3 Key Advantages of Buying Property Under a Company Name in Australia

Discover the key benefits of buying property under a company name in Australia, including tax advantages, asset protection, and long-term strategy.

- In this article

- What Does It Mean to Buy Property Under a Company Name?

- 3 Key Advantages of Buying Property Through a Company Name in Australia

- Individual vs. Company Ownership of Property in Australia

- Can a Foreigner Buy Property in Australia Through a Company?

- Conclusion

- ANNA Money - Absolutely No Nonsense Admin

- FAQ

Most people buy property in their own name because it is straightforward and familiar.

But there's another option: purchasing property under a company name.

There are more rules, more fees, and slightly more paperwork.

However, if you're thinking about expanding your property portfolio or preserving your own funds, it may be worth considering.

In this article, we'll go over how it works, why some people prefer it, and what you should know before deciding.

What Does It Mean to Buy Property Under a Company Name?

Let's start from the very beginning, and that is, what does it actually mean to buy property under a company name?

Purchasing property under a company name indicates that the property is owned by a business rather than a person.

The company is named as the buyer on the contract of sale and is the registered owner of the property title.

This structure is usually used by investors, developers, or persons who intend to own many properties.

It can provide some benefits, particularly in terms of taxation, asset protection, and business planning.

How Does This Differ from Buying in Your Own Name?

When you purchase a property in your own name, you are individually liable for the mortgage, associated fees, and any legal concerns.

All revenue from the property is reported on your personal tax return, and any liabilities are your responsibility.

With company ownership, those responsibilities fall on the company.

The company pays tax on any income generated by the property, whereas you only pay personal tax if you withdraw money from the company (via salary or dividends).

3 Key Advantages of Buying Property Through a Company Name in Australia

Let’s go over key advantages of buying property through a company name in Australia!

1. Asset and Liability Protection

One of the most common reasons people buy property under a company name is to preserve their assets.

This simply means keeping your personal assets (such as your home, car, and money) distinct from the dangers associated with a real estate investment.

When you purchase property in your own name, you are personally liable for any debts or legal concerns associated with that property.

For example, if a tenant sues you or you default on a loan, your personal belongings may be at risk.

By holding property through a business, the risks are contained within it.

So, if something goes wrong with the property, such as a legal conflict or an unpaid obligation, it affects the company rather than you personally.

Directors of companies can still be held personally liable in certain situations, particularly if they acted dishonestly or signed personal guarantees for loans.

2. Tax Benefits and Deductions

Purchasing property through a company business structure can provide various tax benefits, especially if you are an investor looking to improve your tax situation.

In Australia, companies categorised as base rate entities – those with an aggregated turnover of less than $50 million and 80% of their income derived from passive sources – are eligible for a 25% tax rate reduction.

Individuals, on the other hand, must pay progressive taxes. Individuals earning more than $190,000 can face a high marginal tax rate of 45%.

What Tax Deductions are Available to Companies When Buying Property?

If you are buying a property through a company, you can take advantage of a variety of tax breaks, which can boost your cash flow and lower your taxable income.

Here's how these deductions operate and why they're useful:

🔷 Interest on Loans - Companies can deduct the interest paid on loans used to purchase income-producing property. This is frequently the largest single deduction, directly reducing taxable rental income.

🔷 Depreciation - Businesses can depreciate both the building (capital works) and the plant and equipment (e.g., appliances, carpets, blinds). For buildings built after September 16, 1987, a 2.5% annual deduction is provided for 40 years. The ATO determines the effective life of plant and equipment and depreciates it accordingly.

🔷 Property management and maintenance - Expenses, including tenant advertising, property management fees, repairs, cleaning, gardening, pest control, and security, are immediately deductible.

🔷 Rates and taxes - Land tax, council rates, and water charges are deductible when the property is used to create income.

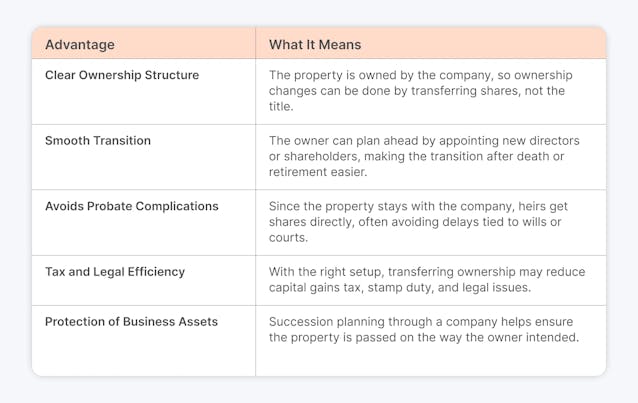

3. Succession Planning and Ownership Transfer

How does buying property through a company help with succession planning?

🔷 Clear Ownership Structure - When a company owns property, so does it through shares in the company rather than directly. This means that transferring ownership can be accomplished by transferring shares, which is typically easier and more flexible than transferring the property title.

🔷 Smooth Transition - Succession planning in a company structure enables the company owner to choose successors as directors or shareholders while still alive, allowing for a more seamless transition of power and ownership following death or retirement without the property having to be sold or re-titled.

🔷 Avoids Probate Complications - Because the company owns the property, the transfer of shares can avoid some of the complexity and delays involved with probate and estate administration, lowering the possibility of disputes or delays for beneficiaries.

🔷 Tax and Legal Efficiency - Properly organised business ownership can help handle the capital gains tax and stamp duty concerns that may arise when transferring individually owned property. It also enables the use of shareholder agreements or buy/sell agreements to codify succession plans.

🔷 Protection of Business Assets - Succession planning ensures that property and other business assets are passed down in accordance with the owner's wishes, thereby safeguarding family or business interests and preventing unexpected consequences.

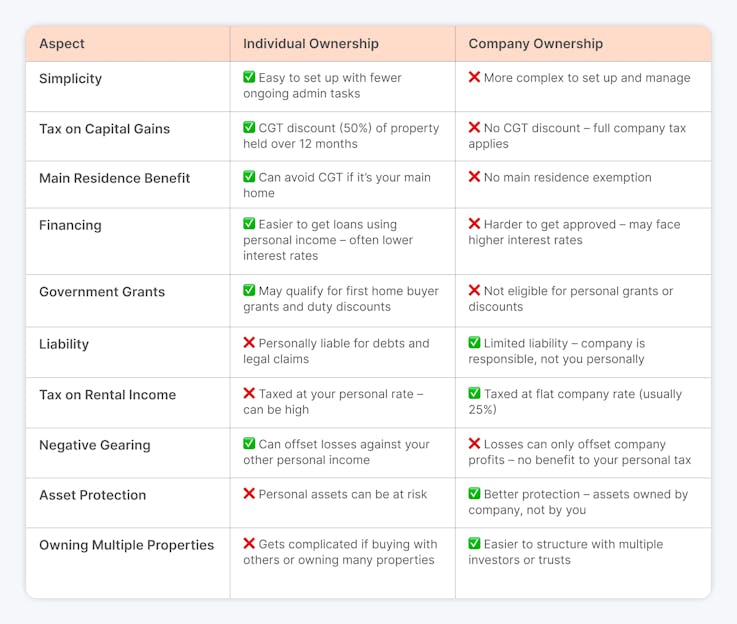

Individual vs. Company Ownership of Property in Australia

Individual ownership has the following advantages:

✅ Simplicity - Purchasing property as an individual is simple, with lower setup fees and administrative burdens.

✅ Main Residence Exemption - If the property is your principal residence, any capital gain on sale is typically excluded from CGT.

✅ Easier Financing - Personal income and credit history are used to simplify loan applications, which frequently result in lower interest rates.

✅ First Home Owner Grants - You may be eligible for subsidies and transfer duty savings when purchasing your first house.

Disadvantages:

❌ Unlimited Personal Liability - You are personally accountable for any debts or legal troubles relating to the property, which puts your personal assets at risk.

❌ Higher Marginal Tax Rates - Rental income and capital gains are subject to your personal marginal tax rate, which can be substantial for high-income individuals.

Advantages of being a company owner:

✅ Limited Liability - Because the company is a separate legal entity, your personal financial risk is limited to the amount you invest in it.

✅ Asset Protection - Corporate ownership can protect assets from personal creditors and legal claims.

✅ Strategic Ownership - Companies can simplify complex ownership structures, such as holding numerous properties or collaborating with trusts for tax purposes.

Disadvantages:

❌ No CGT Discount - Companies are not eligible for the 50% CGT discount. Thus, capital gains are taxed completely at the corporate rate.

❌ No Negative Gearing Against Personal Income - There is no negative gearing against personal income, thus losses can only be offset by corporate income, restricting tax benefits for individual investors.

❌ Higher Setup and Compliance Costs - Starting and running a business incurs legal, accounting, and ASIC compliance expenses.

❌ More Difficult Financing - Loans to businesses may have tougher lending requirements and higher interest rates.

❌ No Main Residence Exemption - Company-owned properties do not qualify for the main residence CGT exemption.

Can a Foreigner Buy Property in Australia Through a Company?

Yes, if you are a foreigner, you can buy property in Australia through a company, but you must follow tight laws and obtain government permission, particularly from the Foreign Investment Review Board.

These laws are in place to guarantee that foreign investment aligns with Australia's national interests and housing market objectives:

🔶 FIRB approval - Before entering into a formal agreement to buy property in Australia, any foreign person or foreign-controlled company must apply to the FIRB and gain clearance. This rule applies to residential, commercial, and agricultural properties. Without FIRB permission, the transaction is not legally binding.

🔶 Temporary Ban on Purchasing Established Homes (2025-2027) - A temporary ban is in effect from April 1, 2025, until March 31, 2027, as part of recent government steps to alleviate housing pressures. During this time, foreign people and foreign-owned businesses are prohibited from purchasing existing (established) residential homes unless they meet a specific set of criteria.

Foreign purchasers can still apply for purchases:

- Newly constructed homes

- Vacant land for the creation of new homes

- Commercial properties.

All of these purchases remain subject to FIRB approval.

What Are the Requirements For the Purchasing Company?

If you're using a company to purchase property, it should:

➡️ Be appropriately registered in Australia (usually as a Pty Ltd company).

➡️ Comply with all Australian corporate laws.

➡️ Have at least one director who typically resides in Australia.

The corporation is recognised as a separate legal entity, but if foreign persons own a controlling interest, the company is classified as a foreign investor under FIRB regulations.

In some cases, foreign corporations may be permitted to purchase property without violating rules, but they must still obtain FIRB permission. For example:

➡️ Purchasing residential property to accommodate Australian-based employees.

➡️ Acquiring commercial property under specific value thresholds

➡️ Each case is carefully reviewed and approved under rigorous guidelines.

Conclusion

Is it worth buying property in Australia under a company name?

Well, it depends on your goals.

- If you're buying your first house, intend to reside there, or want simplicity and access to government assistance, buying in your own name is generally a better option.It's simple, easier to finance, and comes with tax breaks like the primary residence exemption and CGT discount.

- However, if you're thinking long-term, perhaps growing a portfolio, preserving personal assets, or establishing a framework that can be used for various properties or investors, a company structure may provide you with greater control and flexibility.

Yes, there are additional fees and documentation. And, no, it is not a magical answer. But, with proper planning (and solid advice), purchasing through a business can be a wise decision.

In short, don't just think about the property; consider the wider picture:

Where are you going financially?

How can you organise ownership so that it works for you rather than against you?

Even though ANNA Money can’t help you buy property under the company name, it can help you open a company, run a business and take care of all taxes.

Let’s see how!

ANNA Money - Absolutely No Nonsense Admin

ANNA Money is an all-in-one business tool, best known for helping you set up a company. Besides that, it offers numerous helpful features that can help you run and grow your business:

🔷 Centralised Document Storage - Use a separate business address to keep your personal details private when handling important communications.

🔷 Tax Management - Keep on top of your tax obligations and reduce your tax bill with ANNA Money. Get a custom tax calendar and meet every deadline without the stress!

🔷 Business Account - Get a physical debit card, virtual cards, Apple Pay and Google Pay, plus expense cards for your team. Easily track your balance and control payments in one place.

🔷 Registered Office Service - Protect your privacy with a dedicated business address. We scanned and forwarded your official mail the same day, and it is fully compliant with ASIC, ATO, and other authorities.

🔷 Smart Receipt Matching - Automatically match receipts to your transactions and categorise expenses correctly for the best possible tax deductions.

🔷 Help from Tax Experts - Get answers to all your questions.

🔷 Bookkeeping Score - Keep your records in shape with a simple score system and practical tips for tidy bookkeeping.

🔷 Faster Invoice Payments - Create professional invoices in moments and let us follow up on any unpaid ones so you get paid faster.

Sign up today to simplify your taxes before and after buying property under a company name!

FAQ

Can You Live In the House Owned By Your Company?

You can live in a company-owned house if you have a significant interest in the company and reasonable tenure, such as being a shareholder or director with the right to occupy the property. Without this, your occupancy might not be recognised as living in your primary residence.