7 Best Business Bank Accounts in Australia To Consider in 2025

Looking for the best business bank accounts in Australia? Discover the top 5 options to streamline your finances and support your business growth.

Opening the right business bank account is essential for effective financial management and smooth operations, regardless of your business's location.

In Australia, various banking institutions offer accounts specifically designed for businesses of all sizes, from startups to large corporations.

This article will highlight Australia's top 5 business bank accounts, detailing their features and how they cater to different business models.

Whether you need low fees, advanced digital tools, or exceptional customer support, our guide will help you choose the best solution to support your business's financial needs.

Let's dive in!

Understanding the Significance of a Business Bank Account

A business bank account is designed to meet the unique financial requirements of businesses, including sole proprietors, startups, small businesses, and larger companies.

Unlike personal bank accounts, which are geared towards individual financial management, business bank accounts handle the complexities and demands of business operations, facilitating processes such as:

- payroll,

- invoicing, and

- financial reporting.

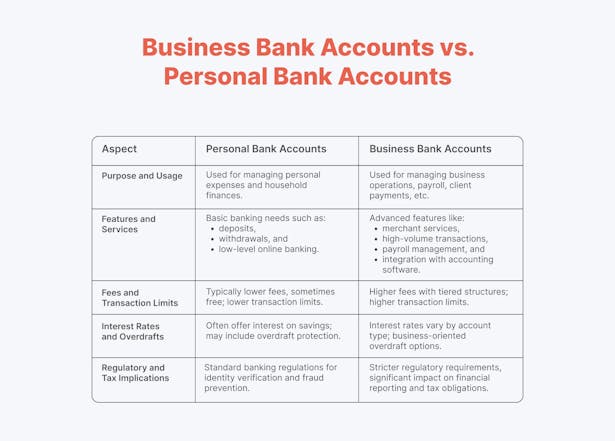

Business Bank Accounts vs. Personal Bank Accounts

Let's check what are the differences between a business bank account and a personal bank account:

What Are the Benefits of Having a Business Bank Account?

Here are the top 5 benefits of choosing the right business bank account for your financial needs:

1. Improved Financial Management: A business bank account helps organize finances, track expenses, and manage cash flow more effectively, enabling better budgeting and financial planning.

2. Professionalism: Having a business account enhances your company's professionalism, providing a dedicated channel for all business transactions, which is particularly important when dealing with clients and vendors.

3. Access to Business Services: Business bank accounts often come with access to additional services such as lines of credit, merchant services, and business loans, which can be crucial for growth and expansion.

4. Regulatory Compliance: Using a separate business account makes it easier to comply with tax and accounting regulations, as it simplifies the process of reporting income and expenses during tax time.

5. Risk Management: Keeping business and personal finances separate reduces personal liability and protects personal assets from business risks or debts.

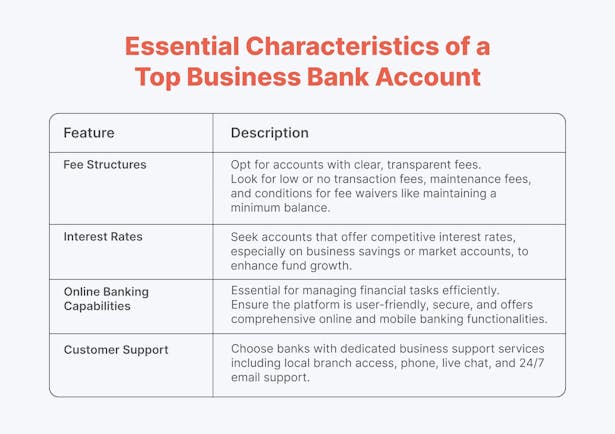

Essential Characteristics of a Top Business Bank Account

And now, let’s check which features to look for when choosing a business bank account Australia.

7 Best Business Accounts in Australia to Consider Today

1. ANNA

ANNA offers a streamlined solution for entrepreneurs looking to start their businesses effortlessly. It provides smart financial solutions designed to help entrepreneurs and startups manage their finances effortlessly in Australia.

This platform integrates free company registration with a robust business account that handles essential financial operations such as:

- bookkeeping,

- invoicing,

- GST, and

- company taxes.

By combining these services, ANNA allows business owners to focus on growth while minimizing the administrative burdens typically associated with starting and running a business.

What ANNA Offers?

👉 One-Stop Business Setup: ANNA facilitates a seamless transition from concept to operation by allowing you to register an Australian company and open a business bank account simultaneously.

This integrated approach significantly simplifies the startup process.

👉 Comprehensive Financial Tools: Subscribers to ANNA gain access to an array of financial tools enhancing the efficiency of financial transactions and expense management, including:

- a business credit card,

- virtual cards, and

- mobile payment options like Apple Pay and Google Pay.

👉 Tax and Compliance Simplification: The service includes all necessary components for annual company tax return statements, ensuring adherence to Australian Tax Office (ATO) regulations from the outset, thereby simplifying tax compliance.

👉 Intelligent Financial Monitoring: ANNA's Business Score feature actively evaluates the organization of financial records, suggesting tasks to enhance tax efficiency and potentially lower tax liabilities.

👉 Automated Tax Reminders: The platform alleviates the burden of remembering tax deadlines by sending automated reminders, ensuring businesses remain prepared and compliant without the need for manual tracking.

👉 Zero Registration Cost: ANNA covers the registration fees with the Australian Securities and Investments Commission (ASIC), allowing new businesses to launch without initial financial hurdles.

👉 Support and Digital Storage: The platform also provides expert accounting support and digital storage solutions for essential documents like receipts and invoices, facilitating easy data management and transaction matching.

Streamlined Company Registration with ANNA One

ANNA offers a quick and straightforward path to officially registering a company with the Australian Securities and Investments Commission (ASIC) while also sorting out business banking and tax requirements.

The process is designed to be as efficient and user-friendly as possible, involving just a few simple steps:

- Choose a Company Name: Select a unique and suitable name for your new business.

- Choose ANNA One Subscription: Opt for the appropriate subscription plan that meets your business needs.

- Provide Business Details: Fill out a form with essential details about your business to tailor the services to your requirements.

- Notification of Completion: ANNA will keep you informed and notify you once your application has been processed and your company is officially registered.

2. ANZ

ANZ provides comprehensive business banking solutions tailored to meet the needs of diverse businesses, whether large or small, local or global.

Their dedicated team of business bankers offers personalized service, gaining an in-depth understanding of each client's unique requirements to propose smart, custom-fitted financial strategies and solutions.

Key Offerings of ANZ Business Accounts

👉 Tailored Financial Solutions: ANZ crafts customized banking solutions that cater specifically to the needs of each business.

👉 Integration and Convenience: Businesses can integrate their banking data with eligible accounting software through ANZ Internet Banking, and manage their finances on-the-go with the ANZ App, which includes features like payment notifications and spending categorization.

👉 Comprehensive Payment Options: The platform supports a variety of payment methods, including ANZ Business Visa Debit cards with Apple Pay and Google Pay, setup for regular bill payments, and high-limit transfers up to $1 million daily using ANZ Internet Banking for Business.

👉 Dedicated Support and Insights: Clients receive dedicated support from specialized business banking teams, who provide valuable industry insights and professional guidance tailored to each business sector.

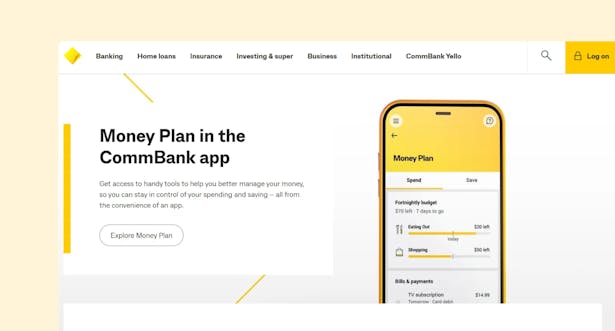

3. CommBank

The Commonwealth Bank of Australia (CommBank) offers a comprehensive range of financial services tailored to both personal and business needs.

It is designed to meet the diverse requirements of businesses, particularly beneficial for sole traders or directors of private companies.

The CommBank offers a notable feature—the "Money Plan"— available in the CommBank app, which equips users with robust tools to manage their finances.

This includes controlling spending and facilitating savings directly through the app, enhancing convenience and financial oversight.

Key Features of CommBank's Business Transaction Account

👉 Smart Mini Offer: From 1 December 2023, CommBank waives the Smart Mini reader cost for eligible businesses.

👉 Cardless Cash: Enables withdrawals up to $500 per day without a card at CommBank ATMs using digital banking tools.

👉 Overdraw Feature: Offers the option to temporarily overdraw your account, enhancing cash flow flexibility.

👉 Transaction Ranking System: Ranks transactions monthly, applying fees to encourage efficient management.

👉 Credit Approval: All finance applications are subject to rigorous credit checks to ensure responsible lending.

👉 Daily IQ: Provides business insights to aid decision-making through data analysis and actionable intelligence.

4. NAB

The National Australia Bank (NAB) serves as a dependable partner for businesses, offering a comprehensive suite of banking solutions tailored to enhance financial management and accessibility.

NAB's range of business bank accounts is designed to cater to the diverse needs of companies, from startups to established enterprises, providing easy access to funds and seamless integration with financial operations.

Solutions Offered by NAB for Businesses

👉 Transaction Accounts: NAB Business Everyday Account with no monthly fee, providing free electronic and ATM transactions.

👉 Savings and Term Deposit Accounts: Offers competitive interest rates and secure investments for maximizing savings.

👉 Specialized Accounts: Customized accounts to meet specific business financial management needs.

👉 Easy Access to Funds: Ensures quick access to funds, supporting liquidity and operational flexibility.

👉 NAB App: Mobile app for managing business finances on-the-go, featuring tools for easy financial tracking and transactions.

👉 Integrated Accounting Software: Allows integration with popular accounting software to simplify administrative processes.

👉 Support for All Business Sizes: Provides extensive support through a network of banking specialists for businesses of all sizes.

5. Westpac

Westpac Banking Corporation offers a robust array of banking services catering to personal, business, and corporate clients.

For business customers, Westpac provides a variety of bank accounts and financial products designed to meet the diverse needs of different business structures throughout Australia.

This includes everything from transaction accounts to savings options and specialized accounts tailored for specific operational needs.

Key Business Banking Solutions Offered by Westpac

👉 Business One Accounts: Everyday transaction accounts for businesses offering a $100 bonus to new customers who deposit $100 within 10 days and meet specific payment criteria.

👉 Foreign Currency Account: Designed for businesses managing transactions in foreign currencies, emphasizing non-speculative use for routine operations.

👉 Community Solutions Cheque Account: Tailored for not-for-profit organizations, providing essential banking services with the ability to change account types if activities become profit-oriented.

👉 Business Cash Reserve Account: Savings account with an introductory bonus rate for new customers without a prior Business Cash Reserve account, promoting financial growth and savings.

6. Volopay

Volopay's business account is designed as an advanced, multi-currency banking platform, ideal for companies that operate on both local and international scales.

It offers a comprehensive solution that combines all financial operations into a single, intuitive dashboard.

This platform is especially suited for a range of businesses, from nimble startups to well-established enterprises, and focuses on three key aspects:

- efficient expense management,

- faster payment processing, and

- reduced foreign exchange fees.

Key Capabilities of Volopay Business Account

👉 Multi-Currency Wallets: Allows users to manage funds in various currencies, easing international payments and reducing costs associated with foreign transactions.

👉 Enhanced Payment Solutions: Offers fast domestic payments within Australia and facilitates simple international transfers to over 180 countries with competitive FX rates, along with real-time payment tracking.

👉 Corporate Cards for Expense Management: Issues corporate cards that can be loaded with selected currencies, streamlining expense management and minimizing FX charges.

👉 Efficient Payroll Management: Simplifies payroll for both local and international employees with features like automated payment dates and bulk payroll capabilities, ensuring timely and accurate salary distribution.

👉 Hassle-Free Reimbursements: Streamlines both local and international reimbursements, with automated compliance systems and easy bulk reimbursement management.

👉 Streamlined Accounting Integration: Enables seamless synchronization of transactions with existing accounting systems, ensuring consistent data and facilitating advanced expense mapping; automated syncing keeps financial records current, irrespective of the currency used.

7. Heritage

Heritage Bank's business account is a dedicated financial solution tailored for Australian organizations. It provides a unified platform that integrates essential banking functions into an accessible interface.

This banking solution is particularly focused on small to medium enterprises, from local to established companies, focusing on three core aspects:

- streamlined transaction processing,

- comprehensive payment solutions, and

- integrated business tools.

Key Capabilities of Heritage Bank Business Account:

👉 Cost-Efficient Banking: Eliminates monthly maintenance fees and provides free access to Heritage and major Australian ATMs, reducing operational costs for businesses.

👉 Digital Banking Access: Delivers round-the-clock access through mobile, internet, and phone banking platforms, enabling real-time transaction management and payment tracking.

👉 Business Payment Solutions: Incorporates MINT merchant facilities to optimize payment processing and enhance operational efficiency.

👉 Specialized Account Options: Offers diverse account types, including business cheques, club cheques for non-profits, Body Corporate, and Self-Managed Super Fund accounts, each designed for specific business needs.

👉 Business Credit Solutions: Features Business Visa Credit Cards with up to 40-day interest-free periods and multi-cardholder capabilities, facilitating expense management and financial control.

👉 Dedicated Support Services: Provides access to specialized Business Banking Managers who offer personalized guidance and solutions tailored to small business requirements.

Wrapping Up

In exploring the 7 best business bank accounts in Australia, it's evident that each offers unique features tailored to diverse business needs.

However, for entrepreneurs who are just starting out and looking for a comprehensive solution that simplifies the complexities of business finance, ANNA emerges as a standout option.

Company Registration with ANNA

▶️ Eligibility: Suitable for proprietary companies limited by shares with a single director and shareholder. Note that these companies cannot act as trustees of a superannuation fund.

▶️ Required Information: Applicants need to prepare:

- a company name,

- a physical street address for the registered office (not a PO Box, to comply with ASIC requirements for document delivery and auditing), and

- director details including full name, residential address, and date and place of birth.

▶️ Director ID: From November 1, 2021, new directors must apply for a Director ID, a process that is quick, free, and takes only about 5 minutes.

Pricing Options

ANNA enables you to choose between 2 pricing packages:

Easy Company Package

👉 Price: $630 annually (includes a $576 ASIC fee).

👉 Features: Offers basic company registration. Essential business documents are organized and stored, making them easy to access and manage.

ANNA One Package

👉 Introductory Offer: $619 for one year.

👉 Comprehensive Services: Includes company registration and an all-in-one business management solution that covers bookkeeping, invoicing, GST, and company taxes.

👉 Financial Management Tools: Automatic tax calculations, a personalized tax calendar, and insights into your upcoming tax bills based on business expenses and income.

👉 Support: Access to expert accountants for guidance and to answer any queries.

With options tailored to varying needs—from basic registration to comprehensive financial management—ANNA One equips business owners with the tools necessary for effective oversight and growth.

Ready to get started?

Register your company in Australia with ANNA for seamless financial management that meets regulatory compliance and streamlines your business operations from day one.

FAQs

1. Which Bank has the Most Complaints in Australia?

Complaint data varies, but larger banks like Commonwealth Bank, Westpac, NAB, and ANZ often receive the most due to their size and customer base. Check official reports for updated figures.

2. Are any Australian Banks at Risk?

Australian banks are regulated under strict financial standards, making collapses rare. However, economic downturns or market instability can still pose risks.

3. What Happens if a Bank Collapses in Australia?

If a bank collapses, the Financial Claims Scheme protects deposits up to $250,000 per account holder, ensuring customer savings are safeguarded.

4. What are the Tier 1 banks in Australia?

Australia's Tier 1 banks are the 'Big Four': Commonwealth Bank, Westpac, NAB, and ANZ. These are the largest and most established banks in the country.