ANZ vs Westpac - Comparison & In-depth Review

Compare ANZ and Westpac to evaluate their features, fees, and services, helping you choose the best banking option for your financial goals.

The options can be overwhelming when considering a bank for your personal and/or business needs.

ANZ and Westpac, two of Australia’s Big Four banks, stand out as prominent choices.

Both institutions offer extensive banking services, but each has distinct features that meet the needs of different types of customers.

Let’s dive into a detailed comparison of ANZ and Westpac, exploring their offerings and key differences to help you make an informed decision.

ANZ: A Legacy of Innovation

ANZ traces its origins back to 1835, beginning as the Bank of Australasia in Sydney.

Over the years, it has grown into one of the world’s top 50 banks, operating in over 30 global markets and serving over 5 million customers.

Business Solutions

ANZ’s comprehensive suite of business solutions combines flexibility, innovation, and expertise, making it a reliable choice for businesses of all sizes:

Business Accounts

Transaction Accounts:

- The Business Essentials Account is ideal for sole traders and single-director companies. It offers no monthly fees, unlimited ANZ ATM and electronic transactions, and features such as real-time payment notifications and spending insights via the ANZ App.

- The Business Extra Account includes 20 free staff-assisted transactions per month, optional overdraft facilities, and a $10 monthly fee.

Savings Accounts:

- The Business Online Saver account provides flexibility with unlimited transfers to a linked account and competitive interest rates.

- The Business Notice Term Deposit offers secure, fixed returns with customisable terms.

Specialised Accounts: Tailored options such as the Statutory Trust Account for legal professionals and the Farm Management Deposit Account for primary producers.

Business Finance

ANZ offers versatile financing solutions:

- Business Loans: Flexible terms, secured or unsecured options, and online applications via GoBiz, allowing borrowing between $10,000 and $500,000.

- Business Overdrafts: Secured and unsecured options with interest charged only on the amount used.

- Asset Finance: Financing for vehicles and equipment, including discounts for energy-efficient purchases.

- Bank Guarantees and Commercial Facilities: Options such as invoice financing and tailored facilities.

Payment Solutions with ANZ Worldline

- On-the-Go Payments: Tap on Mobile app for accepting payments without additional hardware.

- In-Store Payments: EFTPOS terminals integrated with POS systems.

- Online Payments: Solutions for website or app transactions with built-in fraud protection.

Business Credit Cards

ANZ provides credit card options like:

- Rewards Cards: Business Black Card and Qantas Business Rewards Card with uncapped points and travel insurance.

- Low-Rate Cards: Business Low Rate Card and Business 55 Interest-Free Days Card for cost-conscious businesses.

Business Hub and Specialist Support

ANZ’s Business Hub offers resources like templates, checklists, and guides for business management.

Also, Industry-specific services address unique challenges in sectors such as agriculture, healthcare, and retail.

Fees

- Monthly Account Fee: AUD 0 - AUD 10

- Electronic Transactions: Free

- Assisted Transactions: AUD 2.50 (20 free per month for Business Extra)

- International Transaction Fee: 3%

ANZ Bank Pros and Cons

✔️ Competitive fees for electronic transactions and mobile payment options.

✔️ A wide range of account types catering to different business needs.

❌ Higher fees for assisted transactions compared to Westpac, which may affect businesses with frequent in-person banking needs.

Best For:

- Startups and sole traders.

- Digitally savvy businesses.

- Businesses on the move, utilising Worldline’s on-the-go payment solutions.

Westpac: Australia’s Oldest Bank

Founded in 1817, Westpac holds the title of Australia’s oldest bank. With a customer base exceeding 13 million, Westpac operates in Australia, New Zealand, and the Pacific, offering a broad range of services.

Business Solutions

Westpac is a good fit for various business needs with robust solutions:

Business Accounts

- Business One Transaction Account: Everyday account for managing income and expenses.

- Business Savings Accounts: Interest-earning accounts with easy access to surplus funds.

- Not-for-Profit Accounts: Fee-free accounts for non-profit organisations.

Loans and Financing

- Business loans, equipment financing, and trade finance solutions.

- Specialised financial advice for businesses seeking growth.

Merchant Services

Westpac’s merchant services include payment processing solutions with point-of-sale systems.

Business Credit Cards

Westpac’s credit card offerings include:

- Altitude Business Platinum Mastercard: Offers rewards points and complimentary travel insurance.

- BusinessChoice Rewards Platinum Mastercard: Rewards structure for business-related purchases.

- BusinessChoice Everyday Mastercard: Flexible payment options and no introductory fee.

Additional Features

- Expense Management: Integration with accounting software and detailed reporting.

- Dynamic Mobile Cards: Virtual cards for online and in-store transactions.

- Comprehensive Reporting: Enhanced visibility and control over expenses.

Mobile Banking App

The Westpac mobile app provides:

- Account management and payments.

- Budgeting tools and biometric security.

- Notifications for transactions and bills.

Fees

- Monthly Account Fee: AUD 0 - AUD 10

- Electronic Transactions: Free

- Assisted Transactions: AUD 3 (First 25 free for Business One Plus)

- International Transaction Fee: 2.2% - 3%

Westpac Bank Pros and Cons

✔️ More generous free transaction limits (25 free transactions per month).

✔️ Strong support for international transactions, making it suitable for businesses dealing with foreign clients or suppliers.

❌ Monthly fees can accumulate if the business requires more than the allotted free transactions.

Best For:

- Established businesses with complex financial needs.

- Businesses requiring tailored advice and solutions.

- Customers valuing extensive branch and ATM networks.

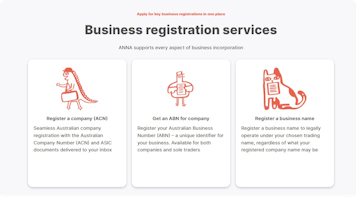

ANNA: A Modern Alternative

While ANZ and Westpac offer reliable and extensive traditional banking services, businesses looking for a modern, integrated financial solution should consider ANNA.

ANNA goes beyond conventional banking by combining financial tools and business management into a single platform, designed specifically for entrepreneurs and small business owners.

Why Choose ANNA?

- Tax and Compliance Simplified: AI-driven tools automatically calculate GST, set aside tax funds, and file BAS and company tax returns, reducing stress and ensuring compliance.

- Automated Financial Insights: Smart receipt scanning and real-time financial overviews empower data-driven decisions.

- Enhanced Payment Solutions: Virtual and physical credit cards streamline team expenses, while automated invoicing ensures prompt payments.

- Personalised Support: 24/7 customer support tailored to small business needs.

Comprehensive Features of ANNA

- All-in-One Platform: ANNA integrates bookkeeping, invoicing, and financial management into one seamless solution, saving time and reducing complexity.

- Real-Time Tracking: Business owners can monitor cash flow and track expenses on the go, with tools that categorise and analyse spending.

- Customisation for Small Businesses: ANNA’s tools are designed to grow with your business, allowing you to scale operations without changing platforms.

- Environmentally Conscious: By leveraging virtual cards and paperless invoicing, ANNA helps reduce environmental impact, aligning with sustainability goals.

ANNA’s Edge

Unlike traditional banks, ANNA eliminates the need for juggling multiple apps or services, offering a unified platform that simplifies bookkeeping, tax management, and invoicing.

For businesses seeking a streamlined, stress-free way to manage finances, ANNA presents a compelling alternative to conventional banking.

Best For:

- Startups and small businesses prioritising simplicity and efficiency.

- Entrepreneurs looking for a digital-first approach.

- Business owners seeking integrated tools for financial and operational management.

Ready to revolutionise your business finances?

Take the hassle out of financial management and empower your business to thrive.

Sign up now and join the growing community of entrepreneurs transforming their operations with ANNA.

FAQ

1. Which Bank Offers Better Online And Mobile Banking Services?

Both banks provide robust online and mobile banking platforms.

ANZ is noted for its strong mobile payment capabilities, while Westpac offers excellent digital banking features that include easy switching between personal and business accounts.

2. Which Bank Is Better For Businesses Dealing With Foreign Currencies?

Both banks offer foreign currency accounts; however, Westpac is particularly noted for its competitive interest rates on savings in foreign currencies and comprehensive international services.

3. Can I Open An Account Online With Both Banks?

Yes, both ANZ and Westpac allow businesses to open accounts online if they meet certain criteria (e.g., being a sole trader or an existing customer). For more complex entities, visiting a branch may be necessary.

4. Are There Any Additional Services Offered By ANZ Or Westpac?

- ANZ: Offers business loans, merchant services, and access to business workshops and networking events.

Westpac: Provides various services, including EFTPOS solutions, foreign currency accounts, industry-specific banking solutions, and business insurance.