Wondering if you need an ABN to invoice your clients? Discover the requirements, benefits, and considerations surrounding ABNs for invoicing.

Approximately 1 billion invoices are exchanged between businesses in Australia each year. However, only 10-15% are e-invoices, with the majority still in paper form.

The e-invoicing mandate is being rolled out in phases: large businesses were expected to comply by 2023, followed by medium and small businesses in 2024 and 2025, respectively.

Is the mandate mandatory for all business types?

Do you need an ABN to invoice clients? What different types of invoices are there?

Read on to find out!

The Importance of Invoicing

Invoicing is essential to running a business, and its importance extends beyond simply billing clients for goods and services.

Here are some key reasons why:

1. Financial Tracking and Record-Keeping

Invoicing provides a detailed record of the transactions between your business and your clients.

This record includes information about the goods or services you've provided, the amount charged, and the payment terms.

Thus, accurate invoicing allows you to track your business income and expenses, assess your financial performance, and plan for future growth.

2. Cash Flow Management

Invoices also help manage your business cash flow by specifying payment terms and due dates.

By sending invoices promptly and following up on payments, you can maintain a steady flow of income and avoid cash shortages.

3. Compliance with Tax Obligations

The Australian Taxation Office (ATO) requires businesses to maintain accurate records of their financial transactions for tax purposes.

Proper invoicing helps companies meet their tax obligations, such as reporting income and paying the Goods and Services Tax (GST) if applicable.

4. Legal Protection

Lastly, invoices serve as legal documents that detail the terms of a transaction, including the goods or services provided and the agreed-upon price.

In case of disputes, invoices can be used as evidence to support a business's claims.

Do You Need an ABN to Invoice Clients?

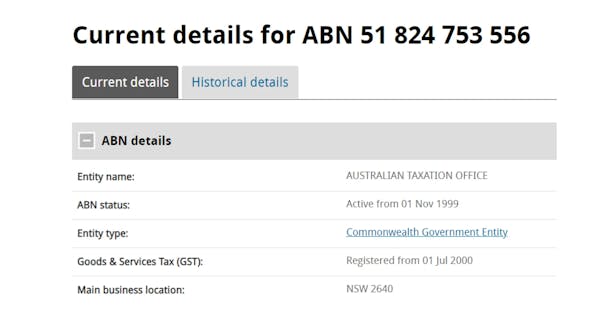

Yes, you need an ABN (Australian Business Number) to invoice clients in Australia. It is required for tax purposes and helps the Australian Tax Office (ATO) identify your business.

Once you understand that an ABN is essential for invoicing, the next step is knowing how to secure one.

Securing an ABN is necessary if you're starting a business and planning to bill clients.

The Government allows new business ventures, from sole traders to charities, to apply for an ABN.

You can obtain an ABN if you are:

- Starting or running a business in Australia

- Involved in making supplies related to Australia's indirect tax zone

- A company registered under the Corporations Act.

In any other case, applying for an ABN, registering for GST, and claiming GST refunds without being eligible can lead to prosecution or criminal charges.

When Is an ABN Required?

The ABN is a critical element of the Australian tax system, allowing businesses and individuals to be recognized and tracked by the Australian Taxation Office (ATO).

The ABN helps streamline various administrative processes, including invoicing, taxation, and reporting.

It also allows businesses to deal more efficiently with suppliers and customers.

An ABN is generally required in the following scenarios:

- Business Activities: If you are running a business or enterprise, whether as a sole trader, partnership, company, or trust, you will typically need an ABN.

- Freelance Work: Freelancers and independent contractors should also have an ABN to invoice their clients for services rendered.

- Earning Income: If you are earning income from any business activities, having an ABN is essential for proper tax reporting and compliance.

- GST Registration: If your business has a turnover of $75,000 or more in a year, you must register for GST and thus require an ABN.

ATO's Standards for Business Records and Tax Obligations

The ATO sets specific standards for business records that must be maintained for tax compliance. These include:

- Retention Period: Businesses must keep records for at least five years from the date they were prepared or when a transaction was completed.

- Record Accuracy: Records must be accurate and complete, clearly showing a business's financial activities.

- Documentation: Records should include all invoices, receipts, bank statements, and other documents related to income and expenses.

When Should You Provide an Invoice?

The Australian Taxation Office (ATO) also provides guidelines for when you need to issue invoices:

- Within 28 Days: If a customer requests a tax invoice, businesses must provide it within 28 days of the request.

- At the Time of Transaction: It's a good practice to issue an invoice at the time of the transaction or shortly after the goods or services have been provided.

Types of Business Invoices

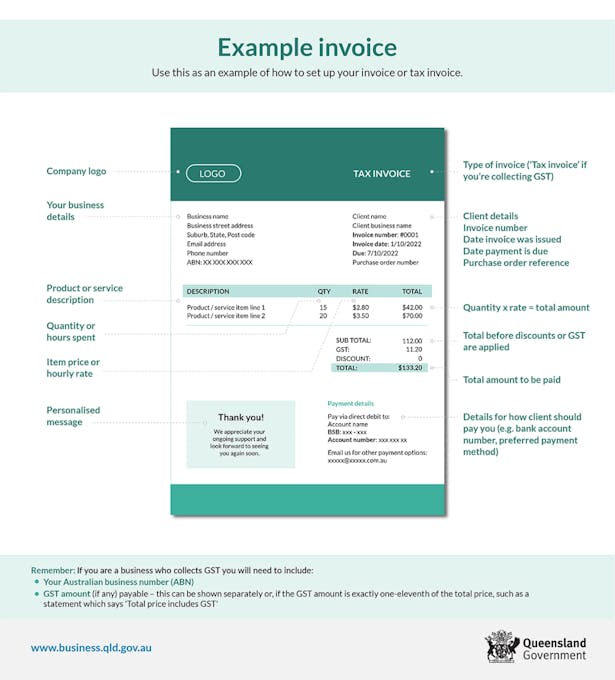

Different types of business invoices serve specific purposes:

- Standard Invoices: A standard invoice is a basic document that lists the goods or services provided, their prices, the total amount due, and payment terms. It does not include GST or any other taxes.

- Tax Invoices: A tax invoice is used when a business is registered for GST and charges GST on the goods or services provided. In addition to the standard invoice details, a tax invoice includes the ABN and the GST amount charged, and the word "tax invoice" may need to be specified on the document.

Additional Requirements for Invoices Over $1,000

If the total amount of the invoice (including GST) is $1,000 or more, the invoice must include:

- Customer's Details: The customer's name and/or ABN (if applicable). If you're unsure about your ABN status, you can check the application status of ABN on the official ABR website.

- Payment Terms: Any specific payment terms, such as due dates and accepted payment methods.

📌 Tip

If you're selling items privately, not as part of a business, you don't need an ABN. The same goes if you run a hobby business and make less than the yearly GST threshold.

In these scenarios, you're off the hook for needing an ABN for invoicing.

If you aren't sure whether you fall into the business or hobby category, you can check out key differences on the Australian Government's page.

What Are the Consequences of Improper Invoicing?

If you don't invoice correctly, you could face several problems, such as not following tax rules and dealing with potential legal and financial trouble. Here are some specific issues:

1. Tax Non-Compliance: The Australian Taxation Office (ATO) enforces strict invoicing rules. If you fail to issue a tax invoice when required (such as for a transaction involving GST), you might face penalties and be responsible for unpaid taxes.

Using an incorrect ABN on an invoice can also lead to penalties and confusion. If you don't provide your ABN on an invoice, your client may need to withhold 47% of the payment and send it to the ATO.

2. Financial Losses: Improper invoicing can cause financial setbacks, including delayed payments due to missing or incorrect invoice information. You might also lose income if a client withholds payment due to missing ABN information.

3. Legal and Reputational Risks: Incorrect or incomplete invoices can spark legal disputes with clients over payment terms or amounts due. This can harm your reputation and lead to a loss of clients if they lose trust in your business.

4. Record-Keeping Challenges: Inaccurate invoices can create inconsistencies in financial records, making it hard to track income and expenses accurately. This can increase the risk of an ATO audit, which can be time-consuming and costly for your business.

📌 Tip

For cross-border transactions and invoicing, remember to specify the conversion rate and payment terms on your invoice when working with international clients.

Also, take into account any tax treaties between Australia and your client or supplier's country, as these agreements can influence tax handling.

Lastly, if you're dealing with imports or exports, be mindful of customs and duties regulations and understand how your ABN interacts with these requirements.

How To Prepare An Invoice?

Proper invoicing helps protect your business's cash flow, maintain good records, and meet tax obligations. Follow these steps to create, send, and manage invoices effectively:

Step 1: Prepare for Invoicing

- Create Customer Accounts: Set up accounts for each customer to track who you've invoiced and who has paid.

- Use Accounting Software: Consider using software to manage invoices and record customer sales.

- Gather Customer Details: Collect information such as name, address, phone, email, and ABN (for tax invoices).

- Determine Payment Methods and Terms: Choose accepted payment methods (e.g., bank transfer, credit card, PayPal) and set payment terms (e.g., "Net 30" for payment due 30 days from invoice date).

Step 2: Determine the Invoice Type

- Tax Invoices: Use these if you're registered for GST and the purchase exceeds $82.50 (including GST).

- Regular/Standard Invoices: Use these if you're not registered for GST; they shouldn't include a tax component or the words "tax invoice."

Step 3: Include Required Information in Tax Invoices

For sales under $1,000 (including GST), include:

- Tax Invoice Label: Preferably at the top.

- Seller Details: Business name or trading name (contact details recommended).

- ABN: Your Australian Business Number.

- Invoice Date: The date you issued the invoice.

- Items Sold: Brief list of items sold, including quantity and price.

- GST Details: Show the GST amount for each item or state that the total price includes GST.

For sales over $1,000 (including GST), also include the buyer's identity or ABN.

Step 4: Customize Your Invoices

- Standard Layout: Use a consistent design to make it easier for customers to find important information.

- Custom Design: Add a personal touch that reflects your brand while still meeting mandatory requirements.

You can also add a thank-you note at the bottom to enhance the customer experience.

Step 5: Send Your Invoices

Choose a method that suits your business:

- e-invoicing: Use digital invoicing through accounting software.

- Printable Web Page: Send a link to a printable invoice.

- Post: Mail a physical copy.

- Email: Send a digital copy.

- In-Person: Hand-deliver the invoice if necessary.

⚡Note

The Australian Government is advocating for e-invoicing to boost efficiency, productivity, and digital benefits for Australian businesses and the broader economy.

Although e-invoicing isn't mandatory for Australian businesses, certain government agencies do have specific requirements to follow.

Step 6: Keep Records of Invoices

- Record Keeping: Maintain records of income received and payments made for at least five years.

- Paper or Digital: Choose whether to keep printed or electronic records.

Step 7: Address Unpaid Invoices

- Prevent Unpaid Invoices: Include accepted payment methods and payment terms on the invoice.

- Handle Disputes: Use detailed item descriptions to prevent misunderstandings.

Step 8: Correct Incorrect Invoices

- Fix Incomplete Invoices: If your invoice is incorrect, replace it with a complete and correct one.

- Request Valid Invoices: If you receive an incorrect invoice, ask your supplier for a valid one.

- Seek ATO Permission: If your supplier doesn't respond within 28 days, you may ask the Australian Taxation Office for permission to treat a document as a valid tax invoice.

How Can Anna One Help You With Invoicing?

Invoicing made easy

Ditch the spreadsheets and get paid faster. ANNA creates and sends professional-looking invoices and automatically follows up when they’re overdue.

ANNA monitors your account for incoming payments and reconciles them against sent invoices. Everything is kept clean, tidy, and up to date for your accountant, and you don’t have to worry about chasing unpaid invoices.

How do we do it?

⚡ Instant Invoices: Create professional-looking invoices in an instant. Add your business logo for a personal touch.

⚡ Easy PDF Creation: Provide us with the details, and we'll create professional invoice PDFs for you.

⚡ Polite Follow-Ups: ANNA automatically sends polite reminders for overdue invoices, so you don't have to.

⚡ Recurring Invoices: For regular work, set up recurring invoices to streamline your billing process.

What else is there?

Anna One streamlines your invoicing process and simplifies tax management, helping your business stay organized and efficient:

🧾 Taxes Calculated Automatically: Ensure you're always up to date on your tax reporting and optimize your tax bill.

💼 Company (Income) Tax: Gain insight into your upcoming tax bill based on your business expenses and income. Plan your budget effectively.

📆 Personalized Tax Calendar: Never miss a tax deadline, and stay compliant with all your tax obligations.

🤝 Support from Expert Accountants: Get your questions answered by our friendly support team.

🗓️ Annual Company Tax Return Statement: Let us take care of your tax obligations and lodge your statement during your first year of trading.

📊 GST Calculation and Logging: Automatic GST calculation and direct logging with the Australian Taxation Office (ATO).

💰 Professional Invoices: Create invoices that look great in seconds.

🕒 Unpaid Invoice Chasing: We'll automatically follow up on unpaid invoices for you.

📈 Bookkeeping Score: Get tips on keeping your books tidy and organized.

🔍 Receipt Matching: Using receipt apps for automated receipt matching and categorization of expenses ensures accuracy and secures the right tax relief.

Start using Anna One today to take the stress out of invoicing and tax management!

FAQ

Is It Okay to Include Promotional Material on an Invoice?

You can add promotional material to an invoice, but be careful not to make it the main focus. Invoices are primarily for requesting payment for goods or services you've already delivered.

What Should I Do If a Client Refuses to Pay an Invoice?

First, follow up with a polite reminder. If the client continues to delay payment, consider sending additional reminders or negotiating a payment plan. Or, if that causes you too much stress, opt for Anna One, as we chase all the unpaid invoices within a week!

What Happens If I Make a Mistake on an Invoice?

If you discover an error on an invoice, correct the mistake as soon as possible by issuing a new invoice. Communicate the change to your client to avoid confusion.

Can I include promotional material on an invoice?

Yes, you can include promotional material, such as discounts or codes, but keep it professional. The invoice should remain focused on the transaction, with promotional content placed discreetly, like at the bottom or in a "Thank You" message.

Is there a standard format for an invoice?

There isn't a strict standard, but most invoices include:

- Invoice number

- Seller’s and buyer’s information

- Invoice date

- Payment terms

- Itemized description of goods/services

- Total amount and taxes