Operating Ratio in Australia - Everything to Know

Learn about the operating ratio in Australia, its importance, how to calculate it, and its impact on your business's financial health.

- In this article

- What Is the Operating Ratio?

- Why the Operating Ratio Is Important for Australian Businesses

- How to Calculate the Operating Ratio

- What’s a Good Operating Ratio?

- Why the Operating Ratio Matters

- How to Improve Your Operating Ratio

- Final Thoughts: Keep Your Operating Ratio in Check

- Introducing ANNA: Simplifying Business Management in Australia

Running a business is much like surfing – sometimes you're riding high on profits, and sometimes you're paddling against the current of rising costs. But just like surfers need to know the tides and waves, business owners need to know their numbers.

One key number that can give you insights into your business's financial health is the Operating Ratio.

In this post, we'll explain the Operating Ratio, how to calculate it, and why it's important for Australian businesses across all industries.

We'll also look at industry benchmarks and tips on improving this vital metric. Let's get started!

What Is the Operating Ratio?

The Operating Ratio (OR) is a crucial financial metric used to assess a business's efficiency. Simply put, it measures the percentage of net sales that goes toward operating expenses. This metric is an essential indicator of how well a business is being run on a day-to-day basis.

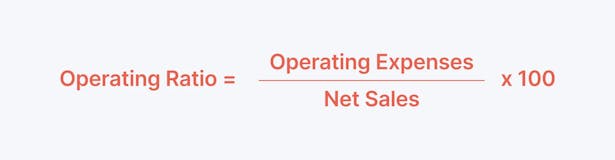

The formula for the Operating Ratio is straightforward:

Here's a breakdown of the two key components:

- Operating expenses include all costs associated with running your business, such as rent, salaries, utilities, insurance, maintenance, marketing, and other administrative costs. These expenses keep your business running but can eat into your profits if they aren't managed well.

- Net sales is the total revenue generated from sales after accounting for returns, discounts, and allowances. It's what you actually take in from selling goods or services.

So, the Operating Ratio essentially shows what percentage of your sales revenue is being consumed by operating expenses. The goal is to keep this ratio as low as possible because that means more of your revenue is available for profits, reinvestments, or other financial goals.

Why the Operating Ratio Is Important for Australian Businesses

In Australia, where small and medium-sized enterprises (SMEs) make up a significant portion of the economy, the Operating Ratio is a key barometer for financial stability.

Whether you're running a cozy café in Melbourne or managing a manufacturing plant in Brisbane, understanding your Operating Ratio can offer invaluable insights.

Here are some reasons why the Operating Ratio is a crucial metric for Australian businesses:

- Efficiency Check: The Operating Ratio gives you a snapshot of how efficiently your business is operating. If your ratio is high, it's a red flag that you're spending too much to keep the business running, potentially at the expense of profitability. Keeping this ratio in check ensures that your costs don't outweigh your income.

- Profitability Indicator: The lower your Operating Ratio, the more profitable your business is likely to be. High operating costs can quickly erode profit margins, especially in competitive industries. Monitoring your OR regularly helps ensure that your operating costs aren't creeping up unnoticed.

- Investor Confidence: Investors and lenders often assess a business's financial health by looking at its operating ratio (OR). A low OR indicates efficient operations, signaling that the business is well-managed. This is especially helpful when seeking funding or attracting investors. A well-maintained OR shows that your business is not just making money but also controlling costs, which builds confidence.

- Industry Benchmarking: The Operating Ratio (OR) is an excellent tool for comparing your business with industry peers. Different industries have different norms regarding acceptable OR levels. Retail businesses, for instance, often have lower ORs than capital-intensive industries like construction or manufacturing.

How to Calculate the Operating Ratio

Calculating the Operating Ratio is relatively simple but requires accurate financial data. Let's take a closer look at how to calculate it step by step.

Step 1: Gather Your Financial Data

You'll need your operating expenses and net sales for the period you're analyzing. Operating expenses should include all day-to-day costs that are necessary to keep your business running, while net sales are your total sales minus any returns or discounts.

Step 2: Apply the Formula

Use the Operating Ratio formula:

Step 3: Analyze the Result

Once you have the result, you can interpret whether your business is operating efficiently. A lower Operating Ratio means your expenses take up a smaller portion of your sales, while a higher OR may indicate inefficiencies in your operations.

Example Calculation

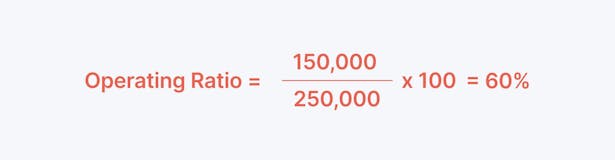

Let's take a real-world example to bring this to life.

Meet Anne, who owns a popular café in Melbourne called "Brewed Bliss." Her financials for the year look like this:

- Operating Expenses: $150,000 (rent, utilities, salaries, etc.)

- Net Sales: $250,000 (her total sales after returns and discounts)

To calculate her Operating Ratio:

This calculation means 60% of Anne's sales are spent on operating costs, leaving her with 40% for profits and reinvestments.

What’s a Good Operating Ratio?

A "good" Operating Ratio can vary depending on the industry you're in, but here's a general guideline for Australian businesses:

- Below 70%: This is generally considered healthy for most businesses. If your OR is below 70%, it means you're efficiently managing your expenses relative to your sales.

- Between 70% and 80%: This range suggests that your operating expenses are starting to take a bigger bite out of your sales. You may want to evaluate whether there's room for improvement, especially in areas like rent or staff costs.

- Above 85%: An Operating Ratio above 85% means your operating expenses are eating into your profits significantly. If your OR is consistently in this range, it could be a sign that your business is at risk of financial instability unless corrective actions are taken.

Industry Variations

While the above guidelines are good for general business operations, the acceptable range for your Operating Ratio may vary by industry:

- Retail: Retail businesses often have thinner margins, so a healthy OR is typically around 50%–65%. Retailers with a higher OR may struggle to stay competitive due to high fixed costs and price-sensitive customers.

- Manufacturing: Due to capital investments and production costs, manufacturing businesses can operate efficiently with an OR of 75% or higher. However, improving efficiency can still be crucial for maintaining profitability.

- Service Industry: Businesses in the service sector, like consulting firms or software companies, often have lower operating costs, so an OR below 60% is usually considered excellent.

Why the Operating Ratio Matters

The Operating Ratio is more than just a number on your financial statement – it's a vital sign of your business's financial health. Here's why it matters for Australian companies:

1. Early Warning System

The Operating Ratio can serve as an early warning sign for financial trouble.

If your OR is steadily increasing, it could indicate that your operating costs are growing faster than your sales, which may lead to shrinking profit margins.

So, you should monitor your OR regularly to catch inefficiencies before they become a bigger problem.

2. Better Decision-Making

Knowing your Operating Ratio allows you to make more informed decisions about where to cut costs or invest.

For example, if your OR is creeping up, you might want to reexamine your largest expense categories, like salaries or utilities, and look for ways to reduce costs without sacrificing quality or service.

3. Benchmarking and Goal Setting

Tracking your Operating Ratio over time can also help you benchmark your performance.

Comparing your OR with industry standards or your historical data allows you to set more realistic financial goals. For instance, if you notice that businesses in your industry typically have an OR of 60%, but you're operating at 75%, that's a sign you should look for ways to improve.

4. Cash Flow Management

A high OR can strain your cash flow.

If most of your revenue is tied up in operating expenses, you'll have less flexibility for reinvestment, savings, or expansion.

Maintaining a low OR ensures that you have enough cash flow to cover unexpected costs or seize new opportunities.

How to Improve Your Operating Ratio

If you find your Operating Ratio too high, don't panic – plenty of strategies exist to bring it down. Here are some practical tips for Australian businesses looking to improve their OR:

- Streamline Operations: Review all aspects of your operations to identify inefficiencies. Can you negotiate better deals with suppliers? Are there tasks that can be automated? Streamlining day-to-day activities can cut costs and improve your OR.

- Increase Sales Without Increasing Expenses: One of the best ways to enhance your Operating Ratio is to grow your sales while keeping your operating expenses steady. For example, you can offer new products, expand your market reach, or increase prices slightly.

- Reduce Overhead Costs: Evaluate your overhead costs, such as rent, utilities, and insurance. Can you renegotiate your lease? Could you switch to more energy-efficient solutions to cut utility bills? Cutting overhead can have a significant impact on your OR.

- Outsource Non-Core Activities: Consider outsourcing tasks not central to your business's value proposition, like payroll, accounting, or marketing. Outsourcing can help you focus on what you do best while keeping costs down.

Final Thoughts: Keep Your Operating Ratio in Check

The Operating Ratio is a powerful tool for managing your business's financial health. When you keep your OR low, you ensure that more of your revenue is available for growth, profit, and future opportunities.

Whether you're running a small café or a large manufacturing operation, knowing how to calculate and use the Operating Ratio can give you an edge in the competitive Australian market environment.

Monitoring it regularly helps ensure you're running an efficient operation that's set up for long-term success.

Introducing ANNA: Simplifying Business Management in Australia

If you're a business owner in Australia, improving your Operating Ratio means more than just cutting costs or increasing sales.

You also need tools that streamline how you manage everything from company registration to accounting. This is where ANNA shines – a one-stop solution that takes the complexity out of business management.

Why ANNA?

ANNA helps Australian businesses handle everything from starting up to managing everyday operations like bookkeeping, invoicing, and tax management.

With ANNA, you can streamline all those time-consuming tasks and get a clear picture of your business's financial health – making it easier to keep that Operating Ratio in check.

Here's how ANNA benefits your business:

- Start Your Business with Ease: ANNA One package offers free company registration. You can easily register your company with ASIC, get an Australian Business Number (ABN), and a business bank account – all in one seamless process. We even cover the registration costs!

- Bookkeeping and Tax Made Easy: ANNA automates your bookkeeping and keeps track of your invoices, receipts, and GST. It also calculates taxes automatically, making it easier to keep your business compliant and avoid surprises when tax season rolls around.

- Expense Management: By automatically categorizing and sorting your business expenses, ANNA helps optimize your tax bills. You'll always know what expenses are deductible, which can improve your Operating Ratio by reducing unnecessary costs.

- Invoicing & Payments: Need to send invoices? ANNA One allows you to create professional invoices that get paid faster. Plus, ANNA can chase late payments for you, improving cash flow – a key factor in improving your OR.

✨ All-in-One Business Solution

- With ANNA, you don't just register your business. You also get access to debit cards, virtual cards, and even Apple Pay/Google Pay functionality, making tracking your spending and managing day-to-day finances easier.

- You also get a personalized tax calendar, so you never miss a deadline, ensuring your compliance and avoiding penalties.

- By using ANNA, you'll save time on financial admin, allowing you to focus on growing your business and improving your Operating Ratio.

So why wait? Sign up with ANNA today!