What's the Difference Between a Sole Trader and a Partnership?

Discover the differences between sole traders and partnerships, including legal structures, tax implications, and benefits to choose the right fit.

- In this article

- Why Structure Matters

- Sole Trader: An Overview

- Partnership: An Overview

- Sole Trader vs Partnership: Quick Comparison Table

- When Should You Use Each Structure?

- Key Considerations: Liability and Risk

- How To Transition from Sole Trader to Partnership

- Common Mistakes to Avoid

- Day-to-Day Management Differences

- Is a Company Structure Better?

- So, What’s ANNA One All About?

Choosing the right structure when starting a business can have a profound impact on how you operate, how you’re taxed, and how vulnerable your personal assets might be.

In Australia, two common options for small ventures are sole trader and partnership.

Both are relatively straightforward to set up, yet they differ in several important ways, particularly regarding ownership, liability, taxation, and day-to-day management.

Why Structure Matters

When you’re eager to launch a new venture, whether it’s a home bakery or a consulting service, it’s tempting to dive in without overthinking.

However, your choice of business structure can affect:

- Personal liability: Could your personal assets (like your home or car) be at risk if something goes wrong?

- Tax obligations: How will your profits be taxed? Who needs to file a return, and in what manner?

- Control and decision-making: Will you call all the shots, or will you share that authority with one or more partners?

- Setup and running costs: How complicated and expensive is it to register and maintain the chosen structure?

Sole trader and partnership models are generally simpler and more affordable than registering a company, but they still come with unique pros and cons you need to understand.

Sole Trader: An Overview

A sole trader is an individual who runs a business under their own name (or under a registered business name if preferred).

This is the simplest and most direct way to operate a small business in Australia.

1. Ownership and Control

- A sole trader has total ownership and authority.

- You make all the decisions (strategic, financial, or operational) without needing another person’s sign-off.

2. Liability

- There is no legal separation between you and your business.

- All liabilities and debts fall on you personally. If your business fails or is sued, your personal assets could be on the line.

3. Setup and Registration

- Generally straightforward: you must get an Australian Business Number (ABN).

- If you plan to operate under a name different from your exact personal name, you need to register that business name with the Australian Securities and Investments Commission (ASIC).

- While not legally required, many sole traders open a separate bank account to keep business and personal finances distinct.

4. Taxation

- Business income is considered personal income.

- You declare your business profits (or losses) on your individual tax return.

- You’re taxed at individual marginal tax rates, which can be advantageous if your profits are low but may become less appealing if your business income grows significantly.

Advantages

✅ Simplicity: Easy to set up and manage.

✅ Full Control: No need to consult partners on decisions.

✅ Direct Taxation: Lodging one personal tax return that includes business income.

Disadvantages

❌ Unlimited Liability: Personal assets are not protected if the business incurs debt or faces a lawsuit.

❌ Resource Constraints: Limited capital and expertise (everything rests on one individual).

❌ Loneliness in Decision-Making: No built-in support network for day-to-day challenges, unless you hire employees or seek external advisors.

Partnership: An Overview

A partnership involves two or more people (or entities) who carry on a business together with a view to making a profit.

Partnerships in Australia can be general or limited:

- In a general partnership, all partners share unlimited liability.

- In a limited partnership, one or more partners may have limited liability, but at least one partner must have unlimited liability.

1. Ownership and Structure

- A partnership is owned by at least two people, who contribute money, property, labor, or skill.

- Responsibilities, profits, and losses are shared according to a partnership agreement (ideally a written one, though it’s not strictly mandatory).

2. Liability

- In a general partnership, each partner is personally liable for the business’s debts and obligations. One partner’s mistake can affect everyone.

- In a limited partnership, some partners have liability capped at what they invested, but at least one partner carries full liability.

3. Setup and Registration

- Similar to sole traders, a partnership must have an ABN.

- Any business name that doesn’t consist entirely of the partners’ legal names must be registered with ASIC.

- Partnership Agreement: Although not legally mandated, having a written agreement can prevent conflicts and outline how profits, losses, roles, decision-making, and dispute resolution are handled.

4. Taxation

- The partnership itself does not pay income tax on its profits.

- Instead, it submits an annual partnership tax return to the Australian Taxation Office (ATO) to declare overall income and expenses.

- Each partner includes their share of the partnership’s profit (or loss) in their personal tax return, paying tax according to individual marginal rates.

Advantages

✅ Shared Responsibility: Partners can divide tasks based on strengths (e.g., one handles marketing, the other handles finances).

✅ Resource Pooling: Easier to gather capital and share expertise.

✅ Relatively Simple Setup: More than a sole trader, but simpler than forming a company.

Disadvantages

❌ Unlimited Liability in a general partnership, exposing personal assets.

❌ Potential Conflicts: Disputes over strategy, investment, workload, or profit-sharing can strain relationships.

❌ Limited Capacity: While a partnership can expand by adding more partners, it may still be less flexible in raising large-scale capital compared to registering as a company.

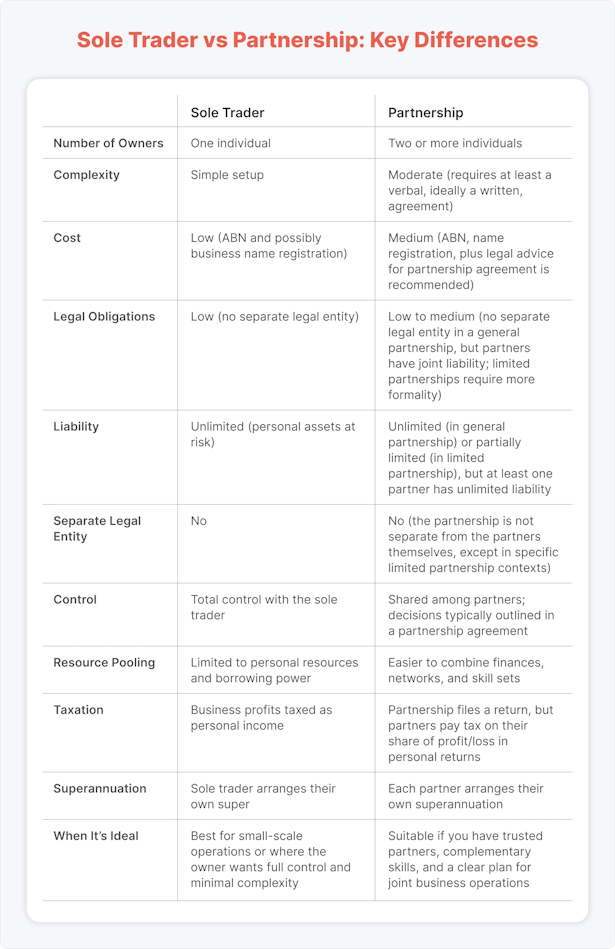

Sole Trader vs Partnership: Quick Comparison Table

To help you see how these two structures measure up, here’s a concise table summarising the main points:

When Should You Use Each Structure?

Even though both structures are quite common, it’s useful to imagine how they might play out in different settings:

1. Freelance Consultant

If you’re a consultant or contractor working independently, a sole trader setup might be enough. You enjoy simpler administration, and you don’t need to coordinate with anyone else.

2. Two Friends Launching a Café

If you and a friend both invest capital, share a passion for food, and split day-to-day tasks like baking, serving, and managing finances, a partnership could be a good fit.

You can pool resources and creativity, but you also share liability.

3. Growing Side Hustle

Perhaps you start as a sole trader selling handmade products online. As your business gains momentum, you might invite a trusted colleague to join as a partner.

In this scenario, you’d transition from a sole trader structure to a partnership model, requiring additional registrations and steps.

4. Professional Services Firm

In fields like accounting, law, or design, a partnership is often chosen to combine different skill sets under one brand. Partners might each have specific specialties, making the firm more versatile.

Key Considerations: Liability and Risk

One of the biggest differences between a sole trader and partnership structure is how risk is allocated:

- Sole Trader: All the risk is on one person. For example, if you run a dog-grooming service and a client sues you for negligence, you could face personal lawsuits.

- Partnership: In a general partnership, if one partner acts negligently, all partners could be liable. This “joint and several liability” means each partner can be on the hook for the total amount of a debt or claim if other partners cannot pay.

Limited partnerships do limit liability for certain partners (often called “silent” partners), but at least one partner still has unlimited liability.

These structures are more complex, so they’re less common for small-scale ventures just starting out.

How To Transition from Sole Trader to Partnership

If you already run a successful sole trader business and want to bring on a partner, maybe someone with additional capital or expertise – here’s a general roadmap:

1. Agree on Terms: Talk through the proposed partnership, including financial contributions, strategic goals, and day-to-day responsibilities.

2. Create a Partnership Agreement: This should be a comprehensive document that covers profit splits, liabilities, decision-making processes, and exit clauses.

3. Apply for a New ABN: A partnership is a new entity, so you’ll need a fresh ABN.

4. Transfer or Register the Business Name: If you previously registered a business name as a sole trader, you can transfer it to the partnership via the Australian Business Register (ABR).

5. Notify the ATO: You generally have 28 days to inform the ATO of changes. You’ll also need a Tax File Number (TFN) for the partnership.

6. Register for GST (if required): If the partnership is likely to exceed $75,000 in annual turnover, you must register for GST.

7. Set Up a Partnership Bank Account: Keep finances separate to simplify accounting.

8. Update All Documentation: This includes websites, business cards, contracts, marketing materials – anything that references the now-defunct sole trader setup.

9. Capital Transfers: If you’re transferring assets or funds into the new partnership, be sure to record these transactions accurately for tax purposes.

10. Superannuation: Each partner must still arrange their own.

Common Mistakes to Avoid

❌ Skipping a Written Agreement in a Partnership: Verbal or informal agreements are a breeding ground for misunderstandings. Always draft and sign a clear partnership agreement.

❌ Mixing Personal and Business Finances: This is especially problematic for sole traders who don’t bother with a separate bank account. It complicates tax time and can blur lines between personal and business liability.

❌ Ignoring Tax Registration Requirements: Missing the threshold for GST or failing to get an ABN can lead to legal and financial headaches.

❌ Not Considering Personal Liability: Under both sole trader and general partnership structures, you have unlimited liability. Make sure you understand this risk and consider insurance or structuring changes if your business grows substantially.

❌ Failing to Plan for Growth or Exit: Even if you start small, you might grow. A robust plan, especially in a partnership, can address how to onboard additional partners or manage someone’s exit.

Day-to-Day Management Differences

⚡ Decision-Making

- Sole Trader: You decide everything, from small expenses to major strategic pivots.

- Partnership: Decisions typically require consensus or a process spelled out in the partnership agreement (majority vote, unanimous vote, or designated roles).

⚡ Workload

- Sole Trader: Expect to handle or outsource administrative tasks, accounting, marketing, and service delivery.

- Partnership: Responsibilities can be split; one partner might focus on client relations while another handles internal processes.

⚡ Conflict Resolution

- Sole Trader: No conflict with partners, but you might feel isolated or overloaded.

- Partnership: Conflicts can arise if partners disagree on strategy, financial allocation, or roles. A written agreement helps prevent or resolve these issues.

⚡ Financial Reporting

- Sole Trader: You track income and expenses for your personal tax return.

- Partnership: Maintain partnership accounts, file an annual partnership return, then each partner reports their share of the income or loss.

Is a Company Structure Better?

While this article focuses on sole traders and partnerships, it’s worth mentioning that a company (e.g., a proprietary limited company) is another common structure.

A company is a separate legal entity, offering limited liability protection to its shareholders. However, the setup cost and ongoing compliance requirements (like annual reviews, formal directorship obligations, and detailed reporting) can be more complex and expensive than operating as a sole trader or partnership.

Many Australian small businesses start as either a sole trader or a partnership because of simplicity, then consider transitioning to a company structure if and when they grow large enough to warrant extra liability protection or need to attract significant investment.

So, What’s ANNA One All About?

If, after exploring sole trader and partnership structures, you decide that a company structure might be your best move, ANNA One is here to help.

Think of it as your all-in-one solution for quickly setting up a company and managing the financial nuts and bolts – bookkeeping, invoicing, GST, and taxes – without the usual stress.

Register your company for free and open a business account that simplifies every aspect of your finances. ANNA One’s tools keep your records tidy, remind you of due dates, and even help with day-to-day tasks like paying bills and sending invoices.

Ready to Take the Leap? Here’s How It Works:

⚡ Pick a Snazzy Name: Let ANNA check if your preferred company name is available in Australia.

⚡ Set Up Your Registered Office: Provide a formal office address to comply with local regulations.

⚡ Director and Shareholder Details: Enter your basic information—and you’re nearly done.

⚡ All Set! – Once you hit submit, your company is officially registered, and your new business bank account is ready for action.

But Wait, There’s More!

- Seamless Invoicing: Create professional-looking invoices in just a few clicks (and ANNA can even follow up on unpaid ones for you).

- Tax Peace of Mind: With a personalised tax calendar and friendly reminders, you’ll never miss another GST, BAS, or any other crucial deadline.

- Friendly Support Team: Whether you need help with day-to-day questions or guidance for a bigger business decision, ANNA’s experts are a quick message or phone call away.

Why wait? Register your company with ANNA One today and set your business up for smooth sailing – minus the usual financial and administrative headaches.