ACN, ABN, TFN: What They Are and Do You Really Need Them?

Starting a business in Australia? You’ve probably heard these three sets of letters thrown around: ACN, ABN, TFN. They might sound similar, but each has a different purpose. This guide will help you understand what they are, who issues them, whether you need them, and how they differ

- In this article

- Quick Summary

- What’s an ACN?

- What is an ABN?

- What is a TFN?

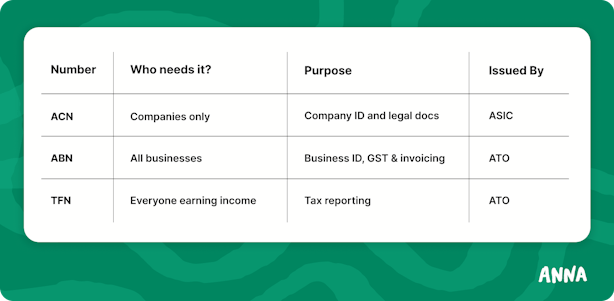

Quick Summary

What’s an ACN?

ACN stands for Australian Company Number. It’s a unique 9-digit unique number issued to every company registered in Australia.

Who issues it?

The Australian Securities and Investments Commission (ASIC) issues ACNs when a company is registered.

What’s it for?

Identifies your company on the ASIC register.

Used on official company documents and legal paperwork.

Helps distinguish your company from others with similar names.

Do you need it?

Only if you are registering a company. Sole traders, trusts and partnerships don’t get an ACN.

Example:

ACN: 123 456 789

Think of ACN as your company’s “ID card” with ASIC.

What is an ABN?

ABN stands for Australian Business Number. It’s a unique 11-digit number used for business dealings with the government and other businesses.

Who issues it?

The Australian Taxation Office (ATO) issues ABNs through the business registration process.

What’s it for?

Identifies your business for tax purposes.

Allows you to register for GST, PAYG withholding, and other business taxes.

Needed for invoicing, claiming GST credits, and dealing with other businesses.

Do you need it?

Yes, if you’re running a business, regardless of the structure - a sole trader, partnership, company, or trust - you need an ABN.

Example:

ABN: 12 345 678 901

ABN is like your business “passport” for dealing with other businesses and the government.

What is a TFN?

TFN stands for Tax File Number. It is a unique 9-digit number issued to individuals, companies, partnerships, trusts, and superannuation funds for tax purposes.

Who issues it?

The Australian Taxation Office (ATO) issues ABNs through the business registration process.

What’s it for?

Used for income tax and other tax reporting.

You need it to open bank accounts, apply for government benefits, and lodge tax returns.

Do you need it?

Yes. Every person and entity earning income or operating a business in Australia must have a TFN.

Example:

TFN: 123 456 789

TFN is your personal or business “tax ID.”

Frequently asked questions

Where can I find ACN, ABN and TFN?

ACN: ASIC company register or Company legal documents

ABN: ABN Lookup tool

TFN: myGov account or ATO correspondence

Is it safe to share ACN, ABN and TFN?

ACN: Publicly available on ASIC, so safe to share

ABN: Safe to share for business purposes

TFN: Keep private to prevent identity theft

What number do I need to put on my invoice?

ABN: This is the main number you should include on invoices for all businesses. Including your ABN makes sure your invoice meets ATO requirements and allows clients to claim GST credits

ACN: It’s not mandatory for invoices. Only companies registered with ASIC can display an ACN on invoices, but it’s not necessary if your ABN is already listed. Sole traders, partnerships, and trusts don’t have an ACN

TFN: Never include your TFN on invoices. TFNs are private tax identifiers and should be kept confidential to prevent identity theft

Check the ATO website for more details about requirements of tax invoices

Disclaimer:

This content is general information for small businesses. You can only use the document for your noncommercial purposes. In no event shall we be held liable for any claims arising due to, or dependencies on the accuracy and completeness of the content provided. ANNA+Taxes does not provide personal or professional financial, accounting or tax advice and you should consult with external professionals for advice tailored to your situation prior to making any decisions.