Do You Need an EIN to Open a Business Bank Account in Australia?

Learn whether you need an EIN to open a business bank account in Australia, including legal requirements, key identifiers, and setup tips for success.

- In this article

- What Is EIN?

- Do You Need an EIN to Open a Business Bank Account in Australia?

- What Do You Need to Open a Business Bank Account in Australia?

- Does Your Business Structure Affect How You Open a Business Bank Account?

- Conclusion

- What Are the Benefits of Having a Business Account with ANNA Money?

- FAQ

Starting a business raises a lot of issues, one of which is frequently asked, particularly when conducting research online: "Do I need an EIN to open a business bank account in Australia?".

If you've come across U.S.-based advice or foreign business recommendations, you're not alone in questioning what is relevant to you and what is not.

The truth is that EIN is useful but only in particular situations.

However, if you run (or plan to run) a business in Australia, the rules are slightly different.

In this article, we'll clear up any confusion about EIN, explain exactly what you need to open a business bank account in Australia, and demonstrate how the procedure varies depending on your business structure.

Plus, if you want a quick, flexible, and simple approach to handle your business financial management, we'll introduce you to a better option: ANNA Money.

Let’s start!

What Is EIN?

An EIN (Employer Identification Number) is not an Australian tax or business identification number. Instead, it is a nine-digit number assigned by the United States Internal Revenue Service (IRS) to identify businesses and other entities for tax purposes.

The primary purposes of an EIN include:

👉 Tax Reporting - The EIN is generally used to identify the business entity when submitting federal tax returns and other tax papers, just as a Social Security Number (SSN) identifies an individual for tax purposes.

👉 Opening Business Bank Accounts - To open a business bank account, most banks demand an EIN, which serves as an official confirmation of business identity.

👉 Hiring Employees - Businesses require an EIN to hire employees and manage payroll taxes.

👉 Applying for Business Licenses and Credit - An EIN is necessary when applying for business licenses, permits, or credit.

👉 Separating Personal and Business Finances - An EIN helps to keep business financial activities separate from personal finances, allowing better record-keeping and compliance.

Do You Need an EIN to Open a Business Bank Account in Australia?

No, you do not need an EIN to open a business bank account in Australia.

You need an EIN only if you do business in the United States (selling items or recruiting people there) and you want to open a business bank account in the US.

If this is your situation and you want to get an EIN, then you have to call the IRS directly.

If you were in the US, you would fill out the SS-4 form. Since you are outside the US, you have to call the IRS at +1 (267) 941-1099.

Before you make a call, prepare the following information:

✅ Entity's Legal Name - The formal registered name of your business in your country.

✅ Business Structure - The type of business entity (such as a partnership or limited liability company) and its structure.

✅ Reason for Applying - Explain why you need an EIN (for example, to start a business, open a bank account in the United States, or hire staff).

✅ Responsible Party Information - Provide the name and identification number of the person in charge of the entity's funds and assets. Non-U.S. residents may use a foreign passport number or other form of identification because they do not have a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

✅ Mailing Address - If you do not have a US address, you may offer your foreign address.

✅ Principal Business Activity - A summary of the primary business activities, products, or services.

✅ Number of Staff - If you have or expect to have employees in the future 12 months, provide an estimate and employee type.

✅ The First Date That Wages or Annuities Were Paid - Relevant only if you have personnel based in the United States.

During the call, an IRS representative should walk you through the application using the questions on the SS-4 form. After approval, the EIN is issued instantly during the conversation.

Now, the only logical question is, what do you need to open a business bank account in Australia?

➕ Bonus Tip

Keep in mind that this is not a free line and international call rates apply.

What Do You Need to Open a Business Bank Account in Australia?

You will need:

👉 Australian Business Number (ABN) - Required for all businesses as a unique identifier for tax and business purposes.

👉 Australian Company Number (ACN) - Required if your business is registered as a company.

👉 Personal Identification - required for all business owners and authorised signatories. Australian banks utilise a 100-point ID verification method that typically includes both primary IDs (e.g., passport, Australian driver's license) and secondary IDs (e.g., utility bills, bank statements).

👉 Business Registration Documents - Evidence of your organisation's legal existence, such as a partnership agreement, trust deed, or company registration certificate.

👉 Proof of Business Address - Documents such as utility bills, leasing agreements, or formal letters that establish your company's actual address.

💡ProTip

You can open an ANNA ONE business account in less than 10 minutes and begin making and taking payments immediately!

🚀 Generate invoices in seconds

🚀 Send invoices from anywhere you are

🚀 Get paid faster with automatic payment reminders

🚀 Schedule future-dated and regular payments to stay on top of your cash flow

What is ABN?

An Australian Business Number (ABN) is a unique 11-digit identity issued by the Australian Business Register (ABR), which is managed by the Australian Taxation Office (ATO).

It identifies your business to the government, other businesses, and the general public for tax and commercial purposes. Besides that, ABN is:

🔶 Required for tax invoices and other tax-related paperwork.

🔶 Allows you to avoid Pay As You Go (PAYG) withholding tax on payments you receive.

🔶 Allows you to claim GST credits and energy grants.

🔶 Allows you to register an Australian domain name.

🔶 Used to validate your business's identification while ordering and invoicing.

You can apply for an ABN online for free using the Australian Government's Business Registration Service or directly through the Australian Business Register website. The application requires:

✅ Your business structure (sole trader, company, partnership, trust)

✅ Proof of identity

✅ Details about your business operations and associates

✅ Business contact information and address

✅ Information about your business, such as when it started and the estimated turnover

💡ProTip

With ANNA Money, you can easily get your ABN!

🚀 Verify your business information

🚀 Submit your application

🚀 Your ABN will be registered, and you will be notified of its number

What is ACN?

An Australian Business Number (ACN) is a nine-digit identifier assigned by the Australian Securities and Investments Commission (ASIC) to each business established under the Corporations Act 2001.

The ACN:

🔶 Is a required number for all companies and serves as ASIC's primary identifier for monitoring company activity and ensuring legal compliance.

🔶 It must appear on all official corporate documents, including invoices, contracts, and public records issued by the company.

🔶 Even if a company's name changes or is deregistered, the ACN remains the same.

🔶 It differentiates companies from different business structures, such as sole traders and partnerships, which do not receive an ACN but instead use an Australian Company Number (ABN).

When you form a company with ASIC, you will automatically get an ACN.

The registration procedure involves choosing a company name, presenting information about company directors and shareholders, and submitting the registration application to ASIC.

💡ProTip

You can simplify ACN registration with ANNA Money!

🚀 Register your company today on our platform and receive your ACN number within minutes

🚀Instantly verify availability and use our Name Checker to ensure accuracy

🚀 Operate as a registered company with an ACN and improve your business's reputation and legitimacy

Does Your Business Structure Affect How You Open a Business Bank Account?

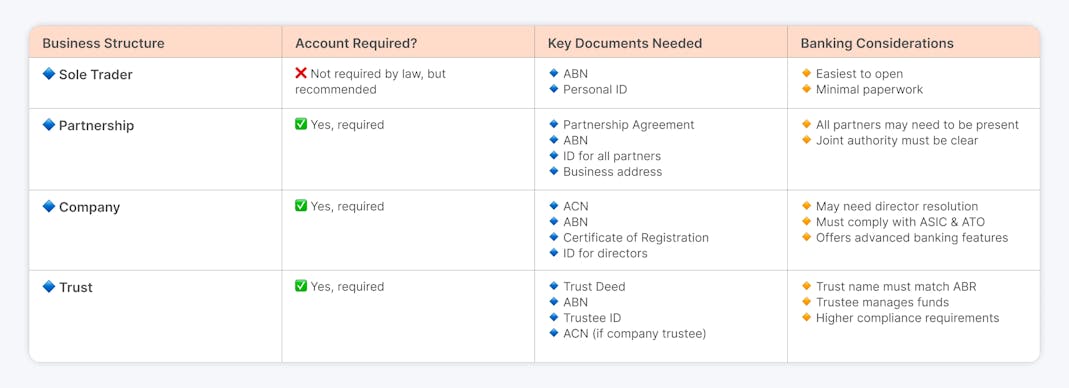

Yes, the process and requirements for opening a business bank account in Australia differ depending on your business structure.

Different legal entities have varying obligations, identification requirements, and levels of complexity.

Here's how needs vary across common business structures:

As a sole trader, you operate your business under your own legal name.

This is the most basic and prevalent form for freelancers and small business owners.

Even though it is not legally necessary to open a separate business bank account, it is recommended in order to ease tax reporting, bookkeeping, and cost management.

Documents required:

✅ The Australian Business Number (ABN)

✅ Personal identification (e.g., driver's license or passport)

Banking Considerations:

✅ Fewer documentation is required when compared to other structures.

✅ Often the fastest and simplest to set up.

A partnership is a structure in which two or more individuals or entities operate a business together, sharing profits and obligations.

For legal and tax purposes, the partnership must keep a separate bank account.

Documents Required:

✅ Partnership Agreement (defines duties, profit sharing, and responsibilities)

✅ ABN for the partnership

✅ Personal identification of all partners

✅ Proof of a business address

Banking considerations:

✅ In most cases, all partners must be present or provide identification and authority

✅ Some banks may request that all partners sign the account opening forms

✅ A clear agreement on account authority is necessary to avoid disagreements

🔷 Company

A company is a separate legal entity from its owners (shareholders) and controllers (directors), governed by the Corporations Act 2001.

To ensure legal protection, the company's finances must be clearly separated from personal cash, and you need a separate business bank account.

Documents Required:

✅ Australian Company Number (ACN).

✅ Australian Business Number (ABN).

✅ Certificate of Registration (issued by ASIC).

✅ Identification of all directors and authorized signatures.

Banking considerations:

✅ Banks may demand director minutes/resolution authorizing the account setup.

✅ Compliance with ASIC and ATO regulations is critical.

✅ Business bank accounts for companies may offer additional services such as multi-user access, corporate credit cards, and integration with accounting software.

🔷 Trust

A trust is an arrangement in which a trustee controls assets or income on behalf of beneficiaries.

It can be established for asset protection, tax planning, or investment objectives.

A separate bank account must be opened in the trust's name rather than the trustee's or beneficiaries' names.

Documents Required:

✅ Trust deed (a legal document that outlines the structure and terms of the trust).

✅ ABN for the trust.

✅ Identification of the trustee (person or company).

✅ If the trustee is a company, the ACN and company documentation may be requested.

Banking considerations:

✅ The trust name must exactly match the name registered with the ABR.

✅ Trust accounts may have more complex compliance duties.

✅ The trustee(s) will handle the account and must act in accordance with the trust instrument.

Conclusion

Now you know what you don’t need and what you need to open a business bank account.

As you can see, opening a business bank account in Australia isn't exactly “one-size-fits-all”.

The actions you'll take (as well as the documents you'll need) are largely determined by the structure of your business.

That's where ANNA Money can really help.

Instead of dealing with forms, you'll get a business account designed just for how you work, whether you're working as a sole trader or starting a company.

There are no lengthy wait times, just a quick setup, useful features, and support whenever you need it.

Wondering what it's like to manage finances with ANNA?

Let's take a look at the advantages of having a business account that operates as quickly as you do!

What Are the Benefits of Having a Business Account with ANNA Money?

ANNA ONE combines an easy-to-use business account with key finance capabilities, including company setup for new businesses.

Your ANNA business account includes a debit card, an account number, and a sort code; nevertheless, we do not provide credit or loans since we are not a bank.

Here are the benefits:

🚀 Invoicing is as simple as entering a few details into the ANNA ONE app. You can prepare and send invoices on the go, and we'll chase them for you if they're unpaid.

🚀 Our tax professionals can share your tax tips and updates, help you stay ATO compliant and answer all your queries.

🚀 You can create an invoice using features like customisable templates, recurring billing, payment integration, and financial reporting.

🚀 You can connect all of your company and personal accounts to ANNA for a comprehensive view of your money and manage everything from a single consolidated platform.

Does it sound like simplified finances? Sign up today and stop worrying about money management!

FAQ

Can ATO check bank accounts?

Yes, the Australian Taxation Office (ATO) can access your bank account information. However, this access is limited and usually occurs during audits or investigations into tax compliance.

Why Is My Bank Asking for Residency in Australia?

Your bank requests your resident status in Australia largely to meet regulatory requirements for identification verification, tax duties, and anti-money laundering legislation.