Business Tax Deductions in Australia - Everything You Need to Know

Learn everything you need to know about business tax deductions, including eligible expenses, key benefits, and tips to maximize your savings.

- In this article

- When You Can Claim a Business Tax Deduction?

- Day-to-Day Operating Expenses vs. Capital Expenses

- How to Take Advantage of the Instant Asset Write-Off and Temporary Full Expensing

- Travel Expenses: What’s Deductible?

- Motor Vehicle Expenses

- Home-Based Businesses: Deductions and Considerations

- Work-Related Clothing, Laundry, and Protective Items

- Gifts and Donations

- Self-Education Expenses

- Other Noteworthy Deductions

- Record-Keeping: The Cornerstone of Successful Claims

- Non-Deductible Expenses to Watch Out For

- When To File Your Business Tax Deductions?

- How ANNA Can Help You with Business Tax Deductions

Paying taxes is mandatory for most businesses, but the good news is that the Australian tax system also offers a wide range of deductions to help business owners reduce their taxable income.

By claiming valid deductions, you can potentially save thousands of dollars, freeing up funds for reinvestment in your enterprise.

In this comprehensive guide, we will walk you through the types of expenses you can claim, the rules for home-based businesses, how to handle travel and vehicle expenses, how to take advantage of instant asset write-offs, and more.

When You Can Claim a Business Tax Deduction?

Before exploring individual deductions, it’s important to grasp the basic rules of what makes an expense “deductible”.

According to the Australian Taxation Office (ATO), you can claim a deduction for most costs you incur in running your business if:

1. The expense is for your business, not private use.

For example, purchasing printer ink for the office printer is a business expense, while buying groceries for personal consumption is clearly a private expense.

2. If the expense is mixed (part business, part private), you can only claim the business portion.

Suppose you use your personal phone for both personal and business calls.

In that case, you must keep accurate records (like phone bills or a phone usage diary) to work out how much of your phone usage is genuinely for business.

You can then claim only that proportion as a deduction.

3. You must have records to prove it.

The golden rule is: no documentation, no deduction.

Keep receipts, invoices, logbooks (for vehicle use), or other records that substantiate each claim. If you ever face an audit, these records can save you from penalties.

💡 Golden Rules in Practice:

- Staff wages – Deductible if they relate to employees directly working for your business.

- Marketing – Deductible if advertisements or promotional material are used to attract customers or clients to your business.

- Private expenses – Not deductible, such as your personal groceries or an employee’s private travel unrelated to the business.

Day-to-Day Operating Expenses vs. Capital Expenses

One of the most common confusions among business owners is whether an expense is considered an “operating expense” or a “capital expense”.

Understanding this distinction helps you know how and when to claim your deductions.

🔸 Operating Expenses

- These are day-to-day costs that help keep your business operational in the short term.

- Examples include office supplies, wages, superannuation contributions, utility bills for your business premises, accounting software subscriptions, and marketing costs.

Generally, operating expenses are claimed in full in the same income year in which you incur them.

🔸 Capital Expenses

- These are typically larger, long-term investments such as machinery, vehicles, or computers.

- Rather than claiming the full cost in a single year (in most cases), these items depreciate over their “effective life”, and you claim the associated deductions over time.

That said, small businesses can benefit from specific provisions like the instant asset write-off or temporary full expensing, allowing them to claim the full cost of eligible assets immediately (if they meet certain criteria).👇

How to Take Advantage of the Instant Asset Write-Off and Temporary Full Expensing

For many small businesses, the instant asset write-off is one of the most appealing rules for reducing taxable income quickly.

It allows eligible small business entities to deduct certain depreciating assets up to a specific threshold immediately.

🔸 Instant Asset Write-Off Thresholds

The relevant thresholds (at the time of writing) for the instant asset write-off have changed multiple times over the years, and it’s crucial to keep track of which threshold applies to you. Notably:

- From 1 July 2023 to 30 June 2024 – You can claim an instant write-off for assets costing less than $20,000.

- From 12 March 2020 to 30 June 2021 (for assets purchased between 7.30 pm (AEST) on 1 May 2015 and 31 December 2020) – The threshold was raised to $150,000 for eligible new or second-hand depreciating assets.

- Various thresholds also existed at $30,000, $25,000, and $20,000 for other date ranges.

🔸 Temporary Full Expensing

- Temporary full expensing allowed businesses to claim an immediate deduction for new or second-hand depreciating assets first held and first used (or installed ready for use) between 7.30 pm (AEDT) on 6 October 2020 and 30 June 2023.

- This rule significantly boosted immediate deductions, but eligibility depends on the timing of both the purchase and when the asset was actually used or installed for business.

❗ Key point: Always double-check the applicable date ranges and threshold amounts when purchasing significant assets.

If in doubt, consult with an accountant or tax professional to ensure you’re applying the correct rules.

Travel Expenses: What’s Deductible?

🔸 Business Travel for Owners and Employees

If you or your employees travel for business purposes, you can claim relevant costs such as:

- Airfares, train, tram, bus, or taxi fares – As long as the journey is strictly for business (e.g., attending a work-related conference, meeting clients, or visiting another office location).

- Accommodation and meals for overnight business travel – If the travel is purely for work, you can deduct expenses like hotel bills and food costs. However, if any part of the trip is private, you must separate out that portion and cannot claim it.

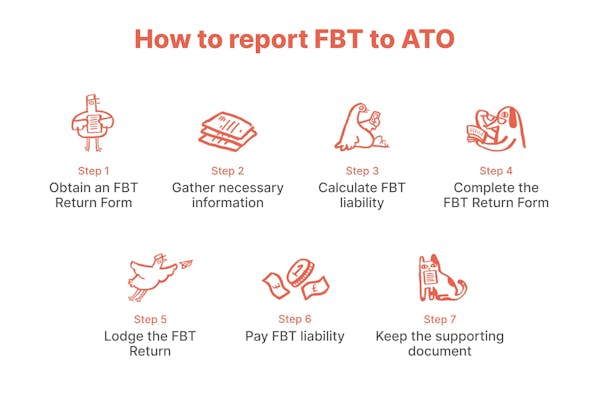

🔸 Fringe Benefits Tax (FBT) Implications

If you pay for or reimburse an employee’s private travel, it may be subject to fringe benefits tax (FBT).

This includes scenarios where employees add a personal holiday onto a business trip.

To minimise any confusion, always keep detailed travel itineraries, invoices, and diaries indicating the purpose of each trip.

Motor Vehicle Expenses

Many businesses rely on motor vehicles for deliveries, client meetings, or picking up supplies. Here’s what you need to know about claiming vehicle expenses:

1. Types of Vehicles

- Depending on your business structure, you can claim deductions for cars, vans, utilities, or trucks (e.g., sole trader vs. company-owned vehicles).

2. Claim Methods

- Logbook Method: You must keep a logbook for at least 12 continuous weeks, recording business vs. private use. You then claim the business-use proportion of fuel, registration, insurance, maintenance, etc.

- Cents per Kilometre Method: Sole traders or some partnerships can claim a set rate (which can change each financial year) for each business kilometre traveled, up to a maximum of 5,000 km per car, per year. This method removes the need for too much detail, but you still need to demonstrate how you calculated the number of kilometres driven for business.

3. Mixed-Use Vehicles

If you use a single vehicle for both business and private errands, only the business proportion of expenses is tax-deductible. Good record-keeping is key to accurately apportioning the costs.

Home-Based Businesses: Deductions and Considerations

The concept of home-based work has gained popularity in recent years. Whether you operate a dedicated home business or occasionally work from your living room, there are certain rules for claiming home-based business expenses.

🔸 Occupancy vs. Running Expenses

- Occupancy expenses: If your home is your principal place of business (for example, a hairdresser who uses one room of the house as a salon), you may claim a portion of mortgage interest or rent, property insurance, rates, and other occupancy costs. The portion is typically calculated based on the floor area used for business relative to the total floor area.

- Running expenses: These include electricity, heating, cooling, cleaning, phone, internet, and depreciation of office furniture. If you work from the kitchen table, you can only claim the portion of time and usage that relates directly to business activities.

🔸 Capital Gains Tax (CGT) Implications

- If you claim occupancy expenses on your home, a portion of your main residence may lose its CGT exemption when you decide to sell the property. You would then need to declare the “business portion” of any capital gain.

- If you rent your home, this complication does not arise, though you can still claim proportionate rent as a business expense if that area is dedicated to your operation.

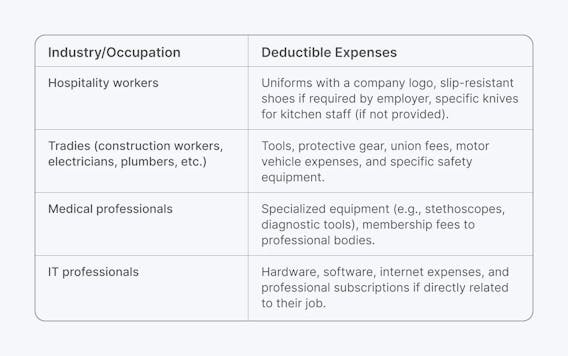

Work-Related Clothing, Laundry, and Protective Items

Not all clothing is deductible. The ATO allows a deduction only if the clothing is:

- Occupation-specific (e.g., a chef’s coat and pants unique to the cooking profession).

- Protective in nature (e.g., steel-capped boots, hard hats, high-visibility vests for construction workers, or face masks and gloves for occupations requiring personal protective equipment).

- Part of a registered uniform (such as a uniform with your company’s logo that employees are required to wear).

For laundry expenses, the ATO may let you claim up to a certain amount without receipts, but only if it’s directly related to cleaning these eligible work garments.

❗ However, even if your boss insists you dress formally, general office attire (e.g., a black suit or a general white shirt) is not deductible unless it meets the specific occupation or protective criteria.

Gifts and Donations

Generosity can also come with tax advantages when you donate to charities or organisations that hold deductible gift recipient (DGR) status.

💡 Key points include:

- The donation must be $2 or more.

- You must have a receipt showing the organisation’s DGR status.

- The gift must be truly philanthropic in nature. If you receive a substantial benefit in return (like a raffle prize), the donation may not be fully deductible.

- You can claim the donation in the same financial year in which you make it. Depending on the nature and amount, you might be able to spread the deduction over a few years if it’s a larger donation.

Self-Education Expenses

Many professionals need continuous training to stay competitive. Certain self-education expenses are deductible if the course, degree, or program you undertake:

- Maintains or improves the skills or knowledge used in your current employment or business.

- Results or is likely to result in increased income.

So, you can claim:

- Tuition fees, course fees, textbooks, stationery, and student service fees.

- Travel and accommodation (if you need to attend an in-person workshop or seminar away from home).

- A portion of internet and phone costs, if these are essential to your study.

❗ However, a course that’s only vaguely related to your industry or that trains you for a different career path may not qualify.

For instance, if you own a hair salon and decide to learn interior design simply out of interest, these studies may not be considered directly related to your existing business.

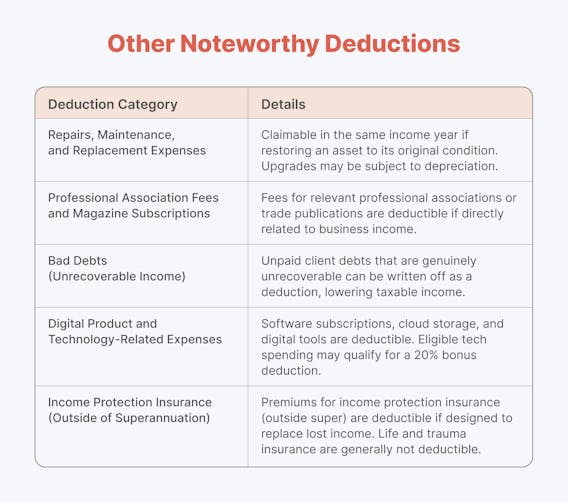

Other Noteworthy Deductions

Record-Keeping: The Cornerstone of Successful Claims

If there is one piece of advice you remember from this entire guide, it should be:

“Keep detailed, accurate records of every expense you intend to claim.”

🔸 Why good record-keeping matters:

- Proof of purchase: If the ATO reviews your claim, you’ll need to show receipts, invoices, or statements to validate that expense.

- Peace of mind: Well-organised records make it easier to manage cash flow, file accurate tax returns, and reduce stress during tax season.

- Compliance: Failing to provide evidence of your deductions can result in the claim being disallowed, or worse, leading to penalties.

🔸 What records to keep:

- Receipts or invoices: Date, amount, supplier, and a brief description of goods or services.

- Bank statements and credit card statements: Especially if they match items you are claiming.

- Travel diaries: A log detailing dates, time, purpose of travel, and associated costs.

- Logbooks for vehicles: At least 12 continuous weeks of business vs. private usage to calculate your claimable portion.

- Home office diaries: If you work from home, keep track of hours worked in your home office to substantiate your claims for electricity, heating, internet, etc.

🔸 Exceptions – When you don’t need a receipt:

- Small expense receipt exemptions: If the expense is $10 or less, and the total of these claims does not exceed $200, you can keep a simple note instead of a formal receipt.

- Hard-to-get-receipt scenarios: Sometimes, it’s genuinely impossible to obtain a receipt (e.g., a work-related toll booth that doesn’t issue receipts). In such cases, maintain your own record specifying the details of date, purpose, and amount.

Non-Deductible Expenses to Watch Out For

Even though the ATO is generous with allowable business deductions, there are explicit items you generally cannot claim:

- Private or domestic expenses: Clothes for your family, personal grocery bills, or childcare fees do not count as business expenses.

- Traffic fines: Speeding tickets or parking fines are not deductible, regardless of whether they occurred during a business run.

- Entertainment expenses: Taking your clients out to lavish dinners could be subject to fringe benefits tax rather than a direct deduction.

- GST portion of a purchase (if you can already claim it as a GST credit on your BAS).

When To File Your Business Tax Deductions?

You typically claim a deduction in the tax year you “incur” the expense. From a tax standpoint, this often means when you have a legal obligation to pay, even if you haven’t actually handed over the cash yet.

- Prepaid Expenses: If you prepay costs (e.g., insurance for the upcoming year), you might have to apportion those expenses across the relevant service period unless the expense is below $1,000 or you meet other criteria for an immediate deduction.

- Part-year Use: If you only use an asset or service for part of the financial year, remember to claim only for that relevant period. For instance, if you purchase new business software halfway through the year, you must apportion your depreciation or usage expense accordingly.

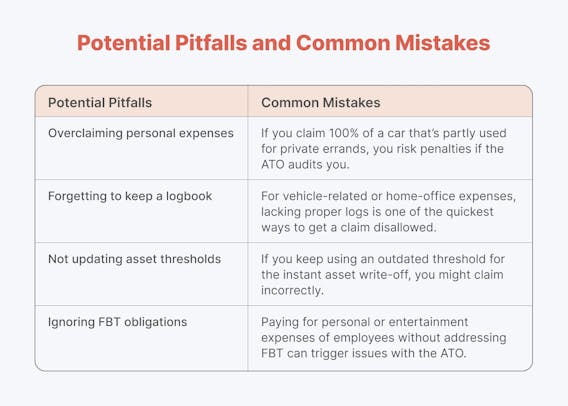

Potential Pitfalls and Common Mistakes

Case Study Example

Imagine you’re a freelance graphic designer working mainly from a home studio:

- You purchase a new laptop for $2,500. If you qualify for the instant asset write-off threshold, you claim it immediately; otherwise, you depreciate it.

- You keep detailed receipts for monthly software subscriptions totaling $60, fully deductible in the year paid.

- You track your hours working in the dedicated home office, claim a proportion of your electricity and internet bills, and keep a separate log for how often you use your personal car to visit clients.

- If you attend a conference in Sydney for three days (purely business) and then stay two extra days for a mini-vacation, you only claim the travel costs for those three business days.

At tax time, proper record-keeping enables you to compile these deductions seamlessly, ensuring compliance and maximising the money that stays in your pocket.

How ANNA Can Help You with Business Tax Deductions

Keeping track of your deductible expenses, lodging your taxes on time, and ensuring your company is set up correctly can feel overwhelming.

That’s where ANNA steps in – making it easier to start, run, and grow a successful business in Australia while handling essential accounting and compliance tasks in the background.

1. Seamless Company Registration

If you’re at the stage of turning your business idea into a registered company, ANNA offers a quick and straightforward solution. You can:

- Register a company with ASIC to get your Australian Company Number (ACN), which is vital for trading as a corporation.

- Automatically apply for an Australian Business Number (ABN) if you need it for tax and invoicing purposes.

- Register a business name so you can legally operate under your chosen trading name.

- ANNA provides free company registration for qualified plans, covering the ASIC fee that usually costs $576, so you can start your business without a huge upfront expense.

2. All-in-One Tax and Accounting Platform

Once your company is set up, ANNA streamlines day-to-day financial management:

- Automatic GST Calculation: If you’re registered for GST, ANNA’s system calculates your GST obligations and helps you prepare your Business Activity Statement (BAS).

- Company (Income) Tax Insights: You can track potential income tax liabilities, so you’re never caught off guard by a large tax bill at year-end.

- Annual Tax Return Lodgment: ANNA can help lodge your annual company tax return statement (and even handle the first year’s BAS) so you can focus on your core business tasks.

3. Effortless Bookkeeping and Expense Tracking

One major stumbling block for business owners is dealing with paper receipts, scattered invoices, and ambiguous categories for expenses. ANNA transforms these pain points:

- Receipt Matching and Categorisation: Snap photos of your receipts; ANNA automatically matches them to corresponding transactions and extracts the key details.

- Bookkeeping Score: ANNA’s unique scoring system nudges you to keep your books tidy, alerting you to unallocated transactions or missing receipts.

- Professional Invoicing: Create sleek, professional invoices that send automatic reminders, resulting in faster payments and a healthier cash flow.

4. Comprehensive Business Banking Features

ANNA isn’t just about registration and tax; it’s also designed to meet your everyday financial needs:

- Business Account: Manage your company’s finances in one place with integrated tax, invoicing, and bookkeeping tools.

- Debit Cards and Virtual Cards: Issue physical or virtual cards for you and your staff, pay via Apple Pay or Google Pay, and keep track of all expenses in real time.

- Integration: Connect your other bank accounts to ANNA for a holistic financial overview, so you won’t miss a single transaction when tax time rolls around.

At its core, ANNA stands for turning complicated, time-consuming tasks into simple routines – so you can invest more energy into developing your products, marketing to new audiences, or improving your services.

Sign up today and see why ANNA’s comprehensive services make it easier for you to start, run, and grow a happy business!