7 Tips to Start a Business in Australia Today [2025 Guide]

Discover 7 essential tips on how to start your business in Australia and empower yourself with the knowledge you need to thrive in this market.

Are you thinking about starting a business in Australia?

While it offers exciting opportunities, it also comes with unique challenges.

Whether you're an experienced entrepreneur or stepping into the business world for the first time, careful planning and a good grasp of the local market are your tickets to success.

Looking for some straightforward tips?

Here are 7 crucial steps to help you start your business on solid ground.

Let's dive in!

How to Start a Business In Australia - 7 Tips to a Successful Journey

1. Market Research: The First Step to Business Success

Embarking on the journey of starting a business in Australia, or anywhere really, begins with one crucial step: market research.

Understanding your audience deeply before spending any money can significantly boost your chances of success and decrease your money spent on testing.

By identifying who your customers are, what your competitors are doing, and the prevailing market trends, you can tailor your products or services to meet market demands precisely.

What to Research?

Your market research should encompass several key areas:

- Customers: Who are they? What do they need?

- Competitors: Who are your competitors, and what are they offering?

- Products or Services: What are you selling, and how does it fit into the current market?

- Suppliers: Who will you depend on, and how reliable are they?

- Business Location and Local Area: Where will you set up your business/shop, and why?

- Industry and Market Trends: What larger movements should you be aware of that could impact your business?

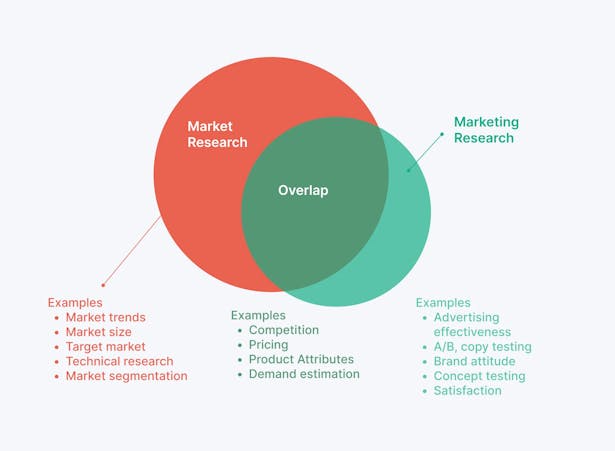

Methods of Market Research

Market research can be conducted using two main methods:

- Primary Research — Collect new data through surveys, interviews, and focus groups directly from potential customers.

- Secondary Research — Utilize existing data from reliable sources such as market reports and government statistics.

Before diving into your own research, tap into available resources such as market reports, government statistics, and publications from trade and industry associations.

For secondary research, consider authoritative sources like the Australian Bureau of Statistics (ABS), which offers comprehensive economic, social, and environmental statistics.

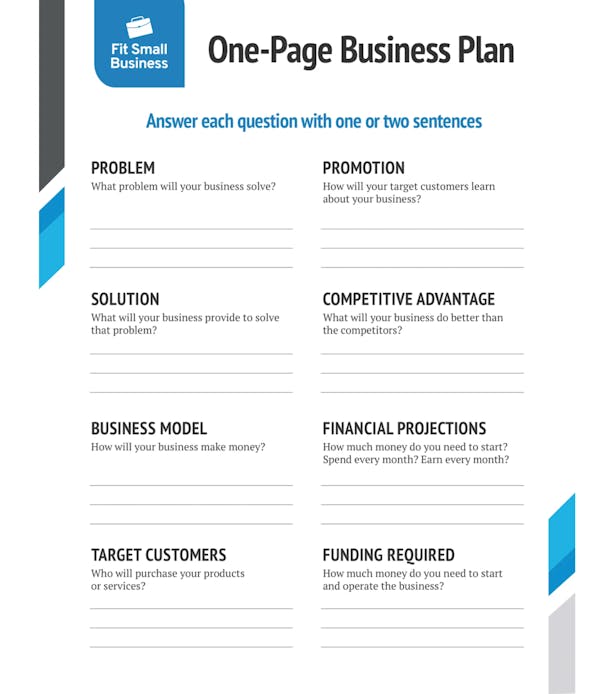

2. Crafting Your Business Blueprint: The Importance of a Solid Business Plan

Imagine embarking on a complex journey without a map—that's akin to diving into the business world without a business plan.

This crucial document serves as your roadmap, detailing every essential aspect of your business journey, from the initial concept to anticipated financial outcomes and strategic growth approaches.

The Core Benefits of a Business Plan

- Direction and Prioritization: Sets your course and outlines clear goals. It guides you through business complexities, helps prioritize actions, and prepares you for potential challenges.

- Operational Control: The planning process offers deep insights into your business's critical factors.

- It allows current business owners to reflect on what’s working and identify needed improvements.

- Securing Finance: Essential when seeking funding, as it demonstrates your business's viability and profitability strategy to potential investors and banks.

Key Steps to Writing an Effective Business Plan

- Purpose-Driven Planning — Define the main aim of your plan, whether it's securing funding, guiding growth, or both.

- Financial Preparation — Detail your financial strategy, including sources of funds, revenue forecasts, and budgeting.

- Executive Summary — Though this section appears first, write it last. It should succinctly capture the essence of your entire plan.

- Seek Expertise — Engage advisors or business planning experts to refine your strategy and foresee challenges.

- Regular Reviews — Adapt your plan to evolving business environments and market conditions through consistent reviews.

- Secure Your Plan — Treat your business plan as confidential, sharing it only with stakeholders interested in your success.

A robust business plan charts the path and equips you to navigate through the business landscape more effectively, enhancing your potential for success.

3. Choosing the Right Business Structure: A Critical Decision for New Entrepreneurs

Deciding on the right type of business structure is a crucial step for new entrepreneurs in Australia.

This foundational choice influences almost every aspect of your enterprise, from daily operations to long-term strategic growth.

By aligning your business structure with your goals, financial needs, risk tolerance, and future aspirations, you can ensure that your business supports your objectives and protects your interests.

Understanding Different Business Structures

- Sole Trader: The simplest structure, offering full operational control. Ideal for starting small with the potential to scale. However, it does not protect personal assets from business liabilities.

- Company: Treats the business as a separate legal entity, limiting personal liability in relation to business debts and offering personal asset protection, albeit with more regulations.

- Partnership: Involves sharing profits or losses with one or more partners, with each liable for business debts, underscoring the importance of a clear partnership agreement.

- Trust: A trustee manages the business for the benefit of others, offering asset protection and potential tax benefits but requiring more complex compliance.

Factors to Consider When Choosing a Structure

Choosing the right business structure requires careful consideration of several factors:

- Tax Implications: Each structure carries different tax responsibilities, which can significantly affect your finances.

- Liability: Assess the level of personal risk you are comfortable with, as some structures might put personal assets at risk.

- Control: Your preference for autonomy in decision-making should influence your choice; sole traders maintain complete control, while partnerships and companies involve shared governance.

- Costs and Paperwork: Consider the initial and ongoing expenses and the administrative burden of each structure.

- Future Needs: Think about the potential growth and evolution of your business, choosing a structure that can adapt to changing needs.

Selecting the appropriate business structure is a strategic decision that sets the tone for your business's operational effectiveness and legal compliance.

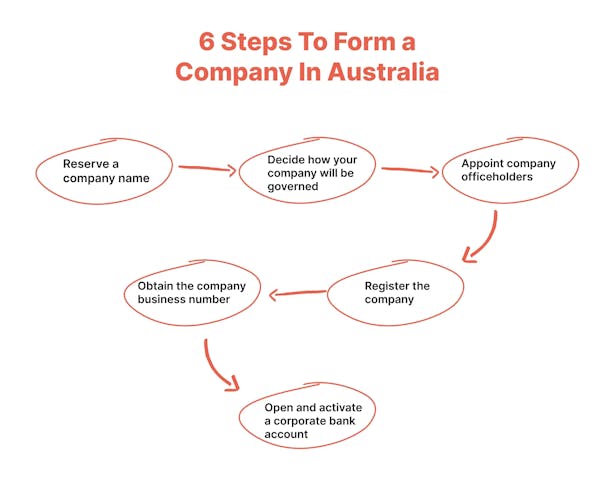

4. Register Your Business in Australia

Registering your business is a vital legal step to establish your entity formally in Australia, going beyond mere bureaucracy to secure your brand and assets.

This process makes your business official but also sets a solid foundation for operational success and future growth.

When you decide to set up a business in Australia, obtaining an Australian Business Number (ABN) is the initial step.

But, to register your business in Australia, there's much more to consider, especially if you choose a company structure.

Understanding Company Registration

Registering as a company in Australia recognizes it as a separate legal entity, distinct from its owners or shareholders.

This separation provides significant advantages, such as legal protections, credibility, and potential tax benefits.

The process begins with selecting an appropriate name:

- Uniqueness: Ensure your company name is unique and not already taken under the Australian Securities & Investments Commission (ASIC).

- Legal Suffix: Include a legal suffix such as "Pty Ltd" to reflect its status as a proprietary limited company.

- Reservation: You can reserve your chosen name with ASIC to secure its availability upon registration.

To register your company, you can utilize the Business Registration Service, which simplifies the process by integrating several registrations at once.

Here’s what to prepare:

- Company Name: Finalize and verify the availability of your company name.

- Company Type: Decide if your company will operate as a proprietary (private) or public entity.

- Legal Obligations: Understand the responsibilities associated with running a company, such as compliance with financial reporting, record-keeping, and regulatory requirements.

Protecting Your Intellectual Property

Beyond the company name, consider protecting other intellectual assets:

- Trademarks: Register trademarks to protect brand elements like logos and slogans from unauthorized use.

- Patents and Designs: If your business includes distinctive products or inventions, secure patents or design rights to shield them from replication.

Once your company is registered, your obligations don't end.

Regular compliance with ASIC regulations, tax filings, and renewing your registrations are crucial to maintaining good standing legally and financially.

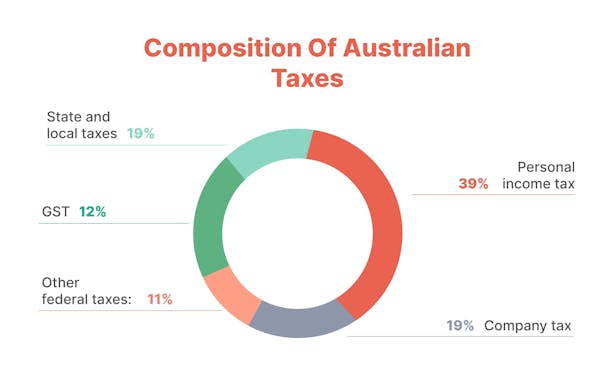

5. Understanding Your Tax Obligations as a Business Owner

Navigating the complexities of tax obligations is a critical aspect of running a successful business in Australia.

Depending on your business structure, the number of employees, and the benefits provided, your tax responsibilities can vary significantly.

Being well-informed and compliant with these obligations not only prevents penalties but also ensures smoother operational flow.

Key Tax Responsibilities

Every business must adhere to a variety of tax obligations, which include:

- Income Tax: The basic tax levied on your business's income.

- Capital Gains Tax (CGT): Applies if your business sells property, shares, or other eligible assets. This also includes crypto taxes, as the ATO treats digital currencies like Bitcoin as CGT assets when sold or exchanged.

- Fringe Benefits Tax (FBT): Incurred when providing certain benefits to employees or their associates.

- Pay As You Go (PAYG) Withholding: Necessary for businesses that have employees; it involves withholding tax from wages to meet employee income tax liabilities.

- Goods and Services Tax (GST): A 10% tax on most goods and services sold or consumed in Australia.

- Other Levies: Such as fuel tax credits, wine equalization tax, luxury car tax, payroll tax, and land tax depending on your business activities and location.

Registering for Taxes

It’s crucial to register your business for the appropriate taxes to ensure compliance:

- Use the Business Registration Service: This platform allows you to register for multiple taxes using a single form, streamlining the process.

- Consult the ATO Website: For detailed information on which taxes apply to your business and how to register for them.

Tax Deductions

Understanding what expenses you can claim as tax deductions is essential for reducing your taxable income.

Most business expenses, such as office supplies, travel, and marketing costs, can typically be deducted.

Lodging and Paying Taxes

- Lodging Tax Returns: All businesses need to lodge an income tax return annually. Additionally, if you are registered for GST, you need to lodge business activity statements (BAS) regularly.

- Payment Methods: Taxes can be paid via BPAY, debit/credit card, or other online options. The ATO provides various online services to facilitate these transactions securely.

Importance of Record Keeping

Effective record keeping is not just a legal requirement—it’s a cornerstone of sound business management. Maintaining comprehensive records helps in:

- Tax Compliance: Ensuring all transaction records are accurate and substantiate the claims made on your tax returns.

- Business Decisions: Providing reliable data for making informed business decisions.

- Future Sale: Offering potential buyers clear insight into the business’s operations if you decide to sell.

6. Set Up Your Business Operations

Setting up your business operations effectively is key to thriving in an opportunistic market like Australia.

Here’s an overview of essential business operations components and strategic insights to guide you:

- Legal Compliance: Compliance with Australian business laws is mandatory to ensure your operations are legally sound, safeguarding against potential legal issues.

- Finance: Maintain accurate financial records and manage cash flow carefully, essential for daily operations and strategic planning. Prepare meticulously for tax obligations to prevent complications.

- Online and Digital Presence: Nowadays, a unique online presence is vital. Maintain a professional website, engage on social media, and ensure cyber security to protect sensitive information and maintain customer trust.

- People Management: Managing human resources effectively—whether employees, contractors, or customers—significantly affects your operational success and reputation. Understand HR best practices and legal responsibilities.

- Products and Services: If your business involves products or services, fully understand all aspects, including logistics and supplier relationships.

- Risk Management: Protect your business by managing risks effectively. This includes investing in appropriate insurance, adhering to health and safety regulations, and boosting cyber security against online threats & vulnerability management.

Wisdom Bids

- Invest in Scalability: Choose systems and technologies that can expand and adapt to your business.

- Continual Optimization: Regularly review and refine your operational processes to enhance efficiency and productivity.

By meticulously setting up and managing these aspects of your business operations, you lay a solid foundation for your company.

This strategic approach mitigates risks while fostering sustained growth and long-term success in Australia’s bustling market.

7. Market Your Business

Effective marketing is essential for increasing your business's visibility and attracting customers.

Establishing a strong online presence through a well-designed website and active social media accounts is crucial in today's digital landscape.

Tailor your marketing efforts to directly engage your target demographic.

Key Marketing Strategies

- Diverse Channels: Utilize both digital and traditional marketing methods. While online platforms are essential, do not overlook the impact of direct mail, print advertising, and face-to-face engagement in certain markets.

- Targeted Messaging: Develop marketing messages that resonate specifically with your intended audience. Understanding their preferences and pain points allows for more effective communication.

- Consistent Branding: Ensure your branding is consistent across all channels. This strengthens brand recognition and enhances customer trust and loyalty.

- Customer Engagement: Use interactive tools like social media polls, surveys, and contests to engage customers and gather valuable feedback.

Wisdom Bids

- Leverage Both Digital and Traditional Channels: Combining modern digital strategies with traditional marketing can broaden your reach and deepen engagement.

- Monitor and Adapt: Continuously measure the effectiveness of your marketing strategies. Use analytics to track engagement and sales, and be prepared to adjust your tactics based on what the data shows.

By implementing these strategies and continuously refining your approach based on data-driven insights, you can effectively market your business and achieve significant growth and visibility.

Start Your Business in Australia With ANNA

In conclusion, setting up and managing a business in Australia involves careful planning and strategic execution across various operational aspects.

From ensuring legal compliance and environmental management to effective marketing and risk management, each element plays a pivotal role in establishing a strong foundation for your business.

Are you curious about how ANNA can assist you in navigating these complexities and streamline the process of starting your business in Australia?

ANNA One emerges as a pivotal tool for entrepreneurs, simplifying everything from company registration to managing financial tasks.

But what specific advantages does ANNA One offer to elevate your business?

👉 Effortless Company Registration: Quickly register your company with the ASIC fee covered by ANNA.

👉 Integrated Business Account: Manage your bookkeeping, invoicing, and tax obligations all in one place.

👉 Automatic Tax Calculations: Ensure accuracy with automatic GST calculations and optimized tax handling.

👉 Comprehensive Business Support: Keep essential documents organized and access expert accounting advice.

How to Get Started with ANNA?

1. Choose a Unique Company Name: Utilize ANNA's search tool to confirm the availability of your desired company name.

2. Provide Basic Company Information: Prepare details about your company’s directors, shareholders, and a registered office address in Australia.

3. Complete the Registration: Submit your details through ANNA, which will take care of the process and notify you upon completion.

Ready to streamline your business setup and management?

Start your business with ANNA today and experience the convenience of tools designed to simplify your entrepreneurial journey. 🚀