GST In Australia Guide - Everything You Need to Know

Learn about GST in Australia, including how it works, registration requirements, and compliance tips to stay informed on goods and services tax.

As a tax on most goods and services, GST can significantly impact your business operations and daily life.

This guide will walk you through the essentials of registering for GST, claiming credits, and following the rules, helping you understand and manage your GST obligations with confidence.

Let's get started!

Is VAT the Same as GST?

In Australia, the Goods and Services Tax (GST) is the equivalent of VAT – Value Added Tax, set at 10% and applied to most goods and services.

The GST was introduced in 2000, and the Australian Taxation Office (ATO) oversees its administration.

However, it doesn't apply to some essentials, like basic foods, menstrual products, certain medical services, educational courses, and even sunscreens!

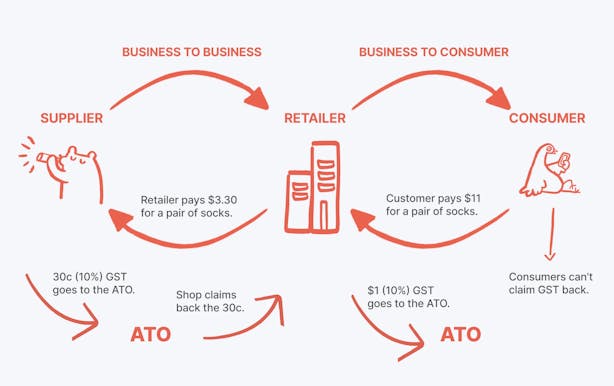

How Does GST Work?

The Goods and Services Tax (GST) system operates through multiple stages, involving both collection and credit, which is why it is essential for businesses and consumers to understand its mechanics.

Calculating GST is simple: multiply the original price by 1.1 to get the final cost or divide by 1.1 to find the pre-tax price.

Here's a breakdown of how GST works through different stages:

Stage 1: Procurement of Raw Materials

The journey starts with the purchase of raw materials. Suppliers charge GST on these purchases, known as "Input Tax," when a manufacturer or producer buys the necessary materials for production.

Stage 2: Processing and Production

As raw materials are transformed into finished products, value is added through various processes like manufacturing, packaging, and branding.

Stage 3: Selling Down the Chain

The manufacturer sells the finished goods to the following entity in the supply chain: a distributor, wholesaler, or retailer. The selling price includes GST, which is called "Output Tax."

Stage 4: Further Value Addition

Each link in the supply chain adds its own value to the products and then sells them onward. At each stage, the entity charges GST on the sale, making them eligible to claim input tax credits for the GST paid on their own purchases.

Stage 5: Final Sale to the Customer

Ultimately, the goods reach the retailer, who sells them to the end consumer. The retailer includes GST in the selling price, encompassing the GST charged at each prior stage in the supply chain.

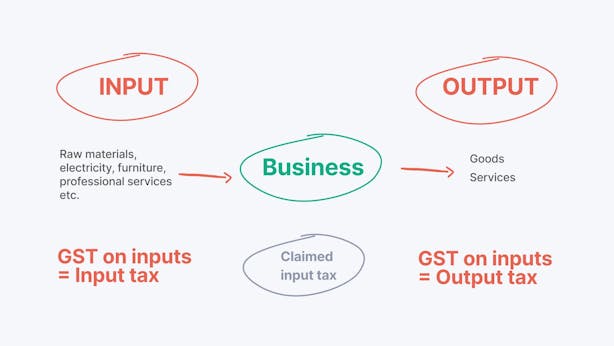

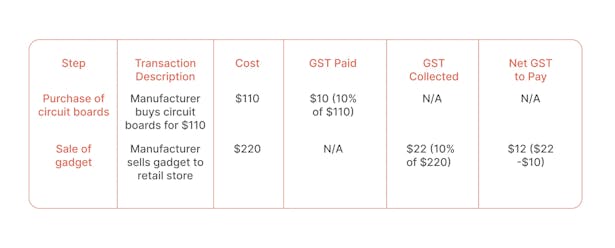

What’s the Difference between Input Tax and Output Tax?

The terms "input tax" and "output tax" refer to how GST is applied to your business purchases and sales:

⭐ Output Tax:

- This is the GST you collect on your sales of goods and services.

- For example, if you sell a product for $110 (including GST), you have collected $10 as output tax.

- The collected output tax must be paid to the Australian Taxation Office (ATO).

⭐ Input Tax:

- This is the GST you pay on your business purchases of goods and services.

- For example, if you buy supplies for your business for $110 (including GST), you have paid $10 as input tax.

- If you are registered for GST, you can claim a credit for the input tax you paid on your purchases.

⭐ Calculating GST Liability:

- The difference between output tax (GST collected on sales) and input tax (GST paid on purchases) determines your GST liability.

- If your output tax is higher than your input tax, you need to pay the difference to the ATO.

- You can receive a refund from the ATO if your input tax is higher than your output tax.

This system allows businesses to avoid being burdened by GST costs by enabling them to claim back the GST paid on their business expenses. It essentially makes your company a tax collector for the government while allowing you to pass the GST cost onto your customers.

What Is GST Credit?

As a business owner, you can claim back GST paid on goods and services used for business purposes. This is known as an input tax credit or GST credit.

🔸Claiming GST credit:

- The purchase must be used solely for business and not for making input-taxed supplies.

- GST must be included in the purchase price.

- You or your business must pay for the goods or services.

- A GST invoice is required for purchases over AUD 82.50.

🔸 Excluded items from GST credit claim:

- Property purchased under the Australian margin scheme.

- Certain entertainment expenses and non-claimable IT deductions.

- Cars exceeding the car limit for the financial year.

- Employee wages (not subject to GST).

- Goods without GST in the price, such as GST-free or input-taxed goods.

🔸 GST on imported goods:

- GST is applied to most imports and is calculated based on the product price plus shipping costs. If GST-registered, businesses can recover these costs through GST returns.

🔸 GST on exported goods:

- Exports from Australia are GST-free if exported within 60 days of payment receipt or invoice issuance. The Australian Tax Office (ATO) can provide extended export timeframes. Services provided to non-Australian entities are typically GST-free.

Steps for GST Registration in Australia

1. Check Your Business Income:

- If your business earns more than AUD 75,000, you must register for GST. The threshold for non-profit organizations is AUD 150,000.

2. Know the Exceptions:

- If your business provides taxi or limousine services, you must register for GST regardless of your income.

3. Obtain an Australian Business Number (ABN):

- To register for GST, you need an ABN. You can apply for it online if you don't already have one.

4. Register for GST:

Once you have an ABN, you can register for GST using one of the following methods:

- Online: Register through the ATO website.

- Phone: Call the ATO to complete your registration.

- Tax Agent: Register through a tax agent.

- Form Submission: Fill out the NAT 2954 form and submit it to the ATO.

5. For Non-Resident Businesses:

If your business is not based in Australia but you sell goods or services connected to the country, you also need to register for GST.

GST registration might be required in these scenarios:

- Importing, installing, or assembling goods in Australia.

- Exporting goods from Australia, depending on the type of export.

- Property transactions (leasing, renting, selling).

- Providing consulting, sports, or entertainment services.

- Offering software licenses or digital products to Australian customers.

- Offering telecommunications services like phone or internet.

- Providing remote work services to Australian clients.

- Participating in events, conferences, or exhibitions and selling goods or services.

- Offering repair and maintenance services.

Follow the same process, but be aware there may be additional requirements.

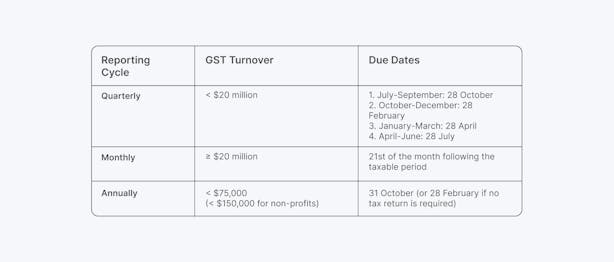

Filing Frequency for GST

The frequency at which you need to file GST returns in Australia depends on your business's annual turnover and other specific factors. Here's how it works:

1. Monthly Filing:

- If your business earns AU$20 million or more in GST turnover, you must file your GST returns every month.

2. Quarterly Filing:

- Businesses with a GST turnover of less than AU$20 million usually file GST returns every three months or quarterly unless the tax office (ATO) specifies monthly reporting.

3. Annual Filing:

- If your business is small, with a GST turnover under AU$ 75,000 (or AU$150,000 for non-profits), and you voluntarily register for GST, you have the option to file your GST return once a year.

Is a Local Tax Representative Required?

In Australia, you are not required to have a local tax representative to handle your taxes.

While some foreign business owners may choose to hire one for added assurance, especially if they find taxes intimidating or confusing, it's not mandatory.

Charging GST in Australia

Once registered for GST, you must charge 10% on each sale to an Australian resident.

You may not need to add or collect tax for business-to-business transactions if the buyer has provided a valid GST number.

In such cases, the buyer will account for the tax using Australia's reverse-charge mechanism.

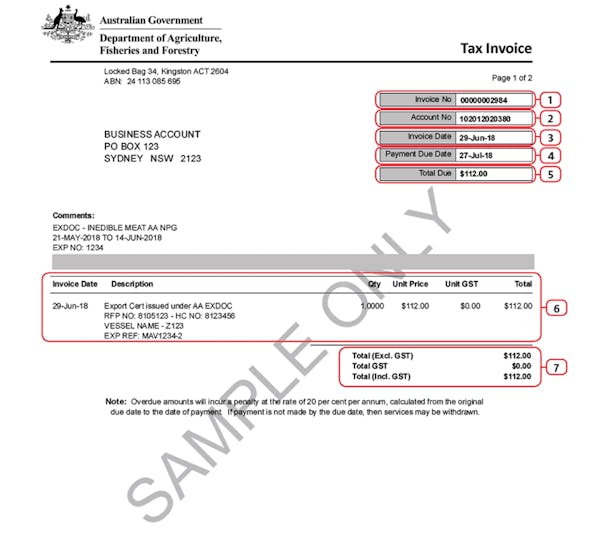

Creating GST Invoices

To comply with Australian tax regulations, ensure your invoices to customers include the following information:

- Your business name and address

- Your business GST number

- Invoice date and unique invoice number

- Detailed description of the goods or services

- GST rate applied to each item

- Total amount, including GST.

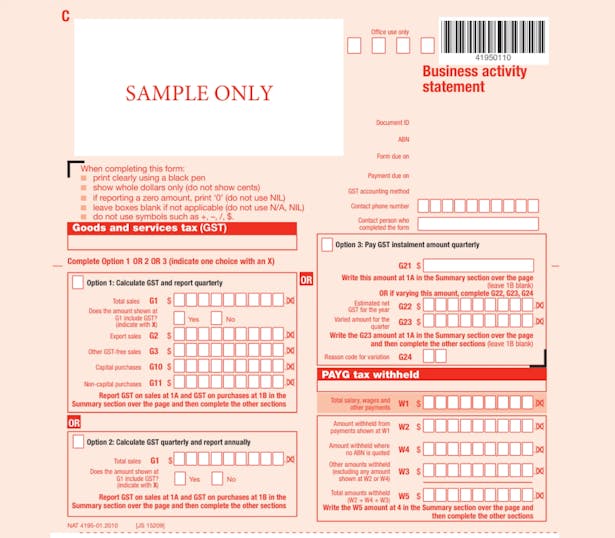

What Is BAS?

Business Activity Statement (BAS) is a key tax document for businesses registered for GST in Australia. It serves as a way to report and pay various taxes, including:

- Goods and Services Tax (GST): Collected on sales of goods and services.

- Pay As You Go (PAYG) Instalments: Tax pre-payments based on your business income.

- PAYG Withholding: Tax withheld from employees' wages.

- Other Taxes: Such as Wine equalization tax or Luxury car tax, if applicable.

After you've completed the registration, the ATO will automatically send you a BAS when it's time to lodge.

This statement helps you keep track of your tax obligations and ensures compliance with Australian tax laws.

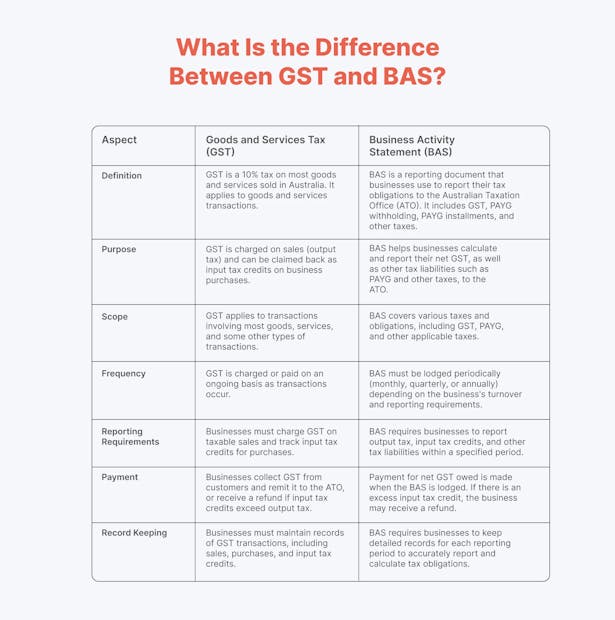

What Is the Difference between GST and BAS?

How to Lodge BAS?

Here's a step-by-step guide on how to lodge your Business Activity Statement (BAS) to report and pay your taxes, including GST and PAYG.

Step 1: Understand Your BAS

- If your business is registered for GST, you need to lodge a BAS.

- BAS helps you report and pay for various taxes, including GST, PAYG installments, PAYG withholding tax, and other taxes.

- Once you register for an Australian Business Number (ABN) and GST, the Australian Taxation Office (ATO) will send you a BAS when it's time to lodge.

Step 2: Choose Lodgment Options

- Online, which you can access through the myGov website or by using SBR-enabled software to lodge directly from your financial or accounting software.

- A registered tax or BAS agent can handle your BAS lodgment, variations, and payments. You can still access your BAS online even if you use this option.

- You can also mail your completed BAS using the provided pre-addressed envelope.

Step 3: Report and Pay on Time

- Make sure to lodge your BAS and pay any amounts owed by the due date to avoid any penalties.

Step 4: Consider 'Nil' BAS

- If you have nothing to report for the period, you can lodge a 'nil' BAS online or by phone.

Step 5: Check Your BAS

- If you lodge through Online services for business, your next BAS will be available there.

- If you use online services, the ATO will email you when your BAS is ready, so keep your contact details up to date.

- Once you lodge online, your next BAS will be issued electronically.

Conclusion

Australia's small businesses are vital to the economy, but the tax system's complexity can be a significant hurdle.

The system often requires companies to navigate intricate legal structures and compliance measures, adding to their administrative burden.

Although tax concessions are available to small businesses, these can sometimes lead to further complexity, making the system even more challenging to manage.

How Can Anna Help You Take Control of Your Finances?

ANNA One is a smart business account and tax management tool designed specifically to help businesses in Australia start, manage, and grow seamlessly.

You can handle everything from company registration and bookkeeping to GST and BAS filing, all in one integrated platform.

Here's how ANNA One can help you navigate the complexities of business finance and tax obligations:

- Easy Business Registration: Simplify starting a new business with covered ASIC fees and hassle-free paperwork.

- Seamless GST Management: Automatically track and manage GST payments and liabilities, keeping you compliant with ease.

- Professional Invoicing: Create branded invoices in seconds and speed up payments with automatic follow-ups on unpaid invoices.

- Streamlined BAS Filing: Accurately track taxable income, deductions, and GST liabilities for smooth, on-time BAS submissions.

- Effortless Expense Tracking: Digitize receipts and invoices, efficiently categorizing expenses for optimized tax deductions.

- Custom Tax Calendar: Stay on top of important tax dates with personalized reminders to avoid penalties and stay compliant.

- Expert Accounting Support: Get guidance from knowledgeable accountants for any tax-related questions or financial challenges.

- Software Integration: Connect with popular accounting and business management tools for a unified financial experience.

Sign up for ANNA One today and experience hassle-free GST, BAS, and invoicing management!

FAQ

What Are Tax Invoices, and Why Are They Important?

Tax invoices are documents that businesses must provide for sales that include GST. They contain specific information such as the seller's ABN, the amount of GST charged, and other details. These invoices are essential for claiming input tax credits.

What Records and Accounts Must Businesses Keep for GST in Australia?

- Maintain records of all inward supplies, including supplier information.

- Record all outward supplies, including buyer details.

- Track the current inventory of goods.

- Keep records of input tax credits availed during purchases.

- Track output tax payable on sales of goods or services.

- Record GST paid using input tax credit or in cash.

- Maintain any other records required by the government, such as:

- Imports or exports during a tax period.

- Transactions involving reverse charge tax, with associated documents like invoices, bills, delivery challans, and other tax-related records.