How Long Does it Take for Tax Refund to Show in Bank Account?

Discover how long it typically takes for a tax refund to show in your bank account and get insights that may affect your refund timeline.

Waiting for your tax refund to arrive in your bank account can be an anxious experience, especially if it takes longer than expected.

The Australian Taxation Office (ATO) processes millions of tax returns each year, and while they strive to be efficient, several factors can affect the timing of your refund.

So, how long does it take for a tax refund to show in a bank account?

Let’s find out together!

What Are Typical Processing Times?

When you claim or lodge your tax refund, you can do so in two ways:

1. Online Lodgement

If you lodge your tax return online through myTax or via a registered tax agent, the ATO typically processes your return within 10 business days.

For example, if you lodge your tax return online on July 1, you could expect to see your refund in your bank account by July 11, provided there are no issues or delays.

How does it work?

To lodge your tax return online with MyTax, start by creating a myGov account and linking it to the ATO. You can access MyTax through either myGov or the ATO app, which allows you to prepare and lodge your tax return using a computer, smartphone, or tablet.

By late July, most information from employers, banks, government agencies, and other third parties is automatically pre-filled, which simplifies this process.

The platform also includes a myDeductions tool for uploading records to pre-fill your return and sends an email confirmation upon successful lodgment.

To use MyTax, ensure your myGov account is linked to the ATO, and remember the deadline for lodging your tax return is 31 October!

2. Paper Lodgement

Lodging a paper tax return takes significantly longer, up to 50 business days (around 10 weeks), due to the additional time required for manual processing. For instance, if you mail your paper tax return on July 1, the processing period might extend up to mid-September because of the manual handling involved.

How does it work?

To lodge a paper tax return, you need the individual tax return instructions and a copy of the paper tax return form. You can order these separately or as a pack with two forms through our online publication ordering service or by phone. For prior year returns, you can also use paper forms.

If you have distributions from a partnership or trust, capital gains, foreign income, or rental income, you need the supplementary section.

For those with personal services income (PSI), net income or loss from a business, or deferred non-commercial business losses, you need the Business and Professional Items schedule. You can order both of these documents online.

📌 Tip

If you choose to lodge a tax refund through a tax agent, make sure they are registered with the Tax Practitioners Board (TPB). You can also use the same website to check their status.

Registered agents ensure consumer protection by meeting high standards of qualifications and experience and adhering to the Code of Professional Conduct.

How to Ensure Accurate Tax Return Submissions

You will typically receive your tax return in about two weeks, but there may be some delays.

If you want to be proactive and prevent waiting more than you should, your tax return application should be accurate and complete.

Here are some steps to help you prepare it:

⚡ Organize your records:

Gather all necessary documents, such as income statements, payment summaries, receipts for deductible expenses, and private health insurance information.

⚡ Use the ATO's pre-fill service:

When lodging online via myTax, take advantage of the pre-fill service. This automatically populates your return with information the ATO has received from employers, banks, government agencies, and other third parties, helping reduce errors and omissions.

⚡ Double-check information:

Ensure that all pre-filled information is accurate and complete. Cross-reference with your records to confirm that all income and deductions are correctly reported.

⚡ Consult a tax professional:

If your tax situation is complex, consider consulting a registered tax agent who can provide expert advice and ensure your return is correctly prepared and lodged.

Checking Your Tax Refund Status

To check the status of your tax return, you can use the ATO’s online services through myGov or contact your tax agent. A professional tax agent can liaise with the ATO on your behalf, providing updates and explanations for any delays.

This can help alleviate stress by giving you a clear understanding of where your refund is in the process.

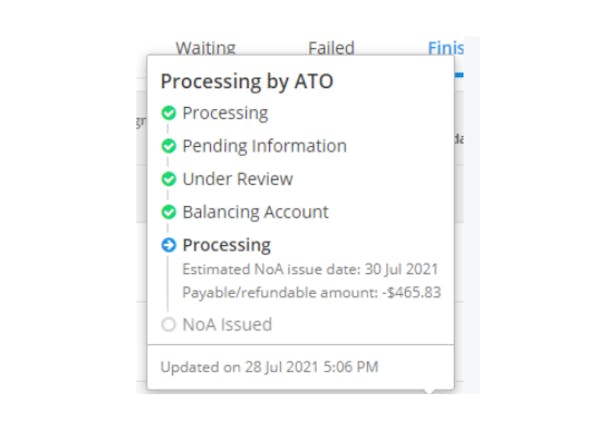

For example, if you lodged your return online two weeks ago and haven’t received your refund yet, logging into your myGov account might show different statuses:

Understanding ATO Tax Return Statuses

The ATO uses various status indicators to update you on the progress of your tax return:

- In progress – Processing: The ATO is processing your return. At this point, you don’t have to take any action unless contacted.

- In progress – Information pending: Additional information is being collected, and you may be contacted if you need to provide more details.

- In progress – Under review: The return is under manual review, which may involve checking previous returns.

- In progress—Balancing account: The ATO is reconciling your return with its records, which means it is finalizing the details.

- Issued – $ Amount: Your notice of assessment has been sent, indicating the refund amount or payment due date.

Reasons for Tax Return Delays

What if you’ve double-checked all the information on your application and did everything right, but you still haven't received a refund?

Well, additional factors can cause delays in processing your tax return:

⚡ Duplicate lodgement: If you submit your return multiple times, the ATO must manually cross-check details, leading to delays. For example, submitting another tax return after noticing an error can extend the verification process.

⚡ Amendments post-lodgement: Making changes to your return after submitting it can also cause delays. For instance, adding forgotten income details after lodging requires additional verification time.

⚡ Lodging returns for multiple years: Submitting returns for several years simultaneously requires more time for verification.

⚡ Outstanding tax debts: Having unresolved debts with the ATO can hold up your refund.

⚡ Insolvency: Being under insolvency administration can result in longer processing times.

⚡ Outdated bank details: Ensure your bank account information is current to avoid delays.

⚡ Additional information checks: The ATO may need to verify details with your financial institution, suppliers, or other business records, which can take time.

For example, if the ATO needs to verify your business income details with financial records that are submitted late, this can delay your refund until the correct details are received and confirmed.

📌 Tip

If you are struggling financially and need your tax refund urgently, your tax agent can contact the ATO to request priority processing, which accelerates the refund process, allowing you to receive the funds sooner.

Conclusion

Once the ATO processes your tax return, it issues a notice of assessment—a document that reveals whether you'll receive a refund or need to make a payment.

Shortly after, the awaited amount appears in your bank account.

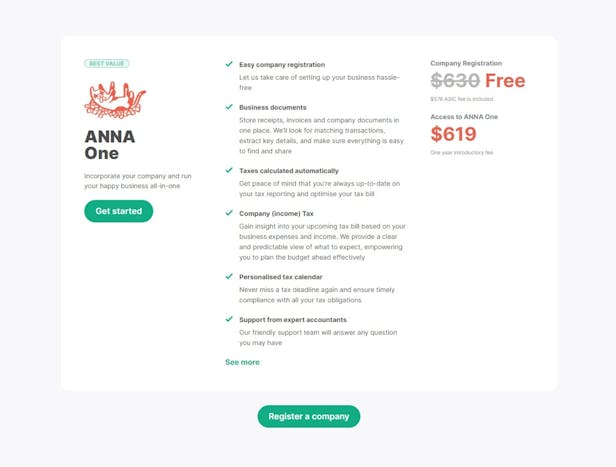

But what if there is an even easier way to stay up to date with all your tax obligations, all from your smartphone? We present you ANNA - a one-stop solution for companies! ⭐

How Can ANNA Help You Manage Taxes?

ANNA offers a comprehensive solution for businesses, providing streamlined processes for registration, banking, and financial management:

📅 All your taxes covered: Company income tax, GST, and Annual tax filing

ANNA makes tax management a breeze. From automatically calculating taxes to providing personalized tax calendars, ANNA ensures you never miss a deadline.

Plus, optimize your tax bills with automatic expense sorting and file taxes directly from the platform.

Features:

- Real-time Tax Estimate: Get an up-to-date estimate of your tax bill, helping you stay informed about your financial obligations.

- Expense Logging: Minimize your tax bill by logging all your expenses accurately.

- Profit Tracking: Monitor your profit throughout the year to maintain a clear picture of your financial health.

- ATO Filing: Seamlessly file your taxes with the ATO during your first year of trading.

- Exportable Records: Keep tidy records with exportable spreadsheets, ensuring all your financial data is well-organized and accessible.

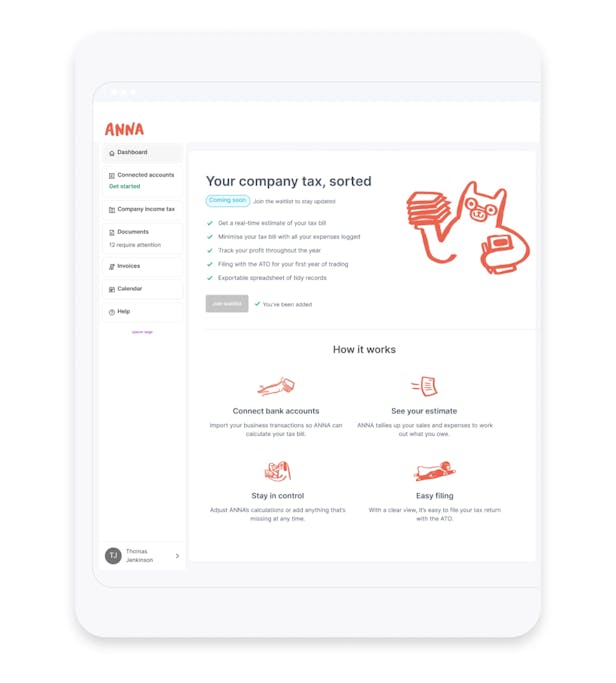

How It Works:

- Connect Bank Accounts: Import your business transactions so ANNA can calculate your tax bill accurately by integrating it with your financial data.

- See Your Estimate: ANNA tallies up your sales and expenses to provide a precise calculation of what you owe, offering transparency and foresight.

- Stay in Control: You can adjust ANNA’s calculations or manually add any missing information at any time to ensure your records are complete and accurate.

- Easy Filing: With a clear and organized view of your financials, filing your tax return with the ATO becomes straightforward and hassle-free.

Interested to learn more about what we have to offer?

Sign up and experience the professional efficiency of ANNA One!

FAQ

What is a BAS?

BAS or Business Activity Statement is a form that businesses use to report their tax obligations to the Australian Taxation Office (ATO). This includes GST collected and paid, as well as other taxes like PAYG (Pay As You Go) withholding, fringe benefits tax, and more.

What is a Tax Refund?

A tax refund is an amount of money refunded to an individual or business by the government when the tax liability is less than the taxes paid. It occurs when the taxes withheld or paid throughout the year exceed the actual tax liability calculated when filing a tax return.

What Are the Differences Between BAS and Tax Refund?

- Purpose: BAS is primarily used for reporting a business's various tax obligations to the ATO, while a tax refund is a reimbursement of overpaid taxes to individuals or businesses.

- Submission: BAS is typically submitted periodically throughout the year, depending on the business's turnover, while tax refunds are claimed when filing an annual tax return.

- Content: BAS includes information on GST collected and paid, along with other taxes, while a tax refund is based on the individual or business's overall tax situation, taking into account deductions, credits, and liabilities.

- Recipient: BAS refunds or payments are made to or from the ATO, while tax refunds are issued by the government to the taxpayer.