How to Start a Bookkeeping Business in Australia in 2025

Learn how to start a bookkeeping business in Australia, covering key setup steps, legal requirements, and tips to build a successful service.

With all the positive statistics surrounding this industry (like the ones you’ll see below), there has never been a better moment to start your own bookkeeping business.

In this article, we'll go over everything you need to know, from selecting your services, registering your business, and complying with ATO rules to using the correct software to offering unique promos.

You'll also find useful ideas, real-world statistics, and answers to frequently asked questions across Australia.

Let's take it step by step so you can easily start your bookkeeping business in 2025!

What Are the Benefits of Starting a Bookkeeping Business in Australia?

Let’s check out some statistics and see why it is a good idea to start a bookkeeping business:

🟢 The Australian Bureau of Statistics predicts a need for 338,362 accountants by 2026, representing an annual demand of roughly 10,000 new accountants.

🟢 The accounting profession is expected to grow by 9.2% by 2026, reaching around 212,800 professionals.

🟢 The Payroll and Bookkeeping Services sector generated an expected $1.2 billion in revenue in 2024, with a compound annual growth rate (CAGR) of 1.1% over the previous five years.

How to Start a Bookkeeping Business in Australia?

Let’s check out 6 steps on how to start a bookkeeping business!

Step 1: Decide on Services You Will Offer

First, you need to decide which services you want to include in your offer. Most clients will expect the following core services:

✔️ Daily Transaction Recording - Keep track of all income and expenses to ensure that their financial records are correct.

✔️ Bank Reconciliation - Check bank statements against financial data to find inconsistencies and prevent fraud.

✔️ Payroll Management - This includes managing employee wages, deductions, superannuation contributions, and payroll tax compliance.

✔️ Tax Preparation and BAS Lodgment - Compile Business Activity Statements (BAS) and aid with tax return filing to ensure compliance with Australian Taxation Office (ATO) standards.

✔️ Financial Reporting - Create essential financial documents, like income statements, balance sheets, and cash flow statements, to provide insights into the client's financial health.

Besides core services that everyone expects and seeks, you can add some others that can help you stand out and make your offer more complete:

➕ Training and Support - Provide instruction to clients who want to manage some of their bookkeeping themselves or need assistance with accounting software.

➕ Business Advisory Services - Offer guidance on increasing cash flow, planning, and growing financial systems as the company grows.

➕ Inventory Management - Help to track inventory levels and integrate them into financial records for better stock control.

Step 2: Get an ABN

ABN registration is required if you operate under any business structure. An ABN is necessary for issuing tax invoices, claiming GST credits, and legally identifying your business.

🔷 Provide personal details, business details and associates' information (if applicable).

🔷 Choose the Application Method:

- Online via Business Registration Service - Use the Australian Government online to apply for an ABN.

- Through a Tax/BAS Agent - Authorised agents may apply on your behalf using their Digital ID (e.g., myID).

💡ProTip

With ANNA Money, you can easily get your ABN!

🔶 Submit your application through our platform

🔶 Quickly receive ABN notification

3. Register Your Business with ASIC

If you want to start a bookkeeping business under a name other than your personal legal name, you must register it with ASIC. For this step, you must have ABN.

How to register a business name with ASIC?

🔷 Check Business Name Availability - Use ASIC's company name search tool to confirm your preferred name is unique and doesn’t already exist.

🔷 Register via ASIC Connect - Log in to ASIC Connect and pick the 'Licences and Registrations' tab at the top of the screen.

🔷 Choose “Business name” - Select 'Business name' from the drop-down box, and input your ABN.

🔷 Provide All Information - Enter your suggested business name, the business name holder's information and the suggested business name's address.

🔷 Pick a Registration Period - You can register a business for 1 or 3 years ($44 for one year

$102 for three years). After this time, you must renew it.

🔷 Confirm the Eligibility to Hold the Business Name - If you want to hold a business name, you can’t be disqualified or convicted of the criminal charges listed in the Business Names Registration Act 2011.

🔷Review Your Application - Check your application and make payment.

💡ProTip

If you choose to start a company for your bookkeeping business, you can easily do so with ANNA Money!

How much does it cost? $288 one-off fee and get 50% off your ASIC fee to get started!

🔶 Check name availability on our platform

🔶 Choose company type

🔶 Provide personal and business details

🔶 Let us do the rest!

4. Register for GST

You must register for GST if your annual turnover exceeds $75,000 or if you want to claim GST credits.

🔷 You can use business services online

🔷 You can register by phone at 13 28 66

🔷 Through your registered tax agent or BAS agent

🔷 Or by filling out the Add a new business account (NAT 2954) form, which you can order through the ATO publication ordering service.

5. Register as BAS Agent

If you want to provide BAS-related services (for example, preparing and lodging Business Activity Statements), you must register as a BAS agent with the Tax Practitioners Board (TPB).

This license lasts for 1 year, and the fee is $54.00.

When registering as a BAS agent, you must have:

- A Certificate IV in Accounting and bookkeeping

- 1,400 hours of relevant experience

- and professional indemnity insurance that meets TPB standards

How do you register as a BAS agent?

🔷 Create a My Profile account through the TPB My Profile site.

🔷 Provide the following:

- Proof of identity

- Electronic copies of award certificates, academic transcripts and course outlines, to demonstrate completion of required qualifications.

- Statement of relevant experience from a supervising tax agent or employer, as well as voting membership in any recognised tax agent association (if available).

6. Choose Accounting Software

What are the benefits of using accounting software when starting a bookkeeping business in Australia?

✔️ Automated GST/BAS Reporting - Software can automatically track GST and prepare BAS reports to ensure compliance with ATO standards.

✔️ Single Touch Payroll (STP) - Software automatically provides employee tax/super information to the ATO, ensuring flawless compliance.

✔️ Automated Bank Feeds - Sync transactions directly from bank accounts to eliminate laborious data entry.

✔️ Real-Time Reconciliation - Instantly match invoices, costs, and payments to save hours of manual work.

✔️ Automated Calculations - Reduce human error in payroll, tax, and financial reporting.

✔️ Audit Trail - Track every modification made to financial data, making ATO audits easier.

✔️ Expand with Your Clients - Easily manage larger transaction volumes, multi-currency needs, or sophisticated payroll as your client base grows.

✔️ Client Collaboration - Share real-time data securely with clients and accountants using cloud access.

💡ProTip

If you are looking for software that will make your work easier and offer all this and more, then look no further than ANNA Money!

It allows you to:

🔶 Get your GST automatically calculated and logged with the ATO in just a few clicks

🔶 File your Annual accounts with ASIC and your Company Tax return for the ATO

🔶 Create a business account and get a debit card, virtual cards, Apple Pay, Google Pay, and employee expense cards.

🔶 Easily check your balance and manage all your payments.

🔶 Pay yourself and file payroll for your employees.

Additional Tips for Starting a Bookkeeping Business in Australia

1. Join Professional Associations

One of the most significant advantages of participation is that membership in recognised BAS agent groups (e.g., Australian Bookkeepers Association) reduces the required experience hours for BAS registration from 1,400 to 1,000 for voting members.

Beside that:

🔹 Continuing Professional Education (CPE) Opportunities - Many associations provide CPE programs to help members maintain and improve their abilities.

🔹 Access to Training Resources - Members frequently receive exclusive access to templates, checklists, and instructions for bookkeeping tasks (e.g., BAS preparation, invoicing), as well as online libraries providing instructional materials on bookkeeping.

🔹 Conferences and Networking Events - Associations organise conferences that mix learning and networking possibilities. These events frequently include expert speakers, panel discussions, and workshops on new developments in bookkeeping and accounting.

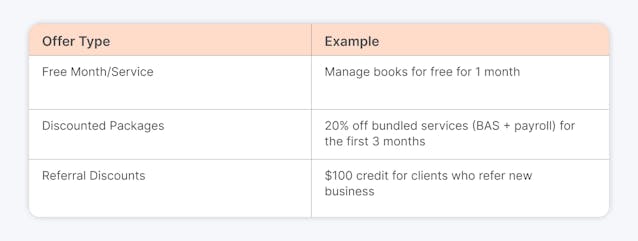

2. Have Promotional Offers

When launching a bookkeeping firm in Australia, offering promotional packages might help you attract clients.

For example, discounts or free trials (e.g., "first month free") can encourage small businesses to try your services.

Clearly specify terms to avoid confusion about post-promotion pricing and ensure that discounts don't undercut operational costs.

As with everything, there is a downside and risk to this approach. Here it is an opportunity to attract low-quality clients and non-lucrative clients.

Conclusion

Building a bookkeeping business entails more than just calculating numbers; it also means achieving financial freedom, flexibility, and stability on your own terms. You've now seen the steps, strategy, and statistics that show the opportunity is real and growing.

The only thing left? Making the initial move.

Whether you're setting up your ABN, filing your BAS, or working out your first payroll, ANNA Money is designed to help bookkeepers like you get started quickly and easily:

✅ Simplify your setup.

✅ Automate your tax and reporting processes

✅ Focus on establishing a client base rather than chasing paperwork.

Let's see how!

How ANNA Money Can Help You Start a Bookkeeping Business in Australia in 2025?

ANNA Money is an all-in-one business tool that can help you start your business!

In addition to opening a company, checking the availability of names and registered ABN, you can do a lot more with this tool:

⚡ Business Documents - Keep receipts, invoices, and company records in one location. We will look for matching transactions, extract crucial facts, and ensure that everything is easy to find and share.

⚡ Taxes Calculated Automatically - Get peace of mind knowing you're always up to date on your tax reporting and minimise your tax bill.

⚡ Company (income) Tax - Learn about your upcoming tax bill based on your business expenses and income. We provide a clear and predictable view of what to expect, helping you to prepare the budget ahead of time.

⚡ Personalised Tax Calendar - Never miss another tax date, and assure timely compliance with all of your tax requirements.

⚡ Annual company tax return statement (BAS) - Let us handle your tax duties from the start and file your statement for your first year of trading.

⚡ Goods and Services Tax (GST) - Automatic GST calculation and direct logging with the ATO.

⚡ Bookkeeping Score - Get automated receipt matching and spending classification to ensure you obtain the proper tax relief.

Sign up today and start your bookkeeping business easily!

FAQ

Do I need TFN for a Bookkeeping Business in Australia?

You need a Tax File Number (TFN) to operate a bookkeeping business in Australia, but the type depends on your business structure.

- Sole traders - Enter your own TFN (which is already necessary for ABN registration).

- Companies and Partnerships - must obtain a business TFN (which is automatically applied during ABN registration).

Is Professional Indemnity Insurance Necessary?

Yes, Professional Indemnity (PI) insurance is required for bookkeeping businesses in Australia, particularly when you are a registered BAS agent or offer professional advice.

What Does Professional Indemnity Insurance Cover?

PI insurance often includes:

- Compensation for financial damages resulting from errors or omissions.

- Legal fees to defend claims.

- Costs associated with disciplinary proceedings.

- Claim investigation costs.

- It does not cover deliberate damage, fraud, or known claims before the policy’s inception.

Can I Offer Bookkeeping Services Without Being a BAS Agent?

You can execute simple bookkeeping duties that do not require interpreting tax rules or representing clients before the ATO.

How Can I Gain Practical Experience Before Starting My Business?

Consider working under an experienced bookkeeper or within an accounting firm to accumulate the hours required for BAS agent registration.