Discover the benefits of working under an ABN, including tax advantages, business flexibility, and access to various government opportunities.

If you’re starting a business in Australia, one of the first things you’ll need is an Australian Business Number or ABN. It’s not just a box to tick off your to-do list – it’s your business’s ticket to a range of perks and protections.

Wondering what makes an ABN so crucial? In this guide, we’ll break down 6 clear benefits of working under an ABN to show why it’s a must-have for any entrepreneur or freelancer in Australia.

Let’s start!

What is an ABN?

Before diving into the benefits, let’s clarify what an ABN actually is.

An ABN is a unique 11-digit number assigned to your business by the Australian Business Register (ABR).

Think of it as your business’s unique identity number, similar to a driver’s licence, but for business operations.

It helps you interact with other businesses, government bodies, and even clients on a professional level.

💡 If you want to learn about ABN eligibility and other important info, don’t miss our blog – What is ABN Number? Everything You Need to Know.

With that sorted, let’s explore why working under an ABN can give your business a leg up!

1. Avoid the “No ABN Withholding Tax” (47% Payment Holdback)

Imagine this: you complete a big job for a client, send them your invoice, and then find out they will only pay you 53% of what you’re owed.

The other 47%? That’s going straight to the Australian Tax Office.

Why? Because without an ABN, businesses are legally required to withhold 47% of your payment.

This isn’t something you want to deal with – especially when cash flow is crucial for business growth.

With an ABN, you get paid in full upfront, without any delays or complicated tax refund processes. This potential situation alone makes an ABN essential if you want to keep your finances in order.

💡 Pro tip

With ANNA, registering your ABN is fast and hassle-free. Simply verify your details, hit submit, and receive your ABN instantly – making it easy to separate your business transactions and get paid in full from day one.

2. Access to GST Credits and Tax Deductions

Running a business means keeping a close eye on expenses. If you have an ABN and are registered for GST (Goods and Services Tax), you can claim GST credits (aka input tax credits) on any purchases made for your business.

This means you can recover the GST you’ve paid on items like office supplies, software, and equipment.

Moreover, having an ABN allows you to:

- Claim business expenses like travel, marketing, and even part of your home office if you’re a freelancer or sole trader.

- Deduct business-related purchases to lower your taxable income.

Essentially, these tax benefits put more money back into your business, allowing you to reinvest and grow.

💡 Pro tip

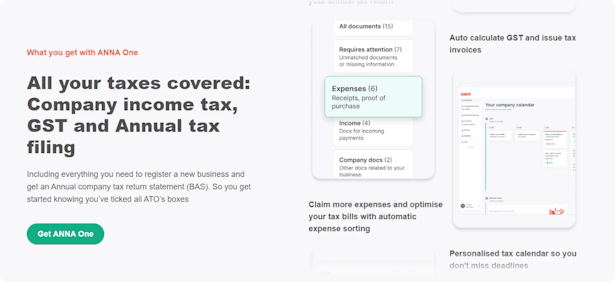

Maintaining accurate records is crucial for taking full advantage of the GST credits and tax deductions available to your business.

However, the Australian Tax Office (ATO) requires you to provide detailed evidence for all claims, which can become overwhelming if you rely on manual methods.

With a tool like ANNA One, you can capture every receipt, invoice, or business-related expense on the go using your phone’s camera.

The software automatically sorts and categorises expenses, matches them with your transactions, and even flags items eligible for GST credits.

Not only does this make tax time stress-free, but it also helps you avoid common errors like:

- Misplacing Receipts: Physical receipts can easily get lost or damaged, making it hard to claim your full entitlements. Digital records, however, are securely stored and searchable.

- Incorrect Categorization: Some expenses, such as home office costs or vehicle expenses, might be partially deductible. Automated categorization ensures you capture these correctly.

- Overlooked Expenses: Subscriptions, software licences, and even small office supplies often slip through the cracks when managed manually. With automated expense tracking, nothing is missed.

Bonus Tip: Stay audit-ready by using ANNA One’s integrated tax compliance features.

All your financial data is stored securely, organised systematically, and readily accessible, helping you respond quickly if the ATO ever asks for supporting documents.

3. Show Professionalism and Build Trust

First impressions matter. Operating under an ABN makes your business look legitimate and professional to potential clients and suppliers.

You can use your ABN on business cards, websites, and invoices, showing that you’re a registered business.

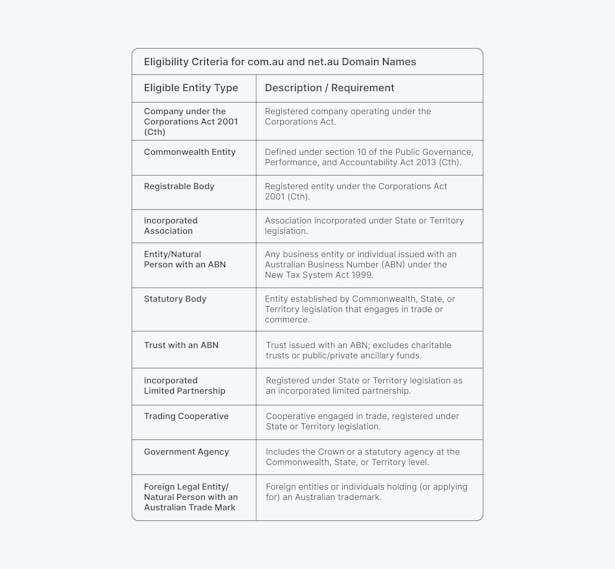

Having an ABN also means you can register a domain like yourbusiness.com.au or yourbusiness.net.au, which further solidifies your brand and boosts your credibility.

Customers are also more likely to trust a business that has taken the steps to establish a professional identity.

Plus, it sends a strong message that you’re committed to serving Australian customers.

⚡ Fun Fact

Did you know that 70% of Australians now prefer to support local retailers when shopping online – up from just 52% before the pandemic?

A recent report by auDA reveals that the easiest way to spot an Aussie business is through a .com.au domain!

It’s a quick signal that a business is local, trustworthy, and secure, making it almost twice as likely to be chosen over other domain names.

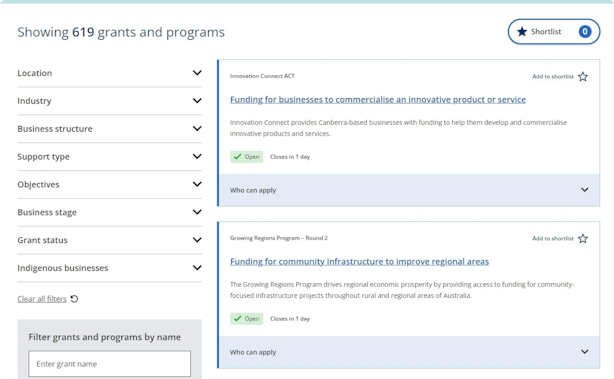

4. Easier Access to Government Grants and Support

The Australian government offers a range of grants, loans, and other support programs for small businesses, but most of them require you to have an ABN.

For example, having an ABN is a prerequisite for applying for the Entrepreneur’s Program or any local business grant.

Grants can be a game-changer when starting or expanding a business.

They provide extra funds without adding to your debt, making investing in new products, marketing, or even hiring staff easier.

An ABN opens up these opportunities and ensures you’re eligible to apply.

5. Protect Your Business Identity

ABN also helps protect your business from mistaken identity, which can be a real issue if there are other businesses out there with similar names.

With an ABN, your business is listed on the ABN Lookup tool, making it easier for others to verify that they’re dealing with the right entity.

Customers, suppliers, and even government agencies can find your business information quickly and accurately. It also helps you avoid the hassle of sorting out mistaken identities that could lead to lost clients or payment delays.

6. Simplified Invoicing and Record-Keeping

Regarding invoicing, things get a lot smoother with an ABN. You’re legally required to include your ABN on all invoices, which gives your clients the green light to pay you in full without any withholding tax.

Additionally, an ABN makes it easier to keep track of your business activities.

With an ABN, you can register for a Business Activity Statement (BAS), which streamlines your record-keeping and tax reporting. This means less time doing paperwork and more time focusing on growing your business.

Pro tip

Just started your business? Save time and avoid tax headaches by letting ANNA handle your Business Activity Statement (BAS) from day one.

We’ll lodge your first-year BAS accurately so you can focus on growing your business instead of worrying about tax paperwork!

What Are My Responsibilities Once I Have an ABN?

It’s not just about getting an ABN and forgetting it. There are a few obligations you’ll need to keep in mind:

- Annual Tax Return: You must lodge a tax return every year, regardless of your income.

- Keep Your Details Updated: Make sure to update your ABN within 28 days if your business details change.

- Cancel Your ABN if You Close: If you decide to stop operating, you need to cancel your ABN and ensure all your tax returns are up to date.

Conclusion: Is an ABN Worth It?

Absolutely! Whether you’re freelancing, running a small business, or starting a partnership, an ABN is a valuable tool that offers numerous benefits.

It helps you get paid in full, access tax perks, look professional, and protect your business identity.

So, if you’re serious about starting or growing your business in Australia, getting an ABN should be at the top of your list.

It’s a small step that unlocks big opportunities and helps set your business up for success from day one.

How Can ANNA Help Your Business Grow?

ANNA takes things even further. As we said, it’s not just about ticking off a box – it’s about setting your business up for long-term success.

With ANNA, you can register your business, manage taxes, and handle day-to-day finances – all in one place. Here’s how:

- Quick Business Registration: Get your ABN, ACN, and even a business name in one streamlined process. There is no confusing paperwork or delays.

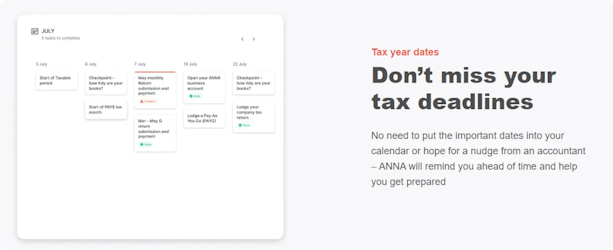

- Stress-Free Tax Management: ANNA automates GST calculations, organises expenses, and keeps you compliant with personalised reminders—so you stay on top of your obligations.

- Fast & Professional Invoicing: Create beautiful invoices in seconds, track payments, and let ANNA chase overdue invoices so you get paid faster.

- Total Compliance Support: Easily stay up-to-date with ASIC and ATO regulations, with access to expert help whenever you need it.

Why ANNA? It’s simple – ANNA handles the tedious administration, freeing you up to focus on what you love: building and growing your business.

With a suite of powerful tools and personalised support, ANNA is the partner that makes business easier every step of the way.

From registration to taxes, we’ve got you covered – sign up now and let ANNA handle the details!