How to Manage Your Small Business’s Receipts

Learn how to manage your small business’s receipts with key steps, legal requirements, and tips for successfully organizing and maintaining your records.

Managing receipts is an essential yet often overlooked part of running a small business. Although it’s not the most glamorous task you can do, proper receipt management can save you time, money, and stress, from tracking expenses to ensuring tax compliance with ATO.

This guide will walk you through everything you need to know about how to manage your small business’s receipts so you can stay organized and prepared for any financial challenge.

Why Do You Need To Manage Receipts?

First, let’ cover the basics. As boring as it may sound, managing receipts is actually vital for several reasons:

1. Tax Compliance: The ATO requires businesses to maintain accurate records of all transactions. Proper receipt management means you will comply with these regulations and prevent potential fines or penalties during audits.

2. Financial Accuracy: Accurate bookkeeping helps you understand your business’s financial health. By doing so, you will know how to budget and help with financial planning and reporting. It allows you to track your cash flow (which is no.1 reason small businesses fail!), identify profitable areas, and detect any discrepancies early.

3. Expense Tracking: Monitoring business expenses allows you to identify cost-saving opportunities and ensure all expenses are business-related. This way, you can use your resources more efficiently.

4. Audit Preparedness: Being organized helps in the case of an ATO audit. Properly keeping receipts allows you to substantiate claims and deductions on tax returns, thus avoiding penalties and fines. This level of organization not only helps you navigate tax seasons smoothly but also gives you confidence that your financial affairs are in order and ready to withstand any audit or review.

What Types of Receipts Do You Need to Keep

In your day-to-day operations, you will encounter various types of receipts. Let’s go over the most common ones you need to keep and organize:

⚡ Sales Receipts:

Sales receipts are issued when you sell goods or services to customers. They should include:

- date of the sale,

- amount, and

- description of the goods or services sold.

These receipts help track income and reconcile it with bank deposits. Ensure they are detailed enough to provide a clear record of each transaction.

⚡ Expense Receipts:

Document all business-related expenses such as:

- office supplies,

- travel, utilities,

- rent,

- marketing, and

- other operational costs.

Each receipt should include the date, amount, supplier details, and the nature of the expense. Categorize these receipts to streamline expense tracking and tax deduction claims.

⚡ Bank Statements:

Monthly statements from your business bank account show all deposits, withdrawals, and transfers. To ensure accuracy, it is important to review your statements for transactions and balance your accounts regularly. This practice can help you quickly identify mistakes or suspicious activities.

⚡ Credit Card Receipts:

For purchases made using a business credit card, keep the receipts and match them with the monthly credit card statements to ensure all expenses are recorded accurately. This also helps monitor and control credit card spending.

⚡ EFTPOS Receipts:

It is important to keep a record of all transactions, whether they involve purchases or payments made via Electronic Funds Transfer at Point of Sale (EFTPOS). By saving these receipts along with your other sales documentation, you ensure you have a complete picture of every transaction you conduct.

⚡ Petty Cash Receipts:

Be sure to collect receipts for small cash payments made from the petty cash fund. These receipts should have the amount, date, and reason for the expense.

📍 Example of a Petty Cash Receipt

Emily, an employee at XYZ Ltd., needs to buy $20 worth of office supplies for a client presentation. She approaches Michael, the petty cash custodian, to request the funds.

Michael disburses the amount and fills out a petty cash receipt.

Emily buys the supplies and returns the store receipt to Michael, who attaches it to the petty cash receipt for documentation.

Petty Cash Receipt Example:

At the end of the month, Michael tallies all receipts to determine how much to replenish in the petty cash fund.

Legal Requirements For Record Keeping

As we mentioned above, ATO has specific requirements regarding the retention and format of business receipts:

⚡ Retention Period: Any business must retain its financial records, including receipts, for at least five years from the date you lodge your tax return. This ensures you can provide evidence of transactions if required by the ATO.

⚡ Format: You can either keep receipts in either paper or electronic form. Digital copies are acceptable as long as they are clear and easily readable. Converting paper receipts to digital format helps reduce physical storage needs and makes organization easier.

⚡ Details: Receipts must include specific information such as the transaction date, amount, nature of the expense or income, supplier’s name, and the purpose of the transaction. This information is necessary to substantiate claims and deductions on your tax return. Ensure all receipts are legible and complete to avoid issues during tax time.

📍 Essential Records:

- Income and Sales: Tax invoices, receipt books, cash register tapes, and records of cash and digital sales.

- Expenses: Receipts, tax invoices, cheque book receipts, credit card vouchers, and diaries for small cash expenses.

- Year-End: Lists of creditors and debtors, expenses related to assets and stock, and depreciation calculations.

- Banking: Deposit slips, cheque butts, bank and credit card statements, and loan or lease agreements.

- Depending on obligations, retain records for GST claims, fuel tax credits, and employee or contractor details (including payments, super contributions, and contracts).

Digitalizing Receipts: Why and How To Do It

Paper receipts tend to accumulate everywhere – in your car, bag, drawers, and all sorts of unexpected places. This clutter makes it challenging to keep track of expenses and organize financial records.

Digitalizing receipts simplifies this process, allowing you to store and manage them efficiently in one place, reducing the mess and making record-keeping much more manageable:

- Accessibility: Digital receipts can be easily accessed from anywhere at any time, provided you have an internet connection. This is particularly useful for business owners who are often on the move.

- Space Saving: Converting paper receipts to digital format reduces physical storage needs, freeing up valuable office space.

- Organization: Digital receipts can be sorted, categorized, and searched more efficiently than paper receipts. This simplifies tracking expenses and finding specific receipts when needed.

- Backup and Security: Digital receipts can be backed up automatically to prevent loss due to damage, theft, or misplacement. Cloud storage solutions offer additional security features to protect your data.

- Environmental Impact: Using receipt apps can further streamline this process by automating receipt scanning, categorization, and storage:

📍 Use a scanner or mobile app to digitize paper receipts. You can then store them on your computer or in the cloud, like Google Drive, Dropbox, or dedicated receipt management software.

Ensure that scanned receipts are clear and include all necessary details.

Organize receipts in folders labeled by month and type of expense, similar to a physical filing system. This organization method allows for quick retrieval and review of receipts when needed.

Leveraging ANNA for Receipt Management

All the above methods may sound dull, but ANNA simplifies the process significantly:

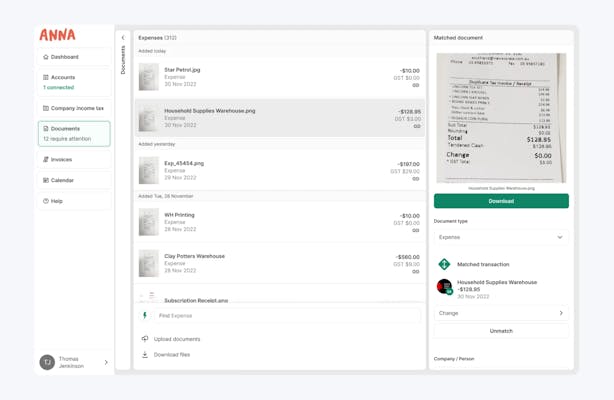

💡 Automated Bookkeeping

ANNA keeps your accounts tidy by automating your bookkeeping tasks. How?

It matches your receipts and invoices to your transactions and orders your payments into the correct accounting categories, such as travel, subsistence, or accommodation.

💡 Bookkeeping Score

ANNA provides a bookkeeping score that reflects the accuracy and completeness of your financial records. If all major transactions have documentation attached and all payments are categorized accurately, your bookkeeping score will be 100%. A lower score indicates that some actions are required to improve your records.

- High Score Benefits: A high bookkeeping score means less hassle when filing annual accounts and taxes. It indicates that your books are in good order, minimizing administrative burdens and potential tax compliance issues.

- Score Drops: Your score can drop if there are purchases from unfamiliar merchants over a certain amount without evidence attached or transactions needing extra confirmation regarding the expense category. This isn’t good accounting practice, so points are deducted to reflect these issues.

- Improving Your Score: To improve your bookkeeping score, ensure all transactions have the necessary documentation and are categorized correctly. ANNA will flag any transactions needing your attention, allowing you to make necessary adjustments and keep your score high.

💡 Potential Tax Savings

ANNA can also help identify potential tax savings throughout the year. This feature highlights expenses initially classified as non-business that, after confirmation, can be reclassified to unlock tax savings.

This proactive approach can reduce your tax bill and enhance your business’s financial efficiency.

Best Practices for Receipt Management

Implementing best practices helps maintain order and accuracy in your receipt management, making the process smoother and less stressful. Here’s how you can stay on top of things:

1. Regular Routine

Imagine coming into your office every Monday morning with a clean slate. Establish a routine for entering receipts into your accounting system, whether daily or weekly.

By regularly entering receipts, you prevent a mountain of paperwork from building up and ensure that all expenses are recorded promptly. This habit keeps your financial records up-to-date and minimizes the risk of errors.

2. Monthly Check-up

Imagine taking a moment to sit down calmly with a coffee in hand at the end of the month. You compare your receipts to your bank statements and financial records, making sure everything lines up.

This process helps you double-check each expense, catch any mistakes, and maintain reliable records. Think of it as a brief audit that helps you keep your financial information safe and accurate.

3. Categorization

Think of how easy it would be if all your receipts were organized into categories like utilities, travel, and office supplies. Properly categorizing your receipts simplifies expense tracking and reporting. When tax season rolls around, or if you ever face an audit, you’ll be able to locate specific receipts quickly and effortlessly.

4. Date Order

Arrange your receipts in chronological order, and you'll never have to rummage through a pile of papers to find that one elusive receipt from three months ago. This practice is especially useful during tax season or an audit, as it allows you to quickly find receipts for specific periods.

5. Labeling

Clearly label your physical folders and digital files. Include details such as the month and year, type of expense, and any other relevant information.

Consistent labeling transforms your chaotic pile of receipts into an organized and easily accessible system. This way, you can reach for a folder and finding exactly what you need within seconds.

Tips for Effective Receipt Management

To manage your small business’s receipts effectively, consider these additional tips:

- Consistency: Be consistent in how and when you record receipts. Set aside specific times each day or week to update your records. Consistency helps maintain an organized system and reduces the risk of missing receipts.

- Backup: To prevent data loss, regularly back up digital receipts. Use both local (e.g., external hard drives) and cloud-based backups. Regular backups ensure that your receipts are safe and can be retrieved if needed. Think of them as an insurance policy for your financial records, providing peace of mind in case of technical issues or disasters.

- Training: Train employees on the importance of receipt management and how to record expenses. Provide clear guidelines and procedures for collecting and submitting receipts. Employee training ensures that everyone understands the process and contributes to maintaining accurate records.

- Professional Help: Consider hiring a bookkeeper or accountant for professional assistance. A professional can help set up an efficient system, ensure compliance with ATO regulations, and provide expertise in managing financial records. Professional assistance, such as ANNA, can be particularly beneficial if your business has complex financial transactions or you lack the time to manage receipts yourself.

What to Do If You Lost Receipts

Despite your best efforts, receipts can sometimes be lost. Here’s how to handle such situations:

- Reconstruction: If a receipt is lost, try to get a duplicate from the supplier. Many businesses can provide copies of old receipts upon request. Contact the supplier with details of the transaction, such as the date and amount, to request a duplicate receipt.

- ATO Policy: The ATO may accept alternative evidence if a receipt is lost. This includes bank statements, credit card statements, or a statutory declaration explaining the expense. Document the details as thoroughly as possible to support your claim. While the ATO prefers original receipts, providing alternative evidence with a clear explanation can be acceptable in some cases.

Wrap It Up

Effective receipt management is crucial to maintaining accurate financial records in compliance with ATO regulations. Simplify this repetitive task by following best practices, staying consistent, and taking advantage of digital tools.

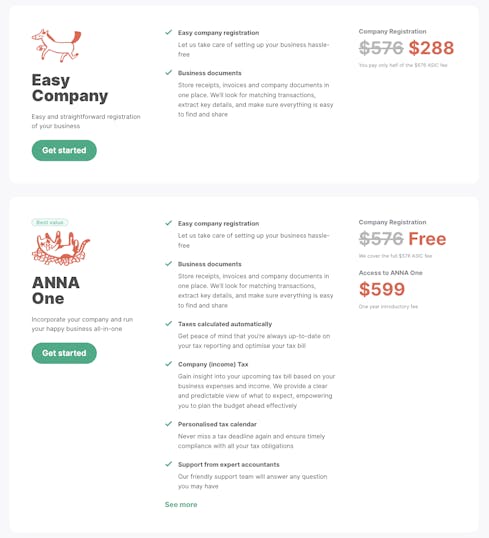

Ready to simplify your receipt management and boost your bookkeeping efficiency? Say goodbye to paper receipts and hello to a streamlined, digital solution with ANNA.

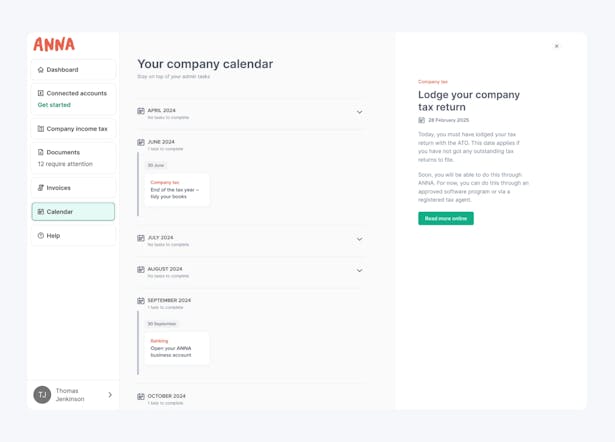

Along with easy company registration and a personalized tax calendar, you can also get:

- Effortless Receipt Management: Snap a picture of your receipts, and let ANNA automatically sort and attach them to the right transactions.

- Optimized Bookkeeping: Keep your financial records in top shape with ANNA’s automated bookkeeping and real-time Bookkeeping Score.

- Maximized Tax Savings: Ensure your expenses are correctly categorized and save more on your taxes.

Transform your small business accounting with ANNA and experience the peace of mind that comes with organized, efficient, and compliant financial records.

Sign up now and take the first step towards hassle-free bookkeeping!