Australian Bank Account Types Explained: How to Choose the Perfect One

Explore the different types of Australian bank accounts, their features, and benefits to help you choose the perfect one for your financial needs.

- In this article

- The Two Main Bank Account Types: Everyday vs. Savings Accounts

- Specialised Accounts: Tailored for Specific Needs

- Choosing the Right Bank Account Type: Tips and Tricks

- Practical Tips for Getting the Most Out of Your Bank Account Type

- The Bottom Line: Bank Accounts Made Easy

- How ANNA One Simplifies Business Setup and Banking in Australia

Are you looking to manage your everyday expenses, grow your savings, or perhaps set up something that fits your business needs?

Each bank account type in Australia has its own features, benefits, and, most importantly, fine print.

This guide will walk you through the essentials of Australian bank accounts, breaking down the different types and their perks.

From everyday accounts designed for quick transactions to savings accounts that help your money grow, we’ll help you find the account that best aligns with your financial goals.

Ready to get started on simplifying your banking choices? Let’s begin, then!

The Two Main Bank Account Types: Everyday vs. Savings Accounts

In Australia, most bank accounts fall into two broad categories: Everyday (Transaction) Accounts and Savings Accounts.

Each one has a different purpose, so understanding the differences helps you choose the right one.

Everyday Accounts: Your Go-To for Daily Expenses

Everyday accounts are your all-purpose accounts for managing day-to-day expenses, like paying bills or grabbing a coffee.

They’re designed for frequent transactions, so you can easily access your money whenever you need it. Here’s what to know:

- Accessibility: These accounts come with debit cards, access to funds via ATMs, and online banking options, making it easy to access your money on the go. You can pay for groceries, transfer money, or check your balance with a few taps on your phone.

- Interest Rates: Don’t expect much in terms of interest – these accounts aren’t meant for savings. While some might offer a small interest rate, it’s usually not enough to grow your money significantly.

- Fees: Some everyday accounts come with monthly fees, but many banks waive these fees if you meet certain requirements, like depositing a set amount each month. It’s worth checking the fine print to avoid unnecessary charges.

📌 Did you know?

According to SECNewgate research, only a small percentage of account holders know their exact interest rates for transaction (14%) and savings accounts (20%), but more are aware of term deposit rates (43%).

💡 Useful tip:

In Australia, an everyday banking account (also called a transaction account) is used to manage your daily expenses, like paying bills.

In other countries, you might hear this type of account referred to as a current account (UK) or a checking account (US), but the purpose is essentially the same: it's a flexible account for everyday use.

Understanding these different terms can help when comparing banking options internationally.

Savings Accounts: For Growing Your Money

If your goal is to build up your savings, a savings account is the better choice. These accounts are designed to help you earn interest and accumulate funds over time.

Here are the main types:

1. Standard Savings Accounts:

These are the most basic options. You earn a modest interest rate and have easy access to your money, making them simple and straightforward.

2. High-Interest Savings Accounts:

If you’re looking for better returns, these accounts offer higher interest rates. However, there’s often a catch – like restrictions on withdrawals – to maintain the higher rate. Think of it as a way to encourage you to let your money sit and grow.

3. Round-Up Savings Accounts:

Round-up savings accounts help you boost your savings while using their debit cards for everyday purchases. These accounts are linked to your transaction card and automatically round up each purchase to the next set amount you choose, such as the nearest dollar, $2, $5, or $10.

The difference between the purchase price and the rounded-up amount is then transferred directly into your linked savings account.

For example, if you make a $12.75 purchase and have chosen to round up to the nearest $5, the total amount debited would be $15. The extra $2.25 would be transferred to your savings account, while $12.75 covers the actual purchase.

4. Bonus Savings Accounts:

These accounts offer extra interest if you meet specific conditions, such as making regular deposits without taking any money out. It’s like a small reward system for good saving habits.

5. Term Deposits:

This option locks your money away for a fixed period (ranging from a few months to several years) in exchange for a higher interest rate. However, withdrawing your money early usually comes with penalties, so it’s best for those who don’t need immediate access to their funds.

📌 Did you know?

Data from the research we mentioned shows that almost all Australians hold a transaction account (95%), and savings accounts are also common (79%).

In contrast, only 19% have a term deposit, and 13% hold cash management accounts.

Also, about a third of Australians have searched for a new transaction or savings account in the last three years, mainly to find better interest rates.

Specialised Accounts: Tailored for Specific Needs

Beyond the basics, there are a few specialised accounts available that cater to specific groups or situations:

- Student Accounts: These accounts often come with perks like reduced fees and other benefits aimed at students managing a tight budget.

- Business Accounts: If you run a business, these accounts help you manage your income and expenses separately from your personal finances. They’re designed to support business transactions and keep your financial records organised.

- Offset Accounts: Linked to home loans, offset accounts can reduce the amount of interest you pay on your mortgage by offsetting the loan balance with the money you keep in the account. It’s a clever way to use your savings strategically.

Choosing the Right Bank Account Type: Tips and Tricks

Selecting a bank account isn’t exactly a one-size-fits-all situation. Here’s how you can ensure you make the right choice without feeling like you’re solving a mystery:

Tip #1: Know Your Purpose

First things first – why are you opening an account? Is it for everyday expenses, building up savings, or managing business finances? This saves you from opening three different accounts when one specialised one could do the job.

Tip #2: Watch Out for Fees

Fees are like the fine print on a contract – easy to overlook, but they can bite.

Monthly fees, ATM charges, or transaction fees can add up over time, eating into your funds. Many banks offer no-fee options if you meet certain criteria, so dig into the details.

Ask yourself: Will I be able to meet these conditions, or is the fee-free dream too good to be true?

Tip #3: Compare Interest Rates

If you’re opening a savings account, interest rates should be your main focus.

Compare different accounts and make sure you’re getting the best return for your hard-earned cash.

📍 Pro tip:

Pay attention to the conditions attached. Sometimes, a ‘high interest’ account only gives you the best rate if you jump through hoops like depositing a specific amount each month or avoiding withdrawals.

Tip #4: Check Accessibility

How easily can you access your funds? Some accounts offer fantastic online banking features, while others might charge you for ATM withdrawals.

If you’re the type who likes to check their balance on the go or make spontaneous purchases, prioritise accounts that offer excellent mobile banking and low ATM fees.

⚡Don’t miss out on our guide on How to open a business bank account in Australia!

Practical Tips for Getting the Most Out of Your Bank Account Type

Once you’ve chosen your ideal account, it’s time to optimise it. Here are some pro tips:

- Automate Savings: If you have or need both accounts, set up automatic transfers from your everyday account to your savings account. This ‘out of sight, out of mind’ approach helps you save without thinking about it – perfect for anyone who might otherwise spend their savings on the latest gadget.

- Keep an Eye on Fees: Even if you’ve selected a no-fee account, review your statements regularly. Sometimes, surprise fees pop up if you’ve used an out-of-network ATM or dipped below a required balance. Staying vigilant ensures you keep the extra charges at bay.

- Maximise Your Interest: If you have a bonus or high-interest savings account, follow the rules religiously to earn the maximum rate. Think of it as a game where you’re playing to win – deposit regularly, avoid withdrawals, and watch your balance grow.

The Bottom Line: Bank Accounts Made Easy

Choosing a bank account doesn’t have to be overly complex. The key is understanding what each type offers and aligning it with your financial goals.

In case you’re after an account that’s easy to access for everyday use or one that’ll grow your savings over time, there’s something out there for everyone.

Remember, bank accounts are tools to help manage your money, not mysterious entities. Approach them with a clear understanding of your needs, and you’ll avoid common pitfalls.

But what if you’re looking to take things a step further, like setting up a business account and managing a business seamlessly?

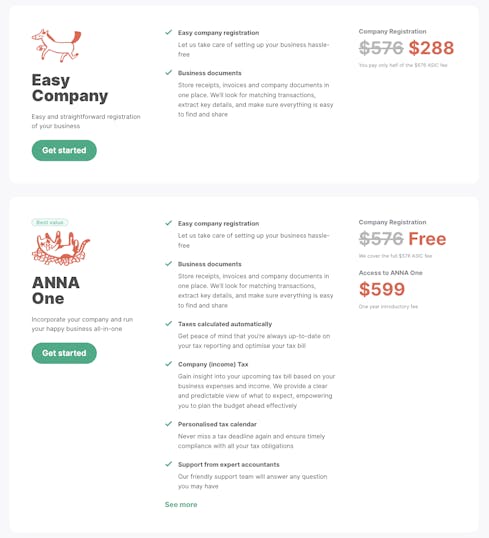

How ANNA One Simplifies Business Setup and Banking in Australia

Imagine getting your company registered and setting up a business bank account, all in a few easy steps – no more jumping through hoops or dealing with complicated paperwork.

With ANNA, you can handle everything from securing your Australian Company Number (ACN) and registering your business name, to sorting out your ABN and GST, all in one place.

But it doesn’t stop there. The real game-changer is ANNA’s business bank account feature, which goes beyond basic banking.

Plus, ANNA’s virtual and credit cards mean you’ve got everything you need to keep your business running smoothly, while automatic tax reminders ensure you never miss a deadline again.

It’s like having a personal assistant for your finances – you can also automate your bookkeeping, send out invoices (and even chasing payments), and keep track of your expenses effortlessly.

With ANNA One, you don’t just have a bank account; you also have a complete financial toolkit that helps you manage your business with ease and confidence.

Say goodbye to paperwork and hello to running your business hassle-free!

Sign up now and set your business up for success!