How to Reactivate ABN In 7 Easy Steps

Discover the steps to easily reactivate your ABN with our guide to quickly and efficiently restore your Australian Business Number.

- In this article

- Should I Reactivate My ABN Or Update It?

- Step 1: Determine Your Eligibility for Reactivation

- Step 2: Gather All Required Information

- Step 3: Access the Australian Business Register (ABR) Website

- Step 4: Log In to Your MyGov Account

- Step 5: Start the Reactivation Process

- Step 6: Provide Detailed Business Information

- Step 7: Review and Submit

- Why Do You Have To Keep Your Abn Details Up To Date?

- How Long Do You Have To Wait After Reactivating ABN?

- Final Thoughts

- What can ANNA Do For Your Business?

- FAQ

Are you ready to jump back into the business world after previously canceling your Australian Business Number (ABN)?

When business owners cancel their ABN, they may mistakenly believe they can resume trading without consequence. However, without an active ABN, your business lacks official identification and risks legal repercussions.

Whether picking up where you left off or starting a new chapter in your business journey, here's a comprehensive guide to smoothly reactivate your ABN.

Let's dive in and get your business up and running again!

Should I Reactivate My ABN Or Update It?

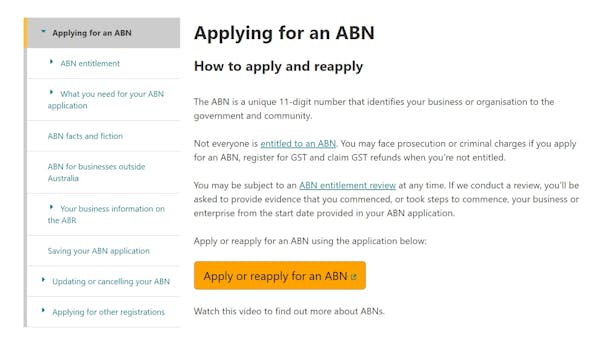

If your ABN has been canceled, reapplying is necessary. You can check the status using the ABN lookup tool to determine whether it's active.

If your ABN is still active, you must update your business details within 28 days.

If your ABN has been cancelled, you must go through the reactivation process. Using an inactive ABN in transactions is illegal, especially if your business earns $75,000 or more annually – you must have an active ABN to trade legally.

Step 1: Determine Your Eligibility for Reactivation

Before diving into the reactivation process, ensure your business is eligible. Generally, you can reactivate your ABN if:

- Your business was previously registered for an ABN and it was canceled.

- You plan to resume the same business activities under the same business structure.

- You are not bankrupt or under insolvency.

For instance, if you're a sole trader who paused operations for personal reasons but now wants to resume, you're likely eligible.

📌 Note

The Australian Business Register (ABR) conducts periodic random reviews to verify the entitlement of businesses to hold an ABN. These reviews may occur either during your application process or after your ABN has been issued.

You may be selected for an ABN entitlement review if:

- Indicators on your tax return, other lodgments, or third-party information suggest that your business operations may have ceased.

- You have reapplied for an ABN after a previous refusal or cancellation.

ABR will ask you to provide evidence confirming your entitlement to an ABN if selected for review, for example:

- Setting up advertising or a social media presence for your business.

- Purchasing business cards, stationery, or obtaining necessary licenses or insurance.

- Leasing or purchasing premises, equipment, or stock for your business.

- Issuing quotes, bidding for work, or consulting with advisers.

- Applying for finance or acquiring an existing business.

If ABR determines that you are not entitled to an ABN, it will cancel it. If you disagree with their decision, you can reapply or lodge an objection.

Step 2: Gather All Required Information

Preparation is key. Having all the necessary information on hand will make the reactivation process smoother and faster. Here's what you'll need:

- Previous ABN: The ABN you wish to reactivate.

- Business Details: Your business name, address, and contact information.

- Tax File Number (TFN): Both personal and business TFNs.

- Business Activity Details: Information about your business activities, industry, and structure.

- Date of Reactivation: The date from which you want your ABN to be active again.

Step 3: Access the Australian Business Register (ABR) Website

To begin the reactivation process, visit the Australian Business Register (ABR) website, the official site for managing ABNs and other business registrations in Australia.

Step 4: Log In to Your MyGov Account

A MyGov account linked to the ATO is essential for this process. If you don't already have one, setting it up is straightforward. Here's how:

- Sign In: Go to the MyGov website and sign in with your credentials.

- Link to ATO: Ensure your MyGov account is linked to the ATO. If not, you'll need to link it by providing your personal information and TFN.

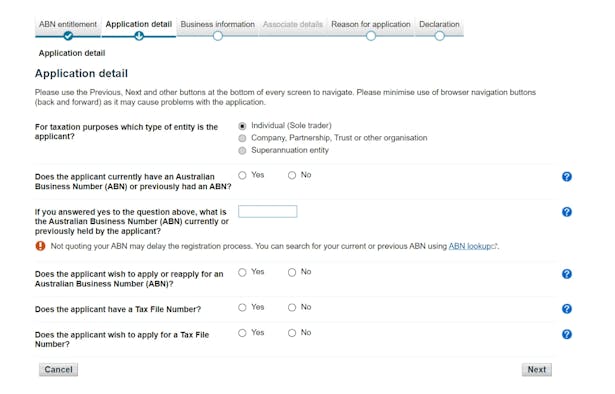

Step 5: Start the Reactivation Process

Once logged into your MyGov account, navigate to the ABR section:

- Select 'Reactivation of ABN': On the ABR page, locate and select the option to reactivate your ABN.

- Enter Previous ABN: Provide your previous ABN so you can retrieve your business record.

- Verify Business Details: Review and verify your business details, making any necessary updates.

📌 Note

Making any false or misleading statements in your ABN application may result in a penalty of up to $12,600.

Step 6: Provide Detailed Business Information

Next, you'll need to fill in detailed information about your business. This step ensures the ATO has up-to-date information about your operations:

- Business Activity: Describe the nature of your business activities and the industry you operate in.

- Business Structure: Confirm the business structure (e.g., sole trader, partnership, company).

- Contact Information: Update your business contact details, including email, phone number, and address.

Step 7: Review and Submit

Before submitting your application, take a moment to review all the information you've provided:

- Accuracy Check: Ensure all details are accurate and up-to-date.

- Declaration: Read the declaration statement and agree to the terms.

- Submit Application: Submit your application for ABN reactivation.

Why Do You Have To Keep Your Abn Details Up To Date?

Reactivating your ABN ensures that your business operates within the legal parameters set by the Australian government. An active ABN is a legal requirement for:

- Invoicing: Your business cannot legally issue invoices without an active ABN. This is particularly important for maintaining proper financial records and avoiding legal complications.

- GST Credits: Your business must have an active ABN to claim Goods and Services Tax (GST) credits. This is essential for reducing your business's overall tax burden.

- Tax Reporting: An active ABN is necessary to comply with various tax reporting obligations. Failure to do so can result in fines and penalties from the ATO.

Additionally, an active ABN is necessary for a wide range of business operations, including:

- Obtaining an Australian Domain Name: An active ABN is required to secure a .com.au domain name for your business website. This is crucial for establishing a professional online presence.

- Applying for Business Loans: Financial institutions require an active ABN as part of their loan application process. Without it, securing funding for business expansion or operations becomes challenging.

- Engaging in Trade: Many suppliers and clients require an ABN to engage in transactions. This ensures that your business is recognized as a legitimate entity.

How Long Do You Have To Wait After Reactivating ABN?

You've filled in all the details and gathered all the documents. So, what's next?

- Confirmation Email: You will receive an email confirming the receipt of your reactivation application.

- Processing Time: Once the application is submitted online, reactivation typically takes 24 hours. However, it may take longer in some cases where additional information is required.

Final Thoughts

Reactivating your ABN is pretty straightforward as long as you have the right information and follow the steps outlined. Keeping your ABN details updated ensures you stay compliant with Australian regulations and keeps your business running smoothly.

Just follow these seven steps carefully, and you'll reactivate your ABN efficiently, allowing you to focus on growing your business.

What can ANNA Do For Your Business?

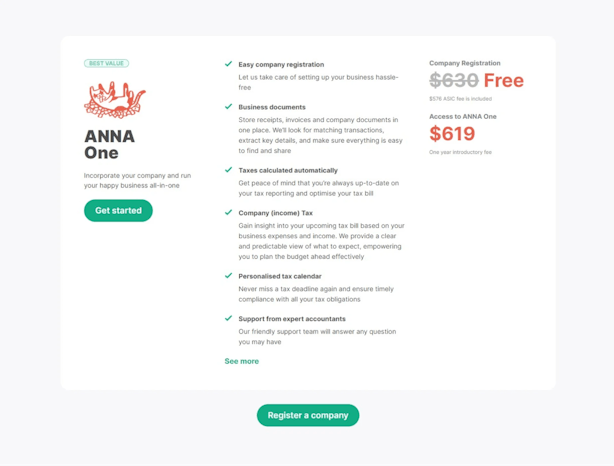

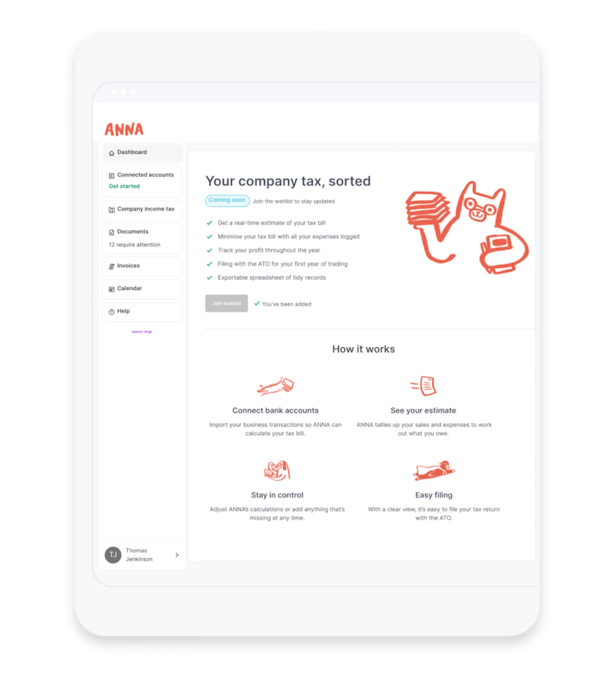

ANNA One is a comprehensive package that includes free company registration paired with a business account to manage bookkeeping, invoicing, GST, and company taxes.

This all-in-one solution ensures you don't have to worry about the administrative complexities of running a business.

Key Features:

- Effortless Company Registration: Get your business set up without hassle.

- Document Management: Store and organize receipts, invoices, and other important documents in one place.

- Automated Tax Calculations: Keep your tax reporting up-to-date and optimize your tax bill with ease.

- Personalized Tax Calendar: Stay on top of all tax deadlines to ensure timely compliance.

ANNA provides clear, budget-friendly plans that suit different business needs. What's more, ANNA covers the registration cost, meaning there are no hidden fees.

Pricing Plans:

- Easy Company: $630 (includes $576 ASIC fee).

- ANNA One: Free company registration with a one-year introductory fee of $619 for access to a full suite of business management tools.

Starting your business with ANNA is simple. Here's how to get started:

- Choose a Company Name: Use Anna’s tool to check availability.

- Select ANNA One Subscription: Choose the plan that fits your needs.

- Provide Business Details: Submit the necessary information about your business.

Create an account today and leave the bureaucratic processes to us so you can focus solely on growing your business!

FAQ

Can I Reactivate An Old ABN?

Yes, you can reactivate an old Australian Business Number (ABN) that has been canceled or deactivated.

Can An Inactive ABN Be Used In Transactions?

No, an inactive ABN prevents legal trading and proper record-keeping.

Can An ABN Be Reactivated If Dormant For A Short Time?

Yes, providing accurate updates helps reactivate an ABN after dormancy.