Discover the best banks for small businesses, offering key features to simplify financial management and support business growth.

Choosing the right bank for your small business is one of the most important decisions an entrepreneur can make.

Your bank doesn't just hold your funds; it provides essential services for your business.

Whether you're based in Australia or Europe or you operate on a global scale, it's essential to choose a banking partner that offers the features you need—be it digital banking, multi-currency accounts, or affordable international payments.

This comprehensive guide explores the best banks for small businesses, providing all the necessary details on their key features and which business models they suit best.

Let's start!

Top Banks for Small Businesses in Australia

Australia's banking landscape offers several strong options for SMEs, from traditional banks to newer digital solutions. Here are the top three banks for small businesses in 2025:

1. ANZ Bank

ANZ Bank is a go-to for Australian businesses that require high transaction limits and seamless integration with financial tools.

⚡ Key Features:

- High Transaction Limits: With ANZ, businesses can make transactions up to AUD 1 million per day, which is ideal for companies dealing with large volumes of payments.

- Accounting Integration: ANZ supports smooth integration with popular accounting software like Xero and MYOB, allowing automated bookkeeping.

- Mobile Payments: Business owners can process payments using their smartphones, thanks to the bank’s mobile payment terminals and PayID feature.

- Global Reach: ANZ also offers strong international banking services for businesses dealing in overseas markets.

⚡ Best For: ANZ is ideal for medium to large businesses with high daily transaction needs and those looking for advanced financial management tools. It’s particularly useful for companies with both domestic and international operations.

2. Commonwealth Bank (CommBank)

Commonwealth Bank provides small businesses with versatile banking solutions, from day-to-day transactions to financial support.

⚡ Key Features:

- Same-Day Settlements: Commonwealth Bank’s Smart Mini reader allows businesses to settle card transactions on the same day, ensuring faster cash flow.

- Mobile-First Approach: Their mobile app enables business owners to track payments, manage cash flow, and make payments on the go.

- Interest-Bearing Savings: By linking a business checking account to a high-interest savings account, businesses can grow surplus funds.

⚡ Best For: CommBank is excellent for small businesses looking for seamless mobile banking, fast payment settlements, and strong savings options.

3. Westpac Business Bank

Westpac offers a comprehensive range of services, including low-fee business accounts, lending options, and cash flow management tools.

⚡ Key Features:

- Minimal Fees: Westpac’s business accounts come with low fees, making it an affordable choice for small businesses with limited capital.

- Cash Flow Management: Businesses benefit from tools that help track expenses, optimize cash flow, and manage payments.

- Flexible Loans: Westpac offers various financing options, including working capital loans and equipment financing, which can be customized to meet specific business needs.

⚡ Best For: Small businesses seeking affordable banking with flexible loan products and cash flow management tools.

Top Banks for Small Businesses in Europe

Europe’s top banks for SMEs often focus on international banking, multi-currency accounts, and flexible financial services.

4. BNP Paribas (France)

BNP Paribas is a leader in SME banking in Europe, offering solutions tailored for businesses that operate internationally.

⚡ Key Features:

- Multi-Currency Accounts: BNP Paribas Fortis supports accounts in multiple currencies, making it easier for businesses involved in international trade.

- Advanced Digital Banking: With a sophisticated online platform, businesses can manage accounts, track payments, and generate invoices digitally.

- Trade Financing: The bank offers extensive trade finance options, helping businesses streamline international payments and optimize cash flow.

⚡ Best For: BNP Paribas Fortis is ideal for SMEs with a global footprint that need multi-currency accounts and strong trade finance solutions.

5. Commerzbank (Germany)

Commerzbank is a top choice for SMEs that require comprehensive banking services, including international transactions and flexible lending.

⚡ Key Features:

- International Trade Support: Commerzbank offers foreign exchange services and trade finance, making it easier for SMEs to manage cross-border payments and currency risks.

- Lending Solutions: The bank provides tailored financing options such as working capital loans, equipment financing, and overdrafts.

- Digital Banking Tools: Businesses can manage all their transactions through a user-friendly digital platform, reducing paperwork and improving efficiency.

⚡ Best For: Commerzbank is great for SMEs involved in international trade and those looking for flexible lending solutions.

6. HSBC Business (UK)

HSBC is one of the world’s leading banks, with a strong presence in SME banking across Europe. The bank’s services are designed to support both domestic and international operations.

⚡ Key Features:

- 12 Months Free Business Banking: New customers enjoy 12 months of free business banking, providing a cost-effective start for small businesses.

- Multi-Currency Accounts: HSBC supports businesses that need to manage multiple currencies for international trade.

- Integration with Accounting Software: The bank offers seamless integration with popular platforms like QuickBooks, Sage, and Xero, simplifying financial management.

⚡ Best For: HSBC is an excellent choice for startups and small businesses that require international banking capabilities and integrated accounting tools.

Top Banks for Small Businesses Globally

The best global banks for small businesses offer digital-first services, fast access to credit, and cost-effective international banking solutions.

7. BTG Pactual Empresas (Brazil)

BTG Pactual is widely recognized for its rapid, digital-first approach to SME banking, offering fast credit approvals and advanced digital banking services.

⚡ Key Features:

- Fast Credit Approval: The bank offers rapid credit approval, with some loans approved in as little as 30 minutes. This is particularly useful for businesses that need immediate funding.

- Digital Banking Platform: BTG Pactual offers multi-user accounts, online invoicing, and seamless payroll integration, making it a comprehensive digital banking solution for SMEs.

- ERP Integration: The bank’s accounts integrate with ERP systems like SAP, allowing businesses to manage financials and reconcile accounts more effectively.

⚡ Best For: BTG Pactual is ideal for SMEs that require quick access to credit and sophisticated digital banking services, particularly in Latin America.

8. Bluevine (USA)

Bluevine is an online-only platform offering fee-free business checking accounts with high-interest rates on balances.

⚡ Key Features:

- No Monthly Fees: Bluevine doesn’t charge monthly maintenance fees, making it ideal for small businesses looking to minimize banking costs.

- Interest on Balances: Businesses can earn up to 2% interest on balances up to $250,000, which is excellent for growing surplus funds.

- International Payments: Bluevine supports payments to over 30 countries, making it a good fit for SMEs with international clients.

⚡ Best For: Bluevine is best for online-based businesses or those looking for a fee-free banking solution that offers interest on balances.

Choosing the Right Bank for Your Small Business

In 2024, the best banks for small businesses offer a range of services that cater to various business needs, whether it’s fee-free accounts, international payment options, or digital-first banking platforms. When choosing a bank, consider the following:

- Australia: ANZ, CommBank, and Westpac are the top choices for businesses looking for high transaction limits, seamless mobile banking, or personalized financial support.

- Europe: BNP Paribas Fortis, Commerzbank, and HSBC provide robust options for businesses with international needs, offering multi-currency accounts, trade finance, and accounting integrations.

- Global: BTG Pactual and Bluevine stand out among the top virtual banks for their digital solutions, quick access to credit, and fee-free banking, making them ideal for SMEs with a tech-savvy approach to business.

Why ANNA Money is Your Best Choice for Small Business Banking 💼

Running a small business is already tough, but ANNA is here to make the process smoother, simpler, and more efficient.

Although not a traditional bank, ANNA provides everything you need to get your business off the ground and keep it running smoothly. Let’s break down why ANNA is a fantastic choice for small businesses in Australia:

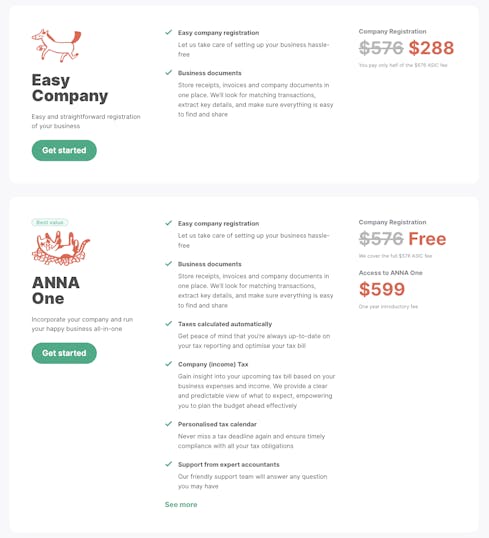

1. Seamless Company Registration 🏢

- Fast & Free: ANNA simplifies the process of registering your company. You can get your Australian Company Number (ACN) with ASIC, and ANNA covers the registration fee.

- Apply for an ABN: Easily apply for an Australian Business Number (ABN) alongside your company registration.

- Instant Name Checker: Before you register, use ANNA's name checker tool to ensure your company name is available.

2. Complete Business Banking 💳

- Physical & Virtual Cards: ANNA provides both physical and virtual cards for your business, including options for Apple Pay and Google Pay, making transactions quick and easy.

- Track Expenses Effortlessly: Snap a photo of your receipts, and ANNA automatically sorts them to match your transactions.

- Connect Other Accounts: Link your external bank accounts to ANNA to view all your business finances in one place.

3. Automated Tax and Accounting Management 📊

- Automatic GST & Tax Calculations: ANNA automatically calculates your GST, company income tax, and tracks all your financial obligations, ensuring you're never caught off-guard.

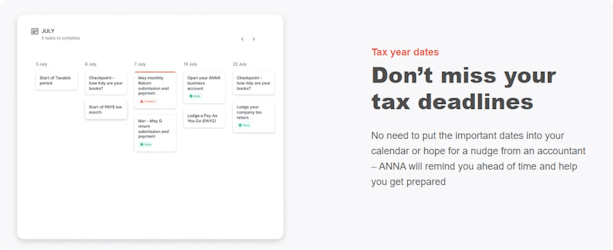

- Personalized Tax Calendar: Never miss a tax deadline again! ANNA keeps you updated with automatic reminders, helping you stay compliant with the ATO.

- Expert Accountant Support: Have a question about your taxes or bookkeeping? ANNA provides access to expert accountants ready to assist you.

4. Efficient Invoicing and Payment Tools 💸

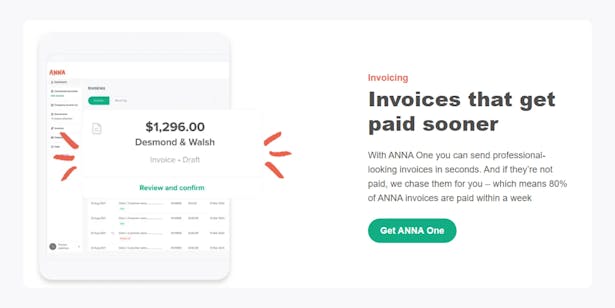

- Create Professional Invoices: Send sleek, professional invoices in seconds. ANNA even helps chase overdue payments, ensuring you get paid faster.

- Fast Payments: 80% of invoices sent via ANNA are paid within a week, helping you keep cash flow steady and your business running smoothly.

5. Transparent and Affordable Pricing 💰

- ANNA One Plan: With ANNA, you get affordable pricing and no hidden fees. The ANNA One plan includes everything you need—from company registration to ongoing bookkeeping, invoicing, and tax management.

- Cost-Effective: With no extra fees for registration or tax calculations, ANNA offers a budget-friendly solution for small business owners.

Why ANNA Stands Out for Small Businesses 🌟

- All-in-One Solution: ANNA combines company registration, banking, accounting, invoicing, and tax management in one easy-to-use platform.

- Business Growth Made Easy: Whether you're just starting out or scaling, ANNA’s comprehensive services adapt to your needs, allowing you to focus on growing your business.

- Time-Saving Tools: From automated tax reminders to real-time expense tracking, ANNA’s features help save time so you can focus on running your business.

Ready to Get Started? 🚀

Turn your business idea into reality with ANNA. Register your company, set up your banking, and take control of your taxes, all in one place – quickly and effortlessly.

👉 Get started with ANNA today and simplify your business journey!