How Much Does it Cost To Register a Company in Australia? [Complete Guide]

Discover how much it costs to register a company in Australia, and explore the factors influencing costs, from government fees to other services.

Starting your business in Australia?

Registering your company is a crucial step for legitimacy and compliance.

But what about the costs?

Knowing the financial details upfront will help you plan better and ensure your business gets off to the right start.

Let’s dive in!

Can You Start a Company Without Money?

Well, you're going to need some cash to get the ball rolling. How much, you ask? Well, that depends on several factors, like how big you want your company to be or what industry you're entering.

Even if you're starting out small, it's still smart to manage your budget.

Here's the deal: registering your company under the Australian Securities and Investments Commission (ASIC) involves some setup costs, such as registration fees and a few other bits and bobs.

How Much Money Do You Need To Register a Business?

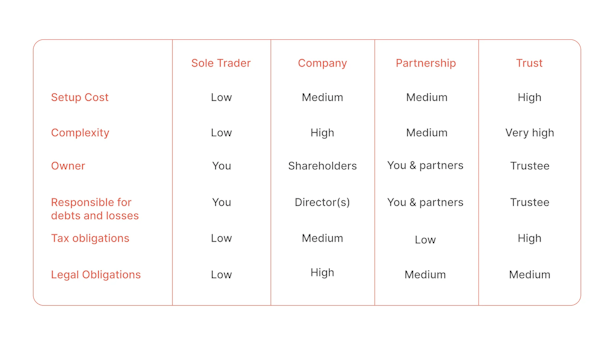

The costs involved vary depending on the structure you choose for your business.

From the straightforward process of registering as a sole trader to the more complex steps for setting up a company or trust, each option comes with its own fees and requirements.

We will walk through the whole process from start to finish so you'll know exactly what to expect.

1. Fees For Registering a Company

The cost of registering your business hinges heavily on the business structure you choose. Let's break it down:

🟠 Sole Trader

This setup involves operating your business as an individual. The setup costs are relatively minimal – just registering your business name. Ongoing compliance is straightforward, typically involving personal tax return filings.

🟠 Company

Brace yourself for more complexity and higher initial costs. Registering with the ASIC starts at $576 for a proprietary company, with additional expenses if you enlist professional services like lawyers and accountants. The upside? Limited liability protection for directors and shareholders. But be prepared for ongoing compliance demands, including annual reporting and strict recordkeeping.

🟠 Partnership

Establishing a formal partnership structure consists of registering your business name and drafting a partnership agreement. Expect to shell out between $500 and $2,000 for a comprehensive partnership agreement, providing essential legal protection.

🟠 Trust

Trust structures entail separating legal and beneficial ownership of assets. Costs vary depending on the type of trust and whether you opt for a personal or corporate trustee. Standalone discretionary trusts could set you back between $150 and $1,500, plus potential stamp duty in some states.

The cost of more complex trusts with corporate trustees could range from $1,200 to $2,500, covering lawyer fees for paperwork, business name registration, trustee company registration, and stamp duty, where applicable.

📌 Note

When you register as a sole trader or partnership, you'll need to get an Australian Business Number (ABN). The good news is that getting an ABN is free. However, it does mean you'll have higher personal liability.

2. Fees For Registering a Business Name

If you choose to go through ASIC to register or renew a business name, here's what you're looking at:

- $42 for one year

- $98 for three years

Are you updating details or canceling your business name? No fees attached.

Do you want to transfer a business name? There's no upfront fee, but the new owner must pay when registering the business under their name. Make sure to choose a business name that works for you before completing the process.

What Are the Payment Options?

ASIC offers a couple of payment methods:

- Credit Cards, like Visa or MasterCard.

- Invoice: You can pay via BPAY or at any Australia Post office. Just give it three business days for processing.

- BPAY: For electronic payments, allow three business days for processing. You will also receive an invoice via email.

Remember, ASIC needs to receive payment within 10 business days of approving your application. Otherwise, they'll have to hit the reject button, and you'll have to start the process all over again.

If you want to reserve a specific company name before registering, ASIC charges a fee of around $51 for this service.

💡 Pro Tip

It costs $576 to register a business yourself, but with ANNA, you can do it for free!

ANNA simplifies the process of registering a Limited Company and opening a business account in just 4 easy steps:

1. Choose the Company Name: Create a unique name for your company to stand out.

2. Fill in Your Data: Provide information about yourself and your company. You can also opt for extra features, such as a virtual office address or invoicing software to maintain privacy.

3. Sign Up for Free: ANNA covers the incorporation fee, so you can register your company at no cost, saving you an additional $500.

4. Receive Notification: Get notified when your application is complete and your company is registered.

In addition to registration services, ANNA offers a range of additional services at reasonable prices, including:

- Access to a dedicated business account to manage your finances.

- Streamlined financial recordkeeping with ANNA's bookkeeping software.

- 24/7 comprehensive accounting support from ANNA's team.

Should You Trademark Your Business Name?

Trademarking your business name is a wise investment as it grants you exclusive nationwide rights to use your distinctive brand name and logo for your goods or services.

It's an essential protection that prevents others from imitating or confusingly using the identity you've worked hard to establish.

The process of applying for trademark registration involves several steps:

1. Thoroughly search IP Australia's database to ensure another business does not already have a similar trademark.

2. Prepare and file a complete application showcasing the text and logo trademarks you want to register and details about your business and the goods/services you provide.

3. Pay the application fee, which starts at $250 for an individual applicant.

📌 Note

The trademarks undergo review during examination, and you may need to respond to any potential objections raised at this stage. If approved within 6-8 months, you will receive an official certificate of registration from IP Australia.

3. Fees For Annual Requirments

Once your registration process is wrapped up, don't forget about your annual reporting duties to ASIC, which come with additional costs like the cost of registering a company in Australia.

These reports are essential to keep your company up and running smoothly.

Here's the breakdown:

- Small Pty Ltd Companies: Typically, you won't need to file financial reports but will be required to pay an annual review fee.

- Large Pty Ltd Companies: Need to submit financial reports along with the annual review fee. The specific reports depend on the company's type.

To better understand which category your company falls into, check out ASIC’s guide.

Each year, ASIC will send your company an annual statement. To ensure your company remains registered for the next year, you'll need to:

- Pay the annual company review fee

- Verify and update your company details

- Pass a solvency resolution

Now, let's talk fees.

Here's what you can expect to pay for your annual review:

- Proprietary Company: $310

- Special Purpose Company (Proprietary): $63

- Special Purpose Company (Public): $59

- Public Company: $1,440

4. Additional Costs

When registering a company, including considering the cost of registering a company in Australia, you should also seek legal advice to ensure compliance with regulations and protect your interests:

- Company Structure: Lawyers assess your business needs and recommend the most suitable company structure, such as Pty Ltd, public company, or special purpose entity.

- Drafting Legal Documents: They draft essential legal documents required for registration, including the company's constitution, shareholder agreements, and director appointments.

- Compliance Requirements: Lawyers ensure your company complies with all legal and regulatory requirements, including ASIC regulations, taxation laws, and industry-specific regulations.

- Costs: Legal fees range from a few hundred to several thousand dollars, depending on the complexity of your structure and the scope of services.

Having an accountant ensures financial compliance and optimizing tax planning strategies through the following:

- Financial Planning: Accountants assess your business's financial health, forecast cash flows, and develop budgeting strategies. They also advise on funding options and capital structure.

- Tax Implications: Accountants optimize tax planning strategies to minimize tax liabilities and ensure compliance with taxation laws, including GST, PAYG withholding, FBT, and income tax.

- Ongoing Compliance: They maintain accurate financial records, prepare financial statements, and lodge tax returns and regulatory filings on time.

- Costs: Accounting fees range from a few hundred to several thousand dollars, depending on the complexity of your business operations and the extent of services provided.

Here are some other expenses you might encounter as your business grows:

- Opening and maintaining a business account.

- Getting the required licenses and permits for your business.

- Covering expansion costs, like renting a bigger office and buying new equipment.

- Spending money on marketing and market research to reach more customers.

- Budgeting for salaries for new hires as you scale up your operations.

💡 Pro Tip

ANNA One is your go-to solution for staying on top of tax obligations and minimizing your tax liability.

We streamline the process by calculating your income, expenses, Corporation Tax, and ATO requirements.

Our service also includes timely reminders for important deadlines and the option to file your taxes directly through us.

Plus, our team of tax experts is on hand to answer any questions you may have.

Designed with newly formed companies in mind, ANNA One allows you to start your business journey with confidence.

With us handling the paperwork and tax admin, you can focus on what you do best – growing your business.

Can you Run a Business Without Setting Up a Company?

Yes, you still have options for running your business if you don't want to set up a company. You could operate as a sole trader or in a partnership.

In this scenario, all you need is your ABN, which you can snag for free – it's a simpler process than setting up a company.

But there are downsides.

Legal protection is pretty limited as you're personally liable for anything that goes down in the business, and these structures aren't great for long-term growth plans.

Setting up a company involves more upfront cost and attention to detail, but it's the safer bet legally.

A company is its own legal entity, capable of owning property, going to court, making money, or racking up debt.

This means your personal liability is limited. Plus, a company structure sets you up nicely if you're eyeing expansion down the line.

To Conclude

Don't let the registration process and fee structure deter you – Australia is a fantastic place to start and grow your business.

Anna –Your Go-To Solution For Fast and Secure Company Registration

ANNA offers a range of financial services to streamline your company registration process in Australia.

With ANNA, you gain access to a suite of tools, including business accounts, bookkeeping software, and tax utilities, all designed to help you efficiently manage your business operations from a single platform.

Along with registration services, ANNA covers various essential sections for businesses operating in Australia:

⚡Taxes: ANNA handles all essential taxes for small businesses, including tax calculations, filings, and payments, based on your business category.

⚡ Transaction Account: Link all your bank accounts to get a comprehensive overview of your finances in one place.

⚡ GST (Goods and Services Tax) Registration: ANNA handles the paperwork and submits the GST registration application on your behalf.

⚡ PAYE/Payroll Registration: ANNA assists with processing PAYE registration with the ATO and provides necessary documents for paying yourself or your employees a salary.

⚡ Invoices: Create and send professional-looking invoices with the invoicing feature and track them for overdue payments.

Ready to streamline your business registration and financial management?

Get started with ANNA and enjoy free company registration, plus a range of additional services to support your business growth.

Sign up now and let ANNA take care of the rest!

FAQ

Why Should I Register My Company In Australia?

Registering a company has several benefits, including limited personal liability, lower tax rates, a clear framework for decision-making, enhanced reputation, and easier access to capital.

Is It Possible To Establish an LLC in Australia?

To formally establish your LLC in Australia, you must register with the ASIC. You can do this online through their website or via traditional mail. Ensure that all necessary information is completed accurately and submit the registration fee. Once approved, you will receive a Certificate of Registration that officially confirms the establishment of your LLC.

Can One Person Own A Company In Australia?

A single individual can establish a company. In a proprietary company limited by shares, one person can serve as both the sole director and sole shareholder.

Do You Have to Pay to Register a Business Name in Australia?

Yes, you must pay a fee to register a business name in Australia. As of 1 July 2024, the fees are $44 for one year or $102 for three years.

How Much Does It Cost To Register a Company in Australia?

As of July 1st, 2024, ASIC updated the company registration fees, which are now as follows:

- $597 for standard Pty Ltd companies, Superannuation Trustee Companies, Home Unit Companies, Not-for-profit Pty Ltd Companies, and Public Companies.

- $491 for companies Limited by Guarantee.