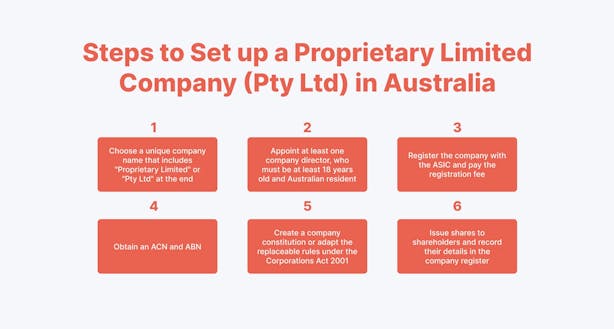

How to Set Up a Pty Ltd Company in Australia?

Learn how to set up a Pty Ltd company in Australia, including the steps, legal requirements, and important considerations for starting your business.

Whether you have a groundbreaking business idea or are simply eager to become your own boss, setting up a Proprietary Limited (Pty Ltd) company in Australia is a great way to structure your business professionally while protecting your personal assets.

So, grab a cup of coffee (or tea), settle in, and let's dive into everything you need to know about setting up your very own Pty Ltd company in Australia.

What Is a Pty Ltd Company? (and Why It Might Be Right for You)

First things first – what exactly is a Pty Ltd company?

In Australia, a Proprietary Limited company (Pty Ltd) is a private company, meaning its shares are not available to the public on the stock market.

It is a separate legal entity from its owners, providing them with personal liability protection.

As such, your personal assets are generally safe from company debts or legal issues.

This structure is popular with small businesses because it allows up to 50 non-employee shareholders, which is an ideal fit for companies not seeking public investment.

Key Features:

- Limited liability for shareholders.

- Up to 50 non-employee shareholders are allowed.

- No public share offerings or stock market listings.

- Reduced reporting requirements compared to public companies.

Differences from Public Companies:

- Pty Ltd companies are privately owned and have fewer shareholders.

- Public companies can sell shares to the public and list on the stock exchange, with more reporting obligations.

So, if you have a vision that's bigger than a hobby or side gig, a Pty Ltd might just be the way to go.

Before You Start: Ask Yourself the Big Questions

Before jumping into the formalities, let's start with some personal reflection:

- Why do I want to start a company?

- What do I hope to achieve?

- Am I prepared for the responsibility?

Starting a business is more than filling out paperwork.

It's about committing to an idea, a vision, and often a team.

Thus, make sure you're clear on your "why" because it will be the fuel that keeps you going through the ups and downs.

Benefits of Setting Up a Pty Ltd Company

Step 1: Pick the Perfect Company Name

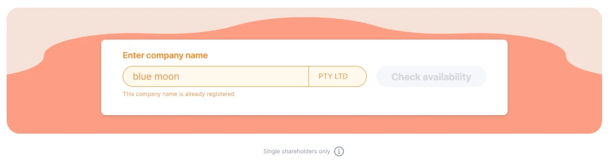

Think of your company name as the face of your business.

It's the first impression potential clients and partners will have, so choose something memorable, meaningful, and—most importantly—available.

If you're anything like most founders, this part might feel overwhelming. But don't worry, you've got tools at your disposal!

2 ways to see if your chosen name is available:

- Use the ASIC Name Availability Search to see if your dream name is taken.

- Use ANNA's quick Name search feature. 👇

If it's already snapped up, brainstorm variations or consider a fresh angle. Just make sure to avoid restricted words like "Bank" or "Royal" unless you have special permissions.

Once you find the name, you'll need to add "Pty Ltd" at the end to show that it's a private company.

Step 2: Choose Your Company Structure and Governance (Who’s in Charge?)

Every company needs a backbone – a solid structure to keep things running smoothly. Start by deciding:

- Who will be the Director(s)? Every Pty Ltd needs at least one director who's an Australian resident.

- Will you have a Company Secretary? This role isn't mandatory, but having one can make managing the admin side easier.

- How many Shareholders? You can have up to 50 non-employee shareholders, and they can be individuals or other entities.

If you're flying solo, you might be the sole director and shareholder. But it's time to clarify roles if you have co-founders or investors.

Take time with this step, and don't shy away from awkward conversations. Setting clear expectations now will save a lot of headaches later.

Step 3: Register Your Company with ASIC (The Official Part)

Ready for the real deal? Head over to the ASIC website and register your Pty Ltd company online. It's a straightforward process, but having all your info handy will speed things up:

- Company Name: (Check, done in Step 1!)

- Type of Company: Proprietary Limited.

- Details of Officeholders and Shareholders: Full names, birth dates, and residential addresses.

- Registered Office Address: This is where ASIC will send official mail. You'll need the owner's permission if you don't own the property.

- Principal Place of Business: The actual location where your business operates.

You'll also need to pay a registration fee (currently around AUD 597). Once you complete the form, ASIC will issue you an Australian Company Number (ACN), which is like your company's ID number.

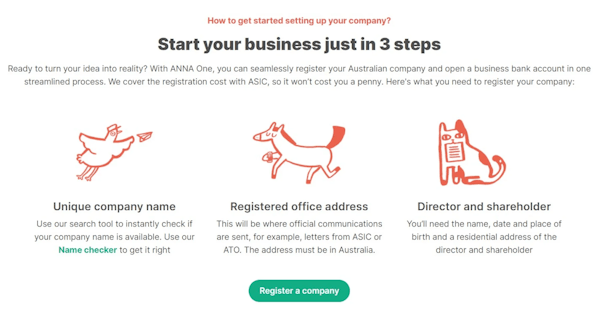

Pro tip

Setting up your company is easier than ever! With ANNA One, you can register your business and open a bank account in just three steps – at no cost to you.

Just have your unique company name, an Australian office address, and director/shareholder details ready.

Use ANNA's Name Checker to ensure your name stands out; we'll handle the rest!

Step 4: Apply for an ABN (Australian Business Number)

Your ACN is a start, but you'll also need an ABN to legally operate. This unique number lets you:

- Issue tax invoices.

- Register for GST (if required).

- Claim back on GST credits.

Head to the Australian Business Register and apply for your ABN – it's free and straightforward if you have your ACN ready.

To learn more about ABN, check out our detailed guide here 👉 What is ABN Number? Everything You Need to Know

Step 5: Draft a Shareholders Agreement (If You Have Partners)

Establish a company constitution or use the replaceable rules defined by the Corporations Act 2001.

This document is your safety net. It outlines who owns what, the decision-making processes, and what happens if someone wants to leave.

You may never need to use it, but you'll be glad it's there if a disagreement arises.

Step 6: Set Up a Business Bank Account

This might seem obvious, but many new business owners make the mistake of mixing personal and business finances.

Avoid that mess by setting up a dedicated business bank account. This step will also make tracking expenses and managing cash flow much easier.

When choosing a bank, think about what features are important to you.

Do you need strong integration with your accounting software? Low fees? Or perhaps an all-in-one business solution that specializes in entrepreneur-friendly features? Weigh your options.

Pro Tip

Boost your business with an ANNA account! Get access to debit cards, virtual cards, Apple Pay, Google Pay, and even expense cards for employees – everything you need to easily manage business spending.

Step 7: Take Care of the Taxes

Depending on what your business does, you might need to register for additional taxes:

- GST: You must register if your revenue is $75,000 or more annually.

- PAYG Withholding: If you hire employees or contractors.

- FBT (Fringe Benefits Tax): If you provide staff perks like cars or health insurance.

Don't let tax obligations sneak up on you. Keep the ATO website bookmarked and stay informed.

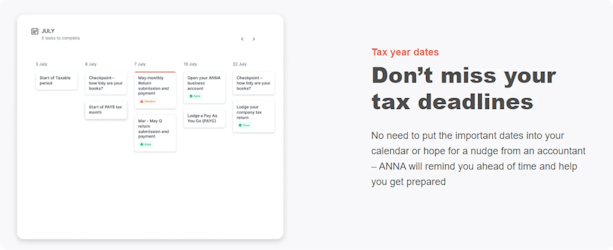

Pro tip

Or, if you don’t have time for endless tab switching, there is an easier solution.

With ANNA, all your tax obligations are handled – from Company Income Tax, GST registration, and ABN setup to Annual Tax Filing and BAS lodgement.

ANNA automates GST calculations, generates tax invoices, and even sorts your expenses to help you claim more deductions.

Plus, with your personalised tax calendar, you'll never miss a deadline and can file taxes directly through ANNA in your first year of trading.

Start your business with peace of mind, knowing every ATO box is checked!

Step 8: Insurance — Protect Yourself and Your Business

It's not just about following the law; it's about peace of mind. Imagine a worst-case scenario: a client gets hurt on your premises, or a project goes wrong. The right insurance will have your back. Consider options like:

- Public Liability Insurance

- Professional Indemnity Insurance

- Workers' Compensation

Step 9: Set Up Accounting Systems (Your Future Self Will Thank You)

Don't wait until tax season to get organized. Setting up a good accounting system from day one will save you hours (and stress) later on. Some popular options are:

- ANNA: All-in-one solution for accounting, invoicing and banking

- Xero: User-friendly and great for small businesses.

- QuickBooks: Excellent for inventory-heavy companies.

- MYOB: Reliable and comprehensive.

If you're not a numbers person, this is the time to hire a bookkeeper or accountant.

Pro tip

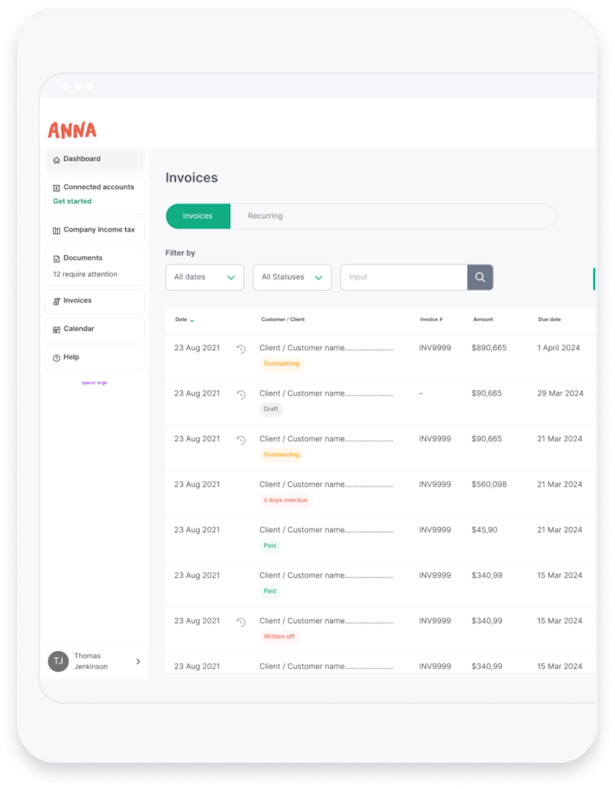

Save on taxes and streamline your bookkeeping with ANNA! Our Bookkeeping Score helps keep your books tidy, guiding you to categorize expenses for maximum tax efficiency.

Plus, say goodbye to paper receipts – just snap a photo, and ANNA automatically sorts and attaches them to transactions.

And with professional invoicing that chases unpaid bills for you, 80% of ANNA invoices get paid within a week. The higher your score, the more you save—while staying organized and stress-free!

Step 10: Plan for Success (Marketing and Operations)

Now that the admin work is done, focus on growth! Build a killer website, set up your social media profiles, and spread the word.

Create a marketing plan and network, and start building those client relationships.

Remember, setting up a company is just the beginning – running and growing it is where the real adventure begins.

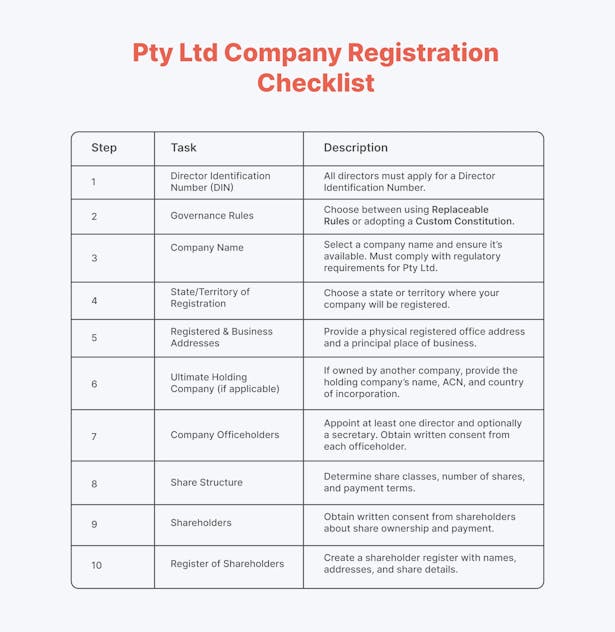

Pty Ltd Company Registration Checklist

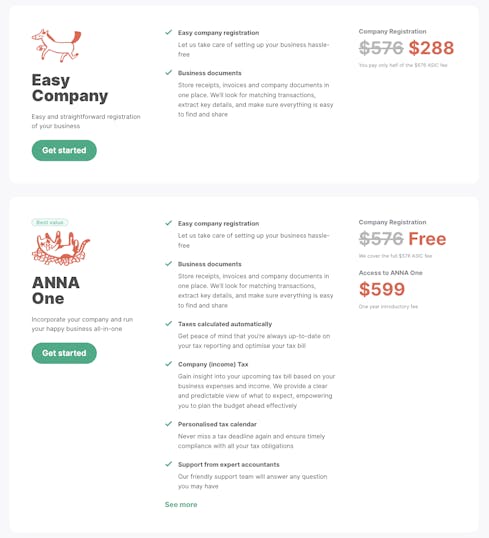

ANNA – Your Trustworthy Companion

Registering your company with ANNA will save you on registration fees and give you comprehensive support to run your business hassle-free.

With ANNA One, you'll have access to:

- Easy Company Registration: Incorporate your company without stress. We handle all the paperwork so you can focus on what matters—growing your business.

- Business Document Management: We store all your receipts, invoices, and company documents in one secure place. We automatically match transactions, extract key details, and ensure your records are neatly organized and easy to access.

- Automatic Tax Calculations: Stay worry-free with real-time tax calculations. Our platform provides clear insights into your income and expenses, ensuring you know exactly what to expect on your tax bill—helping you plan ahead.

- Personalized Tax Calendar: Never miss a tax deadline! We'll remind you of every due date and ensure you comply with all your tax obligations.

- Expert Accountant Support: Need guidance? Our experienced accountants are on hand to answer your questions and offer professional advice whenever needed.

- BAS Lodgement and GST Management: We handle your annual BAS and automatically calculate your GST, submitting it directly to the ATO so you don't have to worry about compliance.

- Professional Invoices & Automatic Follow-ups: Create professional invoices in seconds. Plus, we'll automatically follow up on unpaid invoices, so you get paid faster.

With ANNA, you get more than just a business registration – you get a full suite of tools and expert support to run your company efficiently, all under one roof!

Ready to get started?

Join ANNA today and access a complete suite of essential tools designed to drive your business success!