Learn how to change from a sole trader to a company and understand the process, benefits, and key considerations for making the transition.

If you came up with the idea to change the business structure, your business has certainly grown.

Congratulations!

Surely you know that the laws are not the same for all types of business, and now the question arises: How do I change from sole trader to company?

If that's your concern, you're in the right place!

In this article, in addition to addressing that query, you will also find out the differences between these two business structures and what are the benefits of your decision.

Let's start!

What Distinguishes a Sole Trader from a Company?

Legal, tax, and reporting duties for sole traders differ from those of companies:

1. Set up costs

- Sole trader business arrangements have lower startup expenses.

- Companies have more complicated business structures with greater start-up costs.

2. Record keeping

🔸For a sole trader:

- Business income and expenses are reported on your individual tax return using a separate business and professional items schedule.

- You don’t have to file a separate tax return for your business.

- You must preserve your financial records for 5 years, including tax returns.

- Make sure to notify government agencies of any business changes within 28 days.

🔸Companies must:

- File their own tax returns.

- Maintain tax records for at least five years.

- To comply with the Corporations Act of 2001, retain financial records for a minimum of seven years.

3. Business income

- The Australian Taxation Office (ATO) considers the money you generate from your sole trader business to be personal income.

- The company owns the money it earns, even if you own the business (as a shareholder).

4. Business debt liability

- A sole trader business structure makes you individually liable for financial or tax debts.

- The company is normally responsible for all business debts. However, if you are a director of a corporation and the company is unable to pay its debts, your personal assets may be put at risk.

5. Insurance

- Sole traders are not covered by workers' compensation insurance. Therefore, you should consider insurance for personal injuries, incapacity, and death.

- Directors' and officers' liability insurance is not required. However, it may be considered by directors.

6. Accessing money from your bank

- As a sole trader, you can withdraw funds from your business account as personal draws.

- A separate business bank account is required for a firm. As a director, the company may pay you a salary, wages, or director's fees, but you cannot simply withdraw funds as 'personal draws' from the company.

7. Control of business

- In a sole trader setup, you have complete control over your business.

- In a company structure, if you are the sole director, you will have complete power over your business, but certain decisions must still be documented as corporate resolutions.

If there are multiple directors, you will not have complete control. All directors are responsible for the internal management of the company and must follow particular regulations, such as the company's constitution or the applicable rules.

8. Ongoing costs

- As a sole trader, you must update your business name once a year. Business name registration costs $39 for one year or $92 for three years.

- Depending on your company's operations, various fees may apply at different times.

Your company's annual review date is usually the same as the date it was registered. ASIC issues a yearly statement and invoice shortly after this date. You must pay the annual review charge to keep your company registered. If you're considering a change in your business name as a sole trader, it's important to understand the process, especially as it differs from what you'll encounter when transitioning to a company structure.

9. Closing your business

- If you are a sole trader, you must cancel your ABN and business name within 28 days of discontinuing trading.

- You must properly deregister the company so that it no longer exists as a legal entity.

What Are the Benefits of Changing from Sole Trader to Company?

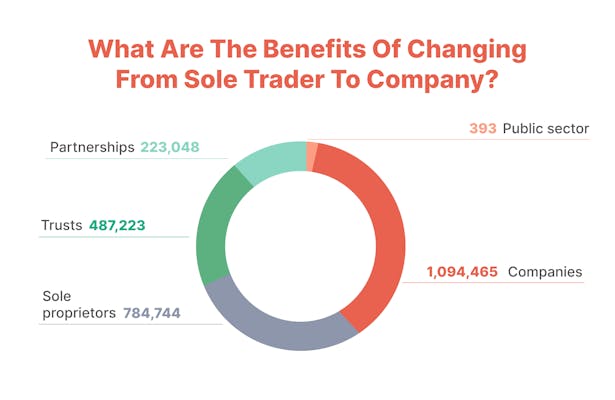

Even though opening a company brings more responsibility and compliance with a greater number of rules, it is still the leading business structure in Australia, with as much as 42%.

Let's look at the advantages of the company over the sole trader structure and see why a significant percentage of businesses in Australia are choosing a company:

✔️Limited Liability - As a sole trader or in a partnership, you are personally responsible for all aspects of your business, including debts and losses, which can endanger your personal assets. On the other hand, running a business as a company separates your personal assets from your business, offering a layer of protection.

✔️Tax-effective - Adopting a company structure can lead to lower taxes because of the reduced tax rate for businesses and the ability to claim various tax deductions.

✔️Brand recognition - Registering your company improves brand recognition and credibility, establishing it as a distinct entity accountable to ASIC and operating with an ACN. This status makes your business more appealing to third parties, improving your reputation which makes it easier to form future partnerships.

✔️Investments - Investors favor registered companies for investment opportunities because they can raise equity capital and borrow funds. The formal structure of registered companies gives investors confidence in the business.

How to Change from Sole Trader to Company?

Here are 3 key steps to change your business from sole trader to company!

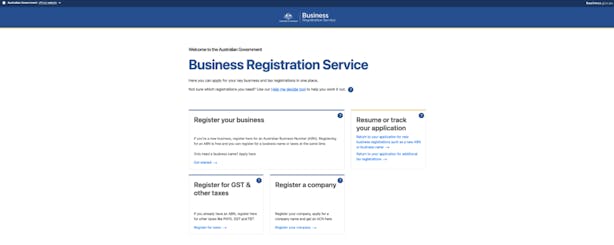

Step 1. Register Your Company

You can register your company using the Business Registration Service, which enables you to apply for an:

⭐ProTip

You can register your business name and get ABN and ACN, all from a single place!

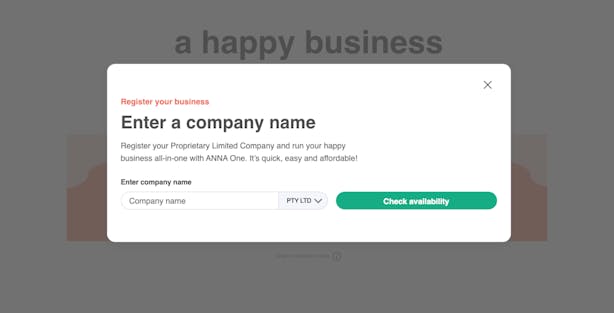

How to register a company with ANNA?

- Select a company name.

- Select ANNA One subscription.

- Give us some information about your business.

- We will tell you once your application is completed.

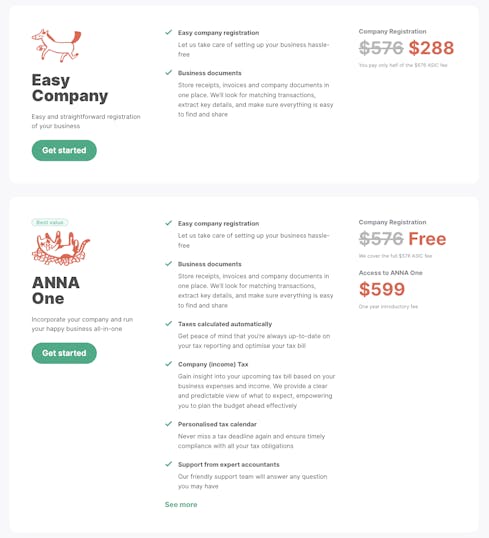

Another benefit?

For the registration price you would pay to ASIC, the ANNA One package offers additional benefits, including:

- Tax management

- Business account

- Invoice management

- Business cards

- and more.

With ANNA One, you get significantly more value: company registration is only $288, including the $575 ASIC fee!

Step 2. Transfer Your Assets

After you register a company, you have to transfer all assets to the new company.

Besides assets, this includes:

- Any licenses

- Trademarks

- and other IPs.

Step 3. Cancel Your ABN

If you've been doing business under your sole trader ABN, you'll need to terminate it.

You can’t use the sole trader’s ABN for your new company.

How to Cancel ABN?

Before you can cancel, keep in mind that you have to complete all of the government agencies' filing, reporting, and payment requirements.

We would suggest that you don't cancel your ABN until all steps have been completed.

Your business may need to:

- Lodge activity statements.

- Submit pay-as-you-go (PAYG) withholding reports.

- Repay GST credit refunds.

- Pay your outstanding tax debts.

Remember that canceling your ABN will also revoke your registration for:

- Any representative with a login credential for your business.

- This may restrict you from using certain government online services (GST, luxury car tax (LCT), wine equalization tax (WET), and fuel tax credits (FTC).

You can cancel your Australian Business Number (ABN) online with myGovID and Relationship Authorisation Manager (RAM).

If you do so, remember that all online changes to your ABN will take effect instantly.

What to Do If You Can’t Cancel Your ABN Online?

If you cannot cancel your ABN online, don’t worry, there are additional options for doing it.

- The first way is to call the Australian Business Register.

Keep in mind that you must be recorded as authorized, and you will have to establish your identity. Also, before calling ABR, it is important to prepare your tax filing number (TFN).

- Another way to cancel your ABN is to submit an application to cancel the registration form. You can order this form online by searching for NAT 2955.

- The third way is to contact your registered tax agency or BAS agent to deactivate your ABN.

Who to Contact When Changing Business Structure?

If you change your business's structure, name, or contact information, first, you must notify all stakeholders.

Besides them, you need to notify all appropriate organizations and agencies.

The changes in your business circumstances will determine who you tell.

Contact ASIC for changes in:

- Postal,

- Email, or

- Contact information

Contact ATO and ABR for:

- Postal, email, and business address

- Primary business activity

- Financial institution account information

- Authorized person contact details

📍Note

You must notify the ATO, ASIC, and ABR of any changes within 28 days.

Conclusion

Changing the business structure from a sole trader to a company has its benefits, but it also brings a lot of difficulties.

It is not easy to register a company, get an ABN number, and transfer all assets.

These are all time-consuming and sometimes frustrating tasks.

But what if they don't have to be that way?

We present you with an alternative way to solve this problem.

Meet ANNA!

ANNA - Your Business Companion

If you are ready to open your company in Australia, the ANNA One package is the easiest and fastest way to do it.

All you need is:

- Original company name

- Office address

- Director or shareholder information (including Director’s ID)

And we will do the rest of the work for you!

What else do you get from ANNA One in addition to opening a company?

⭐All documents saved in one place

⭐Automatically calculated taxes

⭐Detailed information on your upcoming tax bill, depending on your business expenses and income.

⭐Personalized tax calendar.

⭐Support from expert accountants.

⭐Annual company tax return statement (BAS).

⭐Automatic GST calculation and direct logging with ATO.

⭐Tips on keeping your books clean.

⭐Automated receipt matching and expense classification.

Sign up today and reach the goal of starting a company easier than ever!

FAQ

At What Point Should You Change from Sole Trader to Company?

A sole trader setup works well for a personal business in its early growth stages.

However, if your business keeps expanding and your annual profits rise into a higher tax bracket, it's wise to consider switching to a company structure.

Do You Need a New Business Name or Trademark When Changing Business Structure?

If you intend to change any registered trademarks or logos, you must first notify IP Australia. You will also need to transfer or delete your business name with the Australian Securities and Investments Commission (ASIC).