Commonwealth Bank vs ANZ - Which One to Choose?

Compare Commonwealth Bank and ANZ to evaluate their features, fees, and services, helping you choose the best bank for your financial needs.

When comparing ANZ and Commonwealth Bank (CommBank), it’s tempting to view them as interchangeable entities within Australia’s "Big Four."

After all, they both boast vast networks, diverse product offerings, and competitive services. However, the devil is in the details, and choosing between them often depends on your specific financial needs, lifestyle, and preferences.

CommBank vs ANZ - Overview

ANZ traces its roots back to 1835, starting as the Bank of Australasia in Sydney.

Today, it ranks among the world’s top 50 banks, with operations in over 30 global markets and a customer base exceeding 5 million.

Known for its extensive suite of financial products, including bank accounts, home loans, and credit cards, ANZ has solidified its presence in Australia with approximately 2,500 ATMs and 700 branches nationwide.

The Commonwealth Bank, established in 1911, has grown to become Australia’s largest bank, serving over 15 million customers. Its reach extends beyond Australia to New Zealand, Europe, Africa, and the Asia-Pacific region.

Offering a comprehensive range of banking services, from savings accounts and transaction accounts to credit cards and mortgages, CommBank boasts a stronger physical presence domestically, with around 4,000 ATMs and 1,000 branches across the country.

1. Commonwealth Bank – CommBank

Commonwealth Bank is one of Australia's most versatile financial institutions that offers solutions to various needs of businesses, industries, and individuals.

Here's a breakdown of what they offer:

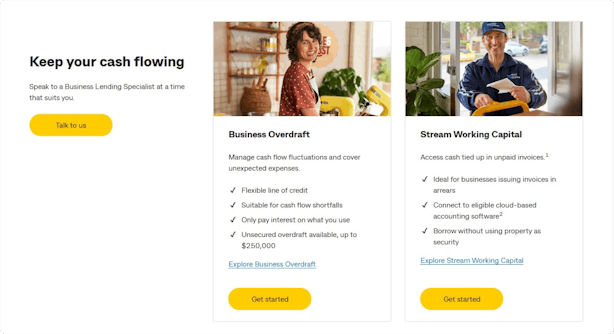

1. Business Cash Flow Solutions

CommBank provides robust tools and support to help businesses manage cash flow effectively and seize growth opportunities.

- Business Overdraft offers flexible credit for cash flow fluctuations, allowing businesses to access up to $250,000 without fixed repayments, ideal for covering unexpected expenses.

- Stream Working Capital connects with cloud-based accounting software for businesses dealing with delayed invoice payments, unlocking funds tied up in receivables.

To further empower businesses, CommBank also offers a complimentary cash flow management course developed with the UNSW Business School.

2. Business Bank Accounts

CommBank’s business bank accounts are known for flexibility and convenience:

- Transaction Accounts: Features like unlimited electronic transactions and Visa Debit Card compatibility (including Apple Pay) ensure seamless day-to-day operations. Customisable alerts keep users informed and in control.

- Savings and Term Deposit Accounts: Options such as the Business Online Saver and Business Investment Account offer competitive interest rates, flexibility, and easy access to funds, making them ideal for businesses looking to grow surplus cash reserves.

- Specialised Accounts: Tailored for industries such as real estate, legal, and not-for-profit sectors, these accounts meet statutory and operational needs while providing community-focused solutions.

3. EFTPOS, Payments, and eCommerce

CommBank delivers fast, secure, and versatile payment solutions:

- EFTPOS Terminals: Options range from portable solutions like the Smart Mini to in-store integrations like the Smart Integrated terminal. These terminals feature flat-rate or custom transaction fees and 24/7 support with rapid terminal replacement services.

- eCommerce and Online Payments: Businesses can connect secure online payment systems to existing platforms, manage billing efficiently, and set up online stores, allowing customers to pay anywhere, anytime.

- Industry-Specific Solutions: From retail to hospitality and healthcare, CommBank provides adaptable payment systems, including split-bill capabilities for restaurants or instant claims processing for medical practices.

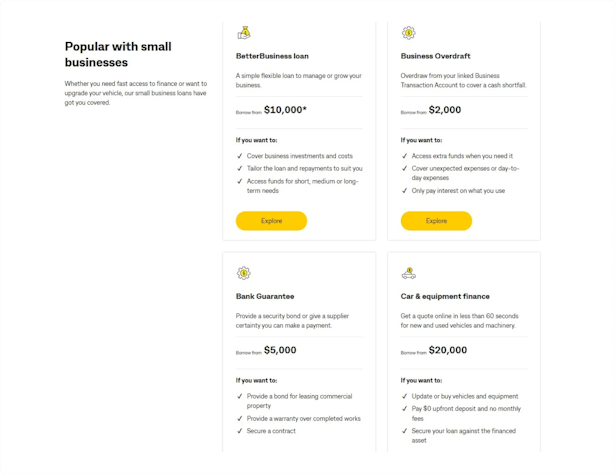

4. Business Loans and Finance

CommBank’s lending solutions are for businesses of all stages:

- Small Business Loans: Products like the BetterBusiness Loan and Car & Equipment Finance provide fast and flexible funding options, with the latter designed for upgrading vehicles or machinery with zero upfront deposit.

- Corporate Finance: For larger businesses, the Market Rate Loan and Working Capital Solutions offer highly adaptable financial support, while industry-specific financing meets unique needs like fleet management or medical equipment.

- Sustainable Finance: Initiatives like the Business Green Loan and Agri Green Loan enable businesses to fund environmentally-friendly projects, reflecting CommBank’s commitment to sustainability.

5. Business Credit Cards

CommBank’s business credit cards simplify expense management and reward spending:

- Low-Rate and Interest-Free Cards: Options like the Low Rate Credit Card and Interest-Free Days Card provide competitive interest rates and extended repayment periods.

- Awards Credit Cards: These cards allow businesses to earn CommBank Awards Points or Qantas Points, with benefits such as international travel insurance for high-spending cardholders.

- Corporate Solutions: Products like the Corporate Charge Card and virtual cards offer advanced expense tracking, security, and control for larger organisations with significant procurement or travel needs.

6. Specialist Support for Industries

CommBank tailors its services to address the unique challenges of various industries:

- Agribusiness: Solutions designed for farm operations, including environmental project financing.

- Health: Comprehensive tools for running medical practices, from payment systems to equipment finance.

- Hospitality and Retail: Industry-specific payment systems, seamless POS integration, and flexible financing.

- Not-for-Profits and Indigenous Businesses: Customised banking products support community and cultural needs, ensuring inclusivity.

2. ANZ

ANZ’s comprehensive suite of business solutions combines flexibility, innovation, and expertise, making it a go-to choice for Australian businesses seeking reliable banking and financial support.

For businesses starting or scaling up, ANZ’s offerings are designed to empower businesses to thrive.

1. Business Accounts

ANZ’s business accounts cater to various needs, whether you’re a sole trader, small business owner, or larger enterprise.

- Transaction Accounts: The Business Essentials account allows sole traders and single-director companies to separate personal and business finances, offering no monthly fees and unlimited ANZ ATM and electronic transactions.

For businesses requiring additional features, the Business Extra account includes 20 free staff-assisted transactions per month and optional overdraft facilities for a $10 monthly fee.

Both accounts integrate with accounting software and include features like real-time payment notifications and categorised spending insights in the ANZ App.

- Savings Accounts: The Business Online Saver account offers flexibility with unlimited transfers to a linked account and a competitive interest rate.

For businesses that prefer secure, fixed returns, the Business Notice Term Deposit provides customisable terms and guaranteed rates.

- Specialised Accounts: ANZ provides tailored accounts like the Statutory Trust Account for legal professionals and the Farm Management Deposit Account, which helps primary producers manage uneven cash flow while enjoying tax benefits.

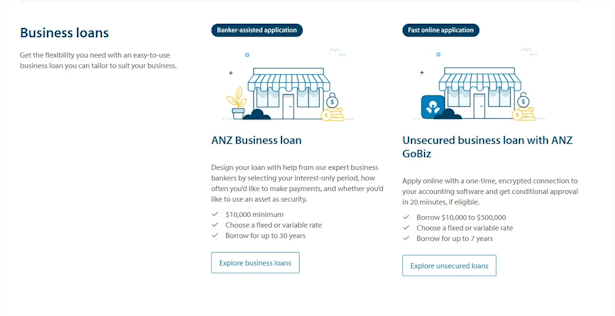

2. Business Finance

ANZ delivers versatile financing solutions to support business growth, cash flow management, and asset acquisition.

- Business Loans: The Business Loan allows flexible terms with secured or unsecured options, and businesses can customise repayment schedules and interest types. Through GoBiz, business owners can apply online and receive conditional approval in minutes, borrowing between $10,000 and $500,000 without needing to visit a branch.

- Business Overdrafts: ANZ offers secured and unsecured overdrafts for businesses needing extra funds to cover unexpected expenses. Interest is charged only on the amount used, with no fixed repayment deadlines.

- Asset Finance: ANZ simplifies acquiring vehicles or equipment with tailored financing options, using the asset itself as security. Energy-efficient purchases may qualify for discounts, further promoting sustainability.

- Bank Guarantees and Commercial Facilities: These options provide flexibility and security for businesses entering contracts or requiring specialised funding, such as invoice financing or tailored facilities.

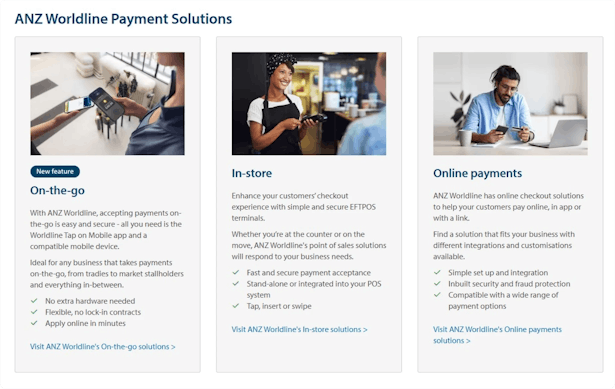

3. Payment Solutions with ANZ Worldline

ANZ partners with Worldline to offer advanced, secure, and flexible payment solutions for businesses:

- On-the-Go Payments: The Worldline Tap on Mobile app enables businesses like tradies and market stallholders to accept payments using only a compatible mobile device—no hardware required.

- In-Store Payments: ANZ Worldline’s EFTPOS terminals offer seamless integrations with POS systems, ensuring smooth customer transactions with tap, insert, or swipe options.

- Online Payments: ANZ Worldline’s solutions enable businesses to accept payments via website, app, or custom links with inbuilt security and fraud protection.

Additional features include same-day settlement into an ANZ Business Account and a Merchant Portal for actionable insights.

4. Business Credit Cards

ANZ provides several business credit card options to suit varying needs:

- Rewards Cards: The Business Black Card and Qantas Business Rewards Card offer uncapped points for eligible spending, along with exclusive benefits like travel insurance and bonus points for new customers.

- Low-Rate and Interest-Free Cards: For cost-conscious businesses, the Business Low Rate Card features competitive purchase interest rates, while the Business 55 Interest Free Days Card allows flexibility in managing purchases.

- Streamlined Applications: Through ANZ GoBiz, business owners can apply for a card online in just 20 minutes, integrating directly with accounting software.

5. Business Hub and Resources

ANZ’s Business Hub provides invaluable tools and guidance for entrepreneurs at all stages:

- Templates and Checklists: Resources include business plans, cash flow forecasts, and growth checklists to help businesses strategise and stay organised.

- Support for Specific Needs: From managing payments to improving cyber security, ANZ offers step-by-step guides, FAQs, and resources for various aspects of business management.

- Customer Stories: ANZ shares insights and experiences from other business owners, fostering inspiration and practical advice.

6. Specialist Support

ANZ’s industry-specific services address the unique challenges of sectors like agriculture, real estate, healthcare, and retail. From trust accounts for legal professionals to innovative payment solutions for tradies, ANZ demonstrates an understanding of the specific needs within each field.

CommBank vs ANZ – Final Verdict

These two banks might appear to be cut from the same cloth, with their vast networks and comprehensive product offerings, but each brings distinct strengths and specialisations to the table.

🟠 CommBank is better for:

- Businesses that need a strong physical presence for banking.

- Those prioritising cash flow management and comprehensive training resources.

- Businesses in industries like retail, hospitality, or healthcare requiring advanced payment systems.

🟠 ANZ is better for:

- Startups and sole traders looking for affordable and straightforward banking.

- Digitally savvy businesses that prefer online applications and integrations with accounting software.

- Tradies or businesses on the move, thanks to Worldline’s on-the-go payment solutions.

But what if your business demands more than what traditional banking can offer? Meet ANNA, a fresh and innovative player that’s redefining what it means to manage business finances.

ANNA: A New Era of Business Banking

Unlike CommBank and ANZ, ANNA isn’t just a bank; it’s an all-in-one business management platform designed for modern entrepreneurs.

While the Big Four focus on conventional banking products, ANNA integrates essential financial tools like bookkeeping, tax management, and invoicing into a seamless experience.

It eliminates the need to juggle multiple apps or services, offering a single, cohesive solution to handle your business’s financial needs.

With ANNA, business owners can expect more than just transactions and accounts:

- Tax and Compliance Simplified: ANNA’s AI-driven tax tools automatically calculate GST, set aside tax funds, and file BAS and company tax returns. This not only saves time but ensures compliance without the stress.

- Automated Financial Insights: From tracking expenses with a smart receipt scanner to providing real-time financial overviews, ANNA empowers business owners to make data-driven decisions.

- Enhanced Payment Solutions: Virtual and physical credit cards make managing team expenses effortless, while automated invoicing and reminders ensure you get paid faster.

- Personalised Support: ANNA’s award-winning 24/7 customer support is designed to assist small business owners with queries big or small, offering a level of care that’s often hard to find.

While CommBank and ANZ offer the reliability and scale of established institutions, ANNA represents the future – a smarter, integrated approach that supports your business in ways traditional banks cannot.

In case you need a streamlined way to manage finances, tools to automate your tax responsibilities, or just a banking experience that feels tailored to your needs, ANNA proves itself as a forward-thinking alternative that’s hard to ignore.

Sign up for ANNA today and experience the future of business banking—streamlined, stress-free, and designed just for you.