How to Register for GST in Australia? Complete Guide

Learn how to register for GST in Australia with this guide, covering eligibility, steps, and tips for compliance and financial management.

- In this article

- What is GST, and Why is it Important?

- Do You Need to Register for GST?

- How to Register for GST in 3 Steps

- What Happens After Registration?

- Obligations of GST-Registered Businesses

- What If You Don’t Register for GST?

- Benefits of GST Registration

- Real-World Examples

- How to Backdate or Cancel Your GST Registration

- Final Thoughts

- FAQ

Running a business in Australia comes with many responsibilities, and one of the most important is ensuring compliance with tax laws.

If your business involves selling goods or services, you may need to register for Goods and Services Tax (GST).

GST registration is mandatory for some, while others may opt to register voluntarily.

Regardless of your situation, understanding how GST works, when to register, and what it means for your business is critical.

So, how to register for GST in Australia? Let’s find out below!

What is GST, and Why is it Important?

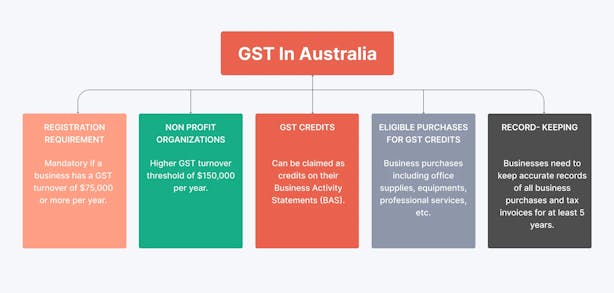

Goods and Services Tax (GST) is a 10% tax applied to most goods, services, and other items sold or consumed in Australia. It’s a value-added tax that businesses collect on behalf of the Australian Taxation Office (ATO).

As a GST-registered business, you will:

- Add GST to the price of most goods and services you sell.

- Collect the GST from customers and remit it to the ATO.

- Claim GST credits for the GST included in the price of items you buy for your business.

For example:

- If you sell a product for $110 (including GST), $10 of that amount is GST, which must be reported and paid to the ATO.

- If you buy business supplies for $220 (including $20 GST), you can claim the $20 as a GST credit.

Do You Need to Register for GST?

Not all businesses are required to register for GST. The need to register depends on your turnover and the type of business activities you conduct.

📌 When GST Registration is Mandatory

You must register for GST if:

- Your GST turnover exceeds $75,000 per year (gross income minus GST).

- You provide taxi or ride-sharing services (e.g., Uber, DiDi), regardless of your turnover.

- Your non-profit organisation earns $150,000 or more annually.

- You want to claim fuel tax credits for your business operations.

For new businesses, you need to register if you expect to exceed $75,000 in turnover during your first year.

📌 Optional GST Registration

If your turnover is below the $75,000 threshold, GST registration is optional.

Some businesses voluntarily register to:

- Claim GST credits for purchases.

- Present a professional image to customers and clients.

- Prepare for growth if they expect their turnover to increase.

Once you register voluntarily, you must remain registered for at least 12 months before deregistering.

How to Register for GST in 3 Steps

Registering for GST involves a few straightforward steps. It is best to prepare in advance and use the right tools to make the process quick and hassle-free.

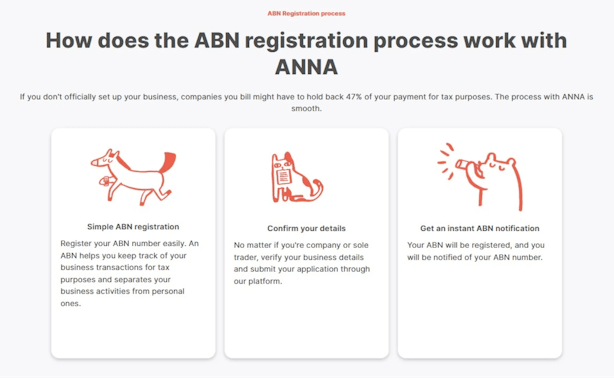

Step 1: Obtain an ABN

Before you can register for GST, you need an Australian Business Number (ABN). This unique identifier is essential for all tax-related activities, including GST registration.

If you don’t already have an ABN, you can apply online through the Australian Business Register (ABR).

The application is free and usually processed quickly.

With ANNA, this process is quite quick:

Step 2: Choose Your Registration Method

After you have your ABN ready, you can register for GST through several methods:

1. Online:

Use the ATO’s Business Portal or the Business Registration Service. These platforms guide you through the process step by step.

2. Phone:

Call the ATO at 13 28 66 to register over the phone.

3. Through a Tax or BAS Agent:

Engage a registered tax agent to handle the process for you. This is often the most reliable option for busy business owners.

4. Paper Form:

Complete the NAT 2954 form (Add a New Business Account), available from the ATO’s publication ordering service.

Step 3: Submit Accurate Information

When registering, you’ll need to provide:

- Your ABN.

- The date you want GST registration to start.

- Your business details, including the types of goods or services you sell.

- Your estimated turnover.

✋ Remember – accuracy is crucial. Providing incorrect information can delay the process or result in penalties.

What Happens After Registration?

Once your GST registration is processed, the ATO will notify you in writing. This notification will include:

- Your GST registration details.

- The date your registration is effective.

From this point onward, you’re responsible for fulfilling several GST-related obligations.

Obligations of GST-Registered Businesses

1. Issue Tax Invoices

A tax invoice is required for any sale over $82.50 (including GST).

It must include:

- Your business name and ABN.

- The total price, including GST.

- A statement that GST is included.

If you sell a product for $1,100, your tax invoice should show:

- Price before GST: $1,000

- GST: $100

- Total: $1,100

2. Lodge Business Activity Statements (BAS)

BAS is used to report GST collected on sales and GST paid on purchases. Most businesses lodge quarterly, but businesses with higher turnovers may need to lodge monthly.

If you collected $15,000 in GST from sales and paid $5,000 in GST for purchases, your BAS will show a net GST payment of $10,000 to the ATO.

3. Keep Accurate Records

Record-keeping is essential for tracking GST on sales and purchases.

We recommend streamlining this process using accounting software like ANNA, Xero, MYOB, or another tool suitable for your business type.

Understanding GST Turnover

Your GST turnover is your total income from taxable sales (excluding GST) minus:

- Input-taxed sales (e.g., residential rents, financial services).

- Sales not connected to your business.

- Certain international transactions.

💡 For instance, Daniel operates a car repair shop. Over 12 months, his income from repairs and parts sales totals $85,000 (excluding GST).

Although his profit is $50,000, his turnover exceeds $75,000, so he must register for GST.

Special GST Rules

📌 Ride-sharing and Taxi Services

GST registration is mandatory for all ride-sharing drivers, regardless of turnover.

If you drive for Uber, DiDi, or similar services, you must register for GST and lodge BAS, even if you earn less than $75,000 annually.

📌 Non-Residents

You may need to register for GST if you’re a non-resident conducting business in Australia.

The rules depend on your activities, and you should seek advice to ensure compliance.

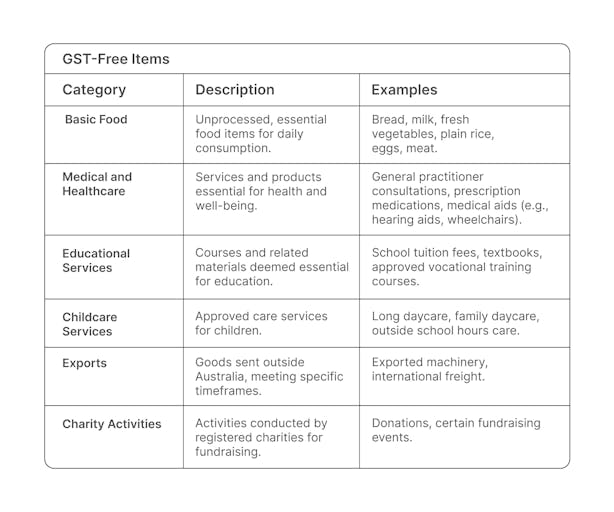

📌 GST-Free Sales

Certain items are GST-free, such as:

- Basic food (e.g., bread, milk).

- Medical and healthcare services.

- Educational courses.

💡 For example, Susan owns a grocery store. While bread is GST-free, soft drinks are taxable.

So, Susan must charge GST on soft drinks but not on bread.

What If You Don’t Register for GST?

Failing to register for GST when required can have serious consequences:

- You may owe GST on past sales, even if you didn’t include GST in your prices.

- The ATO may impose penalties and interest charges.

Benefits of GST Registration

✔️ Tax Credits: Claim back the GST you pay on business purchases, reducing your costs.

✔️ Professionalism: GST registration enhances your business's credibility, particularly when dealing with larger clients who expect tax invoices.

✔️ Compliance: Registering for GST ensures you meet your tax obligations and avoid penalties.

Real-World Examples

Now, let’s take a look at some business examples that may or may not need to register for GST:

Example 1: A Start-Up Business

Jessica launches an online store selling handmade jewellery.

She expects to earn $80,000 in her first year. Since her projected turnover exceeds $75,000, Jessica must register for GST and start adding GST to her prices.

Example 2: Voluntary Registration

Tom runs a gardening service with an annual turnover of $60,000. He voluntarily registers for GST to claim credits on purchases like a new lawnmower and tools.

Example 3: Seasonal Business

Emily operates a surf school with a seasonal income. Her total turnover for the year reaches $76,000.

As soon as she surpasses the threshold, she registers for GST and adjusts her prices to include GST.

How to Backdate or Cancel Your GST Registration

📌 Backdating Registration

If you exceeded the GST threshold in the past but didn’t register, you can backdate your GST registration by up to four years.

For example, if you realised in 2024 that you exceeded the threshold in 2020, you can apply to backdate your registration to 2020.

📌 Cancelling Registration

You can cancel GST registration if your turnover consistently falls below the threshold.

However, you must stay registered for at least 12 months after voluntary registration.

Final Thoughts

GST registration is an essential part of running a compliant and successful business in Australia. You can manage GST effectively by understanding your obligations, keeping accurate records, and using tools like accounting software.

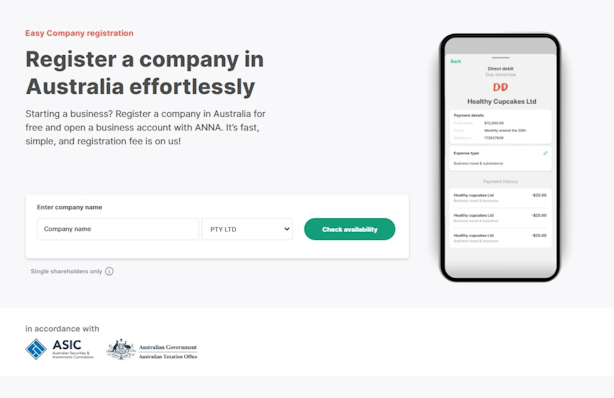

What Can ANNA Do For Your Business?

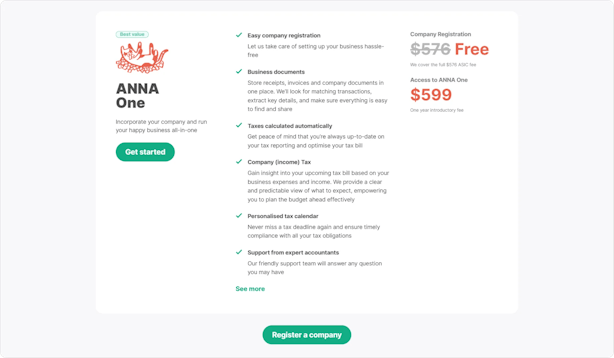

If you're gearing up to register for GST in Australia, ANNA One makes it effortless to manage your business's tax obligations from the start.

With ANNA, you can register for GST alongside your company setup, ensuring compliance with ATO requirements without any stress.

Beyond registration, ANNA handles all your GST needs, from automated calculations to lodging your Business Activity Statement (BAS), leaving you free to focus on growing your business.

If you’re ever in doubt, consult our support – available 24/7!

✔ Automatic GST Calculations – Calculate and track GST effortlessly on every sale and purchase.

✔ GST Filing Made Simple – Lodge your BAS directly through ANNA without worrying about deadlines.

✔ Professional Tax Invoices – Generate GST-compliant invoices in seconds, with unpaid invoices followed up automatically.

✔ Bookkeeping Score – Keep your books tidy and categorised with Business Score, which provides simple tasks to optimise your tax savings. The higher your score, the more efficient and tax-savvy your business becomes!

✔ Tax Year Dates – Never miss a tax deadline. ANNA will remind you of key dates and help you prepare for BAS and GST filings in advance.

And much more!

Sign up with ANNA today and ensure that your GST obligations are handled efficiently and accurately, giving you peace of mind from day one!

FAQ

1. Can I Register For GST if My Turnover Is Below $75,000?

Yes, you can register voluntarily. This is often beneficial for businesses with significant expenses that include GST.

2. How Often Do I Need To Lodge BAS?

Most businesses lodge quarterly, but businesses with higher turnovers may need to lodge monthly.

3. Can I Deregister For GST?

Yes, but only if your turnover consistently falls below $75,000. You must remain registered for at least 12 months after voluntary registration.