and get access to a comprehensive suite of services to ensure smooth business operations and growth.

Whether starting as a sole trader or establishing a limited company, ANNA One provides a seamless introduction to the business world, fully preparing you to thrive.

Ready to streamline your business finances and save on registration fees?

Join ANNA today and unlock a suite of essential services tailored to your business success.