Learn what ANZ Bank is, including its services and how it supports personal, business, and international banking across Australia and beyond.

Are you trying to choose the right bank for yourself or your business?

If so, you need to understand what each bank brings to the table before you make a decision, and ANZ Bank is probably part of that conversation due to its extensive reach and broad suite of services.

In our ANZ Review for 2025, we'll look at ANZ's services in Australia and New Zealand, how it can help you, your businesses, or your institution, and if it is your best option.

If you want to compare ANZ Bank to other bank, check out Commonwealth Bank vs ANZ - Which One to Choose!

Let’s start!

What is ANZ Bank?

ANZ Bank is a worldwide banking and financial services company formally known as the Australia and New Zealand Banking Group Limited.

With its headquarters in Melbourne, Victoria, Australia, it operates in 32 markets throughout the world, including Australia, New Zealand, Asia, the Pacific, Europe, America, and the Middle East.

It is one of the Big Four Australian banks.

Wealth management, corporate banking, investment banking, institutional banking, and personal banking are just a few of the many financial services that ANZ offers.

Globally, it provides services to more than 8.5 million business and retail clients.

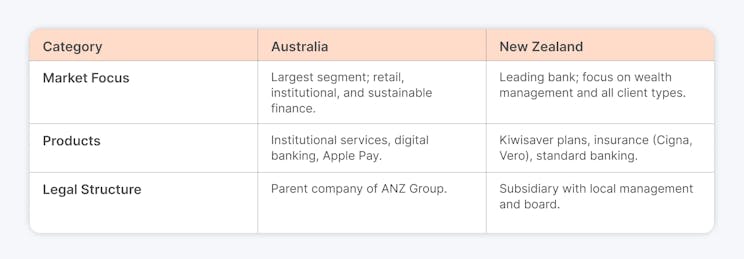

What Are the Main Differences Between ANZ Bank’s Operations in Australia and New Zealand?

1. Market Size and Focus

⚪ Australia - ANZ's operations in Australia constitute its largest and most important segment with a strong emphasis on retail and institutional banking. With a focus on commercial banking, wealth management, and sustainable finance projects, it provides services to almost 6 million consumers in Australia.

⚫ New Zealand - In New Zealand, ANZ Bank emphasises wealth management through ANZ Investments, the biggest fund manager in New Zealand, its operations serve corporate, small business, and personal clients.

2. Product Offerings

⚪ Australia - The bank offers corporate clients a wider choice of institutional services, including derivatives and bonds tied to sustainability. Additionally, it highlights digital banking capabilities and digital financial breakthroughs like Apple Pay.

⚫ New Zealand - Through alliances with companies like Cigna and Vero, ANZ New Zealand focuses on Kiwisaver retirement plans and insurance products in addition to normal banking services.

3. Legal Structure Australia

⚪ Australia - Functions as the group's parent business.

⚫ New Zealand - Operates as a subsidiary of ANZ Bank New Zealand Limited, which has a local management structure and its own board of directors.

What Services Does ANZ Bank Offer? - ANZ Review for 2025

ANZ’s banking services vary depending on the type of account you have. You can choose between:

- Personal

- Business, or

- Institutional

1. Personal Banking Services

Since in this text we will focus on the feature for business users, we will only briefly touch on the offer for individuals.

Here are key services for personal banking:

✔️ Bank Accounts - Choose from daily, savings, and term deposit bank accounts, or go for ANZ Plus' integrated transaction and save accounts.

✔️ Personal Loans - Get loan terms of up to 7 years with flexible repayment options.

✔️ International Money Transfers and Exchange - Make quick and secure international money transfers to over 250 locations using ANZ Internet Banking.

✔️ Private Banking - Get expert banking and assistance if you are a high-net-worth individual.

2. Business Banking Services

Let’s check out key services of business banking!

✔️ Business Finance - Access specialised company funding with flexible secured or unsecured loans, choose fixed or variable rates, and streamline your banking with experienced help that reduces paperwork.

✔️ Merchants and payments - Accept payments in-store, online, and on-the-go with market-leading technology, real-time business insights via the Merchant Portal, automated surcharging, 24/7 local assistance, and same-day settlement into your ANZ Business account.

✔️ International Business - Create opportunities for your company with customised international commerce and foreign exchange solutions.

✔️ Business Hub - Set up your business, manage it, and explore methods to develop.

✔️ Business Accounts - Make and receive payments, access funds while on the go, and earn interest on your excess cash.

3. Institutional Banking Services

ANZ offers a variety of institutional banking services, with a main focus on digital banking. Here are some of them:

✔️ Industries - Get expert assistance and personalised banking solutions for a variety of industries.

✔️ ANZ Fileactive - Automate financial activities such as company payments, reporting, and workflow management while also encrypting files using a secure PGP Key.

✔️ ANZ e-Matching - Get electronic confirmation from ANZ for your Global Markets transactions.

✔️ ANZ Cashactive Virtual - An online sub-account capability to help you manage intra-company cash more efficiently.

✔️ ANZ Austraclear Management Settlement - Use an electronic service for end-to-end management of the Austraclear standard settlement procedure.

Additional Services

In addition to these core services customised for your needs, ANZ provides a variety of additional features to help your business.

1. Unsecured Business Loans With ANZ GoBiz

You can apply online for unsecured business loans up to $500k and borrow money based on your business performance with no assets required. The good things are:

- Zero upfront or admin costs

- No paperwork or branch visits needed

- Secure, one-time link to your accounting software

- Receive conditional approval in just 20 minutes (if eligible)

- Access funds within two business days upon approval

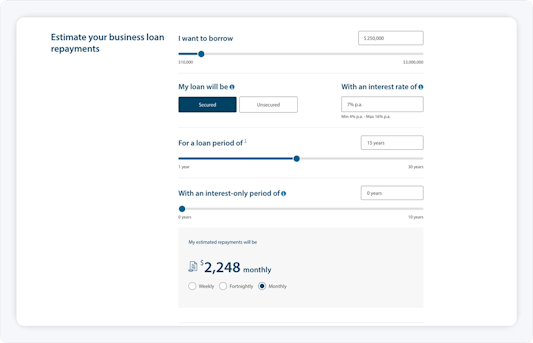

2. Business Loan Calculator

You can use their business loan payback calculator to quickly see how much your repayments may be.

You can estimate your instalments for a secured or unsecured business loan, as well as the impact of an interest-only period on your payments.

If you require a loan of more than $3 million, you may request a callback from a commercial banker.

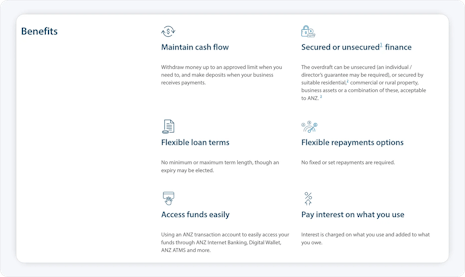

3. ANZ Business Overdrafts

ANZ Bank allows you to manage your cash flow with an ANZ Business Overdraft, a flexible, revolving line of credit that allows you to access additional funds up to an approved limit when you need them.

Starting at $2,000, they offer secured and unsecured options to meet your business needs.

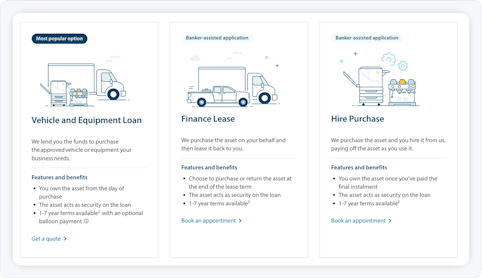

4. Business Finance for Cars, Trucks and Equipment

ANZ Vehicle and Equipment Finance enables you to acquire vital business assets, such as vehicles or machinery, without exhausting your cash reserves.

If you want to buy a car, you can use ANZ's online quote tool to estimate loan repayments depending on your requirements before beginning the application process.

If you need equipment finance, you can schedule an appointment with a business banking specialist to discuss specialised choices and receive advice throughout the process.

Advantages and Disadvantages of ANZ Bank

Here are some advantages and disadvantages of AZN Bank:

Advantages

✅ Digital Banking and Security - ANZ provides advanced digital banking capabilities, such as the ANZ App, which supports digital wallets like Apple Pay and Google Pay. It also has advanced security features, including Voice ID, ANZ Falcon, and Scam Safe safeguards.

✅ Convenience and Accessibility - ANZ offers a large network of branches and ATMs, making it suitable if you like traditional banking. It also offers 24/7 online banking services.

✅ Unsecured Business Loans - You can get unsecured business loans.

Disadvantages

❌ Customer Service Issues - There have been reports of bad online customer service, excessive phone wait times, and uneven service quality.

❌ Competitiveness - ANZ does not always offer competitive home loan and savings account interest rates.

❌ Fees - Some accounts are fee-free under certain circumstances, whereas others may charge fees for transactions or maintenance.

❌ Past Controversies - ANZ has encountered criticism and legal difficulties, including those raised by the Banking Royal Commission.

Conclusion

If you're looking for a full-service bank, ANZ checks a lot of boxes.

It provides a wide range of services, including personal accounts, business financing, and institutional banking, all backed by decades of experience.

Advanced digital banking, solid security technologies, and flexible financing possibilities are significant advantages. However, ANZ isn't perfect.

Some clients had mixed experiences with service, and their products do not always come at the most competitive rates or fees.

So, if you run a small business or want to start a business and want something faster, more flexible, and customised to your needs, it may be worth exploring further.

Meet ANNA Money!

ANNA Money - A Viable Alternative

ANNA Money is an excellent option if you are:

- Small business owner

- Looking to start a business

- Freelancer

With ANNA Money you can easily:

💡 Register company - Start a company for only $288 with the "Easy Company" package, or completely free with the "ANNA One" package.

💡 Business documents - Keep receipts, invoices and company documents in one place and easily find what you need.

💡 Receipt matching - Get matching transactions with key details.

💡 Tax Calendar - Obtain a personalised tax calendar and don’t miss tax deadline ever again.

💡 Support from Tax Experts - Get support from expert accountants whenever you need assistance.

💡 Goods and Services Tax (GST) - Get automatic GST calculation, payroll, and direct lodging with the ATO.

💡 Bookeeping Score - Stay on top of your bookkeeping and get simple strategies to keep your books neat.

💡 Bussines Account - Get Apple Pay, Google Pay and expense cards for you and your employees.

💡 Online payment - Get a personalised webpage with a payment link to send directly to your consumers or embed it in your platforms to simply accept payments online.

Sign up today and keep track of your finances and taxes in an easy way!

FAQ

Is ANZ an Investment Bank?

ANZ Bank provides some investment banking services, but it is not a pure investment bank. Instead, it is a full-service bank with a division dedicated to personal, business and institutional banking, which includes investment banking services.

Which Bank is AZN Affiliated With?

ANZ Bank is affiliated with several banks and financial institutions through partnerships and subsidiaries. Here are some key affiliations:

▶️ Partnerships:

Security Bank (Philippines)

Sacombank (Vietnam)

Tianjin City Commercial Bank (China)

▶️ Subsidiaries:

ANZ Bank New Zealand Limited

ANZ Amerika Samoa Bank

ANZ Royal Bank (Cambodia)

ANZ Bank (Europe)