How To Apply for an ABN as an Independent Support Worker?

Learn how to apply for an ABN as an independent support worker, including key requirements, the application process, and benefits for your business.

- In this article

- What Does an Independent Support Worker Do?

- Why Do You Need an ABN as an Independent Support Worker?

- Independent Contractor vs. Employee: Clarifying Your Status

- How to Apply for an ABN as an Independent Support Worker?

- What Are Your Tax Obligations and Record-Keeping

- How to Maintain Your ABN

- Conclusion

123141241

An independent support worker helps individuals with diverse needs like disabilities or age-related challenges to maintain and improve their daily living.

They focus on personal care, household tasks, healthcare coordination, and emotional support. Working independently means taking on the responsibilities of running a small business.

One critical step is obtaining an Australian Business Number (ABN) to legally invoice clients, register for taxes (if needed), and formalise the business aspect of support work.

If you want to learn more about how to apply for an ABN as an independent support worker, keep on reading!

What Does an Independent Support Worker Do?

Support workers generally assist people who need help with daily living tasks. This can be due to a disability, chronic illness, mental health condition, or aging.

While job descriptions vary, common responsibilities include:

🔸 Personal Care: Assisting with bathing, dressing, toileting, and feeding.

🔸 Household Support: Cooking, cleaning, laundry, and running errands.

🔸 Healthcare Support: Monitoring medication, attending medical appointments, and providing chronic care support.

🔸 Social Support: Encouraging participation in hobbies, community outings, and social events.

🔸 Emotional Support: Providing companionship and emotional well-being.

Types of Support Workers

🔸 Domestic Support Worker: Primarily helps with day-to-day household and personal tasks in a home environment.

🔸 Clinical Support Worker: Often works alongside healthcare professionals, assisting with medical tasks in clinical or residential settings.

🔸 Welfare Support Worker: Provides more extensive social welfare services, coordinating access to community resources and benefits.

Skills and Qualifications That Support Workers Need

Formal qualifications aren’t always mandatory, but essential skills include:

- Excellent communication

- Emotional intelligence and empathy

- Adaptability and resilience

- Relevant practical knowledge (e.g., first aid, manual handling)

- Clearances/Checks: These include a police check, a Working with Children Check, or NDIS Worker Screening.

Also, when working independently, business administration skills are something not to be overlooked, such as managing finances, scheduling, and professional branding.

💡 Check out our blog, 16 Best Tools For Small Businesses in 2025, to find the best tool to help you ease each part of running a business.

Why Do You Need an ABN as an Independent Support Worker?

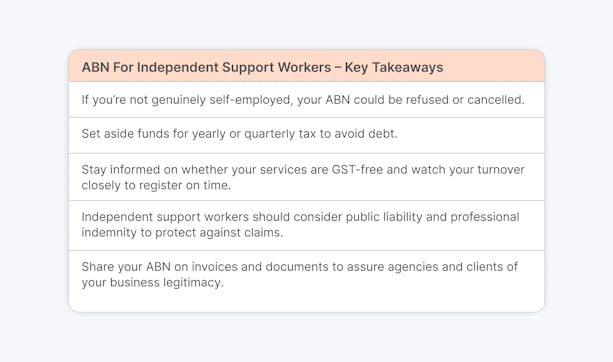

Yes, you do need an ABN if you want to work as an independent support worker.

When you’re self-employed, you operate as a sole trader or independent contractor rather than an employee.

An ABN is crucial because it:

- Enables Proper Invoicing: Businesses and government agencies must withhold tax at the highest rate if you don’t quote an ABN on your invoices.

- Allows Tax Registrations: You can’t register for GST or other tax obligations without an ABN.

- Demonstrates Professionalism: Presenting yourself as a legitimate business fosters trust with clients and funding bodies (e.g., the NDIS).

- Facilitates Government Interactions: Certain subsidies, grants, or online services require an ABN.

❗ Operating without an ABN when you’re technically running a business can lead to compliance issues or difficulties getting paid in full.

Independent Contractor vs. Employee: Clarifying Your Status

Before applying for an ABN, make sure you’re genuinely working as an independent contractor. You are likely an employee if an organisation sets your hours, provides all equipment, and pays a wage under a contract of employment.

You’re an independent contractor if you:

- Work for multiple clients or can accept/reject jobs

- Set or negotiate your rates

- Provide your own equipment and are responsible for your expenses

- Issue invoices instead of receiving a payslip

❗ If an agency exerts significant control over your work but insists you get an ABN, seek clarification – it may be a misclassification.

Employees do not need ABNs, as employers handle taxes and super.

How to Apply for an ABN as an Independent Support Worker?

Step 1: Determine Eligibility

Confirm you’re carrying on a business. Independent support workers generally qualify, as you offer services with the intention of making a profit.

If unsure, consult the ABN Entitlement Tool on the ABR website or speak to a tax professional.

Step 2: Choose Your Business Structure

- Sole Trader: The simplest arrangement where you, as an individual, operate the business. You use your personal Tax File Number and file a single tax return.

- Company: A more complex structure offering limited liability but higher administrative costs. Most solo support workers start as sole traders unless they plan to expand or hire staff.

Step 3: Gather Key Information

- Tax File Number (TFN): Optional but speeds up verification

- Personal Details: Full legal name, date of birth, residential address

- Business Details: Proposed business name (if different from your legal name), contact details, start date

- Description of Services: For instance, “independent in-home support services, assisting elderly and disabled clients.”

Step 4: Apply Online

Access the Australian Business Register (ABR) at abr.gov.au:

- Click “Apply or reapply for an ABN.”

- Answer questions about your business activity and eligibility.

- Enter personal and business details, ensuring they match ATO records.

- Provide your TFN if possible.

- Confirm declarations and submit.

If the system verifies your details automatically, you’ll receive your ABN immediately.

Otherwise, you may get a reference number if it requires manual review, usually resolved within 20 business days.

Step 5: Register for Additional Obligations

During or after the ABN process, register for:

- GST: Required if your annual turnover is $75,000 or more (or you choose to opt in voluntarily).

- PAYG Withholding: If you plan to hire employees or subcontractors.

Step 6: Handle Delays or Refusals

If you’re refused, it often means the ABR believes you’re not operating a business (e.g., it’s a hobby or the details suggest an employment relationship).

What can you do?

Review the refusal letter, gather evidence (like a simple business plan or marketing materials), and request a review or reapply with clearer information.

What Are Your Tax Obligations and Record-Keeping

Income Tax

You’ll pay tax on your net business income through your individual return.

Organise business income and expenses, claim valid deductions (travel to clients, personal protective equipment, insurance, etc.), and keep records to substantiate them.

Goods and Services Tax (GST)

If you earn $75,000 or more per year, you must register for GST.

You’ll add 10% to most invoices and lodge a Business Activity Statement (BAS) each quarter. Some disability or aged care services may be GST-free, so check specific ATO rulings for your service type.

Superannuation

As a sole trader, you’re responsible for your own super contributions. It’s wise to set up regular contributions to build retirement savings and potentially reduce your taxable income.

Record-Keeping

Keep all invoices, receipts, and financial documents for at least five years. A separate business bank account can simplify tracking and demonstrate a clear distinction between personal and business finances.

How to Maintain Your ABN

🔸 Updating ABN Details: If your contact information, address, or business structure changes, update your ABN within 28 days via the ABR website. Failing to do so can lead to missed mail or compliance checks.

🔸 ABN Reviews: The ABR may occasionally review your eligibility. If you receive an inquiry, respond promptly to confirm you’re still running a business. Regularly declaring business income in your tax return helps demonstrate active operations.

🔸 Cancelling an ABN: If you cease trading (e.g., move into full-time employment or close your support work business), cancel your ABN. Holding an inactive ABN can trigger automatic cancellation by the ABR or lead to confusion.

🔸 Renewing a Business Name: If you registered a business name (e.g., “Caring Hands Support Services”), remember ASIC’s renewal deadlines. An expired business name doesn’t affect your ABN status, but you can lose the right to trade under that name.

Conclusion

Applying for an ABN is a key milestone for anyone shifting into self-employment as an independent support worker.

It ensures you can legally invoice clients, manage tax obligations, and run your services as a legitimate small business.

By confirming your contractor status, gathering the right documents, completing the online application accurately, and staying on top of compliance requirements, you’ll set yourself up for a smooth, successful career in providing essential care services.

Embrace the autonomy, responsibility, and flexibility of independent support work, and let your ABN unlock professional opportunities in Australia’s growing care sector.

What Can ANNA Do for You as an Independent Support Worker?

Working as an independent support worker gives you the freedom to choose your clients, set your own schedule, and build a career on your own terms.

But with independence comes responsibility – like handling your own invoicing, taxes, and business administration. That’s where ANNA Money steps in.

We make it simple, fast, and hassle-free to register your ABN, manage your finances, and keep your tax obligations under control. Whether you’re supporting NDIS participants, aged care clients, or private individuals, ANNA helps you focus on what matters most – your clients.

✅ Register Your ABN Easily

- Don’t let admin hold you back. With ANNA, you can register your ABN in minutes, ensuring you’re set up correctly to invoice clients and agencies without worrying about tax withholdings.

🏢 Get Your Business Setup Right from Day One

Whether you’re working as a sole trader or considering setting up a PTY LTD company, ANNA makes the process stress-free.

- ABN & Company Registration – Get your business up and running smoothly, with the ASIC fee covered for company registration.

- Virtual Office Address – Protect your privacy and avoid using your home address for business.

- Business Name Registration – Choose and secure a professional name for your services.

📂 Stay Organised with Smart Business Tools

ANNA helps you manage your finances effortlessly, so you don’t have to worry about paperwork.

- Automated Receipt Matching – Upload receipts, and ANNA categorizes them for tax deductions.

- All-in-One Document Storage – Keep invoices, tax records, and expenses secure and easy to find.

- Professional Invoicing – Generate custom invoices in seconds and chase unpaid invoices automatically.

📊 Taxes Made Simple for Support Workers

Tax time doesn’t have to be a headache. ANNA ensures you stay on top of your obligations with:

- Automatic GST Calculations & BAS Lodgment – If you earn over $75K, ANNA handles GST for you.

- Personalised Tax Calendar – Never miss a deadline with reminders for your tax returns and BAS.

- Expert Accountant Support – Need help? ANNA’s friendly team is here to guide you.

- PAYG Tax Support – If you receive payments from businesses that require withholding tax, ANNA helps you manage this efficiently.

You became an independent support worker to help people—not to stress over admin.

Get started today and let ANNA handle the paperwork while you focus on your clients.