How to Register a Company in Australia [Step-by-step Guide]

Dive into our step-by-step process and learn how to register a company in Australia effortlessly with our comprehensive guide.

- In this article

- The Significance of Proper Company Registration in Australia

- Step 1: Choose the Right Business Structure for Your Company

- Step 2: Name Your Company and Check for Availability

- Step 3: Prepare Required Documents and Information for Registration

- Step 4: Get your Licenses, Permits, and Codes of Practice

- Step 5: Post-Registration Obligations and Compliance Requirements

- Is There An Easier Way To Register a Company in Australia?

- FAQ

So, you've got this idea buzzing in your head, and you're thinking, "Hey, why not start a business in Australia?"

But then reality hits, and you realize there's a bunch of paperwork and legal hoops to jump through.

Don't worry, we've got your back!

Setting up shop Down Under might seem like a maze at first, but with some know-how and practical tips, it's totally doable.

In this blog, we'll explain everything you need to know about how to register your company in Australia.

We'll also point you to valuable resources and share insider tricks to make your life easier.

So, grab a cuppa, and let's dive in!

The Significance of Proper Company Registration in Australia

Properly registering your company in Australia is the first and vital step in establishing your business entity.

And it's not just about ticking boxes and completing bureaucratic tasks.

Legal recognition and protection are among the key benefits of company registration.

It provides:

- A solid framework for conducting transactions.

- Entering contracts.

- Safeguarding your intellectual property rights.

Furthermore, registering your company enhances credibility and reputation.

It signals to customers, suppliers, and partners that you're serious about your business and committed to operating ethically.

Access to government incentives, grants, and support programs is another advantage of proper registration.

These resources can provide valuable financial assistance and support to fuel the growth of your business.

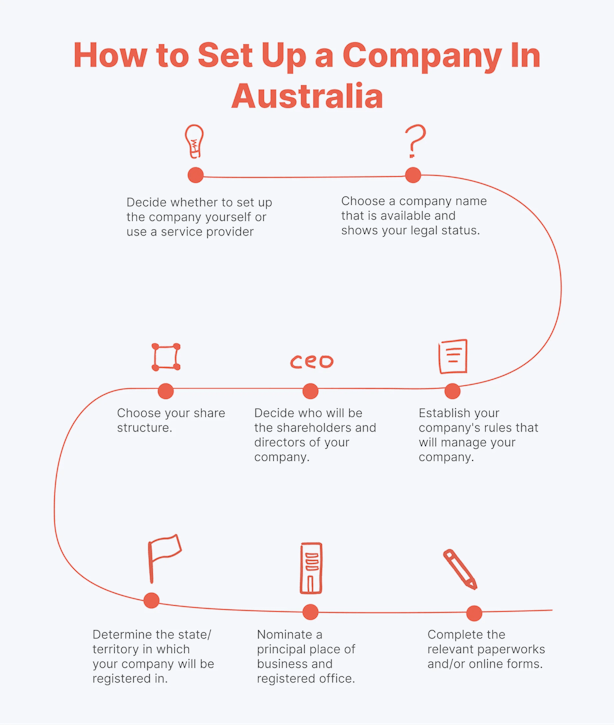

Step 1: Choose the Right Business Structure for Your Company

Choosing the proper business structure is one of the most important decisions when starting a business. This choice isn't a one—time decision; it affects how you'll handle taxes and reporting as your business grows.

So, think about:

- How many people will be involved?

- What exactly will your business do?

- How much money do you expect to make?

- How big do you think your business will get?

Having answers to these questions will help you get closer to a decision about your business structure.

What Business Structures Are Available in Australia?

In Australia, you have choices when it comes to registering your company. You can handle the process independently, with or without professional help.

Registration can be done online through the Australian Securities and Investments Commission (ASIC) website or via traditional paper form submission.

However, before proceeding, it's crucial to determine the most suitable business structure for your specific needs.

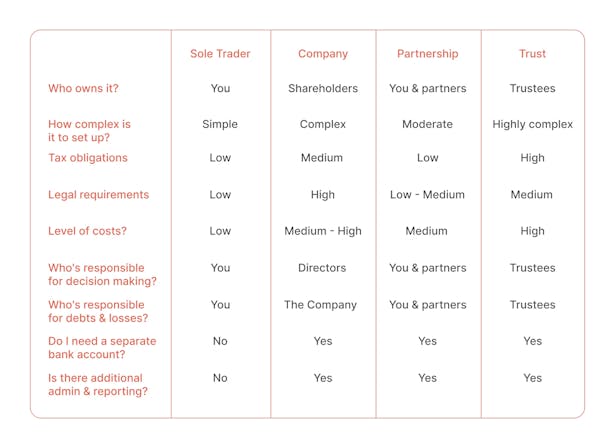

Comparing Business Structures

Let's take a closer look at the 4 main business structures categories:

1. Sole Trader

This is the simplest and most common form of business structure, as it is owned and managed by one person: you.

As a sole trader, you have complete control over your business and its profits.

However, you're personally liable for any debts (including tax debts, loans, and accounts payable) incurred by the business.

This means your personal assets are at risk if the business can't pay its debts.

You can also trade using your name or a registered business name (which will be covered in detail in Step 2).

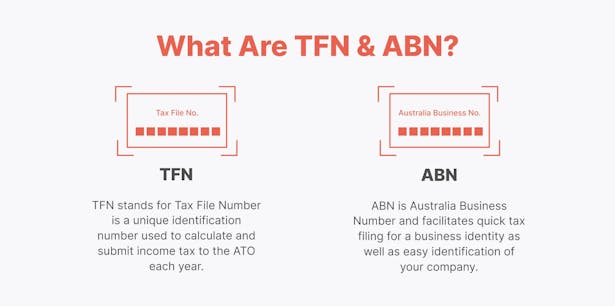

If you opt for this one, you should use your individual Tax File Number (TFN) for tax purposes and must register for an Australian Business Number (ABN).

2. Company

In Australia, the primary types of companies include:

- Private company (or proprietary limited company): This type of company does not offer its shares to the public and cannot raise capital through public share issuance.

- Public company: A public company's shares are publicly traded and owned by the general public, typically listed on a stock exchange.

When a business name is followed by "Pty Ltd," it indicates that the business is a registered legal entity conducting trade autonomously.

Shareholders own the company, while directors oversee its day-to-day operations. Company profits are distributed to shareholders as dividends.

Shareholders enjoy limited liability, shielding them from personal liability for company debts confined to the company's assets.

Pty Ltd companies have a separate legal identity from their owners, meaning they can sue and be sued in their own name.

These companies must register with ASIC, obtain a TFN and ABN, and comply with the Corporations Act 2001.

📌Note

Another necessary abbreviation to know is KYC (Know Your Customer).

It involves verifying a customer's identity before allowing transactions. Australian firms must comply with AML/CTF laws by verifying personal and company information using official documentation.

KYC is crucial for:

- Preventing financial crime

- Ensuring regulatory compliance

- Mitigating risks

- Enhancing security, and

- Aiding law enforcement in investigations.

3. Partnership

In a partnership, all partners jointly own and control the business, and profits are shared among them. Unlike a corporation, a partnership does not have a separate legal existence.

Establishing a partnership is straightforward and typically involves these steps:

- While not mandatory, it's advisable to create a partnership agreement outlining each partner's rights and responsibilities.

- Partnerships can operate under the partners' personal names or a chosen business name. If a business name is used, it must be registered with the Australian Securities Investment Commission (ASIC).

- The partnership needs an Australian Business Number (ABN) regardless of the chosen name.

- Partnerships also require their own TFN, obtainable online from the Australian Taxation Office (ATO).

- If the partnership's annual turnover exceeds $75,000, it must register for Goods and Services Tax (GST).

- While partnerships do not pay income tax themselves, they must lodge annual tax returns. Instead, each partner reports their share of the partnership's net income on their individual tax return.

📌Note

Under the Partnership Act (PA), three types of partnerships are recognized:

- A partnership (general partnership)

- A limited partnership

- An incorporated limited partnership.

Depending on your state or territory laws, each type has distinct requirements and characteristics.

4. Trust

In a trust structure, a trustee, who can be an individual or a company, assumes ownership of the trust's assets and conducts business operations on behalf of the trust beneficiaries.

Establishing a trust requires a formal Deed, and trustees have ongoing annual responsibilities.

Consequently, setting up and managing a trust can entail significant expenses and are subject to complex tax rules.

Step 2: Name Your Company and Check for Availability

When naming your company, the process involves more than just choosing a catchy or meaningful name.

In Australia, specific guidelines and procedures must be followed to ensure that your chosen name is not only unique but also complies with regulatory requirements.

One crucial step in this process is conducting an ASIC company name search to check availability.

This search helps you determine if another entity already registers the name you have in mind. Doing so can avoid potential legal issues and confusion in the future.

Register a website

Once you've selected the right name, consider securing your business domain and initiating your online presence.

If feasible, we advise considering registering two domains: an Australian-focused .com.au domain and a global .com domain.

This strategy ensures that you are prepared for potential expansion into international markets, as you will already have the .com domain name.

💡Tip: Restricted Words and Expressions in Business Names

Certain words and expressions are restricted from being used in business names to prevent consumer confusion (for example, "charitable, Made in Australia, Bank, etc.). These restrictions also apply to similar meanings and abbreviations.

Trademark and Copyright Protection

Additionally, ensure your chosen name isn't already trademarked through an Australian Trademark Search tool.

Trademark registration protects business assets like logos and slogans. Copyright applies to original works such as photography, blogs, and music. Both safeguard against unauthorized use and reproduction.

Step 3: Prepare Required Documents and Information for Registration

Determining the necessary registrations can be confusing, but the government's "help me decide" questionnaire is the simplest clarification method. Though this can vary, these are the typical registration requirements:

- Sole trader: ABN, Business name, GST

- Company: ABN, Business name or Australian company name, TFN, GST, PAYG

- Partnership: ABN, Business name, GST, TFN

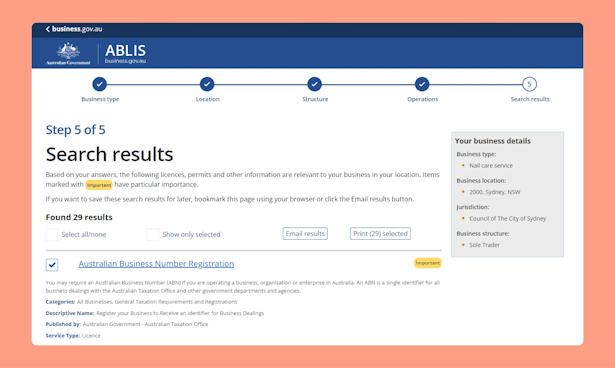

Step 4: Get your Licenses, Permits, and Codes of Practice

The next important step is to obtain the necessary licenses and permits and adhere to codes of practice that align with your business type, structure, and operations.

These depend on various factors, including your location and the activities you plan to undertake.

For instance, if you're a sole trader based in Sydney looking to open a nail salon and hire employees while promoting your business, you may need 29 individual licenses and permits, along with compliance with various codes of practice.

Navigating these requirements can be complex, which is why we recommend using the Australian Business Licence and Information Service.

This service guides you through essential questions and provides a clear list of the licenses, permits, and codes of practice you need.

⭐ Pro Tip From Anna

As the example above shows, obtaining 29 permits can be expensive and time-consuming. In Australia, registering a company typically costs around $576.

However, you can form a company seamlessly with ANNA Money's Anna One package.

It includes company formations, tax services, and soon, a transaction account—all for a single monthly fee of $50, plus an annual charge.

By opting for ANNA Money, we cover the formation fees, saving you an additional $500.

Other solutions, such as ASIC, require visiting their website and spending hours navigating the registration process.

In contrast, with ANNA Money, you can register your company in just 20 minutes, making the process quick and efficient.

Step 5: Post-Registration Obligations and Compliance Requirements

So, you've successfully navigated the labyrinth of company registration in Australia—congratulations!

Now, brace yourself for the thrilling sequel: post-registration obligations and compliance requirements.

One key post-registration obligation is meeting taxation requirements. It involves registering for taxes such as Goods and Services Tax (GST) if applicable and fulfilling annual tax reporting obligations to the Australian Taxation Office (ATO).

Another essential aspect is maintaining proper company records and registers.

For example:

- Keeping accurate records of financial transactions,

- Shareholder details,

- Director information,

- Meeting minutes and

- Any changes in company structure.

⭐ Pro Tip From Anna

Streamline your accounting by effortlessly importing transactions from your ANNA account to Xero.

Open the ANNA app, tap the lightning button, select "Connect to my Xero," and approve the integration terms.

For automatic reconciliation, opt for the extended integration.

Within 10 to 15 minutes, your ANNA transactions will sync with Xero, saving you time and hassle.

Is There An Easier Way To Register a Company in Australia?

While the government provides numerous resources for registering a company, the process can be complex and time-consuming, often taking up to a month to complete.

This position is understandable when you consider that as of June 30, 2023, there were 2,589,873 actively trading businesses in the Australian economy.

Good news - there's a simpler solution! With ANNA, you can breeze through the registration process with ease.

Here's how:

⚡ Streamlined Process: ANNA offers a streamlined process for company registration, which can be completed in as little as 20 minutes!

⚡ Guided Assistance: ANNA's intuitive platform guides you through each registration process step, ensuring nothing is missed.

⚡ Expert Support: ANNA provides expert support every step of the way, answering any questions you may have and offering personalized assistance.

⚡ Integrated Tools: You have access to integrated tools and resources to help with company formation, making the process even smoother.

⚡ Efficient Results: Experience efficient results as ANNA helps you register your company quickly and efficiently so you can focus on growing your business.

And there you have it! Registering a company in Australia may seem like an exhausting journey through the bush of bureaucracy. Still, by partnering with ANNA Money, you'll be surfing the waves of paperwork like a pro surfer on Bondi Beach.

Visit ANNA today to learn more and simplify your company registration process.

Best of luck with your Aussie adventure!

FAQ

1. What Documents Do I Need to Register a Company?

You'll typically need identification documents for company officers, details of the company's registered address, and any necessary licenses or permits for your business activities.

2. How Long Does it Take to Register a Company in Australia?

The registration process can vary, but it usually takes a few days to a few weeks to complete.

3. What Are the Costs Associated with Registering a Company in Australia?

Costs vary depending on factors such as the business structure chosen and any additional services required. Fees may include registration fees, ABN application fees, and optional fees for expedited processing.

4. Do I Need a Business Bank Account When Registering a Company?

While not mandatory, having a separate business bank account is recommended for easier financial management and to maintain separation between personal and business finances.