How to Open a Business Bank Account in Australia? [The Complete Guide]

Learn how to open a business bank account in Australia through requirements, tips, and essential information to help you streamline the process.

- In this article

- What is a Business Bank Account?

- Who Needs a Business Account?

- What Do You Need to Open a Bank Account in Australia?

- How to Open a Business Bank Account in Australia in 6 Easy Steps

- Different Business Account Options in Australia

- How to Compare Business Bank Accounts?

- How To Open a Business Bank Account With ANNA?

- FAQ: Opening and Managing a Business Bank Account in Australia

Hey entrepreneurs! Are you looking into how to open a business bank account in Australia?

So, for those of you who run a business, partnership, or trust registered in Australia, you likely require a separate bank account to manage your finances and fulfill your tax obligations.

And as it might seem daunting, the truth is—it's actually straightforward.

This article is here to walk you through everything you need to know about business bank accounts in Australia, freeing you up to concentrate on growing your business.

Plus, we'll share a handy solution at the end to help you get started immediately.

Let's dive into this!

What is a Business Bank Account?

The main goal of a business bank account is to make managing your company's finances simpler and more organized.

It's the best way to keep your company's money separate from your personal funds.

Different banks offer varied services and fees for business accounts, tailored to the type of business you operate.

Who Needs a Business Account?

Determining if you need a business bank account in Australia largely depends on the legal structure of your enterprise.

Here’s a breakdown of who needs one and why it might be a good idea even if it's not a requirement.

1. Companies

If your business is registered as a company, it's considered a separate legal entity.

This means the finances of the company are distinct from your personal finances.

To keep everything clear and above board, especially for tax and legal purposes, a business account is a must.

2. Partnerships

In a partnership, two or more people run a business together.

Like companies, partnerships are seen as separate from individual partners in the eyes of the law.

This separation necessitates a business account to manage any money the business makes or spends.

3. Trusts

Trusts are another form of business structure where a trustee operates the business on behalf of the beneficiaries.

Due to the unique legal and financial arrangements of trusts, having a business account is essential for clear financial management and fulfilling tax obligations.

4. Sole Traders and Freelancers

For sole traders and freelancers, the line between personal and business finances isn’t legally required to be as clear-cut.

However, opting for a business bank account is still a wise decision.

It simplifies tax preparation by keeping personal and business transactions separate.

Plus, it could potentially save money on fees depending on the account and bank you choose.

In essence, while companies, partnerships, and trusts are obligated to have business accounts due to their distinct legal structures, sole traders and freelancers are not legally required.

Still, they could benefit greatly from the organization and clarity a business account provides.

What Do You Need to Open a Bank Account in Australia?

Here's what you need to know about the essential information and documents required to open your business bank account in Australia:

👉 Business Name: The official name your business is registered under with ASIC (Australian Securities and Investments Commission ).

👉 Business Address: Your main business address.

👉 ABN or ACN: Your unique business ID number (Australian Business Number or Australian Company Number).

👉 Industry: What kind of business you run.

👉 Owner Info: Names and addresses of the owners or partners, with ID.

👉 Tax Status Abroad: If any owner pays taxes outside Australia, this needs to be shared.

👉 FATCA and CRS: Info for the tax compliance acts (Foreign Account Tax Compliance Act and Common Reporting Standard).

👉 ID Documents: A photo ID like a passport or driver's license, or other documents that prove who you are and where you live.

How to Open a Business Bank Account in Australia in 6 Easy Steps

To open a business bank account in Australia is a pretty straightforward process.

However, the steps may differ slightly depending on your choice between a traditional bank and an online service.

Here's a step-by-step guide to getting your business banking up and running.

1. Choose Your Bank or Provider

Start by selecting the bank or online service that best fits your business needs.

Consider factors like fees, services offered, and whether a digital or in-person banking experience suits you better.

2. Prepare Your Documents

Before applying, ensure you have all the necessary documents ready. These include all documents we already established in the previous section.

3. Fill Out the Application

Depending on the provider's process, you can complete your application online or by completing a hard copy.

Online services usually offer a completely digital application, while traditional banks might also have an online option, but it could require additional steps.

4. Submit Your Documents

Provide your documents to the bank or service provider.

This could mean uploading digital copies if you're applying online or physically presenting them at a bank branch if required.

5. Account Verification

Once you've submitted your application and documents, the bank or provider will proceed with account verification.

Online services may offer instant verification, while traditional banks could require 1-2 days, particularly if additional information or document verification is necessary.

6. Activation and Access

After the verification process, you will receive a linked card for transactions and be able to add funds to your Australian business bank account.

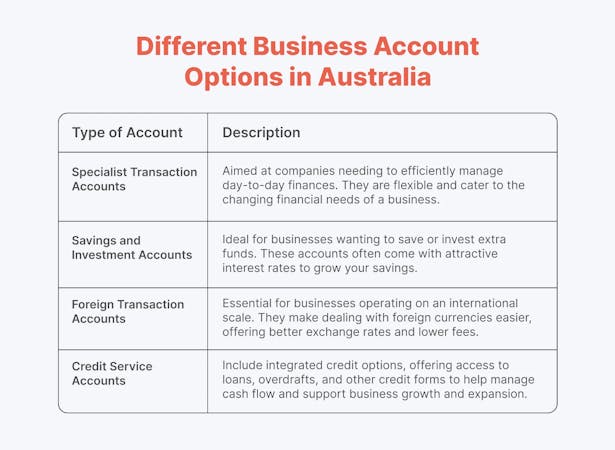

Different Business Account Options in Australia

Navigating the variety of business bank accounts in Australia is key to finding the perfect fit for your company's financial needs.

Whether you're just starting out or looking to expand, there's an account tailored to every business size and type.

👉 No Monthly Fee Accounts: These accounts are ideal for small businesses that handle most of their transactions online. They help minimize costs while offering essential banking services.

👉 Low Monthly Fee Accounts: These accounts charge a minimal monthly fee but come with the advantage of some free transactions. This option suits businesses with an average number of monthly transactions as they balance cost and utility.

👉 Medium to Large Business Accounts: Designed for businesses with larger transaction volumes, these accounts often come with a higher monthly fee but offer a broader range of services and higher transaction limits.

👉 Corporate Accounts: These accounts, tailored for corporate clients, provide specialist services and features. They cater to the complex needs of large corporations and offer customized banking solutions.

In addition to these primary types of accounts, businesses can also benefit from:

With such a diverse range of business bank accounts available in Australia, understanding each type's specific benefits and services is crucial in choosing the right account for your business's financial management and growth strategies.

How to Compare Business Bank Accounts?

Choosing the right business bank account is crucial for smooth financial operations.

While Forbes Advisor notes that opening a business account at your current bank can simplify things thanks to easier applications and transfers, they also stress the importance of prioritizing efficiency over convenience.

This approach helps avoid the hassle of switching accounts later.

Let's dive into the key features to consider when comparing business bank accounts in Australia, ensuring you make the best choice for your business needs.

Business Bank Account Features To Consider

👉 Review All Fees: Understand monthly account-keeping fees, charges for ATM use, in-branch transactions, and costs for depositing cash or cheques.

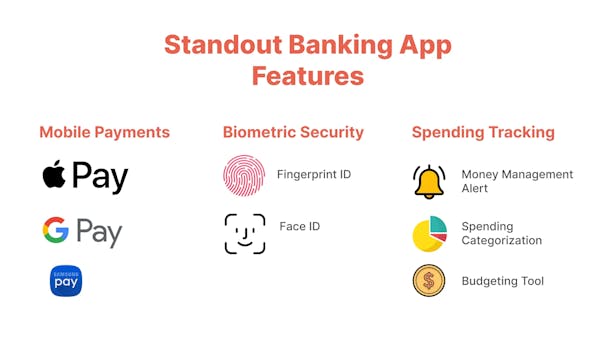

👉 Transaction Accessibility: Prioritize accounts based on the need for cash deposits, card payments, and real-time payment tools like PayID or Osko.

👉 Overdraft Features: If necessary for cash flow, check for the availability of overdraft facilities and the terms attached, including interest rates.

👉 Interest Rates: Compare transaction and savings accounts for the best interest rates, considering any conditions that may apply.

👉 Online Banking Tools: Look for accounts offering features like expense tracking, reporting, and compatibility with accounting software (e.g., Xero, MYOB).

👉 Merchant Support: Choose a bank that supports your future business expansion plans, whether through in-person sales or eCommerce.

👉 Security Measures: Ensure the account offers robust cyber security measures and accommodates multiple signatories if needed.

👉 Cash and Cheque Handling: For businesses still dealing in cash and cheques, select a bank that accommodates these payment methods.

What Else to Consider When Choosing a Business Bank Account?

Picking the right bank for your business isn't just about the handy features—getting expert advice can also make a big difference.

Forbes Advisor points out a few key things to think about when choosing a bank that fits your business needs:

✔️ Choose a bank account that aligns with how you plan to use it to avoid unnecessary travel and effort.

✔️ Look beyond appealing interest rates on business savings accounts; ensure the account's conditions match your operational needs.

✔️ Separating everyday transaction accounts from savings accounts can enhance organization and discourage unplanned spending.

✔️ For sole traders, explore using an offset account linked to a mortgage for savings, which may offer greater financial benefits than traditional savings accounts.

How To Open a Business Bank Account With ANNA?

ANNA is a financial services company that's all about helping small businesses get off the ground and register businesses in Australia.

We offer a one-stop shop with business accounts, bookkeeping software, and tax assistance, making financial management a breeze.

Starting Your Business with ANNA

When starting your business, you might choose to operate as a sole trader or set up a Limited Company.

ANNA steps in here with its Formations service, making it easy to register your new business.

The Registration Process

In Australia, registering a business means applying to ASIC, the body in charge of company registration.

Normally, this would set you back $576, but ANNA can complete this for you with ANNA One product (formation fee is included).

Here’s how we simplify the process into four steps:

1. Pick Your Company Name: Choose a unique name that reflects your business.

2. Provide Your Details: Fill in information about yourself and your business. You can also opt for extra services like a virtual office address to protect your privacy.

3. Sign Up for Free: ANNA One covers the incorporation fee, saving you a substantial amount.

4. Application Completion: Once everything is set up, you'll receive a notification.

By choosing ANNA, not only do you save on the registration fee, but you also get access to our comprehensive suite of additional services, including:

✔️ An Australian virtual office address.

✔️ A dedicated business account.

✔️ Efficient bookkeeping software.

✔️ Expert accounting services.

ANNA Money-Beyond Formation

ANNA doesn’t stop at company formation. We offer extensive support for small businesses in Australia, covering vital areas like:

👉 Taxes: ANNA helps with all your small business tax needs, from calculations to filings, and even automates tax payments for you.

👉 Transaction Account: Link all your bank accounts to ANNA for a consolidated view of your finances.

👉 GST and PAYE/Payroll Registration: Whether it's registering for GST or handling PAYE and payroll with the ATO, ANNA has you covered.

👉 Invoices: Create, send, and manage professional invoices directly through ANNA, including follow-ups on overdue payments.

Register with ANNA One now and streamline your small business financial management, freeing up more time to concentrate on expanding your business.

FAQ: Opening and Managing a Business Bank Account in Australia

How Long Does it Take to Open a Business Bank Account in Australia?

Opening a business bank account can be quick, often just a few minutes to apply if you have all your documents ready. However, banks need to check your details, which can take a day or two. Sometimes, they might ask for more documents.

Can Non-Residents Open a Business Bank Account in Australia?

Yes, if your business is registered in Australia, you can open an account as a non-resident with your ABN or ACN. However, banks might ask non-residents for extra identity and address proof.

Can I Open an Online Business Bank Account in Australia?

Absolutely! Most banks and specialist providers allow you to open an account online. Traditional banks might call to verify your account, while online services usually verify everything digitally.

Is Switching Business Bank Accounts Easy?

Yes, switching is straightforward. Open a new account, transfer your recurring payments, update your account details with your customers, and close your old account once you've moved your balance.