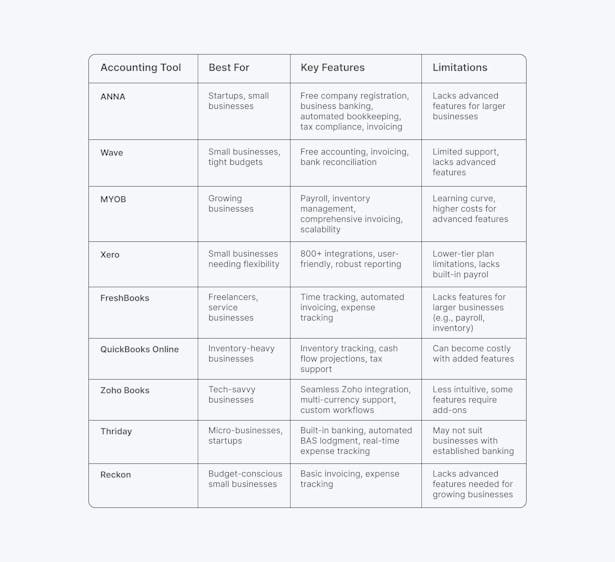

8 Best Accounting Tools for Small Businesses

Explore the best accounting tools for small businesses designed to simplify financial management, streamline bookkeeping, and support business growth.

- In this article

- How to Choose the Right Accounting Software: A Quick Checklist

- 1. ANNA – Your Complete Business Registration and Accounting Tool

- 2. Wave – Best budget-friendly solution

- 3. MYOB: Best for Growing Businesses

- 4. Xero: Ideal for Small Businesses Seeking Flexibility

- 5. FreshBooks: Best for Freelancers and Micro-Businesses

- 6. QuickBooks: Best for Inventory-Heavy Businesses

- 7. Zoho Books: Best for Tech-Savvy Businesses

- 8. Reckon: Best for Small Budgets

- Conclusion

Choosing an accounting tool can feel like a big decision. You want something that won’t just work for you today but will also grow with your business, save you time, and maybe even make managing money a little easier.

With so many options, how do you pick the right one? Don’t worry – we’re here to help.

Let’s break down 8 of the best accounting tools for small businesses in 2024, making it easier to find what’s best for your needs.

How to Choose the Right Accounting Software: A Quick Checklist

When selecting accounting software for your small business, consider the following:

⚡ Ensure the software can scale with your business.

⚡ Look for tools that track income/expenses, manage projects/inventory, offer bookkeeping and invoicing, provide robust reporting, and include bank reconciliation features to keep your finances accurate.

⚡ Ensure it includes tax tools to help you stay compliant.

⚡ Prioritize security, ease of use, and integration with other software.

⚡ Reliable support is key – look for 24/7 support.

⚡ Choose software that allows you to activate or deactivate features for a streamlined experience.

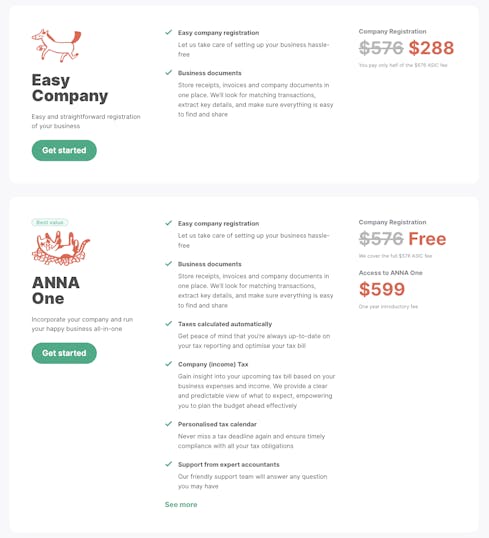

1. ANNA – Your Complete Business Registration and Accounting Tool

Starting a business can feel like a mountain of paperwork, but ANNA makes it easy.

With ANNA One, you’re not just getting an accounting tool – you’re getting a business partner that simplifies everything from day one.

Whether you’re registering your company or managing your finances, ANNA has you covered with seamless company registration, bookkeeping, invoicing, and tax management all in one place. Think of it as your business’s financial co-pilot.

Key Features:

- Free Company Registration: ANNA covers the ASIC fee, so registering your business costs you nothing when you subscribe to ANNA One. You can also apply for key business registrations, like an ACN or ABN, all in one place. It’s not just easy – it’s free.

- Business Bank Account: You don’t have to go searching for a separate business account. With ANNA, you can open a business bank account at the same time as your company registration. No more jumping between different platforms.

- Automatic Bookkeeping: Ever dread receipt tracking? ANNA automates this, matching and categorizing your receipts to make sure you get the maximum tax relief. It’s like having a personal bookkeeper that works 24/7 without the extra cost.

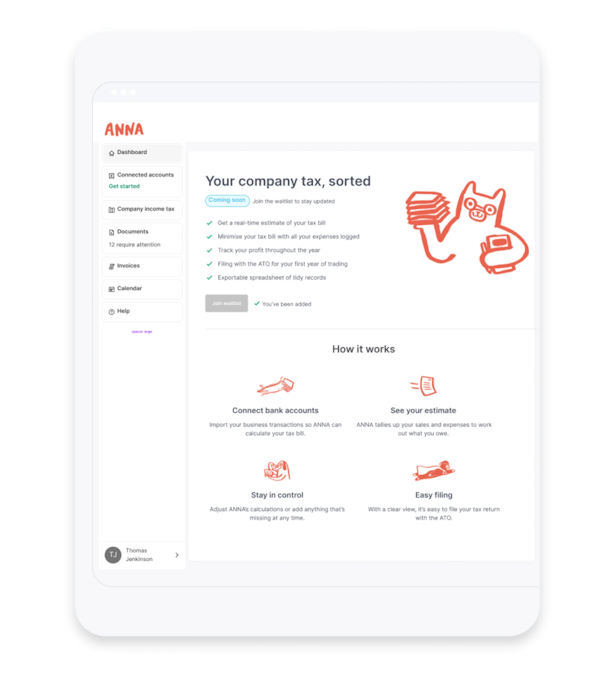

- Tax Compliance on Autopilot: ANNA automatically calculates your GST, files your BAS directly with the ATO, and gives you clear insights into your upcoming tax bills. Never miss a tax deadline again with ANNA’s personalized tax calendar.

- Invoicing Made Simple: With ANNA, you can create professional invoices in seconds. It even automatically follows up on unpaid invoices – meaning you spend less time chasing payments and more time growing your business. Over 80% of ANNA invoices get paid within a week!

Limitations:

ANNA is an excellent fit for most small businesses. It may not offer the advanced features that larger, more established enterprises need, but it ticks all the right boxes for those in the early stages of business.

Best For:

ANNA is the perfect tool for startups, freelancers, and small business owners in Australia who are looking for a no-fuss, all-in-one solution for company registration, taxes, bookkeeping, and invoicing.

It’s designed to take the stress out of business administration so you can focus on building your dream.

If you have any questions, award-winning, 24/7 support with account specialists is available whenever needed.

2. Wave – Best budget-friendly solution

Wave is a free accounting tool tailored for small businesses and startups that are just getting off the ground.

It offers features like expense management, invoicing, and bank reconciliation, all without the price tag.

Available as a web app and on mobile (Android and iOS), Wave is a great solution for businesses looking to manage their finances without spending a dime.

Key Features:

- Free to Use: No fees for core accounting features.

- Double-Entry Accounting: For accurate, professional reporting.

- Unlimited Users and Invoices: Customize invoice templates and allow multiple users with permission controls.

- Mobile Invoicing: Easily invoice clients from your phone.

Limitations:

- Limited Support: Live chat support is only available with paid add-ons like Wave Payments and Payroll.

- No Advanced Accounting Features: Suitable for small businesses, but lacks more advanced options that growing businesses might need.

- Pro Features Only on Paid Plans: Features like unlimited receipt capture are only available with Pro Plus.

Best For:

Freelancers, independent contractors, and small business owners looking for a budget-friendly, no-cost accounting solution that still delivers core features.

3. MYOB: Best for Growing Businesses

MYOB has been a household name in accounting software for years. Designed to cater to businesses of all sizes, it is especially valuable for those planning to scale.

Its strengths lie in its flexibility and scalability, making it an excellent fit for businesses that expect to grow in complexity over time.

Key Features:

- Comprehensive Invoicing: MYOB supports automated invoicing, recurring invoices, and payment tracking. This reduces manual input and the risk of missed payments.

- Payroll Management: It allows for comprehensive payroll management, including tax deductions, superannuation, and leave entitlements.

- Inventory Management: Unlike many competitors, MYOB includes powerful tools for managing complex inventories.

- Bank Reconciliation: Automatically matches bank transactions with accounting records, streamlining the reconciliation process.

Limitations:

While MYOB is powerful for businesses expecting to grow, it does have a few limitations:

- Complexity: Due to its extensive features, MYOB can have a steep learning curve for users who aren't familiar with accounting software.

- Cost: As businesses scale and need more advanced features (like payroll for larger teams), costs can escalate with the need for additional modules.

Best For:

Businesses that expect to grow or already deal with complex accounting requirements, such as those in retail, manufacturing, or services, can use MYOB, which offers the ability to scale seamlessly as operations expand.

4. Xero: Ideal for Small Businesses Seeking Flexibility

Xero is one of the most popular accounting software solutions for small businesses, especially in Australia. With a clean, intuitive interface and excellent integration with third-party apps, Xero offers flexibility and ease of use.

Key Features:

- User-Friendly Dashboard: The dashboard provides a clear overview of cash flow, invoices, and expenses, making it easy to monitor your business’s financial health in real-time.

- Third-Party Integrations: Xero integrates with over 800 apps, including CRM tools, inventory management systems, and payment gateways like PayPal and Stripe.

- Automatic Bank Feeds: Xero syncs directly with your bank, automating the process of importing transactions into the system.

- Robust Reporting: The reporting module is highly customizable, allowing users to generate financial statements, track cash flow, and monitor expenses effortlessly.

Limitations:

The lower-tier pricing plans come with limitations, such as restricting the number of invoices and bills you can issue per month.

Additionally, Xero lacks built-in payroll and advanced forecasting tools without using integrations.

Best For:

Small businesses in need of straightforward accounting tools with excellent integration capabilities. Freelancers, consultants, and businesses with a limited number of employees will find Xero especially useful.

5. FreshBooks: Best for Freelancers and Micro-Businesses

FreshBooks is a cloud-based accounting solution tailor-made for freelancers, consultants, and solo entrepreneurs. It simplifies accounting, particularly for service-based businesses where time tracking and project billing are crucial.

Key Features:

- Time Tracking: FreshBooks allows users to track billable hours directly within the platform, making it ideal for freelancers who need to invoice clients based on time worked.

- Automated Invoices: Users can automate recurring invoices and set up payment reminders, reducing the manual work of chasing clients for payments.

- Expense Tracking: FreshBooks automatically categorizes expenses and allows you to upload receipts using a mobile app, making tax season less stressful.

- Client Portal: Clients can pay invoices directly through FreshBooks, streamlining the payment process and reducing delays.

Limitations:

FreshBooks is excellent for small businesses or sole traders but lacks more advanced accounting features such as payroll, inventory management, or robust financial reporting that larger or growing businesses might require.

Best For:

Freelancers, consultants, and small service-based businesses looking for a user-friendly, no-fuss solution to handle basic accounting needs.

6. QuickBooks: Best for Inventory-Heavy Businesses

QuickBooks is known for its comprehensive feature set, which makes it a top choice for small businesses that need more than basic accounting tools. With a strong focus on inventory management and cash flow forecasting, it offers something for businesses across a variety of industries.

Key Features:

- Inventory Management: QuickBooks excels at inventory tracking, offering low stock alerts, inventory categorization, and detailed tracking by item.

- Cash Flow Projections: The platform helps businesses create cash flow forecasts, ensuring that there’s enough money in the pipeline to cover operational expenses.

- Mobile App: A robust mobile app allows for on-the-go invoicing, receipt scanning, and expense tracking, providing business owners with flexibility.

- Tax Support: QuickBooks assists with tax management, including sales tax calculations and BAS (Business Activity Statements) generation, simplifying tax compliance.

Limitations:

QuickBooks can have a steep learning curve for those unfamiliar with accounting or bookkeeping. Additionally, the cost can quickly escalate with the addition of features and extra users, making it less budget-friendly for smaller operations.

Best For:

Small businesses with complex inventory needs or those requiring comprehensive cash flow management. Retailers, wholesalers, and e-commerce businesses will benefit most from QuickBooks’s robust feature set.

7. Zoho Books: Best for Tech-Savvy Businesses

Zoho Books is a part of the larger Zoho ecosystem, which includes CRM, project management, and HR tools. This makes it an excellent option for businesses already using Zoho products, as it integrates seamlessly across various business operations.

Key Features:

- Multi-Currency Support: Zoho Books supports transactions in multiple currencies, making it ideal for businesses with international clients.

- Custom Workflows: Users can create custom workflows for automating tasks such as sending invoices, payment reminders, and purchase orders.

- Bank Reconciliation: Zoho Books supports automatic bank feeds, similar to Xero, reducing the manual workload of importing and matching transactions.

- Integration with Zoho Apps: Full integration with the Zoho suite (CRM, Projects, People, etc.) offers a streamlined business management experience.

Limitations:

While Zoho Books offers a comprehensive set of features, it might not be as intuitive or user-friendly as some of its competitors. Additionally, advanced accounting features such as payroll require third-party add-ons.

Best For:

Tech-savvy businesses or those already using Zoho applications. Small businesses that want an all-in-one solution for accounting, CRM, project management, and HR would find Zoho Books a valuable addition to their tech stack.

8. Reckon: Best for Small Budgets

Reckon offers a simplified and budget-friendly approach to accounting for small businesses. With essential features such as income monitoring, expense tracking, and budget forecasting, Reckon is ideal for startups and sole traders needing basic accounting functionality.

Key Features:

- Basic Invoicing: Reckon allows users to send professional invoices and track payments with ease.

- Payroll Add-On: A competitive payroll add-on is available, making it a good choice for businesses with small teams.

- Expense Tracking: The platform offers basic expense tracking, making it easier to manage day-to-day financial operations.

Limitations:

While Reckon is affordable and simple, it lacks the scalability and advanced features of larger platforms like MYOB or Xero. As a result, it may not be suitable for businesses expecting to grow or requiring more comprehensive reporting and management tools.

Best For:

Small businesses or sole traders with limited budgets and simple accounting needs. It’s a solid entry-level tool but may need to be replaced as a business grows.

Conclusion

Choosing the right accounting software for your small business can be a game-changer. From saving time to simplifying finances, it’s about finding a tool that fits your needs today and can grow with you tomorrow.

* Prices may vary; for that reason, they are not included.

Why ANNA Stands Out for Small Businesses

ANNA stands out because it’s more than just accounting software – it’s a complete financial toolkit designed to make business management stress-free.

Unlike other platforms that offer great features but may require you to juggle multiple tools, ANNA keeps everything in one place – company registration, bookkeeping, invoicing, tax management, and even a business bank account.

No need for advanced accounting skills – ANNA takes care of the details, so you don’t have to.

For entrepreneurs looking to get off the ground or small business owners ready to streamline their operations, ANNA provides a complete, user-friendly system that makes managing your business finances easier than ever.

So, why wait? Sign up today!