ABN vs ACN – Everything You Need to Know

Learn the differences between an ABN and ACN in Australia. Discover why your business might need both and how they impact your operations.

- In this article

- ABN vs ACN – Key Differences

- What Is ABN Number?

- What Is ACN Number?

- How to Get an ABN

- How to Get an ACN

- How To Find ABN or ACN?

- Benefits of ABN Number

- Benefits of ACN Number

- When Do You Need ABN, ACN, or Both?

- Keeping Your Company Details Up-to-Date With Director ID

- When Should You Use ACN vs. ABN On Documents

- Wrapping It Up

Are you tired of various acronyms floating around, like ABN and ACN?

If you're starting a business in Australia, you might be scratching your head, wondering what these letters mean and whether they're important to you.

Here's the deal: Every business needs an ABN. However, not every business requires an ACN. Only companies registered as such need to get one.

In this article, we will cover the differences between ACN and ABN, why they're valuable, the application process, and whether your business truly needs them.

Let's untangle the confusion together!

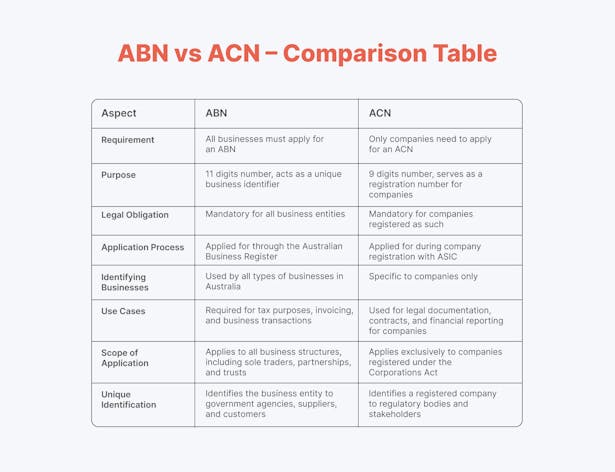

ABN vs ACN – Key Differences

What Is ABN Number?

An Australian Business Number (ABN) is a unique identifier for your business – it's like its own distinct fingerprint. No matter the size or structure of your business, having an ABN is a must in Australia.

The Australian Taxation Office (ATO) issues this 11-digit number, which must be linked to your registered business name.

Now, why is this number so significant?

Well, it's all about fulfilling your financial obligations as a business.

And with many businesses having similar names, your ABN sets you apart.

Additionally, it ensures you're meeting all the necessary tax requirements, be it for profit, income, GST, or PAYG.

What Is ACN Number?

Like the ABN number, the ACN (Australian Company Number) is a fundamental identifier for registered companies.

It consists of nine digits and is a unique marker for each entity under the Corporations Act 2001.

Regardless of its type or size, every company must receive an ACN upon registration with the Australian Securities and Investments Commission (ASIC).

The primary function of the ACN is to make it easier to distinguish between companies in Australia across a spectrum of activities.

So, whether you are engaging in business dealings, legal transactions, or interactions with government bodies, the ACN number is a crucial reference point.

Once you are assigned an ACN, it remains associated with the company until it exists, regardless of any changes in name, ownership, or location.

If you need to check an ACN (yours or that of another company), you can do so through ASIC's online services or by requesting official documentation, such as a company extract.

This document provides comprehensive details about a company's registration and history, including:

- Company registration date

- Current status of the company

- Basic company information

- Share capital information

- Details of directors and officers

- Annual reports

How to Get an ABN

Getting an Australian Business Number (ABN) is a straightforward process:

1. Check Eligibility: Start by visiting the Australian Business Register website to see if you need or qualify for an ABN. If you've already applied for your ABN, you can check the application status on the Australian Business Register website

2. Online Registration: If you're eligible, head to the Australian Government's Business Registration portal.

The process is usually quick and simple, taking only a few minutes if you have all the required information ready.

How to Get an ACN

Do I need an ACN? Yes, if you have a company.

So, how do you get an ACN? You automatically receive one when you register your company. And how do you register a company?

Here is a quick checklist:

- Determine if your company will be limited by shares or unlimited with a share capital.

- Decide whether your company will use the replaceable rules provided by the Corporations Act 2001 or adopt a constitution.

- Choose a unique name that complies with naming rules and check if it's taken using the name availability search tool.

- Nominate the state or territory where your company will be registered.

- Select a registered office address and a principal place of business address within Australia.

- Identify if your company has an ultimate holding company and provide relevant details if applicable.

- Choose company officeholders and obtain written consent from each director and secretary.

- Ensure compliance with director identification number (director ID) requirements.

- Determine the share class or classes, number of shares, and amount to be paid for each share.

- Create a register of shareholders containing relevant details.

- Keep all consent forms and registers of officeholders and shareholders with your company records for compliance purposes.

Pro tip 💡

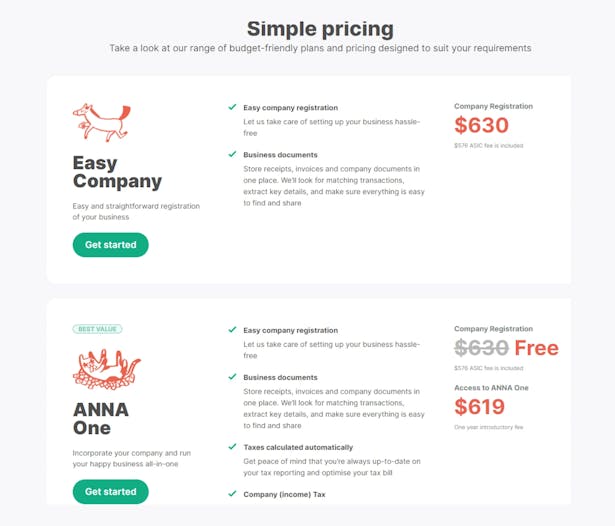

If you find registering a company process a bit overwhelming – ANNA is here to help!

With ANNA, you can easily and officially register your company with ASIC while also effectively managing your business banking and taxes.

All it takes are 4 simple steps:

- Choose a unique company name

- Select ANNA One subscription for added benefits

- Provide essential details about your business

- Stay informed as we handle your application process from start to finish.

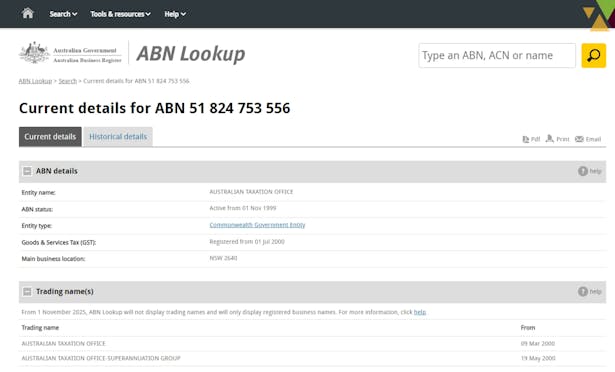

How To Find ABN or ACN?

Finding an ABN or ACN for a company in Australia is relatively straightforward:

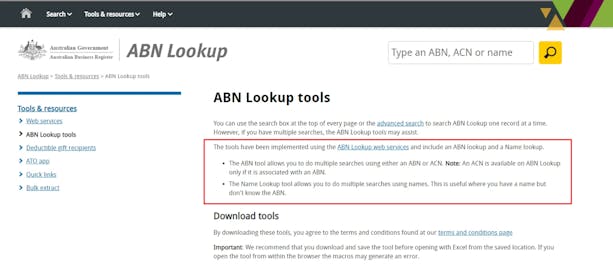

You can find your company's ABN on the Australian Business Register's website under the ABN Lookup tool.

Simply visit the website and use their search function to look up your company's details.

Both of these numbers should be displayed in the search results.

Alternatively, you can search for the ACN on ASIC Connect, which is the online portal of the Australian Securities and Investments Commission. Similar to the ABR, you can search for the company by name or other details to find the ACN.

Benefits of ABN Number

⚡ An ABN uniquely identifies your business, making it easily recognizable in various transactions and interactions.

⚡ Once you have an ABN, you can apply for Goods and Services Tax (GST) registration, enabling your business to collect and remit GST.

⚡ If your business is a charity or exempt from certain taxes, your ABN is required to confirm your charitable status.

⚡ Your ABN is a gateway to accessing various government services, including those provided by the Australian Taxation Office (ATO).

Benefits of ACN Number

Similarly, the benefits of having an ACN include:

⚡ An ACN is necessary for legal compliance, ensuring that your company meets regulatory requirements.

⚡ Shareholders, partners, and other interested parties can easily look into information about your company using its ACN.

⚡ An ACN serves as proof of registration with the Australian Securities and Investments Commission (ASIC), establishing your company as a legitimate business.

⚡ Potential customers and partners often use the ACN to verify the authenticity of your company, increasing trust and credibility in business transactions.

⚡ Registering for an ACN establishes your company as a separate legal entity, reducing trading risks and personal liabilities, especially if you've transitioned from a sole trader model to incorporation.

⚡ Incorporating your business can potentially increase profitability by streamlining operations and enhancing credibility in the eyes of stakeholders.

When Do You Need ABN, ACN, or Both?

🔸 ABN Only

You're opening a small café called "Sunrise Cafe," where you'll serve breakfast and lunch to customers. In this case, you'll need to register for an ABN to issue invoices, order supplies, and interact with suppliers and customers.

Also, it ensures compliance with taxation requirements. However, since you're not registering as a company (such as a Pty Ltd), you won't need an ACN.

🔸 ACN Only

Now, imagine you're setting up a larger business, like a boutique clothing store called "Haute Couture Pty Ltd." Since you're registering as a proprietary limited company, you'll need to obtain an ACN.

You'll use the ACN when filing documents with ASIC, opening a business bank account, or signing contracts. However, you won't need to register for one because you're not engaged in activities requiring an ABN, such as providing goods or services to customers.

🔸 Both ABN and ACN

Lastly, consider a scenario where you're starting a consulting firm called "Tech Solutions Pty Ltd." In this case, you'll need both an ABN and an ACN.

The ABN will be necessary for conducting business activities like invoicing clients and claiming expenses.

Meanwhile, the ACN is essential for legally registering your company with ASIC and fulfilling corporate governance requirements. Having both identifiers ensures your business is properly registered, compliant, and recognized by relevant authorities and stakeholders.

Keeping Your Company Details Up-to-Date With Director ID

To ensure compliance with regulatory changes, company directors must apply for a director identification number, which results in enhanced transparency and higher accountability.

Here's what you need to know:

- Director ID: After applying and receiving this number, you can retain it indefinitely, and it applies to all directors across various corporate entities. Failure to comply may result in penalties as enforced by ASIC.

- Application Process: Whether assuming a new directorship or already serving, you are urged to apply for a director ID promptly. For further details on eligibility and application procedures, visit the ABRS website. Note that you must apply for your own director ID. While your authorized tax, BAS, ASIC agent, or lawyer can assist in checking your eligibility, they cannot submit the application on your behalf.

When Should You Use ACN vs. ABN On Documents

According to ASIC, here are the situations when you should use one or another:

When to Use Your ACN:

- On all 'public documents' and 'eligible negotiable instruments,' including documents lodged with ASIC, statements of account, invoices, orders for goods and services, business letterheads, official company notices, cheques, promissory notes, bills of exchange, and written advertisements with specific offers.

- When multiple companies are mentioned on a document, each company's ACN should be displayed next to its name.

- Refer to it as 'Australian Company Number' or abbreviate it as 'ACN' or 'A.C.N.,' ensuring it's clear, easily readable, and unmistakably linked to the respective company.

When to Use Your Australian Business Number (ABN) Instead:

- Suppose your company has an Australian Business Number (ABN). In that case, you may use it instead of the ACN on documents, provided that your ABN includes the nine-digit ACN and is used in the same places where the ACN would be used.

When Not to Use Your ACN:

You don't have to include it on:

- Product packaging and labeling

- Advertisements that do not make specific offers,

- Credit cards and credit card vouchers,

- Machine-generated receipts, including cash-register receipts, business cards and 'with compliments' slips, and

- Non-document items such as vehicles or television advertisements.

Wrapping It Up

Although it might seem like a hassle to figure out whether to use an ACN or ABN, registering your business as a company comes with some great perks:

- Limited Liability: Protect your personal assets from business debts and losses.

- Tax Advantages: Enjoy lower taxes and take advantage of tax deductions available to registered companies.

- Credibility: Enhance your business reputation and credibility by operating as a registered company with an ACN.

- Investment Opportunities: Attract investors and secure financing more easily with a formal company structure.

Are you looking to transform your business into a success story? ANNA is here to make it happen! Here's why you should choose us:

- Free Company Registration: ANNA offers quick and easy company registration at absolutely no cost. Say goodbye to expensive registration fees and hello to savings from day one.

- Comprehensive Business Solutions: With ANNA One, you get more than just company registration. Our platform includes a business account that handles everything from bookkeeping and invoicing to GST and company taxes. It's your one-stop solution for all your business needs.

- Expert Support: Need help or advice? Our team of expert accountants is always here to assist you. Whether you have questions about taxes or need guidance on business operations, we've got you covered.

- Powerful Features: From debit cards and virtual cards to automatic tax calculations and expense sorting, you'll have everything you need to succeed.

- Tax Savings and Efficiency: ANNA helps you save money on taxes with tax-effective solutions and automated processes. Say goodbye to manual calculations and missed deadlines – we've got your back every step of the way.

Ready to take the business world by storm?

Join ANNA today and experience the difference for yourself!