What are Award Rates and Minimum Wage in Australia?

Learn everything about award rates and minimum wage in Australia, their role in employee pay, and how they affect both workers and businesses.

Paying employees correctly is one of the most important responsibilities of an employer in Australia.

Missteps in this area can lead to legal troubles, financial penalties, and a damaged reputation. To navigate this crucial aspect of business management, you need to understand two key components of the Australian payroll system: award rates and the minimum wage.

This comprehensive guide will break down these concepts, explain their significance, and provide actionable steps for compliance.

What is the Minimum Wage in Australia?

The minimum wage is the lowest legal amount an employer can pay an employee.

Set annually by the Fair Work Commission, it applies to employees not covered by an award or registered agreement.

As of 2024, the national minimum wage is $24.10 per hour or $915.90 per week for full-time employees. This rate ensures a baseline standard of living for workers across the country.

⚡ Key Points About the Minimum Wage:

- Who it applies to: Employees not covered by an industry award or enterprise agreement.

- Gross pay: The minimum wage is calculated before tax deductions.

- Annual Updates: The minimum wage is reviewed each year to reflect economic conditions and ensure workers can maintain a reasonable standard of living.

⚡ History and Purpose:

The introduction of the minimum wage in Australia was a milestone for workers' rights. Before its establishment, employees often faced exploitative conditions with low pay and long hours.

The Fair Work Act 2009 formalised the national minimum wage, providing a framework that continues to evolve to meet modern needs.

Regular reviews ensure that wages keep pace with inflation, economic changes, and societal expectations.

⚡ Minimum Wages for Specific Groups:

Certain categories of employees may have adjusted minimum wage rates, including:

- Junior Employees: Workers under 21 years old often receive a percentage of the adult minimum wage based on their age.

- Apprentices and Trainees: These employees are paid lower rates while they undergo training.

- Employees with Disabilities: Special provisions ensure inclusive opportunities for workers with disabilities while maintaining fair pay.

⚡ Why the Minimum Wage Matters:

The minimum wage is vital in maintaining economic stability and social equity.

Setting a baseline prevents employers from underpaying vulnerable workers and reduces income inequality.

It also benefits businesses by fostering a motivated and fairly compensated workforce, reducing turnover, and boosting productivity.

What are Award Rates?

Award rates are the minimum pay rates, allowances, and working conditions applicable to employees in specific industries or occupations.

These rates are outlined in modern awards, which are legally binding documents created and maintained by the Fair Work Commission.

Modern awards are industry-specific and go beyond the national minimum wage to provide detailed conditions tailored to the nature of work in each sector.

⚡ Key Characteristics of Award Rates:

- Industry and Occupation Specific: Over 100 modern awards cover industries ranging from hospitality to healthcare, ensuring tailored compensation.

- Higher Than Minimum Wage: Award rates often exceed the national minimum wage, reflecting the complexity and demands of various jobs.

- Comprehensive Coverage: Modern awards include provisions for penalty rates, overtime pay, allowances, and leave entitlements.

⚡Examples of Modern Awards:

- The Hospitality Industry (General) Award covers chefs, waitstaff, and kitchen attendants, specifying their minimum hourly rates and conditions.

- The Retail Award applies to sales assistants, merchandisers, and cashiers in the retail sector.

⚡ Why Award Rates Matter:

- Fair compensation: Ensures employees are paid according to the demands of their industry.

- Legal compliance: Protects employers from penalties associated with underpayment.

- Employee satisfaction: Competitive wages help attract and retain talent.

How to Determine the Right Award Rates for Your Employees

Navigating award rates can seem complex, but the Fair Work Ombudsman provides tools to simplify the process. Here’s a step-by-step approach:

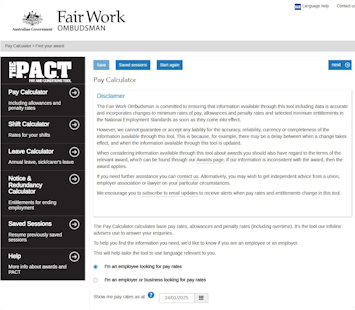

1️⃣ Identify the Relevant Award: Use the Pay and Conditions Tool on the Fair Work Ombudsman website to find the modern award that applies to your employees based on their industry and occupation.

2️⃣ Understand the Award Details: Each modern award outlines specific conditions, including:

- Base Pay Rates: Minimum hourly wages based on job classification.

- Penalty Rates: Higher pay for overtime, weekends, or public holidays.

- Allowances: Additional payments for uniforms, tools, or travel.

- Leave Entitlements: Annual leave, sick leave, and other entitlements.

3️⃣ Calculate Pay Rates: Use the Fair Work Ombudsman’s Pay Calculator to ensure accurate pay calculations, considering penalties, allowances, and other award-specific conditions.

4️⃣ Keep Records: Maintain detailed records of:

- Hours worked

- Pay rates

- Allowances

- Leave entitlements

5️⃣ Stay Updated: Regularly review your employees’ pay rates to align with changes in the relevant award. Subscribing to updates from the Fair Work Commission can help you stay informed.

Legal Compliance: Avoiding Penalties for Underpayment

Starting January 1, 2025, intentionally underpaying an employee’s wages or entitlements can lead to criminal charges. This change shows the government’s commitment to protecting workers and ensuring wage compliance.

Consequences of Non-Compliance:

- Fines: Employers may face significant financial penalties for underpayment.

- Backpay Requirements: Employers must repay owed wages, often with interest.

- Reputation Damage: Public exposure of non-compliance can harm your business's credibility.

Case in Point: George Calombaris and Australian Unity

The case of celebrity chef George Calombaris highlights the consequences of underpayment. His restaurant group underpaid over 500 employees by approximately $7.8 million, leading to fines, legal action, and reputational damage. This case accentuates the importance of accurate payroll management and adherence to award rates.

Another notable example is the case of Australian Unity, a company operating in health, wealth, and care services. Between 2014 and 2021, Australian Unity underpaid over 8,900 employees due to errors in calculating entitlements under various enterprise agreements and awards.

The total underpayment exceeded $7.3 million, with individual cases ranging from less than $1 to over $23,000.

To rectify this, Australian Unity entered into an Enforceable Undertaking (EU) with the Fair Work Ombudsman, agreeing to back-pay all owed amounts, implement corrective measures, and make a $250,000 contrition payment.

The company’s proactive approach, including engaging an independent auditor for annual compliance checks, highlights the importance of self-reporting and preventive measures.

Tools and Resources for Employers

Here are some resources to help you navigate award rates and minimum wage compliance:

- Pay and Conditions Tool: Calculate minimum pay rates, penalties, and allowances.

- Voluntary Small Business Wage Compliance Code: Offers a checklist, case studies, and best practices.

- Fair Work Ombudsman Website: Provides up-to-date information and downloadable pay guides.

- Enterprise Agreements: For businesses with unique pay structures, these agreements can offer flexibility while ensuring compliance.

Final Thoughts

Understanding and adhering to award rates and minimum wage laws is a legal obligation and a foundation of ethical business practices.

As a business owner, you’re not just protecting yourself from fines or reputational damage but you’re ensuring your employees feel valued and fairly treated.

Compliance builds trust, strengthens workplace culture, and ultimately contributes to your business's long-term success.

That said, managing payroll, taxes, and compliance can feel overwhelming, especially if you’re juggling multiple responsibilities.

This is where having the right tools can make all the difference.

Instead of spending hours navigating regulations or worrying about administrative mistakes, imagine having a reliable partner to simplify the process and give you peace of mind.

Introducing ANNA: Revolutionising Business Management

Starting and managing a business in Australia has never been easier, thanks to ANNA One. ANNA provides a seamless platform to register your company and handle essential business tasks all in one place.

Key Features of ANNA for Business Owners:

- Free Company Registration: ANNA covers the $576 ASIC registration fee, allowing you to register your company without any upfront costs. With ANNA, you'll receive your Australian Company Number (ACN) and ASIC documents directly in your inbox.

- Integrated Business Management: Beyond registration, ANNA offers tools for bookkeeping, invoicing, GST, and tax management, ensuring compliance with Australian regulations.

- Tax Optimisation and Filing: ANNA calculates GST automatically, issues tax invoices, and even helps file your annual tax return. This reduces errors and ensures timely compliance with the ATO.

- Personalised Tax Calendar: Never miss a deadline with ANNA's reminders and calendar, tailored to your business's tax obligations.

- Expense Management: Capture receipts on the go, automatically sort expenses, and link them to the right transactions for accurate bookkeeping.

- Business Banking: Open an ANNA business account with features like debit and virtual cards, expense cards for employees, and integration with Apple Pay and Google Pay.

How ANNA Benefits Employees:

While ANNA is primarily a tool for business owners, it indirectly enhances the experience of employees by ensuring:

- Timely and Accurate Payroll: ANNA automates payroll processes, reducing errors and ensuring employees are paid on time.

- Transparency in Tax Deductions: With ANNA's detailed tracking, employees can trust that their taxes and superannuation are managed correctly.

- Improved Workplace Efficiency: By streamlining administrative tasks, ANNA allows employers to focus on creating a better work environment for their team.

Ready to get started? Visit ANNA’s platform to register your company today and unlock the tools you need to run a happy, thriving business.

FAQ

1. Do Award Rates Apply To All Employees?

Award rates apply to employees covered by a specific modern award. Some employees, like those in managerial roles, may not fall under an award but are still entitled to the national minimum wage or enterprise agreement rates.

2. How Do I Know If My Employees Are Covered By An Award?

Use the Pay and Conditions Tool or consult the Fair Work Ombudsman for guidance.

3. What If I Make A Mistake Calculating Pay Rates?

Rectify underpayments promptly and consult professional advisors to avoid repeat issues.