Explore the pros and cons of buying a car with an ABN, including tax benefits, business use advantages, and potential financial considerations.

Thinking about purchasing a car for your business in Australia?

If you hold an Australian Business Number (ABN), you may have more options and potential savings than you realise.

An ABN can transform a regular car purchase into a good business decision by offering lower fleet pricing and GST credits, as well as flexible financing choices and tax benefits.

However, there are standards to follow, records to keep, and potentially applicable taxes such as the Fringe Benefits Tax (FBT).

In this article, we will go over the benefits and drawbacks of purchasing a car with an ABN, allowing you to make an informed and financially smart decision.

What Do You Need An ABN?

The ABN is generally used to identify your business to the government, other businesses, and the general public for tax and business purposes.

It is necessary for operations including invoicing, registering for Goods and Services Tax (GST), claiming GST credits, and applying for an Australian domain name.

While an ABN is required for business transactions, it does not replace your Tax File Number (TFN), which is used for both personal and business tax purposes.

Entities eligible for an ABN include solo traders, partnerships, companies, trusts, and certain other organisations, provided they are carrying out an activity in Australia or making supplies related to Australia.

4 Pros Of Buying A Car With An ABN

Let’s take a look at the key advantages of buying a car with an ABN!

1. Discounted Pricing and Fleet Deals

Using an ABN to buy a car in Australia allows you to take advantage of exclusive pricing and discounts that are generally unavailable to individual buyers.

This can be a significant benefit for small business owners or sole traders wishing to save.

Key advantages include:

🔷 ABN pricing - Many dealerships offer reduced rates to ABN holders. This primarily pertains to commercial vehicles such as utes, vans, and even some SUVs intended for work purposes.

🔷 Fleet discounts - You don’t need to buy many vehicles to qualify. In many circumstances, purchasing just one vehicle through an ABN may get you access to fleet rates.

🔷 EOFY promotions - End-of-year sales frequently include additional incentives, such as cashback, upgrades, or even bonus accessories when purchased through an ABN.

🔷 Lower upfront costs - With these discounts, the price tag is frequently substantially lower than typical retail prices, freeing up finances for other aspects of your organisation.

What to bear in mind?

- Deals vary according to the brand and dealership. Some manufacturers provide more extensive ABN and fleet programs than others.

- Not every vehicle qualifies. These discounts often apply to commercial-use models. Thus, personal cars or luxury vehicles may not be eligible.

2. Tax Deductions

Purchasing a vehicle with an ABN provides considerable tax savings, particularly if the vehicle is mostly used for business. The Australian Taxation Office (ATO) permits a variety of deductions that can dramatically reduce your total tax bill.

What may you claim?

🔷 Purchase price - You may claim a portion of the vehicle's cost under the instant asset write-off or temporary full expensing schemes.

🔷 Finance costs - If the vehicle is utilised for business purposes, the interest on the loan or lease instalments may be partially deductible.

🔷 Running costs - Fuel, service, repairs, registration, and insurance charges can all be claimed; just be sure they are related to business use.

3. GST Credits

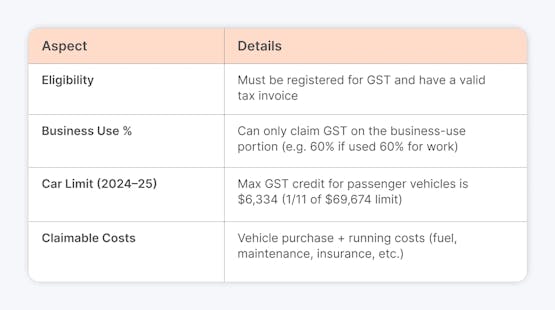

If your company is registered for GST and you purchase a vehicle for business purposes, you can claim input tax credits (GST credits) on the GST paid for the vehicle and its operating costs. The amount you can claim is determined by the level of business use.

🔷 Eligibility - To claim GST credits, you must be registered for GST and have a valid tax invoice for the purchase.

🔷 Business Use Percentage - You can claim GST credits for the portion of the vehicle's use that is business-related. For example, if you use the vehicle for 60% business and 40% personal use, you can claim 60% of the GST paid.

🔷 Car Limit - You can only claim a certain amount of GST credit for passenger vehicles. For the fiscal year 2024-25, the maximum GST credit is $6,334, or one-eleventh of the car limit of $69,674.

4. Flexible Finance Options

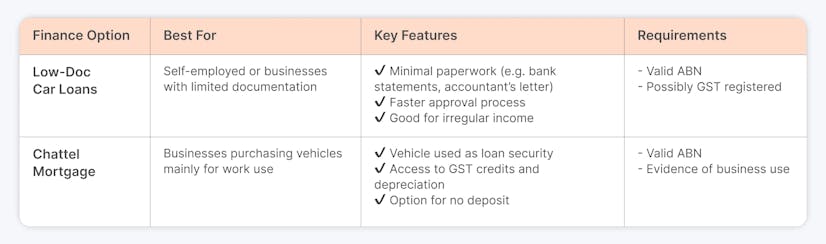

Holding an ABN grants access to a wide range of customised finance solutions designed to meet the specific needs of business owners, particularly those with intermittent income streams or insufficient documentation.

Depending on your financial situation, you may also choose to get a car loan separately, especially if you want clearer repayment terms or prefer to keep personal and business finances structured. This approach can work well for sole traders or small businesses planning vehicle purchases without complex arrangements.

Key funding options include:

🔷 Low-Doc Auto Loans

▶️ Ideal for self-employed people or businesses without detailed financial records.

▶️ Instead of detailed financial statements, require only the most basic paperwork, such as bank statements or an accountant's declaration.

▶️ Suitable for individuals having a valid ABN and, in many situations, GST registration.

🔷 Chattel mortgages

▶️ A popular option for buying vehicles used mostly for business purposes.

▶️ The vehicle serves as collateral for the loan, allowing for prospective tax benefits such as GST input tax credits and depreciation deductions.

▶️ Depending on the lender's criteria, these loans are frequently available with flexible terms and the option of making no deposit.

3 Cons Of Buying A Car With An ABN

1. Fringe Benefits Tax (FBT) Exposure

When a company or trust provides an employee with a car that can be used for private purposes, including commuting, it may be subject to the Fringe Benefits Tax. This tax can have a considerable impact on the total cost of delivering such benefits.

Key considerations are:

FBT Rate - For the fiscal year ending March 31, 2025, the FBT rate is 47%.

Employers can determine the taxable value of a car fringe benefit using one of the following methods:

🔸 Statutory Formula Method - The Statutory Formula Method applies a flat 20% rate to the car's base value, regardless of actual usage.

🔸 Operating Cost Method - The actual costs of operating the car, divided between business and personal use.

🔸 Gross-Up Rates - To calculate the FBT payable, the taxable value is "grossed-up" to reflect the gross salary required to acquire the benefit using after-tax income.

2. Record-Keeping Requirements

One of the biggest cons is that you have to go above and beyond to make sure that your records are clean and that you are compliant.

The Australian Taxation Office (ATO) requires particular paperwork to support your claims.

Logbook Maintenance:

🔸 Maintain a diary for a full 12-week period that matches your regular business travel.

🔸 Record the following details for each journey:

🔸 Start and end dates.

🔸 Odometer readings at the start and end

🔸 Kilometres travelled

Odometer readings:

🔸 Keep track of the vehicle's odometer readings at the beginning and conclusion of each fiscal year.

🔸 These measurements are used to calculate the total kms travelled and the percentage of usage for business purposes.

Expense Documentation:

🔸 Maintain receipts or invoices for all vehicle-related expenses, including:

🔸 Fuel and Oil

🔸 Repair and servicing

🔸 Insurance Premiums

🔸 Registration Fees

🔸 Loan or lease payments

Failure to maintain accurate records can have a significant impact on your ability to claim tax deductions or GST credits.

Without a legitimate logbook or sufficient paperwork, you may be unable to support your business use claims, which might result in refused deductions. In the event of an audit, missing or incomplete records may result in penalties or interest charges.

3. Eligibility and Restrictions

While having an Australian Business Number (ABN) can grant you access to exclusive vehicle discounts, it is important to note that not all vehicles or customers are automatically eligible for these benefits.

Eligibility criteria and limits vary by manufacturer and dealership.

- For example, Isuzu UTE Australia provides ABN savings to small registered businesses that operate fleets of 1 to 4 vehicles.

- Larger fleets may be eligible for additional savings under various categories, such as Business Fleet or Corporate Fleet customers.

- Also, some manufacturers may want the ABN to be active for a set period of time, usually 12 months, to indicate established business operations.

Given these conditions, it is best to contact the dealership to understand the precise eligibility criteria and restrictions that apply to your circumstance.

Conclusion

Purchasing a car with an ABN can be a great decision for your business, but only if you understand the full picture.

The tax breaks, fleet discounts, and financial benefits are real, but they come with eligibility requirements and record-keeping obligations.

If you're just getting started or need help managing your business finances, tools like ANNA Money make it easier than ever to register your ABN, conduct tax reporting, and keep your business organised!

How ANNA Money Can Help You Get an ABN?

ANNA Money is an all-in-one business tool that can help you start and grow your company, and you can easily get an ABN through this platform.

All you need to do is:

- Confirm your details, whether you are a company or a sole trader

- Your ABN will be registered, and we will notify you of its number

What are the benefits of registering your ABN through ANNA Money?

✅ Easy Company Identification - Other businesses can identify you to authenticate invoices and orders, increasing your reputation.

✅ Centralised Document Storage - Keep all of your receipts, invoices, and company records in one secure location. Keep everything organised and accessible when you need it.

✅ Virtual Address - There is no need to make your home address public. ANNA provides a virtual address in Australia for your business to preserve your privacy.

✅ Tax Management - With ANNA Money, you can stay on top of your tax reporting and optimise your tax bill. Receive a personalised tax calendar and never miss another deadline.

✅ Avoid PAYG Taxes - You may be able to avoid pay-as-you-go (PAYG) tax on payments received.

In addition to ABN, ANNA Money can help you run your business:

✅ Bookkeeping Score - Stay on top of your bookkeeping and discover simple ideas for keeping your records clean.

✅ Invoices Paid Sooner - In seconds, we can generate professional-looking invoices and immediately chase any unpaid invoices on your behalf.

✅ Goods and Services Tax (GST) - GST is automatically calculated and logged with the ATO in only a few clicks.

✅ Annual Accounts and Company Tax Return - File your annual accounts with ASIC and your company tax return with the ATO straight through ANNA.

Sign up today, get your ABN in a few clicks and don’t worry about strict record-keeping when buying a car with an ABN!

FAQ

How Much Does it Cost to Keep ABN?

Having an ABN (Australian Business Number) is free.

Maintaining an active ABN does not incur any ongoing government fees or levies, as long as you continue to complete your business duties and keep your details up to date.

Can I Get a Loan on ABN?

Yes, you can use your ABN to get a loan in Australia.

An ABN loan is a sort of business loan accessible to individuals or businesses operating under an Australian Business Number (ABN), meant to help finance business expansion, cover cash flow deficits, purchase equipment or vehicles, and more.