5 Steps to Update Your ABN Details [2025 Guide]

Discover the steps to easily update your ABN details. Follow our guide for keeping your Australian Business Number information accurate and current.

The Australian Business Number (ABN), an essential 11-digit identifier, is a cornerstone for any business operating in Australia.

It is required for activities like invoicing, registering for GST, and conducting business transactions.

Therefore, keeping your ABN details up-to-date is necessary for maintaining accurate records and complying with legal requirements.

If your business details change, this article will help you update your ABN information promptly in just a few steps.

Let's dive!

Why is it Important to Update Your ABN Details?

Keeping your ABN details current is crucial for several reasons:

✔️ Authorized Permissions – Ensures the right people have permission to act on behalf of your business.

✔️ Accurate Government Records – Keeps government agencies informed with up-to-date information for emergency contact and assistance.

✔️ Access to New Services – Prepares your business for new government services as they become available.

✔️ Reflecting Business Activities – Ensures your ABN accurately reflects the range of business activities you undertake.

Key Aspects of Up-to-Date ABN Records

Maintaining updated ABN details allows you to take advantage of improvements and new features in ABR online services, facilitating better business management and support from various agencies.

Let’s dive into the key aspects to consider:

👉 Accuracy – Regularly verify and update your contact information to avoid missed communications.

👉 Authorizations – Ensure that the right people are listed to act on behalf of the business, especially when there are changes in personnel.

👉 Business Activities – Update the details to reflect any new business activities or changes in operations.

👉 Emergency Preparedness – Ensure your information is current so that you can receive timely assistance in case of emergencies.

By keeping your ABN details accurate and up-to-date, you enhance your business’s credibility and readiness to interact with various government services effectively.

Step-by-Step Guide to Update Your ABN Details

To quickly update your ABN details, use ABR online services. Here's how:

1. Access the Australian Business Register (ABR)

The ABR allows you to update information about eligible associates, such as:

- Trustees

- Directors

- Public officers

- Partners, and

- Office bearers of a club or association

Here’s how to get started:

1. Visit the ABR Website – Start by visiting the Australian Business Register (ABR) website to access the relevant sections for ABN updates.

2. Navigate to Update Section – Once on the ABR website, locate the section specifically for updating ABN details. This ensures you can make necessary changes efficiently.

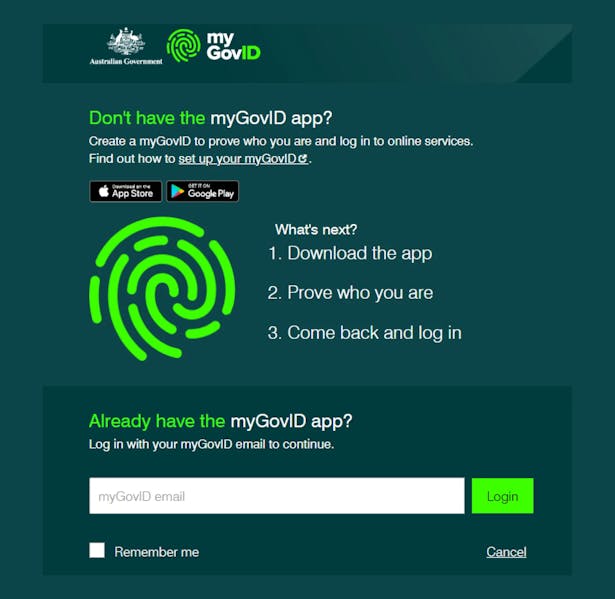

2. Log In to Your ABR Account

Ensuring secure access to your ABR account helps maintain the integrity of your business information.

By using myGovID linked to the ABN in Relationship Authorisation Manager (RAM), you guarantee that only authorized individuals can update your details.

Once you click on the “Update your ABN” option from the ABR website, you’ll be transferred to the myGovID page.

Here’s how to log in effectively:

1. Enter Email Address – Input the email address used to set up your myGovID. A code will be generated.

2. Open myGovID App – On your smart device, open the myGovID app. Log in and enter the four-digit code that appears on the login screen into the pop-up box within the app.

Tap "Accept."

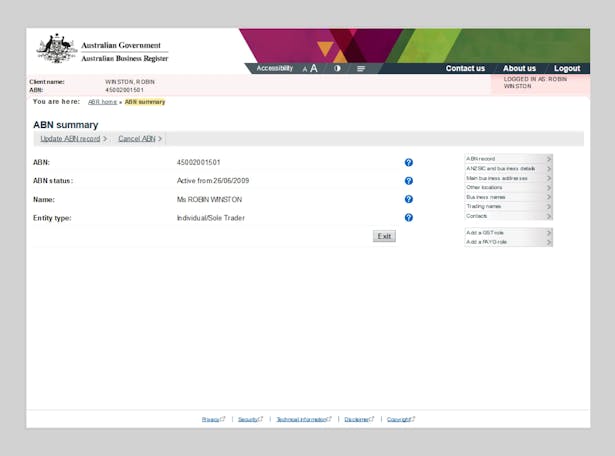

3. Select the ABN to Update

After logging in, you’ll see an ABN summary that provides a snapshot of your business information, such as:

- ABN number – Your unique 11-digit Australian Business Number.

- ABN status – The current status of your ABN (active, canceled, etc.).

- Business Name – The registered name of your business.

- Entity Type – The type of business entity (e.g., sole trader, company).

On the right side of the ABN summary window, you’ll find a menu with options such as:

- ABN Record – View and update your ABN details.

- ANZISIC and Business Details – Update your industry classification and business information.

- Main Business Names – Update the primary names associated with your business.

- Trading Names – Manage and update your trading names.

- Contacts – Update contact information for your business.

- Add a GST Role – Register for Goods and Services Tax if applicable.

- Add a PAYG Role – Register for Pay As You Go withholding if needed.

Depending on what needs updating, select the suitable section from the menu.

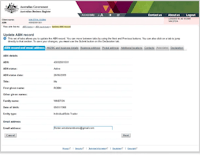

4. Update Your Details

To start updating your ABN details, first decide what needs updating. This could include your business name, address, or contact information:

- If the provided information is correct, no further action is needed.

- If the data is outdated, update the relevant sections and proceed.

Verifying Business Address

Even if your business address hasn't changed since you registered for an ABN, it's important to confirm that ABR has the correct location listed in the register.

Your main business address should be a physical street address, not a post office box or your tax/BAS agent’s address.

However, you can still use a different postal address for receiving communications.

If your business operates from multiple locations, ensure these addresses are updated, too.

Additional Business Activities

You can register up to 4 additional business activities along with their respective Australian and New Zealand Standard Industrial Classification (ANZSIC) codes.

For example, if you run a fitness center, your main activity might be Sports and Physical Recreation Instruction (8211).

If you also offer a health cafe, massage services, and a retail shop, you can add the following ANZSIC codes:

- Cafes and Restaurants (4511)

- Other Allied Health Services (8539)

- Sport and Camping Equipment Retailing (4241)

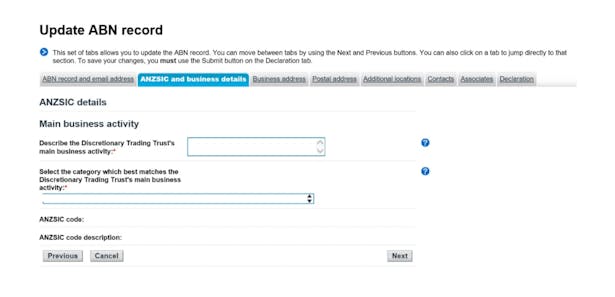

Steps to Add Business Activities:

1. Use your myGovID and select “Update ABN record.”

2. Select ANZSIC and Business Details option.

3. Provide a short description of your business activity to find the best match.

4. Select the Category from the drop-down menu.

5. Based on your selection, the ANZSIC code and ANZSIC code description will be auto-updated.

6. To add more activities, repeat these steps from step 2.

5. Review and Submit Changes

Once you have made all necessary changes, it’s time to review and submit them.

First, it is important to double-check all the updated information.

Accuracy at this stage ensures that there are no errors that could affect your business operations.

Finally, submit the changes through the ABR portal. This action finalizes your updates and ensures your business information is up-to-date.

Follow these steps to submit changes to your ABN details:

1. Select Declaration — After making changes, go to the declaration section.

2. Accept the Declaration — Tick the box to confirm that you accept the declaration.

Alternative Methods to Update Your ABN Details

If you can’t access ABR online services, there are alternative methods to update your information.

👉 Contact ABR: Reach out directly for assistance.

👉 Tax Professional: Ask your tax professional to update your details.

👉 Mail a Form: Complete and mail a form to the relevant authorities.

Steps for Specific Updates

For changes considering business or legal names, please follow these instructions:

👉 Business or Legal Names of Sole Traders: Call the ATO on 13 28 66.

👉 Legal Names of Companies: Visit the ASIC website.

👉 Legal Names of Not-for-Profit Organisations and Charities: Visit the ACNC website.

Important Considerations for Updating Your ABN Details

Keeping your ABN details updated is also essential to avoid penalties and maintain your business’s credibility.

Here are some key points to consider when updating your ABN details.

1. Timing of Updates

Every day, businesses access ABN Lookup to verify information.

If your details are outdated, they may choose not to engage with you, potentially harming your business relationships.

To avoid this, make sure to update your details within 28 days after your changes took place.

2. Resolving Login Problems with myGovID

Experiencing login issues with myGovID can be frustrating, but there are several troubleshooting tips you can try:

- Verify that the email address you are logging in with matches the one linked to your myGovID.

- Close and reopen the myGovID app.

- Restart your mobile device.

- Switch your network connection (e.g., from WiFi to mobile data).

- Clear the cache and data in your device settings.

- Uninstall and reinstall the myGovID app.

If these steps don't resolve the issue, contact ATO directly for further assistance.

3. Dealing with Error Messages During Updates

Encountering errors while updating your ABN details can be challenging.

Here are some common myGovID error codes and their descriptions:

- Error Code 45047 (422): Indicates an issue with the authentication process, often due to incorrect or incomplete information provided during identity verification.

- Error Code NWK000003: Usually caused by network issues, such as connectivity problems or server downtime, preventing the myGovID app from communicating with the server.

- Error Code 51008 (422): Typically arises when there is a problem with the email address used during registration, such as it is already in use or incorrectly formatted.

These errors generally involve issues with identity verification, network connectivity, or account information mismatches.

For more detailed information and additional support, visit the myGovID help page here.

Conclusion

By now, you understand the critical importance of keeping your ABN details up to date.

Let's reflect on something equally beneficial for business owners and sole traders:

- the seamless process of registering your company,

- managing your bookkeeping and

- maintaining clean finances.

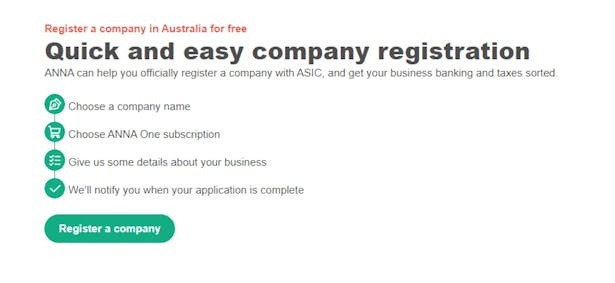

Meet ANNA!

About ANNA

ANNA specializes in financial services for small businesses, focusing on simplifying business registration in Australia.

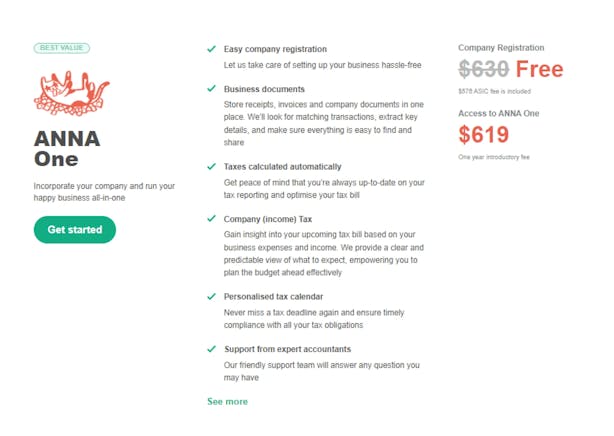

With the ANNA One package, you can seamlessly register your Australian company and open a business bank account in one streamlined process.

We cover the registration cost with ASIC, so it won’t cost you a penny.

Key Features of ANNA One Solution

✔️ Easy Business Setup — ANNA takes care of the entire registration process, making it hassle-free and stress-free.

✔️ Business Documents Management — Store and organize all your business documents in one convenient place.

✔️ Comprehensive Business Management — Streamline your operations with efficient financial tools.

✔️ Automated Financial Tools — Manage receipts, invoices, and tax calculations automatically.

✔️ Expert Support — Get access to a dedicated support team for all your business queries and tax needs.

How to Get Started with ANNA?

1. Visit ANNA's Website — Explore the various packages ANNA offers.

2. Choose Your Package — Opt for the Easy Company package for a straightforward business setup or the ANNA One package for comprehensive business management.

3. Sign Up — Complete the registration process with your business details.

4. Start Managing — Begin using ANNA's tools to manage your business efficiently.

Ready to simplify your business management?

Sign up for ANNA One today and take control of your business finances effortlessly!