5 Best Accounting Software for a Sole Trader in 2025

Discover the best accounting software options for sole traders to simplify your finances and find the perfect tool for managing your business accounts.

Managing regulations, taxes, income, and business insights can be challenging for any company, especially for sole traders.

Then, what is the solution?

Accounting software!

But what exactly is accounting software, how is it used, and which options are available?

In this article, we’ll answer these questions and introduce you to the 7 best accounting software for a sole trader on the market.

Read on to discover how these tools can help with your financial management and help you stay on top of your business finances.

Let’s get started!

What is Accounting Software?

Accounting software is a type of computer program that automates and simplifies accounting and financial processes such as:

✔️ Bookkeeping

✔️ Invoicing

✔️ Payroll processing

✔️ Budgeting

✔️ Financial reporting.

These tools let you handle:

✔️ Financial data

✔️ Track transactions

✔️ Adjust accounts

✔️ Generate reports

✔️ and much more, depending on the tool.

Why Should You Use Accounting Software as a Sole Trader?

As a sole trader, you probably spend most of your time and resources on developing your business, coming up with ideas, hiring people, and looking for clients.

It would be nice if you had a little more time and money, wouldn't it?

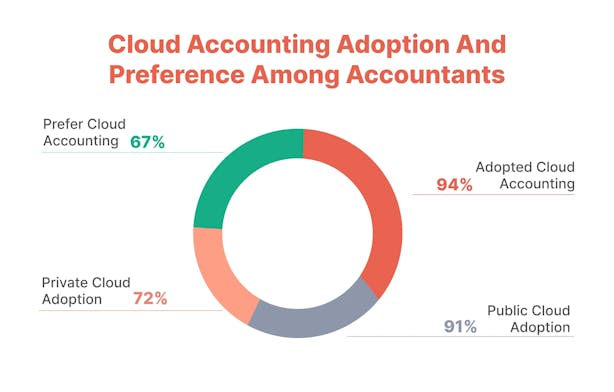

Even accountants are adopting cloud accounting, with 94% making the switch.

The public cloud adoption rate stands at 91%, while the private cloud adoption rate is 72%. Furthermore, 67% of accountants prefer cloud accounting to traditional solutions.

And what do you think is the reason for such large percentage numbers?

The time and money you save when you adopt these tools!

Other reasons why you should use accounting software as a sole trader are:

⭐ Accuracy and reduced errors - Manual bookkeeping can result in errors that are costly and time-consuming to correct. Accounting software reduces the risk of errors by automating calculations and ensuring accurate financial records.

⭐ Financial Insights - These tools generate extensive financial reports and dashboards that provide insight into the company's financial health. This enables you, as a sole trader, to make informed decisions and prepare for future growth.

⭐ Compliance and tax preparation - Accounting software helps you manage GST, prepare BAS, and ensure all tax requirements are completed on time, simplifying the end-of-year tax preparation process.

7 Best Accounting Software for a Sole Trader

1. ANNA

ANNA is a business solution designed to simplify the process of starting, managing, and growing a business in Australia.

Made specifically for business owners and sole traders, ANNA Money offers streamlined solutions for:

- Company registration

- Bookkeeping

- Invoicing and

- Tax management

It addresses all your financial needs in one place!

What benefits do you get from this software as a sole trader?

✔️ Saving on company registration fees if you decide to expand your business

✔️ Automated bookkeeping, invoicing, and tax calculations to save time and ensure accuracy

✔️ Access to professional advice from accountants to navigate complex financial and tax-related issues

✔️ Detailed insights into your financial status and upcoming tax obligations, helping in better financial planning

ANNA: Key Features

📍 Free company registration - ANNA Money takes care of the ASIC registration fee, allowing you to register your company without any cost.

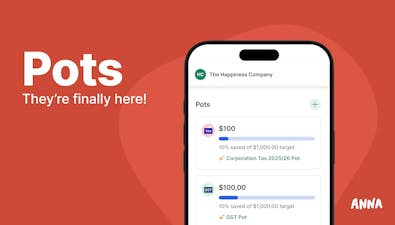

📍 Business account - Easily open a business bank account that integrates directly with your company registration.

📍 Tax management - Automatic tax calculations give you a clear picture of your tax obligations and ensure compliance.

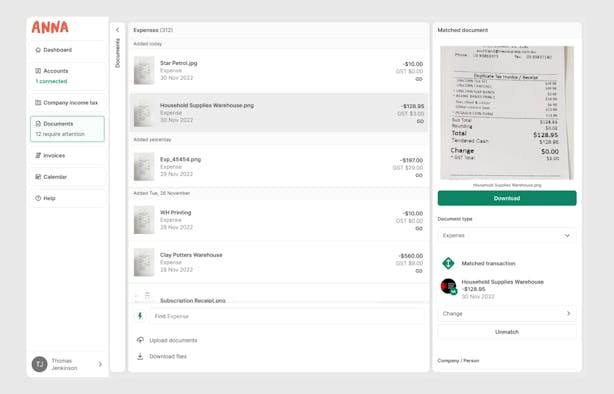

📍 Document storage - Keep all receipts, invoices, and company documents in one place, with key details extracted for easy access and sharing.

📍 Expert support - Get answers to your queries from professional accountants.

📍 Automated bookkeeping - Enjoy automated receipt matching and categorization to optimize the tax process.

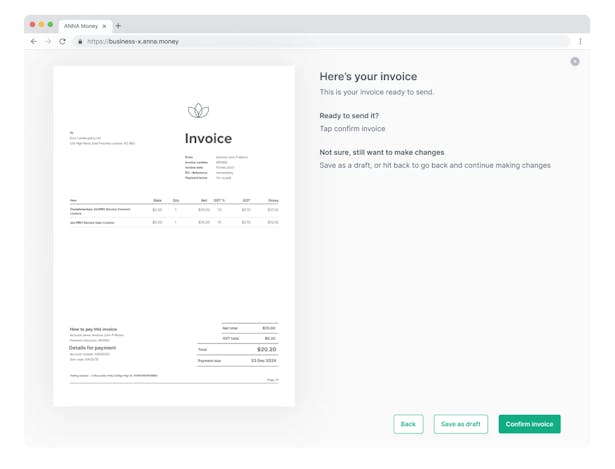

📍 Invoicing - Quickly create professional invoices with reminders for unpaid invoices.

📍 GST management - Automatically calculate GST and log it directly with the ATO.

📍 Tax Insights: Obtain clear insights into upcoming tax bills based on your business expenses and income.

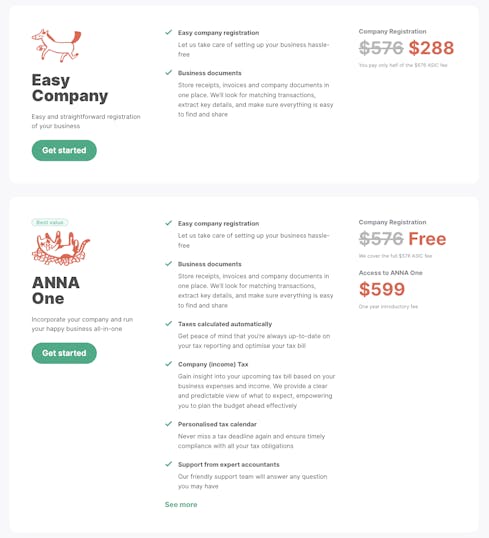

ANNA: Pricing

ANNA offers you 2 packages to choose from:

- Easy company

- ANNA One

2. MYOB

MYOB is an accounting software that can help you manage your finances, including:

- Invoicing

- Payroll

- Inventory management and

- Tax management.

What benefits do you get from this software as a sole trader?

✔️ Insights into your business success

✔️ Automated payment reminders

✔️ Connected bank accounts

✔️ Insights into the progress of each project

MYOB: Key Features

📍 Invoicing - Generate and send invoices from any device.

📍 Tax and GST - Get pre-filled BAS reports sent directly from your software to the ATO.

📍 Inventory management - Keep track of what's in stock, view your top sellers, and re-order things before they sell out.

📍 Payroll - Calculate payroll elements such as superannuation, tax, and annual leave.

📍 Expenses - Take pictures of your receipts and forward your bills directly from your inbox.

📍 Timesheets and rosters - Manage staff timesheets, rosters, and approve employee hours.

MYOB: Pricing

MYOB offers you 4 paid plans:

- Lite

- Pro

- AccountRight Plus

- AccountRight Premier

and a free trial for each of them 👇

3. FreshBooks

FreshBooks is an accounting software that allows you to:

- Track billable hours

- Manage interactions with the ATO

- Create invoices

- Streamline cost management

- Handle online payments

What benefits do you get from this software as a sole trader?

✔️ Efficient invoicing

✔️ Fast payment processing

✔️ Comprehensive time tracking

✔️ Improved financial insights

FreshBooks: Key Features

📍 Invoicing - Create and customize your invoice, include your logo, and tailor your thank you email.

📍 Payments - Receive payments through invoices and get them automatically recorded in your account.

📍 Time tracking - Monitor how much time you spend on clients and projects.

📍 Accounting - Stay organized for tax season and keep compliant with rules with a customizable chart of accounts.

📍 Expenses and receipts - Connect your bank account or credit card and get insights on how profitable you are.

📍 Reports - Get insightful dashboards and reports and see exactly where your business stands.

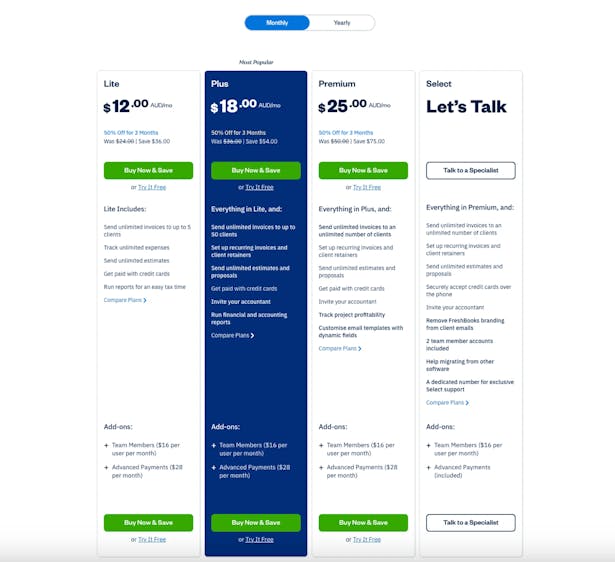

FreshBooks: Pricing

FreshBooks offers you 4 plans:

- Lite

- Plus

- Premium

- Select

You can get a free trial for three of them 👇

4. ReckonOne

Reckon One is a simple and cost-effective Australian accounting software.

It enables you to:

- Manage your income

- Plan budgets

- and track expenses efficiently

What benefits do you get from this software as a sole trader?

✔️ Optimized financial management

✔️ Streamlined payroll processing

✔️ Improved cash flow

✔️ Simpler expense tracking

Reckon One: Key Features

📍 Monitor your accounting and cash flow - Keep track of your daily income, expenses, and cash flow with real-time reports and a customizable dashboard.

📍 Manage payroll and employees - Manage pay runs, leave, super, and Single Touch Payroll.

📍 Create and send online invoices - Increase cash flow with professional invoices that feature a 'Pay Now' button for clients who pay with a credit card.

📍 Track and store employee expenses - Monitor, manage, and store business expenses by attaching receipts to claims for easy approval or safekeeping during tax season.

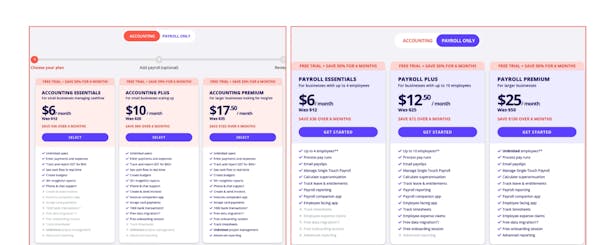

Reckon One: Pricing

Pricing for the Reckon One depends on the plan you choose 👇

For “Accounting” plan, you can choose between:

- Accounting essentials

- Accounting plus

- Accounting premium

For “Payroll Only” plan, you can select from:

- Payroll essentials

- Payroll plus

- Payroll premium

5. Zoho Books

Zoho Books is an accounting software that stands out because it seamlessly integrates with the full Zoho system.

This feature makes the software very scalable, allowing it to expand to meet your company's needs.

What benefits do you get from this software as a sole trader?

✔️ Efficient invoice management

✔️ Reconciled bank accounts with connected feeds

✔️ Reporting features and precise insights into your company's financial condition

Zoho Books: Key Features

📍 Quotes - Create quotes and include contact information, item details, and prices recorded in Zoho Books.

📍 Customer portal - Share recent transactions, speed up the quotation approval process, collect comments, and allow your clients to make bulk payments through the customer portal.

📍 Expenses - Upload receipts to remain organized and track your spending.

📍 Bills - Create bills to monitor the amounts you owe your vendors, or Create recurring invoices for purchases that occur at regular periods and have Zoho Books deliver them instead of you.

📍 Banking - Securely retrieve transactions from both your PayPal and bank accounts and quickly reconcile your balances.

📍 Projects - You can log the amount of time you spend on a project on a daily or weekly basis, or you can use the timer widget to track your time.

📍 Inventory - Keep an eye on high-demand items and maintain them well-stocked.

📍 Documents - Simplify and save all of your documentation in one location and attach them to transactions.

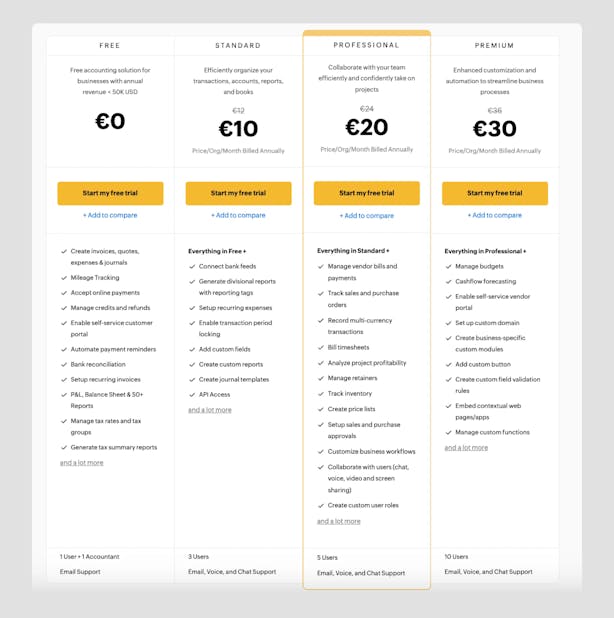

Zoho Books: Pricing

In addition to the free account, you can choose from 3 paid plans as well:

- Standard

- Professional

- Premium

Who Is the Winner?

Well, it depends on your needs and your budget.

For example:

- Besides bookkeeping assistance, ANNA offers you great help with the registration process and fees

- MYOB helps you with your stock numbers as well

- Freshbooks offers extensive time-tracking features

- Reckon One offers you separate plan for accounting and payroll both with extensive features

- Zoho Books lets you integrate with the whole Zoho system

- Hnry doesn't charge you until you earn

- Thriday lets you create multiple bank accounts and multiple payment methods

See?

The choice is wide and your only and it depends on what you need assistance with.

But let’s see why ANNA should be your top choice!

Because:

✔️ ANNA takes care of the registration and setup process, letting you concentrate on your business

✔️ It lets you craft and send invoices with automated follow-ups to ensure timely payment

✔️ With ANNA, you can easily manage your expenses and get automated receipt matching and categorization

✔️ It enables you to stay compliant with GST calculations and direct logging with the ATO

✔️ Plus, it offers qualified accountants for assistance with any questions

Are you ready to make your accounting simple?

Create an account today and experience all the benefits!