Discover tips to prepare your BAS with this guide, covering key steps, compliance requirements, and strategies for accurate financial reporting.

- In this article

- 14 Tips For Easy BAS Preparation

- Wrapping Up

For many business owners, the end of the quarter comes with a mix of relief and apprehension. Relief that another period is behind you and apprehension because it’s time to tackle your Business Activity Statement (BAS).

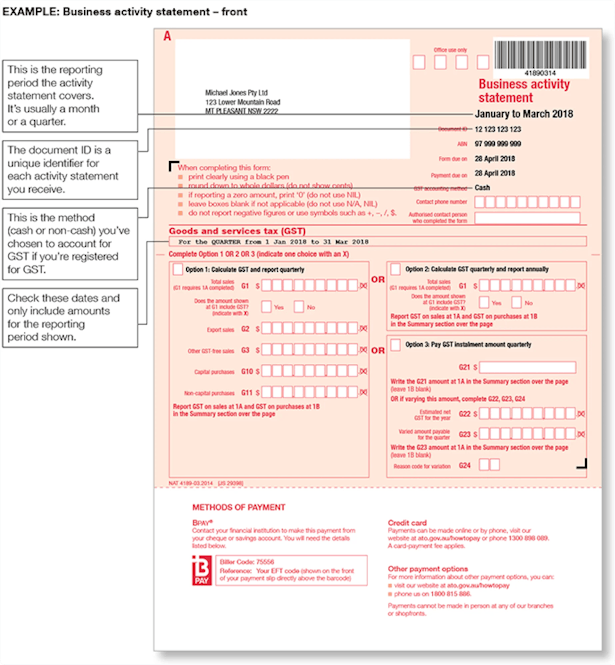

The Australian Tax Office (ATO) requires your BAS to detail your business's financial activity, including GST, PAYG withholding, and other tax-related responsibilities.

Whether you’re dreading the paperwork or just need a streamlined approach, this guide will help you prepare your BAS efficiently.

So, let’s dive into 14 simple steps for BAS preparation that will save you time, reduce stress, and ensure your BAS lodgement goes off without a hitch.

14 Tips For Easy BAS Preparation

While it might seem daunting at first, breaking the process into manageable steps can simplify things and help you approach BAS preparation with confidence.

1. Understand What Your BAS Covers

The first step in preparing your BAS is knowing what you need to report.

Your BAS is a snapshot of your tax obligations, and depending on your business activities, it might include:

- GST collected from customers and paid to suppliers.

- PAYG withholding tax if you have employees.

- PAYG instalments, which are prepayments towards your income tax.

- Other liabilities like fringe benefits tax (FBT) or luxury car tax.

For a small business selling handmade candles, BAS preparation might simply mean reporting GST on sales and expenses.

For a larger company, it could also include payroll taxes and fuel tax credits.

The scope of your BAS depends entirely on how your business operates, so take time to identify all the components relevant to you.

Pro Tip from ANNA

With ANNA One, your BAS obligations like GST and tax invoices are automatically tracked and categorised.

You’ll always know what needs to be reported and when it’s due, saving you time and reducing errors.

2. Know Your BAS Reporting Frequency

Your BAS lodgement frequency is determined by your GST turnover, and the ATO assigns it when you register for GST:

- Businesses with turnover over $20 million report monthly.

- Most small-to-medium enterprises lodge quarterly.

- If your turnover is below $75,000 (or $150,000 for not-for-profits), you might qualify for annual reporting.

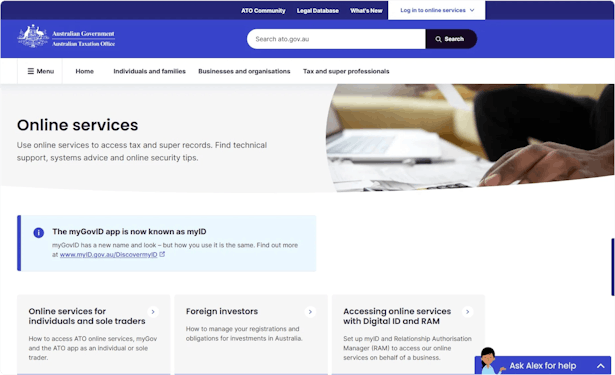

To check your frequency, log in to the ATO’s online services. Knowing your deadlines ensures you can plan ahead and avoid penalties.

For example, if your quarterly BAS is due on April 28, it’s best to start gathering records by early April to avoid last-minute stress.

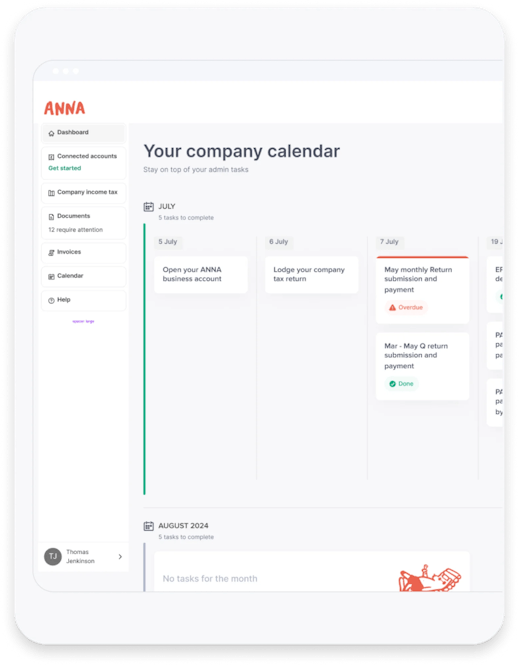

Pro Tip from ANNA

ANNA’s personalised tax calendar ensures you never miss a BAS lodgement deadline.

We send you timely reminders specific to your reporting frequency, whether monthly or quarterly.

3. Keep Your Financial Records in Order

No matter how small or large your business is, accurate record-keeping is the foundation of BAS preparation.

Collect and organise all relevant documents, including:

- Sales invoices and purchase receipts.

- Bank statements.

- Expense records, especially those with GST implications.

Using accounting software like ANNA, Xero or QuickBooks can make this process a breeze by automatically categorising transactions and generating BAS reports.

If you are a hairdresser, for example, you could log supplier invoices for shampoo stock and automatically allocate GST, ensuring nothing is missed.

Also, don’t forget to reconcile your bank accounts weekly to catch errors early. This habit will save you hours of frustration when BAS lodgement rolls around.

Pro Tip from ANNA

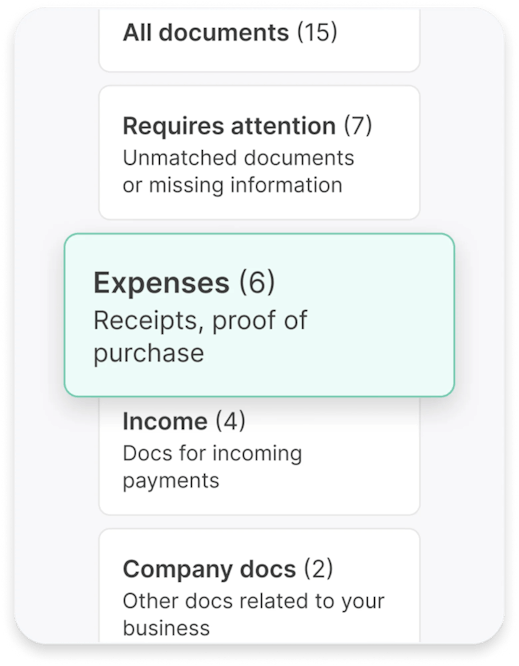

ANNA automatically matches your receipts to transactions and categorises them by type, ensuring you’re always BAS-ready.

You can also snap a photo of your receipts, and ANNA will store and sort them for easy access during tax time.

4. Get The Dates Right

Your BAS is only as accurate as the data you include. One common mistake is using transactions outside the reporting period.

Let’s say your reporting period is July to September. If you receive a supplier invoice in October for services rendered in September, double-check whether it belongs in the current BAS or the next one.

Most accounting software lets you filter transactions by date to ensure everything lines up correctly.

📌 To learn more about the Australian financial year, key dates and compliance requirements for your business, don’t skip on our The Australian Financial Year - Beginner's Guide!

5. Categorise GST And GST-Free Items Properly

Not every transaction involves GST, so it’s important to know the difference:

- GST-Free: Basic food, medical services, and exports.

- Taxable Items: Most goods and services sold in Australia.

- Input-Taxed Supplies: Residential rent and financial supplies like interest.

For instance, a café should not include GST on fresh produce like lettuce (GST-free) but must account for GST on prepared meals. Misclassifying these transactions can lead to errors and penalties.

6. Don’t Overlook Cash Transactions

If your business accepts cash payments or makes cash purchases, don’t forget to include them in your BAS.

It’s easy for cash transactions to slip through the cracks, but the ATO requires them to be reported just like electronic payments.

For example, if you’re a market stall vendor, you should record every cash sale made during the weekend and ensure those amounts are included in your BAS.

Pro Tip from ANNA

ANNA tracks all cash and electronic transactions seamlessly. By linking your bank accounts to ANNA, you get a complete view of your finances in one place.

7. Verify GST on Purchases

Claiming GST credits requires valid tax invoices, but not every expense qualifies. Make sure you’re only claiming GST where it’s due:

- Purchases under $82.50 (including GST) don’t require a full tax invoice, but you still need a receipt.

- For larger expenses, ensure the supplier’s ABN, GST breakdown, and description of goods are included.

For instance, if you buy office supplies worth $500, the invoice must clearly state the GST amount and the supplier’s ABN.

Without these details, your GST claim might be denied during an audit.

8. Reconcile Your Bank Account Regularly

Reconciling your bank accounts ensures your BAS figures match your financial activity. This step helps you spot duplicate entries, missed transactions, or incorrect amounts.

Take, for example, a cleaning service business that notices a $1,000 client payment missing from their accounting software due to a bank error.

Reconciling accounts promptly can prevent such discrepancies from affecting your BAS.

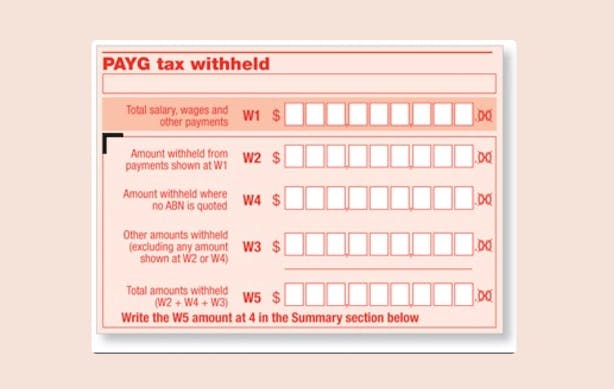

9. Report PAYG Withholding Properly

If you have employees, PAYG withholding is an essential part of your BAS. This is the tax you withhold from employee wages and pay to the ATO.

For example, a retail store paying $50,000 in wages for the quarter might withhold $8,000 in PAYG tax.

These figures need to be reported under the W2 label on your BAS form.

The ATO’s Tax Withheld Calculator can help you get these numbers right.

To use this calculator, you’ll need the details provided by your employees or workers in their:

- Tax File Number (TFN) Declaration

- Withholding Declaration

- Medicare Levy Variation Declaration.

10. Avoid Double-Claiming GST

One of the most common errors in BAS preparation is accidentally claiming GST twice – once on the purchase price and again on repayments for financed assets.

For example, let’s say a courier business buys a delivery van for $50,000 using a loan.

GST is claimed on the purchase price at the time of purchase but should not be included on monthly loan repayments.

So, double-check your GST claims to avoid costly mistakes.

11. Include Overseas Transactions Carefully

Overseas purchases and imports can be tricky. While many overseas suppliers are now registered for GST in Australia, others are not.

Always confirm the GST status of your supplier before claiming GST credits.

For example, an e-commerce business importing products from the US cannot claim GST unless the supplier is registered in Australia and charges GST on the invoice.

12. Carefully Review Your BAS Before Lodging

Before you hit “submit,” review your BAS thoroughly. Errors can lead to costly penalties or additional work to correct the lodgement.

This step ensures that your GST figures, PAYG withholding, and other reported amounts align with your financial records.

How to review effectively:

- Check all labels (e.g., G1 for total sales, G10 for capital purchases) and confirm that the figures match your accounting software reports.

- Pay extra attention to GST claims, ensuring you have valid tax invoices for every expense.

- Confirm that transactions outside the reporting period are excluded.

- Review PAYG amounts to ensure employee withholding figures are consistent with payroll reports.

For instance, you’ve noticed during the review that GST was claimed on employee wages, which is incorrect.

Catching this mistake before lodging prevents the ATO from flagging the BAS for audit.

Taking this final step may feel tedious, but it’s worth the effort to avoid penalties, audits, or additional administrative work down the line.

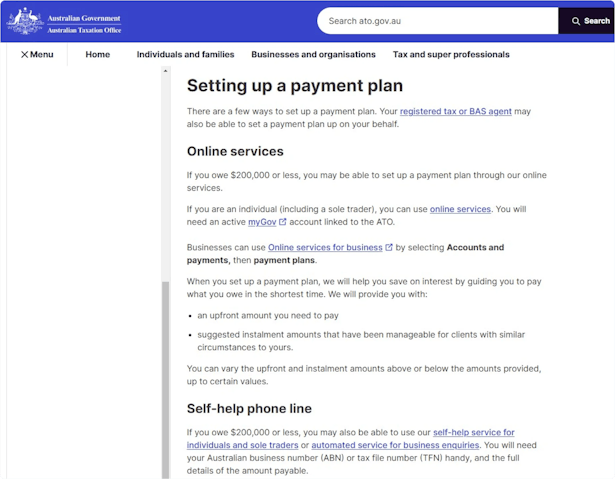

13. Lodge and Pay Your BAS on Time

BAS deadlines are strict, and missing them can lead to penalties and interest charges.

For most small businesses, BAS lodgement is due quarterly on the 28th of the month following the end of the quarter (e.g., April to June BAS is due July 28).

Monthly lodgements are due on the 21st of the following month.

Tips to stay on schedule:

- Mark your BAS due dates on a calendar or set reminders in your accounting software.

- Start preparing your BAS early to leave time for reviews and corrections.

- Use the ATO Business Portal or your accounting software (like ANNA) for quicker online submissions.

If you’re struggling to pay on time due to cash flow issues, the ATO offers payment plans.

Apply via the ATO Business Portal or consult a BAS agent for guidance.

Submitting your BAS on time, even if you can’t pay immediately, can help you avoid late lodgement penalties.

14. Retain BAS Records For Five Years

Your BAS responsibilities don’t end once you’ve lodged and paid. The ATO requires you to keep all BAS-related records for at least five years.

This includes:

- Copies of lodged BAS forms.

- Tax invoices and receipts for all purchases.

- Workpapers or spreadsheets showing GST calculations.

These records are vital for compliance and can protect you in the event of an ATO audit.

To be able to always have your records on hand, consider the following:

- Use cloud storage platforms like Google Drive or Dropbox to store digital copies.

- Label files clearly with the reporting period for easy retrieval.

- Back up digital records regularly to avoid data loss.

Pro Tip from ANNA

ANNA securely stores all your financial records digitally. From receipts to lodged BAS forms, everything is easily accessible and backed up for compliance and audits.

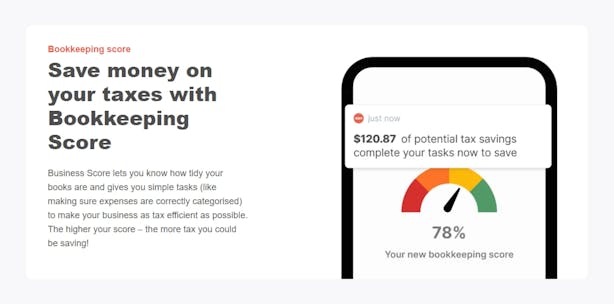

Also, you can save money on your taxes while being compliant!

Wrapping Up

Preparing your Business Activity Statement (BAS) doesn’t have to be stressful.

With clear organisation, an understanding of your obligations, and careful attention to detail, you can simplify the process and lodge your BAS with ease.

Following these BAS preparation tips will not only keep you compliant with the ATO but also give you better control over your business finances.

If BAS still feels overwhelming, there’s an easier solution – ANNA, your all-in-one business assistant.

Why ANNA is Perfect for BAS

With ANNA, you get automation, accuracy, and peace of mind – all while saving time. ANNA’s tools for bookkeeping, tax calculation, and deadline management are designed to make your BAS process smooth and efficient.

Sign up with ANNA One today and see how it transforms your business admin!