Do You Need an ABN to Sell on Shopify [Guide]

Learn whether you need an ABN to sell on Shopify, including legal requirements, benefits, and key considerations for Australian sellers.

You're ready to launch your Shopify store, but before you start selling, there's one important question: Do you need an Australian Business Number (ABN)?

If you’re selling casually as a hobby, an ABN may not be required.

But you need one if you’re running your store as a business (selling regularly and aiming for profit).

And once your revenue reaches $75,000 per year, GST registration (which requires an ABN) becomes mandatory.

Many new Shopify sellers delay this step, only to face tax issues later. This guide will clarify when you need an ABN, why it matters, and how to get one so you can focus on growing your business with confidence.

What Is an ABN?

An Australian Business Number (ABN) is an 11-digit unique identifier issued by the Australian Taxation Office (ATO). It allows businesses to legally operate, register a business name, and interact with government agencies, suppliers, and customers.

What Does an ABN Do?

Having an ABN allows you to:

✅ Register a business name and operate legally in Australia

✅ Issue tax invoices to customers

✅ Claim GST (Goods and Services Tax) credits

✅ Avoid 47% tax withholding from businesses paying you

✅ Access wholesale suppliers that require an ABN

✅ Register a .com.au domain for a professional website

In short, an ABN is essential if you want to sell products as a business rather than just a casual hobby.

Do You Need an ABN to Sell on Shopify?

1. Selling on Shopify as a Hobby

If you are selling as a hobby, you are not required to register an ABN. However, the ATO has specific criteria for what qualifies as a hobby vs. a business.

You are likely selling as a hobby if:

- You do not intend to make a consistent profit

- You only sell occasionally and not as a regular activity

- You do not advertise, promote, or reinvest profits

- You don’t buy products in bulk or restock inventory

- Your annual sales are significantly less than $75,000

Example: Selling as a Hobby

Emma loves making handmade candles and occasionally sells them on Shopify.

She only makes candles when she has spare time and doesn’t actively market her store.

Since she doesn’t intend to make a long-term profit, she is selling as a hobby and doesn’t need an ABN.

2. Selling on Shopify as a Business

If your Shopify store is structured to make a profit, then it is considered a business and you must register for an ABN.

You are likely running a business if:

- You regularly sell products or services

- Your store has branding, advertising, or marketing strategies

- You reinvest profits into buying stock, running ads, or expanding

- Your Shopify store is a primary or secondary source of income

- You keep financial records and operate like a business

Example: Selling as a Business

Jake starts a Shopify store selling customised phone cases. He advertises on social media, works with a manufacturer to produce stock, and offers discounts for repeat customers.

Since his goal is to scale the business and make consistent profits, he is running a business and must have an ABN.

❗ Key Rule: Earning More Than $75,000 Per Year

Even if you start as a hobby, the moment your annual revenue reaches $75,000, you are legally required to:

✅ Register for an ABN

✅ Register for GST (Goods and Services Tax)

💡Did you know what cities have most Shopify stores? 👇

Why You Should Register for an ABN (Even If Not Required)

Even if you technically don’t need an ABN, registering one comes with several advantages:

1️⃣ Professionalism & Trust

Customers and suppliers are more likely to trust a registered business than a random Shopify store with no credentials. An ABN adds legitimacy and boosts customer confidence.

2️⃣ Tax Benefits & GST Claims

With an ABN, you can:

- Register for GST and claim tax credits

- Deduct business expenses from your taxable income

- Avoid 47% tax withholding from suppliers

3️⃣ Access to Wholesale Suppliers

Many wholesalers and suppliers only work with businesses that have an ABN. If you want to buy products at wholesale prices, an ABN is essential.

4️⃣ Registering a .com.au Domain

If you want a professional website like yourstore.com.au, you must have an ABN. Australian domain providers require an ABN to issue .com.au domains.

5️⃣ Easier Business Growth & Financing

Banks, lenders, and investors only recognise registered businesses. If you plan to grow your Shopify store, whether through scaling operations, hiring a Shopify development service, or expanding product lines, and need funding, having an ABN will make it easier to secure loans.

How to Apply for an ABN

Applying for an ABN is free and takes about 15 minutes.

Step 1: Visit the ABR Website

Go to the Australian Business Register (ABR)

Step 2: Choose Your Business Structure

- Sole Trader (Most Shopify owners choose this)

- Partnership (If you run the store with a partner)

- Company (For larger, more complex businesses)

Step 3: Provide Business Details

- Business name (if applicable)

- Type of business activity (e-commerce, retail, dropshipping, etc.)

- Contact details and business location

Step 4: Submit Application

If all details are correct, your ABN is issued instantly.

Did You Know? The Most Popular Domains for Shopify Stores in Australia

Did you know that nearly half of all Shopify stores in Australia use a .com.au domain?

While .com remains a strong contender, Australian businesses have been quick to adopt country-specific domains to establish trust and local credibility.

📌 Here’s how Australian Shopify stores are choosing their domains:

- 48.1% use .com.au (57,264 stores)

- 40.2% use .com (47,865 stores)

- 2.2% use .store (2,641 stores)

A smaller percentage of businesses uses other domains like .co, .au, .shop, and .net.

Choosing a .com.au domain signals that your store is Australian-based and verified, which can build customer trust and improve local SEO.

If you’re setting up a Shopify store in Australia, securing an ABN is required to register a .com.au domain, which is another reason why getting your business structure right from the start is essential!

Common Mistakes Shopify Sellers Make (And How to Avoid Them)

Setting up a Shopify store is an exciting step, but many sellers make mistakes that can lead to tax issues, legal trouble, and financial mismanagement.

Avoiding these mistakes early on will help your business run smoothly and ensure compliance with Australian regulations.

1️⃣ Waiting Too Long to Register an ABN

Why it’s a mistake:

Many Shopify sellers start as a hobby, casually selling a few products without officially registering their business.

However, as their store grows and they begin earning consistent revenue, they unknowingly cross into business territory.

The ATO considers a seller a business if they are:

✅ Selling with the intention of making a profit

✅ Reinvesting money into stock, marketing, or branding

✅ Regularly selling products and managing an online store

What happens if you delay registering for an ABN?

- If you don’t have an ABN but operate as a business, other businesses may be required to withhold 47% of your payments for tax purposes.

- If your business continues growing and you reach the $75,000 GST threshold, you may owe backdated GST payments from your revenue.

- You cannot legally register a business name, invoice properly, or claim GST credits without an ABN.

How to avoid this mistake:

If you are selling regularly on Shopify, it’s best to register an ABN early, even if you’re not making huge profits yet. This ensures compliance and prevents tax headaches in the future.

2️⃣ Not Registering for GST When Required

Why it’s a mistake:

The moment your annual turnover exceeds $75,000, you are legally required to register for GST and charge 10% GST on your sales. Failing to do so can result in:

❌ Penalties from the ATO for non-compliance

❌ Having to back-pay GST from past sales (which can be financially overwhelming)

❌ Incorrect tax reporting, making it harder to claim deductions

Example:

Let’s say Lisa runs a Shopify store selling handmade jewellry.

She started casually but over time, her store grew, and by the end of the financial year, she made $85,000 in sales.

Since she did not register for GST, she now owes 10% GST on all sales over $75,000 – meaning she has to back-pay at least $1,000 in GST to the ATO.

How to avoid this mistake:

- Track your Shopify store’s revenue closely. Once you approach the $75,000 mark, register for GST before you exceed the threshold.

- If you register for GST, update your Shopify prices to include the 10% GST so you don’t accidentally undercharge customers.

- Keep proper tax records using accounting software like ANNA One, Xero, or Rounded to make tax time easier.

3️⃣ Using a Personal Bank Account Instead of a Business Account

Why it’s a mistake:

Many Shopify sellers mix personal and business finances, using their personal bank account to receive payments, pay suppliers, and cover expenses. This leads to:

❌ Confusion at tax time – sorting through transactions to separate business and personal expenses is time-consuming.

❌ Difficulty tracking business cash flow – without clear records, it’s harder to see if your business is profitable.

❌ Problems when applying for loans or business funding – banks prefer businesses with separate financial records.

✅ How to avoid this mistake:

- Open a business bank account under your registered business name. This makes it easy to track sales, expenses, and profit.

- Use a separate business debit or credit card for Shopify-related expenses.

- Sync your Shopify payments directly to a business accounting system to automate bookkeeping.

4️⃣ Failing to Issue Proper Tax Invoices

Why it’s a mistake:

Once your Shopify store operates as a business, you must provide proper tax invoices when selling to Australian customers. A tax invoice is required for:

✅ Business customers who need to claim GST credits

✅ Large transactions (typically over $82.50)

✅ Legal and tax record-keeping

A tax invoice must include:

- Your ABN

- The words "Tax Invoice"

- Your business name and address

- The total amount of GST charged (if registered for GST)

- The date of issue

What happens if you don’t provide tax invoices?

❌ Customers may not trust your business legitimacy

❌ You may face issues with ATO tax audits

❌ You won’t be able to claim GST credits on business expenses

How to avoid this mistake:

- Set up automatic invoicing in Shopify or use software like ANNA to generate compliant tax invoices.

- Always include your ABN and GST details on invoices (if registered for GST).

- Keep copies of invoices for at least 5 years for tax record-keeping.

5️⃣ Not Keeping Accurate Business Records

Why it’s a mistake:

Shopify sellers often neglect proper bookkeeping, which leads to:

❌ Unpaid taxes and incorrect tax returns

❌ Missed GST claims on expenses

❌ Financial mismanagement – not knowing how much profit you’re actually making

How to avoid this mistake:

- Use accounting software to automatically track income and expenses.

- Keep digital copies of receipts, invoices, and Shopify transactions.

- Set aside money for tax payments so you don’t fall behind.

6️⃣ Underpricing Products & Forgetting Business Costs

Why it’s a mistake:

New Shopify sellers often set their prices too low, not accounting for:

- Shopify transaction fees (up to 2.9%)

- Shipping costs

- GST (if registered)

- Marketing & advertising expenses

If you don’t factor in these costs, you might end up losing money instead of making a profit.

How to avoid this mistake:

- Calculate your total cost per product, including platform fees, taxes, and packaging costs.

- Research competitor pricing to set profitable prices.

- Consider adding a buffer for discounts or promotions.

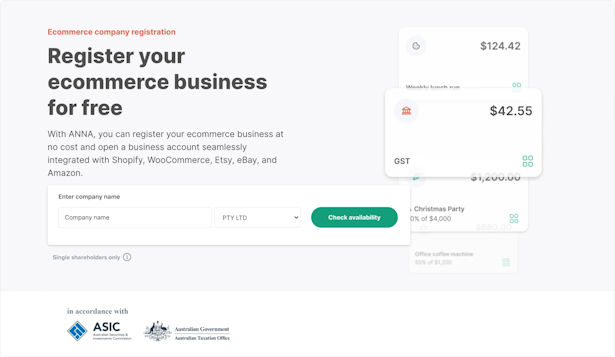

How ANNA Can Help You Build a Compliant & Scalable Shopify Business

Avoiding these common Shopify mistakes is just the first step but having the right tools in place ensures that your business remains legally compliant, financially organised, and ready to scale.

At this point, ANNA steps in.

ANNA is a comprehensive business solution for Australian entrepreneurs, including Shopify store owners.

It streamlines everything from ABN registration and bookkeeping to tax management and invoicing so you can focus on what matters most: growing your store.

Why ANNA is the Perfect Partner for Shopify Sellers

Whether you’re just starting out or looking to scale your Shopify business, ANNA provides a full-service solution that eliminates financial and tax-related headaches.

Here’s how ANNA can help:

1️⃣ Register Your ABN & Business Name in Minutes

If you’re selling on Shopify as a business, an ABN is essential, but navigating the registration process can be confusing. ANNA makes it fast and simple by handling:

- ABN registration for sole traders and companies

- Business name registration with ASIC

- Delivery of your ACN (Australian Company Number) and other legal documents straight to your inbox

2️⃣ Hassle-Free Bookkeeping & Expense Tracking

Tracking Shopify sales, expenses, and business transactions can quickly become overwhelming, especially if you’re still using a personal bank account for business.

With ANNA, you get:

- Automatic bookkeeping that syncs with your bank transactions

- Expense tracking with digital receipt storage

- Invoicing tools for professional, tax-compliant invoices

- A real-time financial overview to track revenue and cash flow

No more guessing how much profit you’re actually making, because ANNA keeps everything organised for you.

3️⃣ Stay GST Compliant Without the Stress

Reaching $75,000 in annual revenue means mandatory GST registration, which can complicate your Shopify finances.

ANNA helps you stay compliant by:

- Automating GST calculations on your Shopify sales

- Tracking key tax dates to ensure you never miss a deadline

- Generating Business Activity Statements (BAS) for seamless tax reporting

With ANNA, you never have to worry about underpaying GST or getting caught off guard by tax obligations.

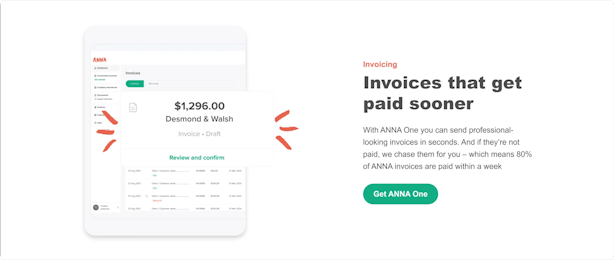

4️⃣ Simplify Shopify Invoicing & Payment Processing

Whether you’re selling physical products, digital downloads, or services, professional invoices help build trust with customers and suppliers.

ANNA offers:

- Customisable invoicing templates that meet Australian tax laws

- Automated invoice follow-ups to reduce late payments

- Integration with Shopify Payments and Stripe for seamless transactions

Having clear, professional invoices with your ABN ensures your business remains credible and compliant with tax laws.

5️⃣ Keep Your Business Documents Secure & Accessible

From invoices and tax records to business registration documents, managing paperwork can be a nightmare.

ANNA provides:

- Secure cloud-based document storage

- Easy access to receipts, tax records, and legal documents

- A streamlined system to organise everything in one place

No more digging through emails or shoeboxes of receipts – all your business documents are just a click away.

6️⃣ Expert Support for Your Shopify Business

Running a Shopify store comes with financial and tax complexities but you don’t have to figure it all out alone.

With ANNA, you get:

- Friendly support from business experts

- Guidance from professional accountants

- Help with tax obligations, ABN registration, and compliance

Get Started with ANNA Today

Building a successful Shopify store starts with avoiding costly mistakes and using the right financial tools to keep your business compliant.

- Need an ABN & Business Name for your Shopify store? ANNA can register it for you hassle-free.

- Struggling with bookkeeping, invoicing, or GST management? ANNA automates it all.

- Want expert support to help grow your Shopify business? ANNA is here to help.

Take the next step today – sign up for ANNA and simplify your Shopify business operations!

FAQ

1. Can I Start Selling On Shopify Without An ABN?

Yes, but only if you are selling as a hobby. If you are running a business, an ABN is required.

2. What Happens If I Don’t Register For An Abn But My Shopify Store Earns Money?

Without an ABN, other businesses may be required to withhold 47% of your payments for tax purposes.

3. How Long Does It Take To Get An Abn?

Most ABNs are issued instantly if the application is complete and correct.

4. Do I Need A Separate Abn If I Already Have One For Another Business?

No, you can use the same ABN for multiple business activities as long as they fall under the same entity.

5. Can I Switch From A Hobby To A Business Later?

Yes, you can register for an ABN anytime if your Shopify store evolves into a business.