How to Get an ATO Linking Code in 3 Easy Steps

Learn how to get an ATO linking code in 3 simple steps, making it easy to access and manage your Australian tax and business information.

- In this article

- What is a Linking Code and Why Do You Need It?

- Step 1: Setting Up Your myGov Account

- Step 2: Linking Your myGov Account to the ATO

- Step 3: Generating a Linking Code

- Tips for a Smooth Linking Process

- Common Challenges and How to Overcome Them

- Why Linking Your myGov Account to the ATO is Essential

- Final Thoughts

- ANNA – Your One Stop For Registration and Financial Management

Navigating tax matters in Australia can feel like learning a new language (pretty intimidating), especially when connecting your myGov account to the Australian Taxation Office (ATO).

Still, as a business owner, linking your account to the ATO is crucial for managing your tax obligations efficiently.

This comprehensive guide walks you through every step of the process, ensuring you don’t get lost in the jargon or overwhelmed by the technicalities.

So, here’s everything you need to know about how to get a linking code for ATO, explained in plain English!

What is a Linking Code and Why Do You Need It?

A linking code is a unique identifier used to connect your myGov account with the ATO securely. This connection allows you to:

- Access your tax details online,

- Lodge your returns and

- Manage various tax-related tasks.

Also, as a business owner, linking your account enables smoother integration with other government services, like GST reporting or accessing BAS details.

You’ll typically need a linking code if:

- You’re unable to answer the security questions based on your tax records.

- You’re new to the ATO’s online services.

- You’ve recently created a myGov account.

Step 1: Setting Up Your myGov Account

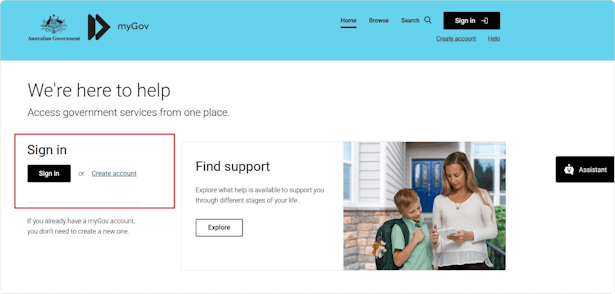

Before you can obtain a linking code, you’ll need a myGov account. Here’s how to create one:

- Visit the myGov website: Go to my.gov.au.

- Click ‘Create an account’: If you don’t already have one, follow the prompts to set up your profile.

- Choose a secure login option: You can use your email address or download the myID app (formerly known as myGovID). Ensure your login credentials are private and secure.

- Verify your identity: Depending on your chosen method, you might need an Australian mobile number or a strong identity strength on your myID app.

- Save your details: Keep your login details handy once your account is created.

Step 2: Linking Your myGov Account to the ATO

Once your myGov account is ready, it’s time to link it to the ATO.

Follow these steps:

1. Log in to your myGov account: Use your secure login method.

2. Locate the ‘Link Services’ section: This can usually be found on your dashboard.

3. Select the ATO: Click on "Australian Taxation Office" from the list of available services.

4. Provide your details: Confirm your personal information, including your Tax File Number (TFN), name, and date of birth.

5. Answer two security questions: The ATO will ask you to provide details from your tax records. Examples include:

- Bank account details: Use the account where your tax refunds are deposited or an account that has earned interest in the past two years.

- PAYG payment summary: This document, provided by your employer, contains your gross income from the past two years.

- Centrelink payment summary: If you receive government benefits, this summary includes your taxable income.

- Notice of Assessment (NOA): Found in your tax records, it includes the date of issue and reference number.

- Superannuation details: Your super fund’s ABN and member account number.

- Dividend statements: Use the investment reference number from your dividends.

If you can answer these questions correctly, you won't need a linking code. But if you cannot provide this information, proceed to the next step.

Step 3: Generating a Linking Code

If you can’t link your account through the standard method, the system will prompt you to generate a linking code. Here’s how to do it:

- Access the linking code option: During the linking process, if you’re unable to answer the required questions, choose the option to request a linking code.

- Verify your identity: The ATO will guide you through a process to confirm your identity. Be prepared to provide:

- Your TFN.

- Bank account or other tax-related details.

- Receive your linking code: Once verified, you’ll receive a unique linking code. This might be sent via email or SMS or displayed on your screen.

- Enter the code: Return to the myGov platform, input the linking code, and complete the process.

Tips for a Smooth Linking Process

- Keep Your Documents Ready: Having all your tax records on hand makes the process faster. If you’re missing any documents, consider contacting your accountant or the ATO for assistance.

- Double-Check Details: Ensure that the information you provide matches exactly with what’s on your tax records. Minor discrepancies, like misspelled names or incorrect dates, can cause errors.

- Stay Secure: Only access myGov and ATO services through official websites or apps. Avoid clicking on links from unsolicited emails or messages.

Common Challenges and How to Overcome Them

1. Missing Tax Records

If you can’t locate your tax records, you can:

- Use alternative questions provided by the ATO.

- Contact your tax agent for copies of past documents.

- Call the ATO helpline at 13 28 61 for guidance.

2. Trouble with myGov Login

If you’re locked out of your myGov account or forgot your login details, follow the recovery options on the myGov website. For added security, consider using the myID app.

3. Errors During Linking

Technical errors or outdated information can prevent successful linking. Check:

- If your myGov account uses a secure sign-in method (e.g., myID or SMS code),

- Whether the ATO system is undergoing maintenance (you can find this information on the ATO website).

Why Linking Your myGov Account to the ATO is Essential

For business owners, linking your account offers a range of benefits:

- Access to ATO Online Services: Manage tax returns, BAS, and GST online.

- Streamlined Reporting: Link your account to your business software for seamless tax reporting.

- Time Savings: Eliminate the need for phone calls or in-person visits to the ATO.

Final Thoughts

Linking your myGov account to the ATO might seem intimidating at first, but with the right information and a step-by-step approach, it’s entirely manageable. Whether you’re a new business owner or simply updating your records, this guide ensures you’re prepared for a seamless experience.

Take the time to set up your account correctly, and you’ll enjoy the benefits of hassle-free tax management. If in doubt, don’t hesitate to reach out to the ATO or consult your tax professional.

ANNA – Your One Stop For Registration and Financial Management

ANNA One is your all-in-one solution for starting, managing, and growing your business in Australia. From hassle-free company registration to seamless financial management, ANNA takes care of the hard work so you can focus on success.

Key Features of ANNA

- Free Company Registration: Save $576 in ASIC fees with ANNA covering the cost. Get your ACN, ABN, and ASIC documents delivered to your inbox in minutes.

- Integrated Tax Management: Automatically calculate GST, lodge returns, and stay on top of your tax obligations with a personalised tax calendar.

- Smart Bookkeeping: Match receipts, categorise expenses, and optimise your tax bills effortlessly.

- Professional Invoicing: Send invoices in seconds, with automated reminders for unpaid invoices – 80% paid within a week.

- Virtual Office Address: Protect your privacy with a professional Australian address for correspondence and regulatory communications.

- Ecommerce Integration: Sync with Shopify, WooCommerce, Amazon, and more for automated sales data imports and tax calculations.

- Credit Cards and Payments: Get physical and virtual cards for business expenses, plus Apple Pay and Google Pay compatibility and a business account!

Why Choose ANNA?

- Time-Saving Simplicity: Streamline business registration and financial tasks with one platform.

- Cost-Effective: Register your business for free and save money with efficient tax management.

- Credibility Boost: Operate as a registered company with an ACN, enhancing trust and brand recognition.

- Support for Growth: Easily access tools to manage GST, BAS, and income tax while optimising your financial records.

Register your business with ANNA One and unlock everything you need to run your company smoothly. Let ANNA handle the details so you can focus on growing your business.

Start now and experience seamless business management with ANNA.

FAQ

1. Can I Use The Same Linking Code For Multiple Purposes?

Yes, your linking code can often be used to connect to other government services, such as Centrelink.

2. Is My ATO Linking Code Permanent?

No, linking codes are usually temporary and expire after a set period. If your code expires, you can generate a new one.

3. Can I Link My Business Account?

Yes, you can link your business account by providing additional information, such as an ABN (Australian Business Number).