How to Find Your Tax File Number (TFN)? [Guide]

Learn how to find your Tax File Number (TFN) with this step-by-step guide, covering key requirements and tips for easy retrieval.

If you’ve ever wondered how to locate or safeguard your Tax File Number (TFN), this guide has you covered.

From understanding what a TFN is to finding it and ensuring its security, let’s dive into everything you need to know.

What Is a Tax File Number?

A Tax File Number (TFN) is your unique personal reference number in Australia’s tax and superannuation systems.

Think of it as your key to interacting with the Australian Taxation Office (ATO) and accessing certain financial benefits.

Here are some quick facts:

- Unique Identifier: Your TFN is a nine-digit number unique to you.

- Lifetime Use: It remains yours for life, even if you change jobs, move interstate, or go overseas.

- Free to Apply: Obtaining a TFN does not cost anything.

In Australia, a Tax File Number (TFN) is not mandatory for every individual, but it is highly beneficial and often necessary for various purposes.

Having a TFN simplifies tasks like filing taxes, applying for government benefits, and securing higher education loans.

Without it, you may face higher tax withholding rates or limited access to financial opportunities.

Why Should You Consider Applying for TFN

Without a TFN, you might face these limitations:

1. Higher Tax Rates

- Withholding Tax: If you do not provide your TFN to your employer or financial institutions, they are required to withhold tax at the highest marginal rate, which can be as high as 47% (including the Medicare levy). This means you will take home significantly less income than you would if your TFN were on file.

- Tax Refund Delays: When you file your tax return without a TFN, any potential refund may be delayed, as the ATO will need to verify your identity and tax situation.

2. Restricted Benefits

- Ineligibility for Government Allowances: Many government benefits and allowances, such as JobSeeker or Family Tax Benefit, require you to provide your TFN.

Without it, you may not only be ineligible for these payments but also miss out on financial support during times of need.

- Access to Superannuation: Your TFN is also necessary for accessing your superannuation funds. Without it, you may face difficulties in managing or transferring your superannuation accounts.

3. Online Lodgment Barriers

- Inability to Lodge Tax Returns Online: The ATO encourages taxpayers to lodge their tax returns online for efficiency and speed. However, without a TFN, you cannot complete this process online, which can lead to additional paperwork and longer processing times.

- Applying for an Australian Business Number (ABN): If you plan to start a business or operate as a sole trader, obtaining an ABN is essential. A TFN is often required during the application process for an ABN. Without it, you cannot legally operate your business or meet your tax obligations.

4. Difficulty in Establishing Financial Relationships

- Bank Accounts and Loans: Most banks and financial institutions require a TFN when opening an account or applying for loans. Without a TFN, you may face restrictions on account types or higher withholding taxes on interest earned.

- Credit Applications: Lenders often require a TFN as part of their identification process when assessing credit applications. Not having one can hinder your ability to secure loans or credit facilities.

5. Complications in Employment

- Job Opportunities: Some employers may require a TFN before hiring you, especially if they are obligated to report your earnings to the ATO. This could limit your job opportunities and affect your ability to earn an income.

Where to Find Your TFN

If you already have a TFN but can’t recall the number, there are several places to check:

Online:

- Sign in to your myGov account linked to the ATO.

- Use the ATO app.

Documents:

- Income tax notice of assessment.

- Letters from the ATO.

- Payment summary or income statement from your employer.

- Superannuation account statements.

Tax Agent: If you use a registered tax agent, they can provide your TFN.

❗ Tip: If your TFN is lost, stolen, or misused, contact the ATO immediately for assistance.

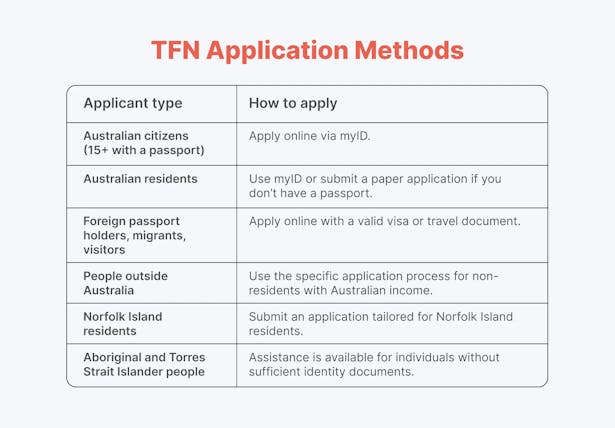

How to Apply for a TFN

If you don’t already have a TFN, applying is straightforward and free. Your application method depends on your residency status and circumstances.

Application Methods

Processing Time

- Most applicants receive their TFN within 28 days of submitting a completed application.

- For Australian citizens with a passport using the beta online process, the TFN might arrive even sooner.

- If you haven’t received your TFN within 28 days, contact the ATO for updates.

Keeping Your TFN Secure

Protecting your TFN is crucial to avoid identity theft or fraud. Here’s how to stay safe:

🔸Share Sparingly: Only disclose your TFN to:

- The ATO.

- Your employer.

- Banks and financial institutions.

- Government agencies for benefits claims.

- Your superannuation fund or university.

🔸 Secure Storage: Keep your TFN and related documents in a safe place.

❗ Note: The ATO can implement additional security measures on your account to monitor suspicious activity.

Lost or Stolen TFN? Here’s What to Do

If your TFN is lost or stolen, act quickly to protect your identity:

- Report the Issue: Call the Client Identity Support Center at 1800 467 033 (Mon–Fri, 8:00 AM–6:00 PM).

- Find It Online: Log in to your myGov account or the ATO app.

- Seek Assistance: If you’re unable to locate it, contact the ATO for help.

The support center provides guidance, helps re-establish your identity, and applies safeguards to your account.

Quick Tips for Updating Your TFN Details

Ensure your TFN registration details remain current:

- Contact Details: Update your phone number, email, or postal address online or via phone.

- Name or DOB: Submit identity documents to amend your name or date of birth.

- Bank Information: Update financial institution details promptly for tax refunds or payments.

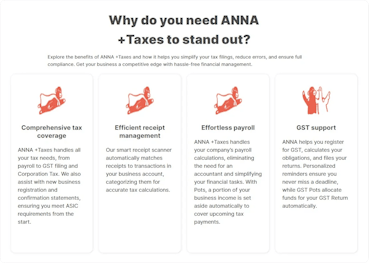

Transform the Way You Manage Taxes with ANNA

Managing taxes doesn’t have to be complicated or time-consuming. ANNA is your all-in-one solution for business tax management, combining automation, simplicity, and accuracy to keep your finances in order.

From tracking your expenses to filing with the ATO, ANNA ensures you’re always one step ahead of your tax obligations.

A Complete Tax Solution for Businesses

ANNA covers all your business tax needs in one place, including:

- Income tax for companies

- GST reporting and payments

- End-of-year tax filings

No more juggling spreadsheets, calculators, and filing systems. With ANNA, your taxes are handled seamlessly, so you can focus on growing your business.

What Makes ANNA Stand Out?

Here’s how ANNA transforms tax management into a stress-free experience:

- Real-Time Tax Estimates: Don’t wait until tax time to know what you owe. ANNA calculates your tax obligations on the go, providing up-to-date estimates so you’re always informed and prepared.

- Smart Expense Management: Track and categorise every business expense effortlessly. ANNA’s smart tools ensure you don’t miss out on deductions that could save you money.

- Profit and Performance Insights: Keep an eye on your financial health with ANNA’s profit tracking. Regular updates let you see how your business is performing, helping you make better decisions.

- ATO Integration for Hassle-Free Filing: Filing your taxes has never been easier. ANNA connects directly to the ATO, allowing you to submit your returns without unnecessary paperwork or stress.

- Exportable Financial Data: Need to share your records with an accountant or store them for reference? ANNA’s exportable spreadsheets ensure all your financial information is well-organised and accessible.

How ANNA Works

1. Connect Your Business Accounts

Link your business bank accounts to ANNA. The platform pulls transaction data automatically, ensuring your tax calculations are accurate and up-to-date.

2. Stay Updated with Tax Estimates

ANNA combines your income and expenses to calculate your tax liabilities in real time. This feature gives you clear visibility into your finances, so you’re never caught off guard.

3. Fine-Tune Your Records

You’re in control – add or adjust details manually to ensure your tax records reflect your business activity perfectly.

4. File with Confidence

When it’s time to lodge your return, ANNA simplifies the process with ATO integration. Submit your taxes with just a few clicks, saving you time and effort.

Why Choose ANNA for Your Tax Needs?

Managing taxes can be overwhelming, especially when you’re trying to run a business. ANNA takes the guesswork out of the equation by combining:

- Automation: Say goodbye to manual calculations and data entry.

- Simplicity: With a user-friendly interface, ANNA makes tax management easy for everyone.

- Reliability: Stay on top of deadlines with reminders and accurate estimates.

Get Started Today

ANNA isn’t just another tax tool – it’s your partner in business success.

From simplifying everyday expense tracking to ensuring you meet ATO requirements, ANNA makes tax management effortless.

Ready to take control of your finances?

Sign up for ANNA One today and discover a smarter, simpler way to manage your taxes!