Learn how to change from a company to a sole trader and understand the process, benefits, and key considerations for making the transition.

Have you ever wondered if transitioning from a company to a sole trader could be the right move for you?

It may sound complicated, but it’s actually quite straightforward.

While a sole trader structure offers full control and simplicity, it also exposes personal assets to business liabilities.

So, what should you do?

In this article, you will learn how to smoothly change from company to sole trader and what are the benefits of that decision.

Let’s start!

What Are the Benefits of Operating as a Sole Trader?

A sole trader is the most basic type of business structure and is relatively straightforward and affordable to set up.

This business structure:

- Provides complete control over assets and business decisions.

- Is low-cost and needs fewer reporting requirements.

- You can use your individual tax file number (TFN) to lodge tax returns.

- A separate company bank account is not required, but it is suggested to track business income and expenses.

5 Steps to Change from Company to Sole Trader

Let’s check out 5 easy steps to transition to sole trader structure!

Step 1: Settle Company Debts and Obligations

When changing from a company to a sole trader, the first and most important step is to settle all debts and obligations.

It includes:

- Repaying creditors

- Closing business accounts

- And ensuring there are no outstanding liabilities

Besides the mentioned debts, it is equally important to finalize employee entitlements:

- Paying any unpaid salaries

- Leave entitlements and pension obligations

- Presenting employees with final pay stubs and termination notices

- Discontinuing any ongoing contracts. This includes informing landlords, suppliers, and service providers about the business's closure or structural change.

📍 Note

We recommend you consult your accountant or financial advisor for a thorough review of all financial responsibilities so you can prevent future legal issues.

Step 2: Deregister Your Company

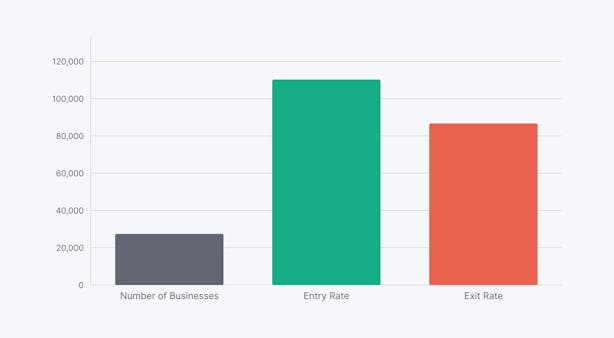

Did you know that in the March 2024 quarter alone, there were 84,351 business exits in Australia, which also included deregistered companies?

The moment you deregister the company, it will no longer be a legal entity.

Keep in mind that, even if the company is no longer trading, you will have to comply with all legal requirements that apply to the company, which includes paying the annual review fee.

You can deregister your company with ASIC for $47, but before applying for the voluntary deregistration of a company, make sure that it:

- Has no outstanding liabilities or employee entitlements

- Is not involved in any legal procedures

- Has paid all fees and penalties to ASIC

- Has stopped trading

📍 Note

Remember that all company members have to agree to deregister, and the assets must be worth less than $1000.

How to Deregister a Company with ASIC?

Follow these steps:

📍 Note

Remember that the application fee will be invoiced after submission and you have to pay it within 28 days.

If you fail to pay the fee in this timeframe, your application will lapse, and you will have to submit it again.

Why Should You Submit an Application Online?

Choose online submission to ensure timely receipt and processing of your application, so you can avoid additional costs.

If your company’s annual review fee is approaching, make sure that ASIC receives and processes your deregistration application at least two weeks before the due date.

If not processed in time, you will have to pay the annual review fee in full, even if the company is inactive.

But, if you still don't want to send the form online, you can do it offline.

Follow the next steps:

- Include a cheque to cover the application fee and any outstanding ASIC fees

- Post the form to the address provided by ASIC on their official website

Step 3: Register as a Sole Trader

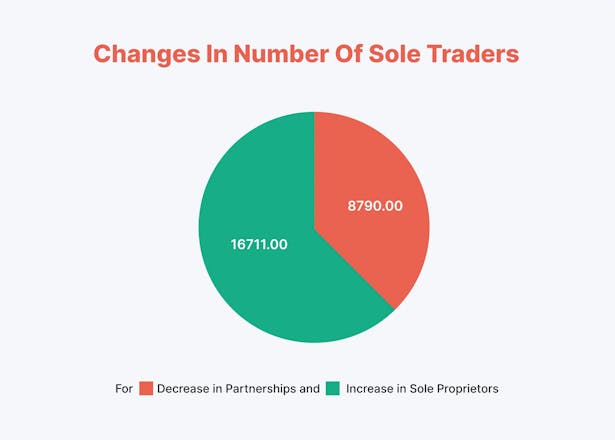

Australia had 784,744 sole traders as of June 2023.

This figure indicates a 2.2% (16,711) rise over the previous year, indicating a growing trend of individuals choosing sole trader structure over other business formats.

To get started as a sole trader in Australia, follow these key steps:

- Obtain an Individual Tax File Number (TFN): You'll need a TFN to pay your income tax.

- Apply for an Australian Business Number (ABN): This number is necessary for your business dealings with the government and other businesses.

- Register a Business Name: If you don't plan to use your own name for your business, you must register a business name with the Australian Securities and Investment Commission (ASIC).

- Register for Goods and Services Tax (GST): If your expected annual turnover is $75,000 or more, you need to register for GST.

📍 Note

For you as a sole trader, none of these things are mandatory, except for the TFN number.

However, each of them has its own benefit and reason why you should still obtain them.

Why Do You Need an Individual Tax File Number (TFN)? ✅

Without a TFN, your banking institution must withhold additional tax from payments they make to you.

Without a TFN, you can't:

- Apply for government benefits

- Register your tax return online

- Obtain an Australian Business Number (ABN)

Registering for a TFN is a required step in launching any type of business.

The good thing about sole traders is that you can use your individual TFN.

Why Should You Obtain ABN? ✅

You don’t have to register for an ABN, but doing so is free and makes managing your business easier, especially when registering for other taxes.

For example, if you need to register for GST now or in the future, you must apply for an ABN first.

If you don’t have ABN, businesses must withhold 47% of their payments to you for tax purposes.

Why Should You Register a Business Name? ✅

If you plan to trade under your personal name, for example, Alex Smith, you only need to apply for an Australian Business Number (ABN).

However, if you plan to use a business name different from your personal name, you must register it with ASIC.

This allows you to operate your business across any state or territory in Australia.

Even if you are adding something to your personal name, such as Alex Smith Consulting, you must register it as the business name.

Why Should You Register for GST? ✅

Registering allows you to reclaim the GST paid on certain goods and services used in your business operations.

Of course, it is difficult to predict your company's revenue, especially as a sole trader.

So, if you are not registered for GST, you should monitor your monthly turnover to see if you have achieved or are about to surpass the GST threshold of $75.000.

If your turnover exceeds the GST threshold, you must register within 21 days after reaching it.

Step 4: Update Business Details

When you make changes to the company, such as your business structure, name, or contact details, you must notify relevant agencies and organizations, in addition to stakeholders.

You have to notify ATO and ABR, about the following changes within 28 days:

- Postal, email, and business addresses

- Primary business activity

- Financial institution account information

- Authorized contact information

Step 5: Set Up New Financial Systems

When changing from a company to a sole trader, you can’t use the company’s bank account.

If you operate as a sole trader, you don’t have to open a separate business bank account.

Instead, you can use your own.

Conclusion

See?

Changing from a company to a sole trader doesn't have to be complicated and difficult.

If you follow the steps that we have prepared for you in this article, this transition can go much easier.

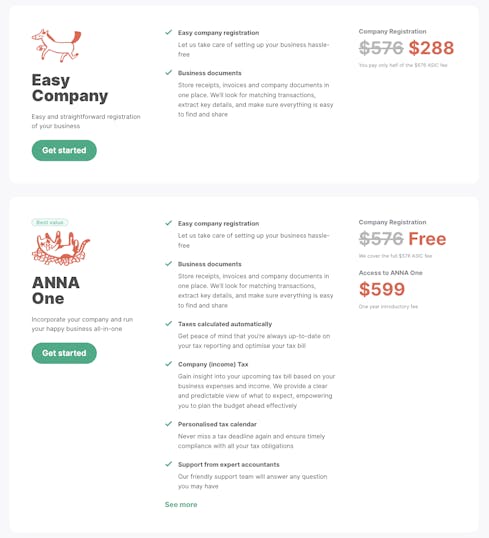

However, there is one solution that can simplify all your business-related tasks significantly.

Which one is that?

It is ANNA! ⭐

ANNA - Your Business Assistant

If you want to run your business from a single platform, the ANNA One package is right for you!

Who is it best for?

This package is great for those who want to:

⭐ Optimize their business operations

⭐ Manage taxes efficiently

⭐ Keep organized financial records

all while receiving expert guidance and modern financial tools!

What can ANNA One help you with?

⭐ Business document management - Store and organize receipts, invoices, and business papers in one location.

⭐ Small Business Accounting - Get automated transaction matching, key details extraction, and easy document sharing.

⭐ Automatic Tax Calculations - Stay updated with tax reporting, optimize your tax bill, and gain a clear understanding of potential tax bills based on business spending and profits.

⭐ Support from expert accountants - Get access to a friendly support team for any queries, with email support available during the early stages to assist with any questions or issues.

⭐ Bookkeeping Score - Stay on top of your bookkeeping and receive simple tips to keep your books neat.

⭐ GST and BAS calculation - Manage your annual company tax return (BAS) and GST calculations, with automatic GST calculation and direct logging with the ATO.

Create an account today and streamline your business operations! 🚀

FAQ

What Is the Application Processing Time for Deregistering a Company?

When you submit your deregistration application on paper, ASIC may take up to two weeks, including postage, to process it and post a notification on their website.

On the other hand, they will process online applications instantly.

After they post the notice on the website, your company may be deregistered two months later. ASIC will then send you a confirmation notice to finalize the process.

What to Do If ASIC Rejects Your Company Deregistration Application?

If ASIC declines your application, they will inform you of the reasons behind the rejection.

For further inquiries about your application, you can reach out to ASIC directly.