FreshBooks vs Quickbooks - Which Accounting Software is Better?

Compare FreshBooks and QuickBooks to explore their features, pricing, and usability, helping you choose the best accounting software for your needs.

When it comes to accounting software, it’s not a one-size-fits-all situation. Choosing the right platform requires looking closely at the specific needs of your business, whether that means managing invoices, tracking time, or handling complex inventory.

Two of the most popular options, FreshBooks and QuickBooks, suit different types of businesses – FreshBooks is ideal for freelancers and small service-based businesses.

At the same time, QuickBooks is better suited for larger businesses with more complex needs. Let’s break down the pros and cons of each to help you decide.

FreshBooks: Simple, Affordable, and Perfect for Freelancers

FreshBooks has long been a favourite among freelancers and solopreneurs for its user-friendly interface and affordability.

FreshBooks has a lot to offer if your business is primarily service-based and you don’t need to track inventory or manage a large team.

Here’s why this tool might be the right fit for you:

- Affordable Pricing: FreshBooks’ pricing starts at $12 per month/AUD (at the time, 50% off for 3 months), making it one of the more budget-friendly options for those just starting out or on a tight budget. You can manage invoicing, expense tracking, and time tracking without breaking the bank.

- Easy-to-Use Interface: FreshBooks’ interface is clean and intuitive, with callout tips that make it easy to navigate. It’s designed for users who may not have extensive accounting knowledge, so you can dive in without feeling overwhelmed.

- Time Tracking: Every FreshBooks plan includes time tracking, a feature especially useful for freelancers who bill by the hour. You can track time live or add it retroactively, then easily add it to invoices.

- Basic Project Management: FreshBooks offers basic project management capabilities, allowing you to assign tasks, set budgets, and track progress, all within the app. This is a handy feature if you’re working on multiple projects or need a simple way to stay organised.

However, FreshBooks has its limitations. If your business plans to scale or requires features like inventory tracking or complex reporting, you may find FreshBooks’ capabilities somewhat limited.

QuickBooks: Feature-Rich and Built for Scaling Businesses

On the other hand, QuickBooks is tailored for businesses that need a more comprehensive set of accounting tools. QuickBooks caters to medium to large companies or any small business that’s planning to grow.

Here’s why QuickBooks could be the better choice for those looking for robust functionality:

- Advanced Reporting and Customisation: QuickBooks comes with powerful reporting capabilities that allow for custom reports. Unlike FreshBooks, which has more basic reporting, QuickBooks lets you dig into granular data, making it easier to analyse profitability, track expenses, and understand your business’s financial health.

- Inventory Management: If you sell physical products, QuickBooks’ inventory management tools are invaluable. Available from the Plus plan and up, you can set restock alerts, create pricing rules, and generate reports on your best-selling items. FreshBooks, by contrast, offers only basic stock updates.

- User and Accountant Access: QuickBooks offers multi-user access in its higher-tier plans, allowing you to share access with your accountant or other team members. This multi-user capability, paired with QuickBooks’ expansive set of features, makes it ideal for larger teams.

- Payroll Integration: QuickBooks provides an optional payroll add-on, allowing you to manage employee pay, automate tax calculations, and handle compliance within the same platform. This feature is essential for larger businesses with employees and makes QuickBooks a more scalable choice.

- Automation with Workflows: For businesses needing automated workflows, QuickBooks’ Advanced plan offers custom workflows, which let you schedule reminders, automate reporting, and more. This feature can streamline routine tasks and boost efficiency – a standout offering that FreshBooks doesn’t provide.

However, all this functionality comes at a cost.

QuickBooks’ plans start at $14.50 per month (at the time, 50% off for 3 months) for the Simple Start plan, with prices climbing to (currently) $55 per month for the Advanced plan.

If you’re running a small operation, these costs can add up, especially if you require multiple features or users.

FreshBooks vs. QuickBooks: How They Compare on Key Features

- User-Friendliness: FreshBooks takes the lead in ease of use with its simple interface, clear breakdowns, and minimal learning curve. QuickBooks, while more complex, provides tutorials and walkthroughs that help new users get acquainted.

- Time Tracking: FreshBooks includes time tracking on all plans, which is ideal for service-based businesses. QuickBooks offers time tracking but requires a separate subscription to QuickBooks Time for advanced features like geofencing and shift scheduling.

- Invoicing: Both platforms allow for invoicing, but FreshBooks is the more affordable option for businesses focused solely on invoicing clients for services. QuickBooks, however, supports more extensive invoicing capabilities, including syncing with sales channels and integrating with POS systems, which is better suited for businesses with product-based revenue.

- Inventory: QuickBooks is the clear winner here, with inventory features like low stock alerts and pricing rules that are essential for businesses selling products. FreshBooks’ inventory management is basic, making it more suitable for service-based operations.

- Pricing and Value: FreshBooks’ pricing is more accessible, particularly for freelancers or smaller businesses that don’t need every accounting feature under the sun. QuickBooks is pricier but justifiable for growing businesses that require a comprehensive tool with the ability to scale.

FreshBooks vs. QuickBooks: And Why You Should Consider ANNA

When it comes to finding the perfect accounting software, there’s no shortage of options.

While FreshBooks is ideal for freelancers and QuickBooks is built for larger businesses, ANNA offers a unique alternative, especially for businesses in Australia.

ANNA’s comprehensive solution combines accounting and business registration tools, making it an attractive option for those who want an all-in-one platform.

Here’s a breakdown of how ANNA compares to FreshBooks and QuickBooks:

ANNA: The New Kid on the Block for Australian Businesses

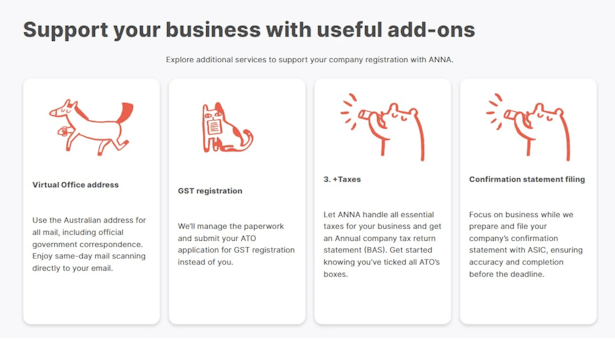

ANNA is more than just accounting software – it’s a complete business tool that helps you manage finances and streamlines company registration and compliance.

If you’re in Australia and looking to start and grow a business, ANNA provides a powerful blend of bookkeeping, invoicing, and tax services.

Why ANNA Might Be Right for You

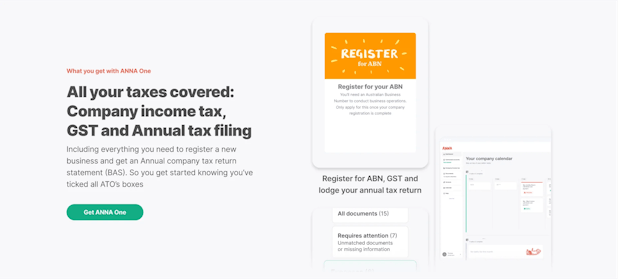

⚡ Built-In Business Registration: Unlike FreshBooks or QuickBooks, ANNA includes company registration services. You can register your Australian Business Number (ABN), set up a GST account, and even get your Australian Company Number (ACN) seamlessly through ANNA’s platform.

⚡ Comprehensive Tax Management: ANNA handles GST calculations, provides a personalised tax calendar, and even helps with your annual tax return statement. For new businesses, this all-inclusive approach can simplify tax compliance and ease the burden of keeping up with deadlines.

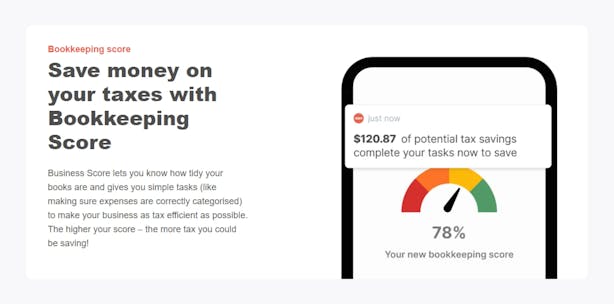

⚡ Affordable Pricing with Added Value: ANNA offers straightforward pricing that includes everything from company registration to daily bookkeeping support. There’s no need to purchase add-ons like payroll or time tracking – everything is included. This makes it a budget-friendly choice for businesses that want a single, all-inclusive solution.

⚡ Automated Invoicing and Expense Management: ANNA’s invoicing tools are designed for quick, professional invoicing with automatic payment reminders, helping ensure you get paid faster. Plus, ANNA’s receipt matching automatically categorises expenses for tax relief, keeping your finances organised without added effort.

⚡ 24/7 Customer Support: ANNA’s award-winning support team is available around the clock, even on holidays, so you’re never left in the dark if an issue arises. This level of support is especially valuable for businesses without in-house accounting staff.

Comparing FreshBooks, QuickBooks, and ANNA on Key Features

⚡ User-Friendliness

- FreshBooks: Simple and intuitive, with callout tips and a clean dashboard.

- QuickBooks: Feature-rich but with a steeper learning curve for new users.

- ANNA: User-friendly and streamlined, with an interface designed for business owners who want simplicity without sacrificing power.

⚡ Invoicing and Payment Tracking

- FreshBooks: Great for freelancers who need quick invoicing and time tracking.

- QuickBooks: Advanced invoicing with options for syncing sales channels.

- ANNA: Professional invoicing that’s quick and customisable, with automated payment reminders and expense matching.

⚡ Tax and Compliance

- FreshBooks: Limited tax management, with a focus on basic reporting.

- QuickBooks: Comprehensive tax and expense tracking but at a higher cost.

- ANNA: Fully integrated tax management, with GST calculation, compliance reminders, and a personalised tax calendar.

⚡ Pricing

- FreshBooks: Starts at $12/month for basic features, with extra costs for more robust tools.

- QuickBooks: Starts at $14.50/month and climbs with advanced features; additional costs for add-ons like payroll.

- ANNA: Transparent pricing that includes company registration, tax services, and accounting features in one plan, offering more value for Australian businesses.

⚡ Customer Support

- FreshBooks: Good support but limited hours.

- QuickBooks: Offers live support, though it can be challenging to reach during busy times.

- ANNA: 24/7 customer support, even on holidays, so help is always available when you need it.

Final Verdict: FreshBooks, QuickBooks, or ANNA?

Choosing between FreshBooks, QuickBooks, and ANNA depends on your specific needs:

- Choose FreshBooks if you’re a freelancer or solopreneur needing simple invoicing and time tracking at a low cost.

- Choose QuickBooks if you run a larger or growing business that requires advanced accounting features, inventory tracking, or integrations.

- Choose ANNA if you’re in Australia and want an all-in-one solution that covers everything from company registration and tax compliance to invoicing and expense management.

For Australian business owners, ANNA offers a truly unique option by combining essential business registration and accounting features in one.

With transparent pricing and unmatched support, it’s a compelling alternative to traditional accounting software, making it easy to get your business off the ground and keep it running smoothly.

Ready for an easy start?

Get started with ANNA today and equip your business with the tools and support you need to grow confidently.