4 Best Small Business Bank Accounts in 2025

Discover the best small business bank accounts in Australia to manage transactions and simplify your finances efficiently.

Opening a business bank account is one of the smartest moves a small business owner can make, and finding the best small business bank accounts can set you up for success right from the start.

It's more than just keeping your finances in check, but also about simplifying your entire financial workflow.

Separating your business and personal expenses gives you a clear understanding of where your money is going and instantly elevates your professional image with clients and vendors.

Whether you're a freelancer, launching a new venture, or scaling an established business, the right business bank account helps you stay organized, track income, and easily manage taxes.

Top 4 Small Business Bank Accounts in Australia and Worldwide

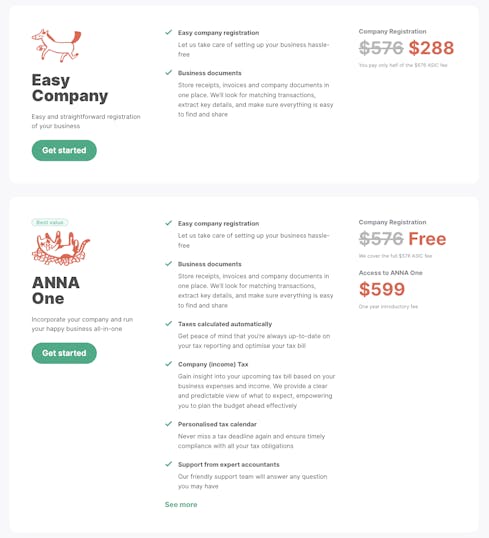

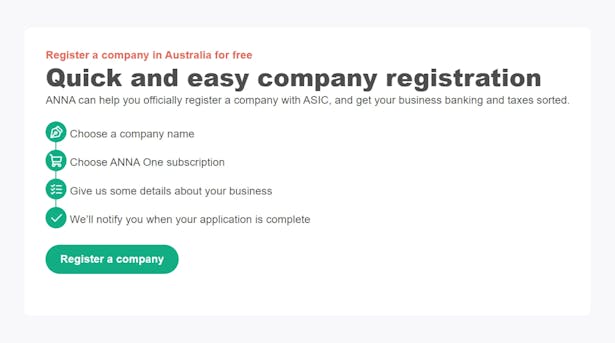

1. ANNA One

Why Choose ANNA One?

ANNA One provides an all-in-one solution for small businesses, offering not just a business account but also tools for managing tax, invoicing, and bookkeeping.

It's perfect for entrepreneurs who want to simplify business operations and enhance financial management.

Key Features:

- Free Company Registration: ANNA covers the costs associated with registering your Australian company with ASIC, making it easier for startups to get started.

- Automated Tax Management and Bookkeeping: The platform automatically calculates GST and other taxes, providing a personalized tax calendar to help you meet your obligations without hassle.

- Integrated Invoicing and Receipt Matching: You can create and send invoices directly through the app, which automatically matches receipts to expenses and streamlines financial tracking.

- Real-Time Financial Insights: ANNA gives real-time insights into your financial status, helping you make informed business decisions.

- Business Debit and Virtual Cards: You can receive a business debit card and create virtual cards for online transactions, enhancing security and control over spending.

- 24/7 Customer Support: ANNA offers round-the-clock support via chat, ensuring assistance whenever needed.

Why It Stands Out:

ANNA One is more than just a bank account – it's a comprehensive financial platform that supports your business from registration to daily operations.

Its focus on automation and outstanding accounting possibilities makes it particularly appealing for small business owners who want to minimize administrative tasks and maximize efficiency.

2. St. George Bank

St. George Bank offers a variety of business accounts designed to cater to the needs of small business owners in Australia. These accounts provide flexibility for both electronic and in-branch banking, making them suitable for businesses that handle a mix of cash and digital transactions.

1. Freedom Business Account

The Freedom Business Account is best for modern businesses seeking efficient banking solutions focusing on digital management.

Key Features:

- $0 Monthly Account-Keeping Fee for the First Year: After the first 12 months, the fee reverts to $10.

- Unlimited Electronic Transactions: Covers online and mobile transfers, direct debits, and credits.

- 30 In-Branch Transactions Monthly: Allows for physical banking needs without additional fees.

- Business Visa Debit Card: Provides a clear separation between personal and business expenses.

- 24/7 Online Access: Manage your account anytime from anywhere.

- Osko Payments: Instant payments with enhanced security features, including real-time alerts.

- MYOB Bonus Offer: Pay for one month of MYOB Business and receive an additional 12 months free, facilitating easier invoicing and payment tracking.

2. Business Cheque Account Plus

This account is designed for businesses that value both digital banking and frequent in-branch services.

Key Features:

- $20 Monthly Fee: Provides unlimited electronic and 70 in-branch transactions monthly.

- Business Visa Debit Card: Ensures separation of personal and business finances.

- 24/7 Online Access: Similar to the Freedom Business Account, enabling easy management of finances.

- Osko Payments: Instant payments with added security measures.

- MYOB Bonus Offer: Same as the Freedom Business Account, promoting efficient financial management.

3. Business Access Saver

The Business Access Saver is ideal for businesses looking to maintain a savings cushion while earning interest.

Key Features:

- $0 Monthly Fee: No account-keeping fees while earning interest on savings.

- 24/7 Online Access: Manage savings through a linked St. George transaction account.

- No Minimum Monthly Deposits or Balances: Offers flexibility in managing funds.

- Unlimited Electronic Transfers: Free transfers to and from the linked transaction account.

- Enhanced Security: Protection against internet fraud and unauthorized access.

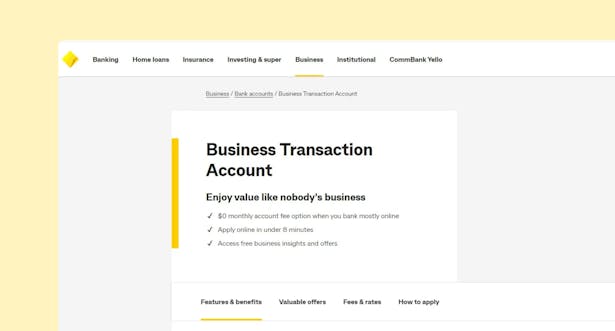

3. Commonwealth Bank Business Transaction Account

Commonwealth Bank is one of the "Big Four" banks in Australia.

Their Business Transaction Account is popular for small businesses due to its flexible fee structure and unlimited free electronic transactions.

Key Features:

- Unlimited Free Electronic Transactions: The account offers unlimited free electronic transactions, including online transfers, BPAY, and direct debits.

- Integration with Apple Pay and Google Pay: Customers can use their Business Visa Debit Card with these mobile payment platforms for added convenience.

- Flexible Fee Options:

- $0 Monthly Fee: This option includes 5 free monthly assisted transactions (usually $5 each).

- $10 Monthly Fee: This option includes 20 free monthly assisted transactions.

- Business Visa Debit Card: Customers receive a Business Visa Debit Card for in-person and online purchases.

- Online and In-Branch Banking: Commonwealth Bank offers both online and in-branch banking services, providing flexibility for businesses with varying needs.

Why It Stands Out:

The account stands out for its flexibility regarding fee options and the ability to customize it based on specific requirements.

However, while electronic transactions are free, assisted transactions (e.g., in-branch deposits and withdrawals) are limited based on the fee option chosen and may incur fees beyond the included amount.

4. NAB Business Everyday Account ($10 Monthly Fee)

The NAB Business Everyday Account is a versatile and feature-rich business transaction account for businesses that handle a high volume of cash and cheque transactions.

It meets small to medium-sized businesses' needs that require flexibility and cost-effectiveness in their daily financial operations.

A $10 monthly account fee covers a range of banking services, from unlimited electronic transactions to value-added tools that streamline business management and support growth.

This account allows businesses to manage cash flow, make everyday payments, and access business-specific features such as linking transaction data to accounting software.

It is ideal for sole traders and businesses with up to two directors, with a quick and easy online application process that can be completed in less than 15 minutes.

Key Features:

- $10 Monthly Account Fee: Provides value with a moderate monthly fee that includes a range of benefits.

- 15 Free Eligible Transactions per Month: Covers the 15 most expensive eligible transactions, including banker-assisted deposits or withdrawals, Express Business Deposits (EBD), Coin Deposit Machine (CDM) deposits, Express Cheque Deposits (ECD), and cheque transactions.

- Unlimited Electronic Transactions: NAB ATM withdrawals and deposits, EFTPOS transactions, and NAB Internet or Telephone Banking transfers at no additional cost.

- NAB Business Visa Debit Card: Account holders receive a free Visa Debit Card, enabling ATM withdrawals, contactless payments, and secure online purchases.

- Integration with Accounting Software: It supports direct integration with popular accounting software like MYOB, Xero, and NAB Bookkeeper, simplifying transaction management and reconciliation.

- 24/7 Support: Access to business bankers seven days a week, ensuring your banking needs are met whenever required.

- 6-Month Free Trial with NAB Bookkeeper: New customers get a complimentary 6-month trial with NAB Bookkeeper to manage invoices and expenses and track finances in real time.

Why It Stands Out:

The 15 free eligible transactions each month allow businesses to save on fees typically associated with cash and cheque handling, which is ideal for retail, hospitality, or service-based businesses.

Also, including dedicated business support and financial tools, such as the free NAB Business Visa Debit Card and NAB Bookkeeper trial, add value beyond traditional banking, supporting business growth and efficiency.

In summary, the NAB Business Everyday Account is a well-rounded solution for businesses seeking a blend of traditional transaction features and modern digital tools.

However, there are some additional fees you should be aware of:

- Every transaction made using an Express Business Deposit (EBD), Coin Deposit Machine (CDM), or Express Cheque Deposit (ECD) is charged $3 each, making it costly for businesses that rely on frequent cash or cheque deposits.

- If a cheque is lodged as part of a deposit, an extra $3 is added to the base $3 transaction fee, which can quickly add up for businesses handling multiple cheques.

- Banker-assisted deposits or withdrawals at NAB branches or Australia Post locations incur a $3 fee per transaction. Plus, there’s another $3 fee for each cheque lodged with these transactions, resulting in higher overall costs for face-to-face banking.

Conclusion

As you explore your options regarding the best small business bank accounts, think about what matters most to you. Maybe it is low fees, easy online access, or tools that integrate seamlessly with your bookkeeping.

Whatever your priorities, choosing the right bank account can set you up for success and help you focus more on growing your business than managing your finances.

If you're looking for a one-stop solution, ANNA One takes it even further by handling everything from banking to tax management, making your business journey less about paperwork and more about doing what you love.

Simplify Your Business Setup with ANNA One

If you're in the early stages of launching your business, ANNA One can help you hit the ground running. Here's how ANNA One makes setting up and managing your business easy:

- Free Company Registration: ANNA One handles the legal registration of your business, including securing an Australian Business Number (ABN).

- Integrated Banking and Tax Tools: ANNA One automates tax calculations, invoice management, and receipt matching, helping you stay on top of your finances without the hassle.

- Expert Support: Do you need financial or legal advice? ANNA One's award-winning support team is ready to help.

Let ANNA One manage the details – registration, banking, and tax management – so you can focus on growing your business.

With everything you need in one platform, ANNA One simplifies the process and helps you stay organized and compliant. So, start your journey with ANNA One today!