Learn whether you need an ABN for Uber, including legal requirements, tax obligations, and key considerations for Australian drivers.

- In this article

- What Is the Gig Economy?

- ABN: What It Is and Why It Matters

- Why Rideshare Drivers Are Classified as Sole Traders

- The GST Obligation for Uber Drivers

- Step-by-Step to Getting Your ABN and GST Registration

- Managing Your Taxes as an Uber Driver

- What Happens If You Don’t Register for an ABN or GST?

- Additional Tips for Success as an Uber Driver

- Conclusion

- How Can ANNA Help You Get Started With Uber?

With its promise of flexible hours, independence, and a straightforward onboarding process, it’s no surprise that driving with Uber has become one of the most popular options for those seeking extra cash or a full-time gig on their own terms.

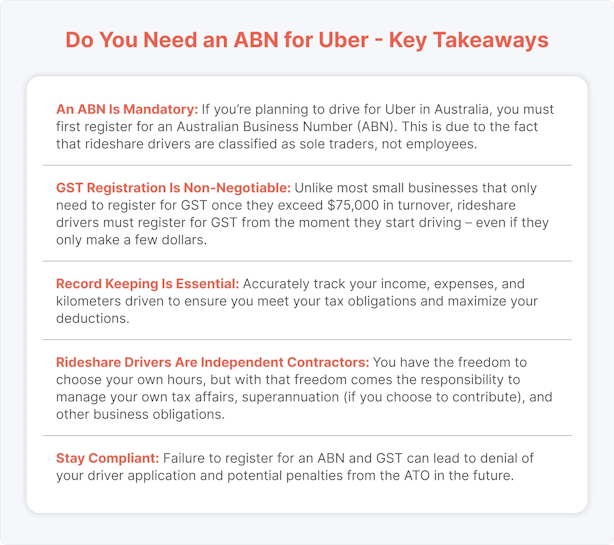

One of the biggest questions at the start of the journey is: Do you need an ABN (Australian Business Number) to drive for Uber in Australia? The short answer is yes – but there’s a lot more to the story.

In this blog post, we’ll explore the role of the ABN in a rideshare driver’s life, why it’s required, and what you need to know about GST obligations and tax implications.

What Is the Gig Economy?

Before we dive into the specifics of ABNs for Uber drivers, it’s useful to take a quick look at the broader context of the gig economy.

Put simply, the gig economy is characterised by flexible, short-term, and on-demand work. Ridesharing platforms like Uber have been at the forefront of this change, allowing Australians to earn an income without following traditional employment structures.

⚡ Flexibility: One of the biggest draws of the gig economy is the freedom to choose your own schedule.

Whether you want to drive on weekends, at night, or only when there’s a major event in town, you’re in the driver’s seat, both literally and figuratively.

⚡ Variety of Options: Beyond ridesharing, many gig workers pick up extra gigs such as food delivery or freelance projects on different platforms. This can lead to multiple streams of income.

⚡ Lower Barriers to Entry: Signing up with Uber typically involves relatively minimal requirements – possession of a valid driver’s licence, a suitable car, and the right to work in Australia.

However, you also need to be aware of tax obligations, which include registering for an ABN and (for most rideshare drivers) registering for GST.

In essence, while the gig economy offers new and flexible ways of working, it also brings new responsibilities you should understand from a tax and legal standpoint.

ABN: What It Is and Why It Matters

An Australian Business Number (ABN) is essential for most businesses operating in Australia, whether they’re large corporations or sole traders.

As a rideshare driver, you’re typically classified as a sole trader – even if you’re working through an existing platform like Uber.

Why does this classification matter? Because if you’re a sole trader in Australia, you operate under your own legal name and are personally responsible for your business obligations, including tax.

Here’s why having an ABN is so critical:

⚡ Legal Requirement for Rideshare Drivers: The Australian Taxation Office (ATO) has determined that people providing rideshare services (like Uber, Ola, DiDi, etc.) are performing a taxable activity from the moment they start carrying passengers for a fare. Therefore, you must have an ABN to legally run this “business.”

⚡ Issuing Invoices and Receiving Payments: Technically, even though Uber calculates fares and pays drivers through the app, you’re still responsible for the income you generate from your ridesharing activity.

An ABN is crucial for properly issuing or recognising any invoices or payment records, especially if you ever decide to use additional ridesharing or delivery platforms.

⚡ GST Registration: An ABN is your gateway to registering for GST, which is another critical component for Uber drivers in Australia.

We’ll discuss this in more detail in the next section, but suffice it to say, you can’t register for GST without an ABN.

Why Rideshare Drivers Are Classified as Sole Traders

A common point of confusion is whether rideshare drivers are employees or independent contractors.

The difference has significant implications for insurance, tax, and superannuation:

- Employees are on a company’s payroll, have set working hours (or shifts), and often receive employee benefits such as holiday pay, sick leave, and superannuation contributions from their employer.

- Independent Contractors (Sole Traders) provide services on their own terms. They can choose when and how often they work, typically provide their own tools or equipment (in this case, your car), and are responsible for managing their own tax obligations.

Uber drivers fall under the umbrella of independent contractors because they can choose their own hours, decide which trips to accept, and must use their own vehicle to provide the service. Despite the app-based nature of the job, Australian regulators (and Uber’s own terms and conditions) categorise rideshare drivers as business owners, not employees.

Therefore, as a self-employed individual, you must:

- Obtain an ABN.

- Keep track of your income and expenses.

- Pay your own taxes (including GST) directly to the government.

This classification is key to understanding the next portion of your responsibilities as a driver: GST registration.

The GST Obligation for Uber Drivers

Most small businesses in Australia only need to register for Goods and Services Tax (GST) if their annual turnover exceeds $75,000.

However, there’s a specific rule for rideshare drivers: all rideshare drivers must register for GST from the moment they start driving, regardless of their income level.

This is different from most other sole trader activities, like running a small online store or freelance graphic design, which can wait until they near the $75,000 turnover threshold.

Why Are Rideshare Drivers Treated Differently?

Rideshare drivers are considered to be providing “taxi travel” services under the ATO’s definition.

The ATO requires anyone providing taxi travel for a fare – whether that’s through a ridesharing platform or a traditional taxi service – to register for GST immediately.

This requirement has been around for some time, and it aims to level the playing field between ridesharing apps and traditional taxis.

How GST Works for Rideshare Drivers

⚡ GST on Fares: Say a passenger pays you $55 for a trip. That amount includes a 10% GST. You are responsible for paying the GST portion ($5) to the ATO.

The fact that Uber takes a commission from your fare doesn’t affect your GST responsibility. You still owe GST on the total fare paid by the passenger.

⚡ Claiming GST Credits: The flip side is that you can claim GST credits (also known as input tax credits) for any goods or services you purchase that are directly related to providing your rideshare service.

Common examples include:

- Fuel

- Car maintenance and servicing

- Car cleaning expenses

- Toll fees (when paid by the driver)

- Mobile phone bills (at least the portion used for managing your rideshare work)

⚡ BAS Reporting: Once you’re registered for GST, you’ll need to lodge a Business Activity Statement (BAS) either monthly, quarterly, or annually (usually quarterly for most small operators). This is how you report the GST you’ve collected on fares and the GST credits you’re claiming.

Step-by-Step to Getting Your ABN and GST Registration

If you’ve decided to start driving for Uber, you might be wondering how complicated it is to register for an ABN and GST.

The good news is that the process is straightforward and can typically be completed online in a matter of minutes.

1. Gather Your Documentation

A valid form of identification (e.g., Australian driver’s licence, Medicare card, or Australian passport).

- Your Tax File Number (TFN).

- Basic personal details, such as your name, address, and date of birth.

2. Visit the Official ABR Website (or Use a Registered Provider)

The Australian Business Register (ABR) website allows you to apply for an ABN for free.

Alternatively, you can use registered providers like ANNA, which offers a streamlined application process and other perks.

3. Complete the Application

You’ll be asked to specify your business structure.

- Select sole trader if you’re a single individual driving for Uber.

- Provide the required personal information, including your TFN and contact details.

- Outline the nature of your business activities (e.g., rideshare driving).

4. Register for GST

Within the same application, you’ll have the option to register for GST.

Since you’re providing rideshare services, check the box that indicates you want to register for GST immediately.

5. Obtain Your ABN

In most cases, if your application is complete and the ABR system can verify your details, you’ll receive your ABN on the spot.

Once you have your ABN, you’re officially recognised as a sole trader in Australia.

6. Keep Your Details Up to Date

If you change your address or contact details, or if you decide to stop driving for Uber, you must update your ABN details accordingly.

If you stop ridesharing permanently, you can cancel your GST registration to avoid ongoing obligations.

Managing Your Taxes as an Uber Driver

Now that you’ve got an ABN and are registered for GST, it’s time to look at how to handle your taxes and ensure you remain compliant.

Income Tax Responsibilities

Like any individual earning income in Australia, you’ll need to declare the income you make from Uber in your annual tax return.

Remember that as a sole trader, you don’t receive a payslip with tax withheld on your behalf.

It’s up to you to set aside enough money to meet your tax obligations.

- Keep Accurate Records: Be diligent in tracking all of your trips, fares, and associated expenses.

- Paying Income Tax: Depending on how much you earn in a financial year, you may need to make Pay As You Go (PAYG) instalments to the ATO. This spreads your tax liability across the year instead of paying a large lump sum at tax time.

Claiming Deductions

Operating as a sole trader allows you to claim deductions for expenses related to your rideshare activities.

These might include:

- Vehicle Costs: If your car is used for a mix of personal and rideshare-related travel, you can claim a portion of costs like fuel, registration, and insurance.

- Vehicle Depreciation: Over time, the value of your car will decrease. You may be able to claim a portion of your car’s depreciation as a tax deduction.

- Mobile Phone and Data: If you use your phone primarily to manage rides, communicate with passengers, and track your progress, you can claim the work-related percentage of your phone bill.

- Car Maintenance and Cleaning: Frequent vacuuming, washing, and routine servicing are essential for providing a quality rideshare experience. These costs can be claimed based on the proportion that relates to your business use.

Keeping receipts and using a logbook or mileage-tracking app will make these calculations much smoother and help you substantiate your claims in case of an ATO review.

Lodging Your BAS

Most rideshare drivers lodge their BAS quarterly, though some may choose a monthly or annual reporting cycle (annual is uncommon and typically needs approval).

Remember:

⚡ On your BAS, you’ll list:

- Total sales (fares plus any tips you add to the formal fare amount).

- GST on sales (the GST portion of all fares).

- GST on purchases (the GST portion of eligible business-related expenses).

⚡ Lodgement and Payment: If you owe money to the ATO after offsetting GST collected with GST credits, you’ll need to pay that amount by the due date.

If you’re owed a refund, the ATO will process it accordingly.

What Happens If You Don’t Register for an ABN or GST?

Driving for Uber without an ABN (and a corresponding GST registration) can lead to significant problems:

- Application Rejection: Uber typically checks that you have an ABN and are registered for GST before approving you to drive. If you don’t have both, your application could be denied.

- Penalties from the ATO: Even if Uber didn’t check, the ATO can impose penalties and interest if they discover you’ve been operating a business without registering for GST.

- Backdated GST Liabilities: You may end up owing back payments of GST for the entire period you were driving. This can create a substantial financial burden if not addressed quickly.

In the long run, it’s easier, cheaper, and far less stressful to set up your ABN and GST from the outset than it is to fix the issue retroactively.

Additional Tips for Success as an Uber Driver

Beyond understanding your tax and legal obligations, here are a few best practices that can help you thrive as an Uber driver:

⚡ Stay Organised with Technology: Take advantage of apps and software that can automate your record-keeping. This helps you keep an accurate record of fares, kilometers driven, and expenses without manual spreadsheets.

⚡ Consider Opening a Separate Bank Account: Separating your business income from personal finances makes it easier to track your earnings and expenses. This can be especially beneficial at tax time.

⚡ Plan for Tax Time: A good rule of thumb is to set aside a percentage of your earnings each week or month to cover GST and income tax, so you’re not caught off guard by a large bill at year’s end.

⚡ Maintain Your Vehicle: Your car is your livelihood in this business. Regular maintenance not only reduces the risk of breakdowns but can also keep your ratings high by ensuring a comfortable ride for passengers.

⚡ Understand the Insurance Requirements: Be aware that your personal car insurance policy may not cover commercial usage.

Consider looking into rideshare-friendly insurance policies or adding a rideshare endorsement to your existing policy. This way, you’re fully protected in case of an accident while on the job.

Conclusion

Remember that ridesharing is all about combining the convenience of technology with the entrepreneurial spirit of self-employment.

With an ABN and a solid understanding of how GST works for rideshare drivers, you’ll be well-equipped to make the most of this dynamic earning opportunity.

Just keep your records organised, ensure your vehicle is in good condition, and set aside enough money for taxes and you’ll be on the road to success as an Uber driver in Australia.

How Can ANNA Help You Get Started With Uber?

If you’re eyeing Uber as your next business venture, ANNA offers a streamlined way to handle the paperwork and financial admin that come with driving as a sole trader or setting up a company.

Since every Uber driver in Australia needs an ABN (and, in many cases, decides to formalise their business structure), ANNA simplifies the entire process – from registering to managing your bookkeeping and taxes.

⚡ Easy Company or Sole Trader Registration

With ANNA One, you can quickly register a new company and receive an ACN at no extra cost (ANNA even covers the ASIC fee on certain plans).

If you prefer operating as a sole trader, ANNA can help you get an ABN so you can legally drive for Uber and meet ATO requirements.

⚡ Business Account and Debit Cards

ANNA doesn’t just set you up on paper, it also provides a business bank account complete with physical and virtual cards. This makes it easier to keep track of your rideshare earnings and automatically separate personal and business expenses.

⚡ All-in-One Bookkeeping and Tax

Rideshare drivers have to manage GST on every fare.

ANNA One automatically calculates GST, organises receipts, and prepares invoices or tax statements, helping you stay on top of your quarterly Business Activity Statements (BAS).

You’ll also benefit from a personalised tax calendar and automated reminders, ensuring deadlines never catch you out.

⚡ Expert Support

Not sure how to maximise your deductions for fuel and vehicle maintenance? ANNA’s friendly support team is on hand with guidance, so you can focus on driving rather than wrestling with tax forms.

By using ANNA for everything from initial registration to daily financial tasks, you’ll free up more time to hit the road and deliver great service to your passengers.

Sign up today and watch your Uber side hustle thrive.